2025 Cryptocurrency Adoption and Consumer Sentiment Report

After Bitcoin’s remarkable performance in 2024, 60% of Americans familiar with crypto believe the value of cryptocurrencies will rise due to Trump’s return to the White House.

Bitcoin’s upward trend, which started in 2023, gained momentum in 2024, pushing prices to new all-time highs and outperforming the S&P 500. As values continue to rise, consumers have regained some confidence in the cryptocurrency sector.

For the fifth year in a row, we conducted our annual cryptocurrency study to see what Americans think about cryptocurrency adoption, regulation, and security at the start of 2025. Our research includes original insights from nearly 2,000 American adults, measuring their sentiment toward digital currencies and unearthing the key factors influencing cryptocurrency adoption in the U.S.

Key Findings

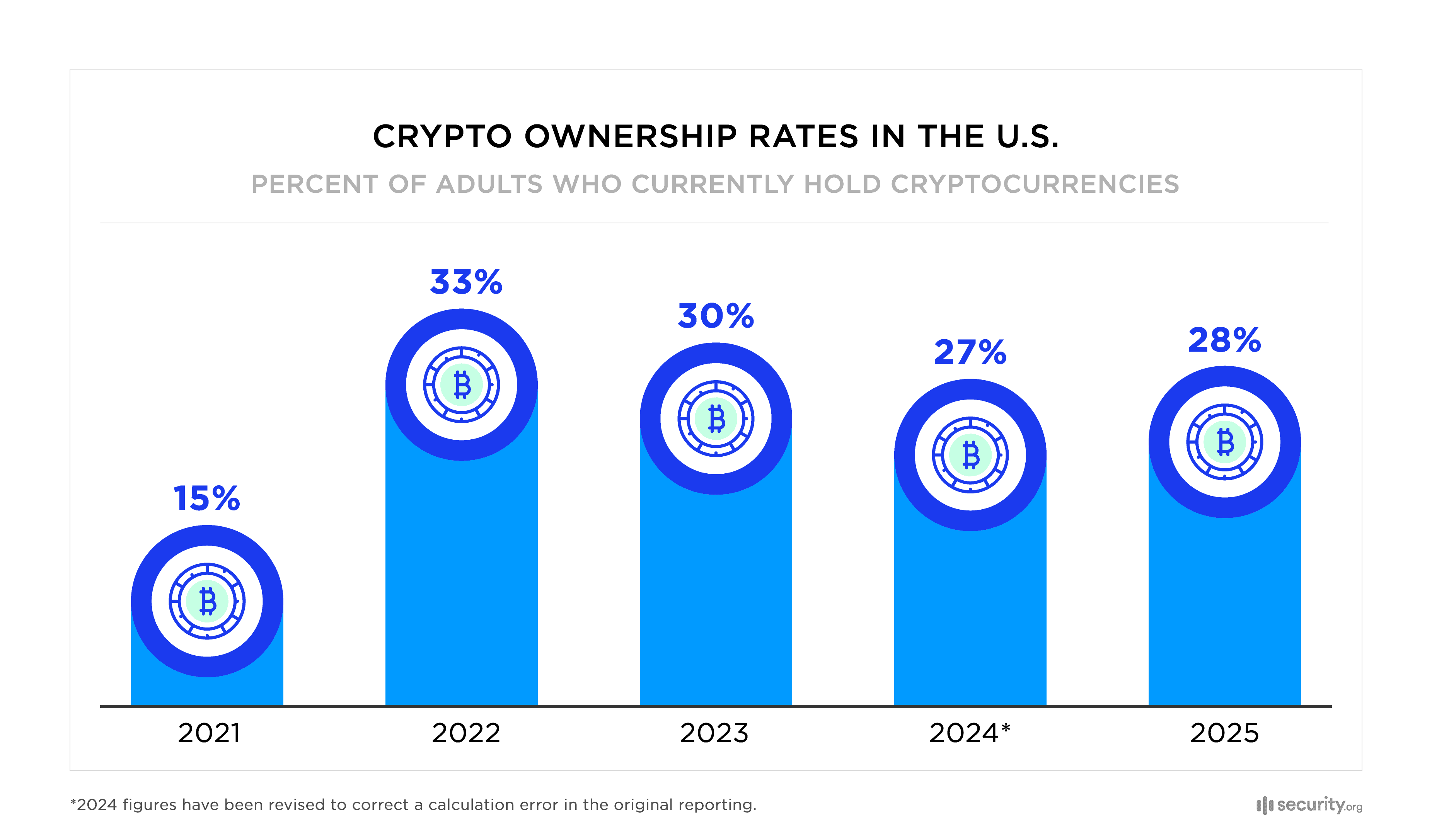

- Cryptocurrency ownership has nearly doubled in the three years since the end of 2021. In 2025, approximately 28% of American adults, or about 65 million people, own cryptocurrencies.

- 14% of people without crypto plan to buy it in 2025, and 67% of current owners plan to buy even more this year.

- Among those who plan to buy crypto in 2025, Bitcoin, Ethereum, and Dogecoin are among the top three most desired currencies.

- 60% of adults familiar with crypto believe that the value of cryptocurrencies will increase during Donald Trump’s second presidential term, and 46% believe that Trump will boost mainstream cryptocurrency adoption in the U.S.

- Though public enthusiasm for crypto has grown in recent years, 40% of people who own cryptocurrency still aren’t confident that the technology is safe and secure. Nearly one in five cryptocurrency owners have had difficulty accessing or withdrawing their funds from custodial platforms.

Table of Contents

Cryptocurrency Ownership Rates 2021-2025

Today, two out of three American adults said they are familiar with crypto. Not long ago, most people you asked about cryptocurrency would say they aren’t familiar with it, but it sounds like something potentially sinister —maybe a scam or even something for criminals or people with something to hide.

Nowadays, more and more people in the mainstream and inner circles of tech and financial markets know that crypto is a bank and financial services platform that reliably operates as an internet broadcast instead of a corporation’s private accounting system.

Since 2009, its value has only become more apparent to the public. Based on our research, 28 percent of American adults, or as many as 65.7 million people, own cryptocurrency in the U.S. today, rising from just 15 percent in 2021. This may indicate that public confidence is growing after the “crypto winter” of 2022.

Men are overrepresented in crypto ownership compared to women. Our survey found that 67% of current cryptocurrency owners are men, and just 33% are women. Additionally, younger Generation Xers and older Millennials are likelier to own crypto than older people. The median age of current owners in our study was 45.

The average crypto owner in our study holds at least two different cryptocurrencies. On days when one is overpriced and the other underpriced in markets, they can make some swaps, selling the high one and buying the discounted with the proceeds to accumulate faster.

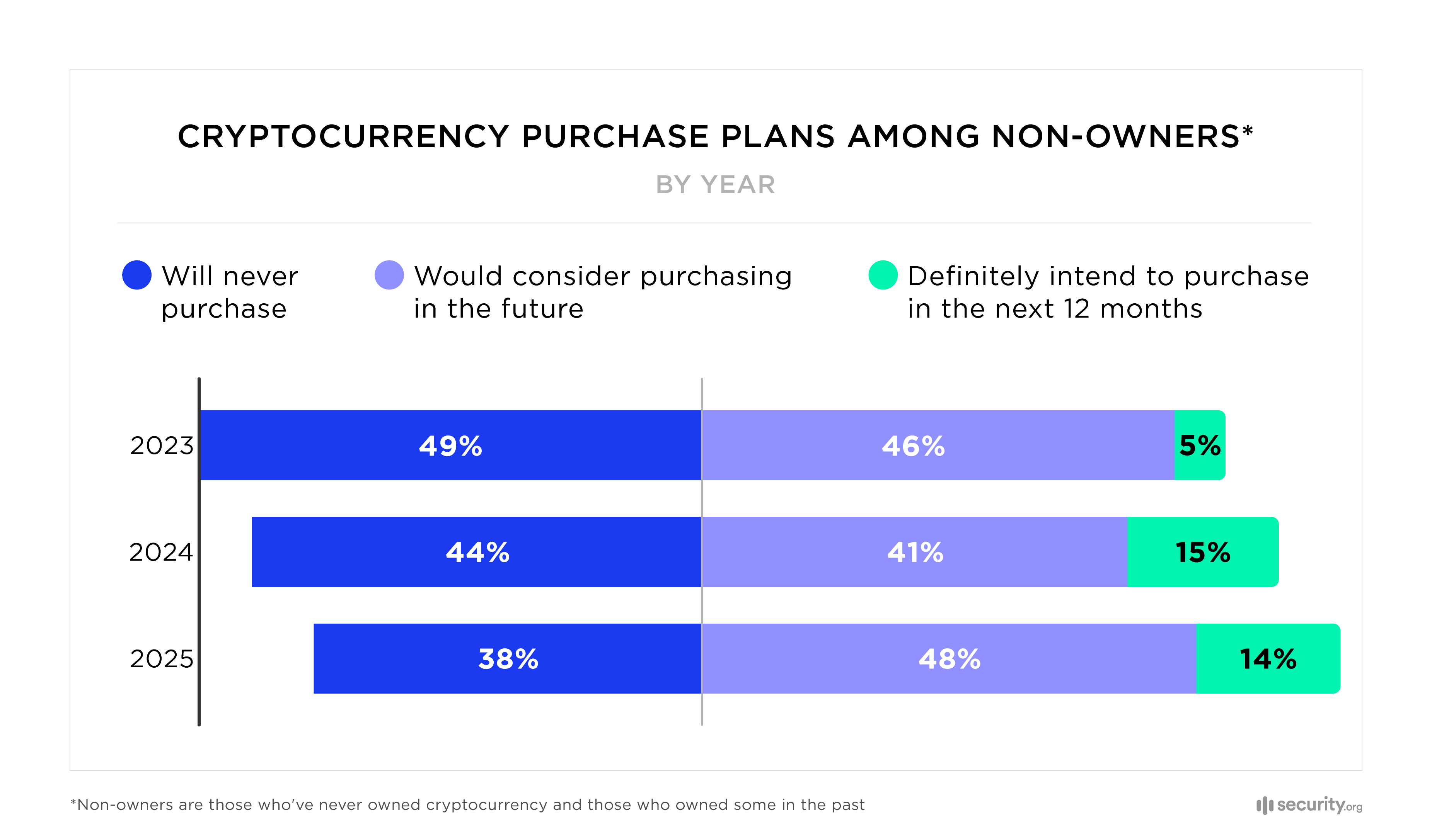

Ownership rates are likely to accelerate this year. According to our research, 14 percent of non-owners plan to enter the crypto market in 2025, and another 48 percent are open to doing so.

In addition to the newcomers planning to dip a toe in the waters of Web3 cryptocurrencies this year, two in three current cryptocurrency owners are definitely buying more this year. Twenty-two percent of former owners also plan to return to the market in 2025.

Most Popular Cryptocurrencies in 2025

As they were last year, Bitcoin, Ethereum, and Dogecoin remain the most widely held currencies in our study. However, Ethereum tokens have lost some lead over Solana, Dogecoin, and others during the previous three years. These figures bear out the meta-narrative for the smart contract blockchain economy: decentralized finance competitors with a second mover advantage are accumulating vast capital flows to provide the benefits of the blockchain with faster service and lower fees.

| Which cryptocurrencies do you currently own? | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| Bitcoin (BTC) | 77% | 78% | 76% | 74% |

| Ethereum (ETH) | 65% | 58% | 54% | 49% |

| Dogecoin (DOGE) | 26% | 31% | ||

| Solana (SOL) | 11% | 10% | 11% | 18% |

| U.S. Dollar Coin (USDC) | 12% | 10% | 12% | 17% |

| Shiba Inu (SHIB) | 19% | 18% | 12% | 15% |

| Stellar (XLM) | 16% | 14% | 12% | 13% |

| Cardano (ADA) | 19% | 14% | 12% | 12% |

| Ripple (XRP) | 6% | 7% | 9% | 12% |

| Binance Coin (BNB) | 6% | 6% | 10% | 11% |

| Tether (USDT) | 5% | 5% | 7% | 9% |

| Avalanche (AVAX) | 5% | 6% | 5% | 5% |

Which currencies are people planning to buy this year?

This year, Bitcoin, Ethereum, and DOGE topped the list of Internet currencies Americans are most likely to buy— holding them with a custodian or securing their crypto themselves with a Web3 wallet or cold storage hard wallet.

In 2025, Bitcoin remains the most sought-after cryptocurrency. Two in three people who plan to purchase crypto in 2025 want Bitcoin. After all, it has the most secure blockchain, real-world electricity invested in its tokens, and digital scarcity. Only a very limited number of BTC tokens will ever be created—on a schedule to top out at 21 million by 2140.

| What currencies do you plan to buy in 2025? | Percentage of respondents open to purchasing crypto |

|---|---|

| Bitcoin (BTC) | 66% |

| Ethereum (ETH) | 43% |

| Dogecoin (DOGE) | 24% |

| Solana (SOL) | 17% |

| Ripple (XRP) | 15% |

| U.S. Dollar Coin (USDC) | 12% |

| Shiba Inu (SHIB) | 11% |

| Binance Coin (BNB) | 10% |

| Cardano (ADA) | 9% |

| Binance USD (BUSD) | 9% |

| Binance USD (BUSD) | 9% |

| Stellar (XLM) | 8% |

| Tether (USDT) | 7% |

| Avalanche (AVAX) | 6% |

| Toncoin (TON) | 5% |

| TRON (TRX) | 5% |

| Decentraland (MANA) | 2% |

| Curve (CRV) | 2% |

| Something else | 4% |

Bitcoin remains the blockchain industry’s leader, supported by its limited supply and growing acceptance from traditional financial institutions and some governments like El Salvador. Many cryptocurrency analysts from established financial firms and online believe Bitcoin and major altcoins like Ether, XRP, and Dogecoin are currently in a mid-cycle upward trend.

Besides Bitcoin, Ethereum has also become a very popular and developed blockchain platform for smart contracts. Forty-three percent of people planning to buy cryptos say they’ll get Ethereum in 2025. Meanwhile, Dogecoin gained more attention thanks to strong public support from Tesla and SpaceX CEO Elon Musk.

Solana has seen significant growth in market value, and 17 percent of crypto customers want to buy the currency this year. Blockchain researchers note that its proof-of-history mechanism efficiently helps achieve network consensus, allowing it to process up to 65,000 transactions per second (TPS)—one of the fastest speeds among blockchain platforms.

Crypto Performance Expectations in 2025

Investors deluged the total crypto market cap to a historic record high of $3.33 trillion by Oct. 31 last year, according to TradingView data. That was after starting the year at $1.6 trillion in capitalized tokens for the entire segment.

Here are some milestones that drove crypto’s enormous market cap growth in 2024 and set the stage for the market’s current conditions:

- Bitcoin underwent its four-year supply halving on April 20, 2024.

- The SEC approved a Bitcoin ETF on January 11 and an Ether ETF in July 2024.

- The U.S. District Court SDNY cut the SEC’s Ripple Labs fine from $2B to $150M on Aug. 8. Grayscale launched an XRP Trust on Sept. 12.

- Pro-crypto U.S. presidential candidate Donald Trump won reelection on Nov. 5. Pro-crypto Republicans who lean toward deregulation won many key elections and will retake control of both houses of Congress in 2025.

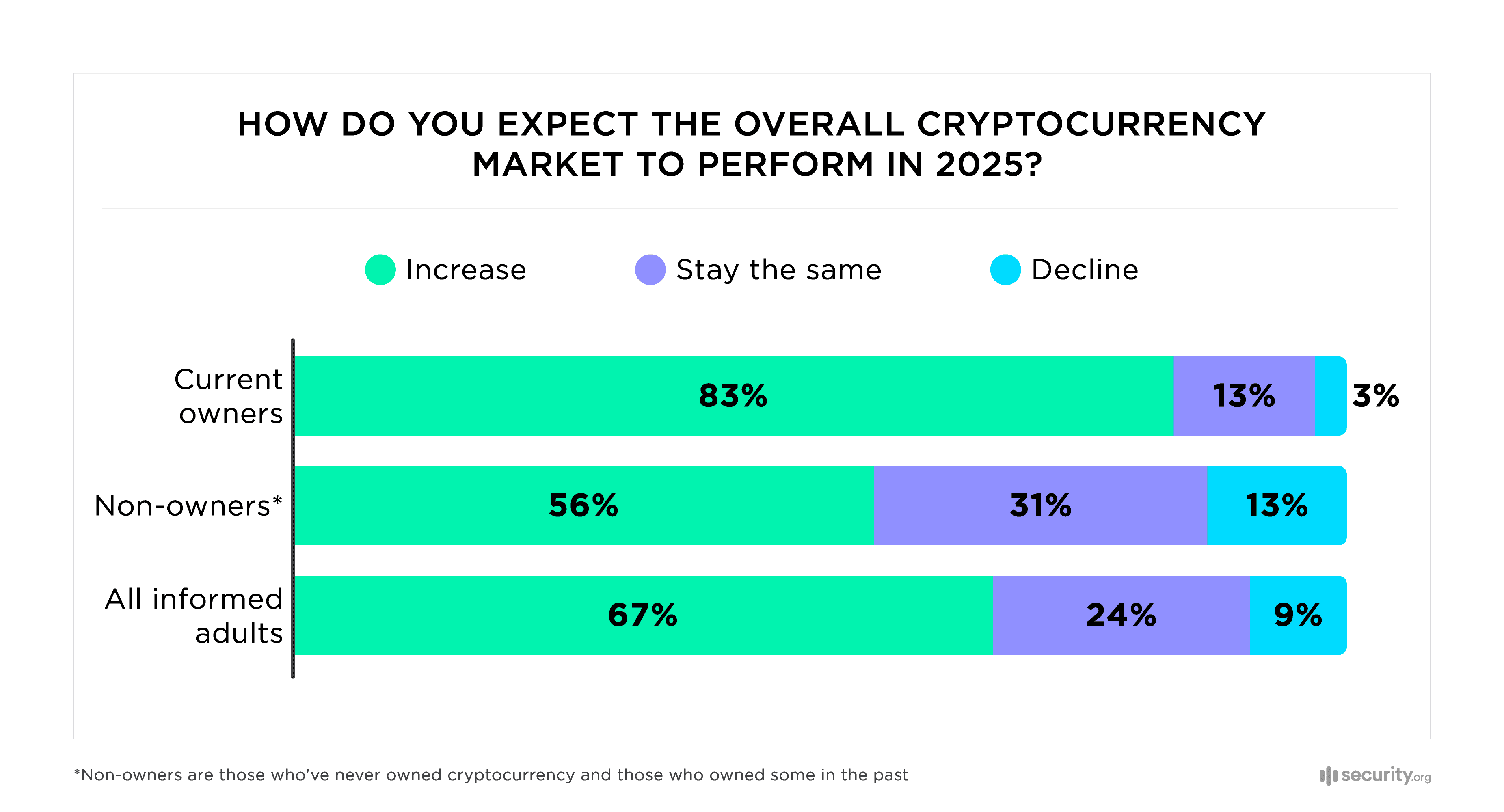

After a dynamic 2024, most people in our study think the market will be up in 2025, and many experts agree. Of course, current cryptocurrency owners are most optimistic about the potential for strong performance.

According to industry experts, Bitcoin prices could reach as high as $150,000 in 2025. Galaxy Digital’s head of research is even more bullish, targeting $185,000 in Bitcoin prices this year. Meanwhile, the head of digital assets at British multinational bank Standard Chartered says his office expects Bitcoin’s price to top $200,000 in 2025.

| How has your crypto portfolio performed overall since your first purchase? | 2024 | 2025 |

|---|---|---|

| Net gain | 45% | 69% |

| Breaking even | 20% | 16% |

| Net loss | 30% | 10% |

| Prefer not to say | 6% | 5% |

A solid majority of people who currently have crypto are profiting from it. According to our survey responses, some 69 percent of current crypto owners hold their tokens at a realized or unrealized gain in market value.

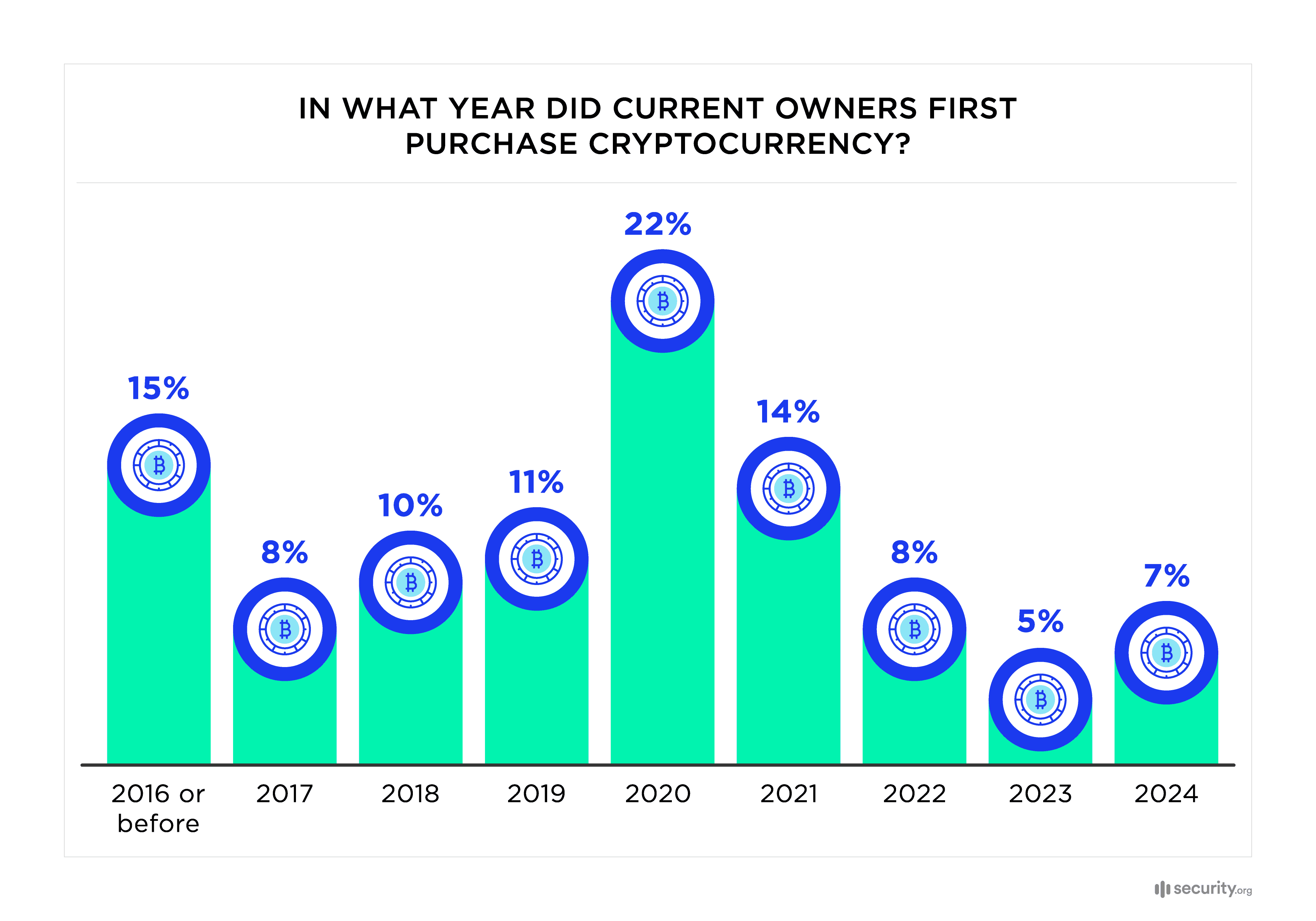

Of the current cohort of crypto owners, a significant share first bought their tokens in 2020 and 2021, and another third first bought crypto between 2016 and 2018. Meanwhile, fewer than 10 percent of current crypto owners first bought their coins sometime in the last year.

| Overall crypto portfolio performance by year of initial investments | 2019 or before | 2020-2024 |

|---|---|---|

| Net loss | 10% | 12% |

| Breaking even | 14% | 18% |

| Net gain | 76% | 70% |

Early crypto investors who made money have stayed in the market, hoping for more gains. Their success has encouraged new people to also invest in cryptocurrencies as a way to earn money.

Because of Bitcoin’s bull market since the start of 2023, even new crypto investors who started buying coins in 2024 saw gains that will likely encourage them to stay in crypto.

Will Crypto Change Under the Trump Administration?

2025 could be a monumental year for cryptocurrencies as a very pro-crypto leader takes to the White House and several pro-crypto and crypto-friendly bureaucrats take the levers of power.

As the data from our survey show, many people think crypto will continue to perform strongly in 2025. Notably, 60 percent of respondents believe cryptocurrency will perform even better now that Trump is back in office. Speaking at the Bitcoin Conference in Nashville while campaigning for president last year, Donald Trump vowed to establish a national strategic Bitcoin reserve and prevent the government from selling any of its Bitcoin holdings seized from criminal operations.

Others, such as Wyoming Senator Cynthia Lummis (R-WY), have pushed the federal government to go even further and buy up to one million BTC for a national reserve. Fewer than 30 percent of adults support the idea of a national Bitcoin reserve, but crypto owners are more supportive of a reserve than the general public.

| Percentage agreeing with the following statements | All respondents familiar with crypto | Current crypto owners | Non-owners |

|---|---|---|---|

| I expect the value of cryptocurrencies to increase under Trump’s presidency. | 60% | 75% | 49% |

| The Trump administration will help mainstream cryptocurrency adoption in the U.S. | 46% | 59% | 36% |

| Government regulation of cryptocurrency will ultimately destroy its purpose and value as a decentralized asset. | 44% | 48% | 41% |

| A national Bitcoin reserve would strengthen the U.S. economy. | 28% | 44% | 17% |

| The U.S. government should offer cryptocurrency-related tax credits or subsidies. | 25% | 39% | 15% |

| I trust the government to regulate cryptocurrencies effectively. | 24% | 28% | 20% |

Current crypto owners are far less supportive than non-owners of government interventions to regulate the blockchain industry and cryptocurrency markets. Meanwhile, current owners are far more likely than non-crypto owners to say they expect the market value of cryptocurrencies to increase while Donald Trump is president.

Mr. Trump also promised to replace the fiercely anti-cryptocurrency SEC Chair Gary Gensler and other SEC commissioners with regulators who are more fair to crypto. In addition, Trump has appointed David Sacks as his AI and crypto “czar.” Sacks is a former PayPal executive with close ties to the blockchain sector and one of the sector’s most prominent investors, PayPal co-founder Peter Thiel. Most current crypto owners are at least neutral regarding this appointment, and only 18 percent oppose it.

Crypto Concerns in 2025

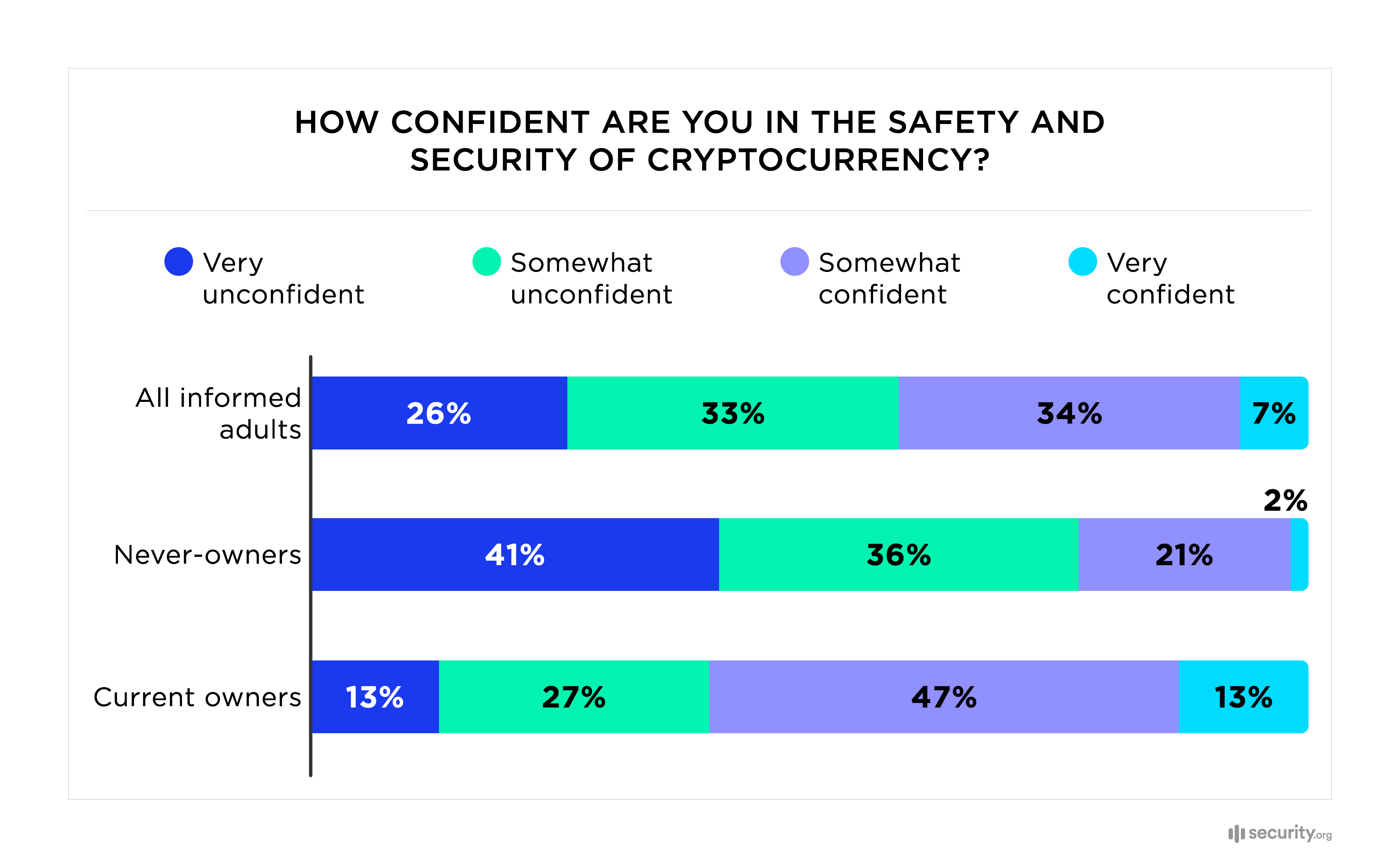

Despite its growing acceptance, people who are aware of crypto are concerned about its safety and security. Today, 59 percent of people familiar with crypto aren’t confident in its security, and even 40 percent of people who own cryptocurrency aren’t confident that the technology is safe and secure. There’s good reason to be wary. Nearly one in five respondents who currently own cryptocurrency say they have had difficulty at some point withdrawing their funds from custodial platforms.

Though popularity has grown over the past few years, 38 percent of non-owners said they will never purchase cryptocurrencies. Why? Top concerns that lead some Americans to rule out ever owning crypto are:

- Volatile markets, unstable token values, and currency exchange rates

- Computer glitches and lost access to tokens

- Digital scams, online hoaxes, rug pulls, and cyberattacks

- Lack of government oversight and consumer protections

| What is your greatest concern regarding cryptocurrency? | Never-owners | Current owners | Past owners |

|---|---|---|---|

| Unstable value | 39% | 32% | 37% |

| Cyber attacks | 11% | 20% | 14% |

| Lost access | 8% | 16% | 11% |

| Difficulty trusting exchanges | 11% | 12% | 11% |

| Unprotected by government or bank oversight | 15% | 6% | 9% |

| Environmental impact | 9% | 6% | 8% |

| Hard to trade | 3% | 4% | 5% |

| No concerns | 3% | 3% | 2% |

| Other | 2% | 1% | 3% |

Current crypto owners’ concerns focused more heavily on practical investment risks. While value instability remains their top worry, they’re uniquely concerned with security threats. Thirty-six percent feared either cyber attacks or losing access to their wallets. Unlike people who’ve never held cryptocurrencies, they show little concern about the lack of regulation. To many owners, cryptocurrencies’ decentralization and unregulated nature are major benefits.

Conclusion

Last year’s cryptocurrency adoption and sentiment study found a bullish outlook for cryptocurrencies returning to the market after participants went into 2023 with a cautious view.

This year, that optimism has held through the previous 12 months of sustained growth in Bitcoin’s price and even more exuberant gains for many altcoins.

Crypto markets are now moving faster and with more participants than ever before. With President Donald Trump’s support, greenlights for crypto developers from several civil cases in U.S. court, and approvals from the SEC for bitcoin and ether ETFs on Wall Street, crypto assets may seem more legitimate and less risky to newcomers.

However, careful investors should not interpret these promising developments for cryptocurrency markets as an unqualified endorsement of crypto tokens. These assets are still held at risk and traded in volatile open markets on the Internet with a broad range of global participants.

Methodology

We conducted an internet-based survey of 1,969 American adults in December 2024. The respondents’ ages, genders, and ethnic backgrounds were representative of the American population. 557 (28%) respondents owned cryptocurrency.