Aura Identity Theft Protection Review 2025

For its $12 per month minimum price, we learned that Aura offers unique features such as auto title monitoring and data removal.

Aliza Vigderman, Senior Editor, Industry Analyst

&

Aliza Vigderman, Senior Editor, Industry Analyst

&

Gabe Turner, Chief Editor

Last Updated on Jul 11, 2025

Gabe Turner, Chief Editor

Last Updated on Jul 11, 2025

What We Like

- All-around protection: Aura's all-inclusive plans provide identity, personal information, credit and device protection all in one with lots of useful extras like data and spam list removal.

- Customizable: Aura's identity protection can be tailored to the user. For parents, family plans provide access to parental control software, so they can better protect their children from identity theft.

- Customer support: Aura can be reached via phone and live chat 24/7 for any concerns about billing, accounts and identity restoration.

What We Don't Like

- No cheaper options: Although Aura does offer several different pricing packages, there aren't any real tiers of service, meaning you can't purchase a lighter version of the service for less money. The cheapest you can get is the Kids service for $10 per month, billed annually.

- Difficult to navigate: Aura offers lots of features, especially in the digital security space. It includes a VPN, antivirus software, parental control software and more. Some of those require different apps, making Aura harder to manage than other identity protection services.

Bottom Line

As one of the premier identity theft protection services, Aura has essential features like a data removal service to keep your personal data off the web and a VPN to support privacy. But at a time when many of us are feeling subscription fatigue, it’s understandable to wonder if Aura is worth the monthly fee.

We are always testing identity theft services like Aura, and our recent tests indicate that it provides a lot of bang for your buck. We have been impressed with its all-around protection and handful of unique features. However, there are a few drawbacks that might give you pause. Let’s get into the details to see if Aura is the service for you.

Aura isn’t just a good deal, we found it’s one of the best identity theft protection service of 2025. Let’s get into what we liked, and a few drawbacks that you need to consider.

Overall Rating

- Criminal and court records monitoring

- Monthly credit scores

- $1 million identity theft insurance reimbursement maximum

Our Methodology

When we research a product or service, we start by researching the features, company claims and user reviews. This gives us a sense of the pros and cons so we can focus our testing in key areas. Then, we purchase the product or service and put it through its paces. With Aura, we scanned the Internet for our personal information, tested credit locks, and more.

Finally, we compare prices with the competition. Is Aura charging a fair price based on what we saw and experienced? How does it compare to other identity theft services from LifeLock and Identity Guard? These price comparisons help us make our final recommendations and consider a product or service like Aura for one of our ‘best of’ lists.

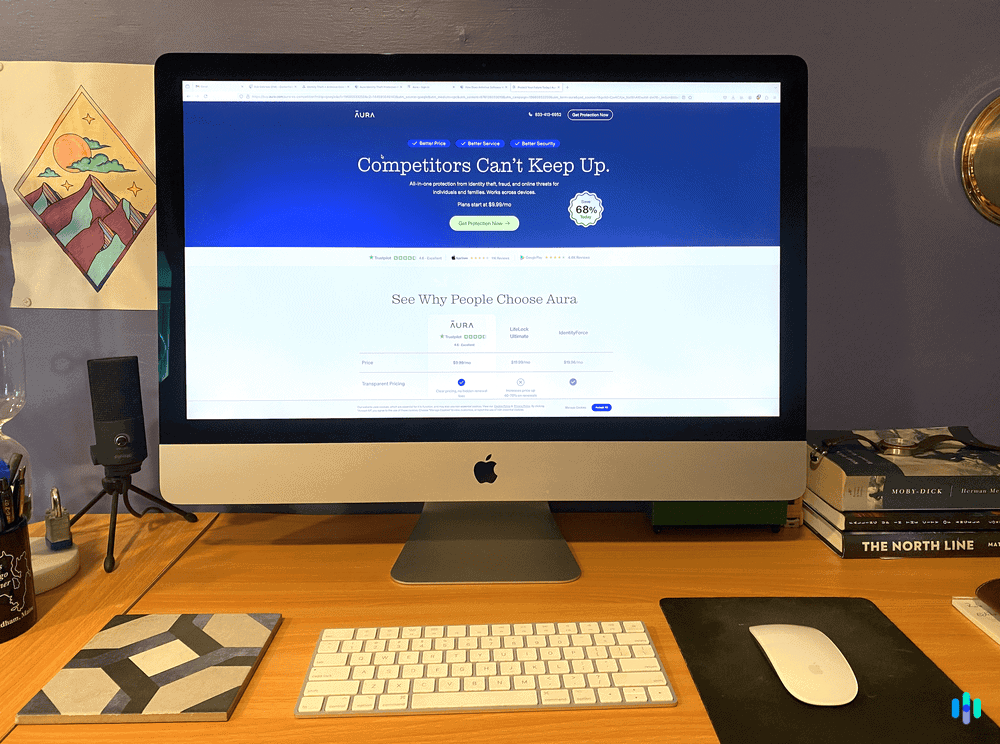

Purchasing and Setting Up Aura Identity Theft Protection

Purchasing and getting started with Aura takes all of 10 minutes. You’ll be asked which service package you’re interested in before entering your personal information to get your account set up. Here’s a quick breakdown of the different plans and prices for reference:

| Plan | Annual Plan Cost (average per month) | Monthly Plan Cost |

|---|---|---|

| Family | $32 | $50 |

| Couple | $22 | $29 |

| Individual | $12 | $15 |

| Kids | $10 | $13 |

Unlike services like LifeLock, Aura doesn’t have tiers that include different features. Aura’s one-plan-to-rule-them-all can be bought in different sizes: individual, couple, and family. It can also be purchased as an annual or monthly subscription. Our Aura pricing breakdown details what each member gets with their Aura plan.

The Family plan adds parental controls like safe gaming for Windows, screen time limits, online history and usage reports. If you’re a single parent with one child and want those features, you can buy an Individual plan for yourself and add a Kids plan for $10 per month. Otherwise, it makes sense to buy the Family plan for $32 per month.

Once you’ve got your account set up, you’ll be asked to answer a few questions that will help tailor the service to your needs.

Activating each individual service wasn’t as simple as toggling on each feature. Many required information from us, while others had us digitally sign some forms. It wasn’t as straightforward as we expected, but that’s a good thing because the more information Aura knows about you, the better it can protect you.

All in all, it took us about 30 minutes to answer all of the setup questions. We recommend having all of your devices with you, including your phone, tablet, and laptop, so you can set up Aura’s cybersecurity features at the same time. Also, be prepared to turn over sensitive information like your Social Security Number, which Aura needs to be able to monitor it.

Pro Tip: We find that the best time to set up identity theft protection services is at night when we don’t have any other tasks waiting for us. That way, we can put all our attention on what we’re doing and make sure the information we’re putting in is correct.

Aura Identity Theft Protection — An Overview

Aura offers a list of features longer than most identity protection services we’ve tested. Here’s a quick rundown of the services provided with an Individual plan:

- Identity theft protection

- $1M identity theft insurance

- Triple-bureau credit monitoring

- Instant credit lock

- Home and auto title monitoring

- Financial transactions alerts

- Antivirus software

- VPN

- Password manager

- People search sites and spam list removal

- Fraud remediation services

To be clear, most identity protection services worth their salt offer these features. Although, some companies offer features like a VPN and password manager as add-ons. The differences between these services come down to execution. This is why we put each function through its paces and live with each identity protection service on a daily basis for an extended period of time.

FYI: Speaking of not knowing until you’ve tried it, Aura offers a 14-day free trial on all plans. That means you won’t be charged for the first 14 days, and if you end up not liking it, you can cancel the subscription and go your merry way without spending a dime.

Putting Aura to the Test

Aura offers a lot of features, so let’s do this methodically. Let’s start with their flagship service: their identity theft protection.

Identity Theft Protection

Simply put, Aura’s identity theft protections are some of the best in the market today. They offer account breach monitoring, Social Security number monitoring, criminal and court records monitoring, and even home and auto title monitoring — yes, some fraudsters have been able to steal people’s homes or at least titles to use as collateral for loans.

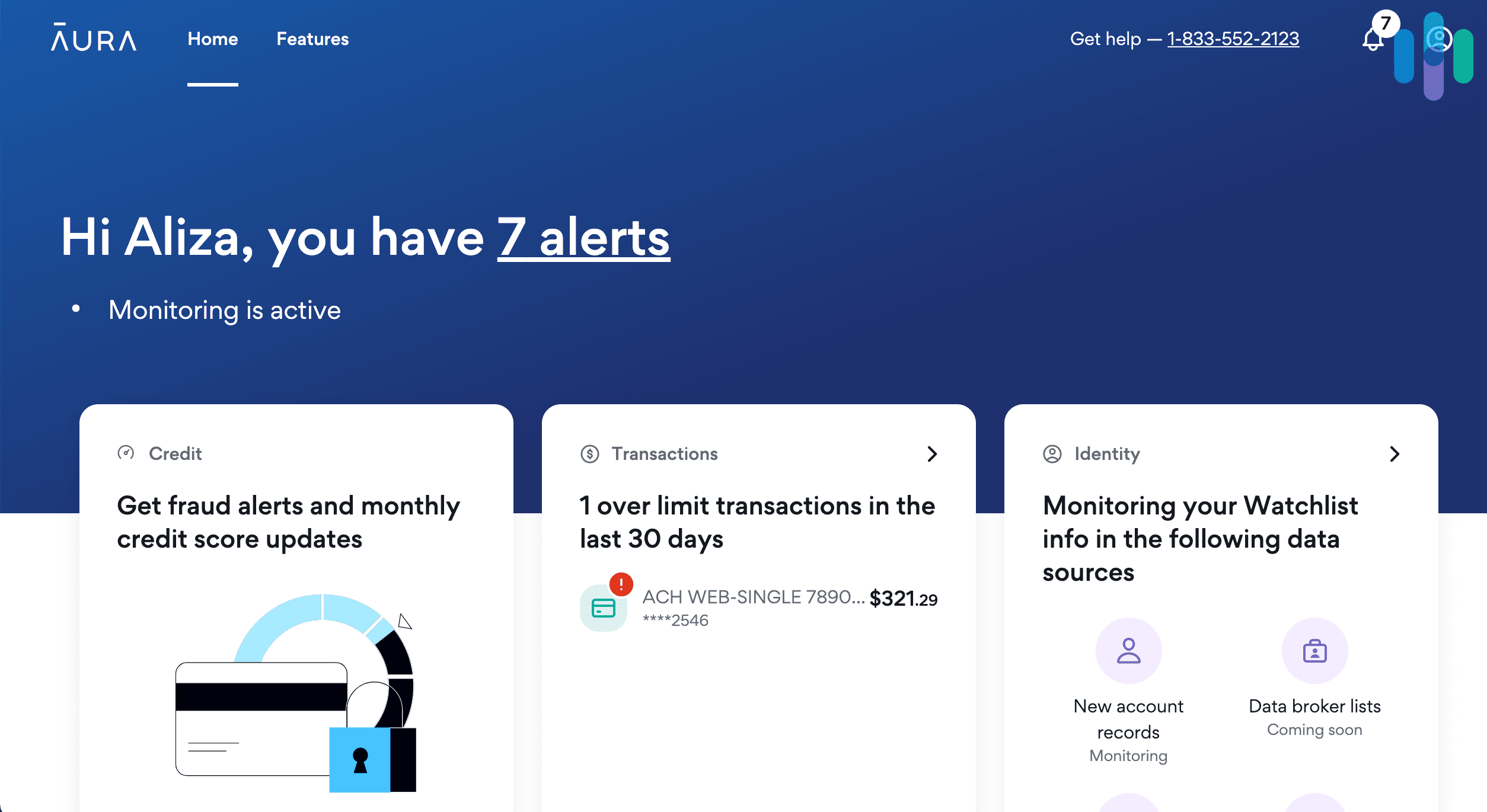

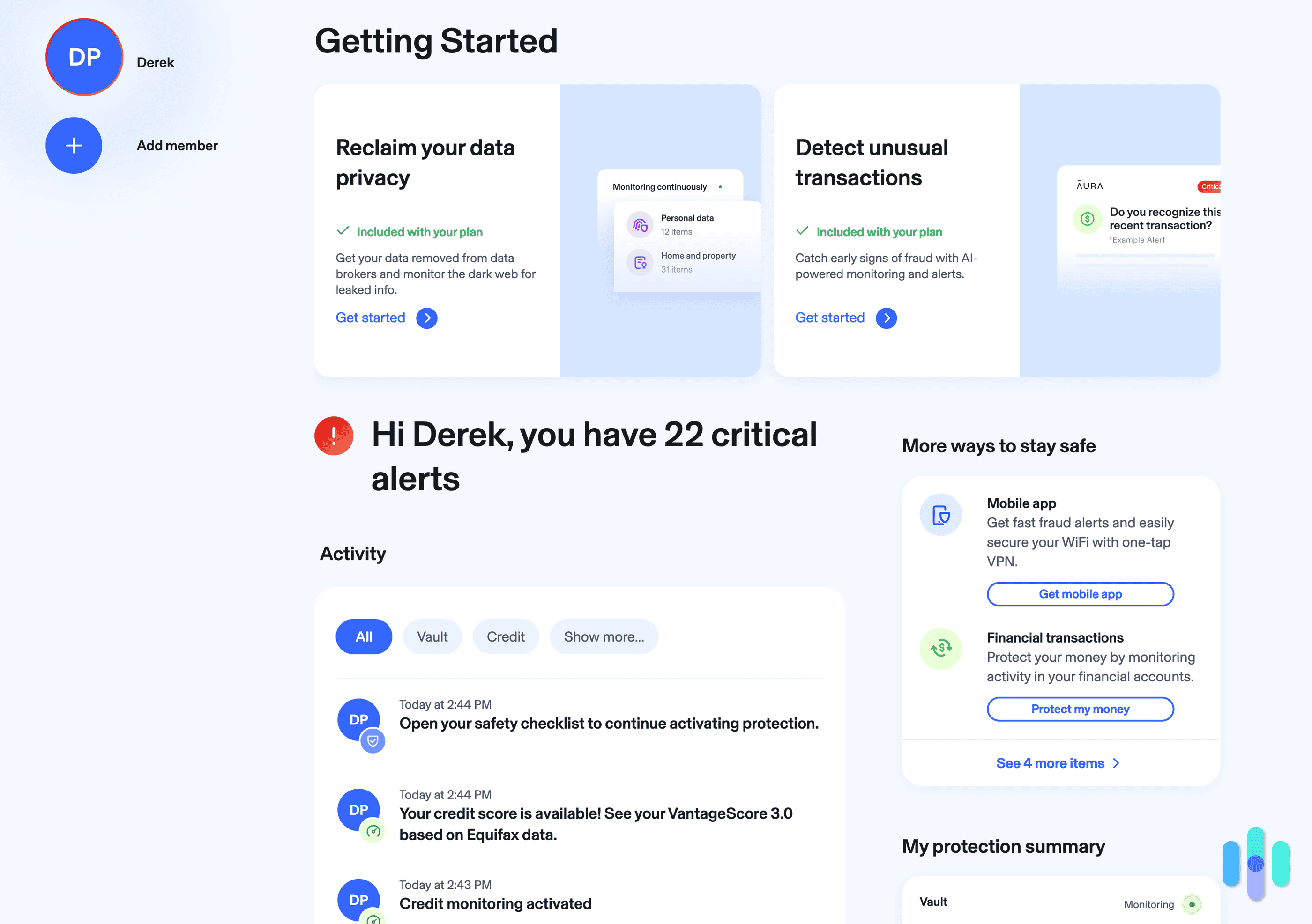

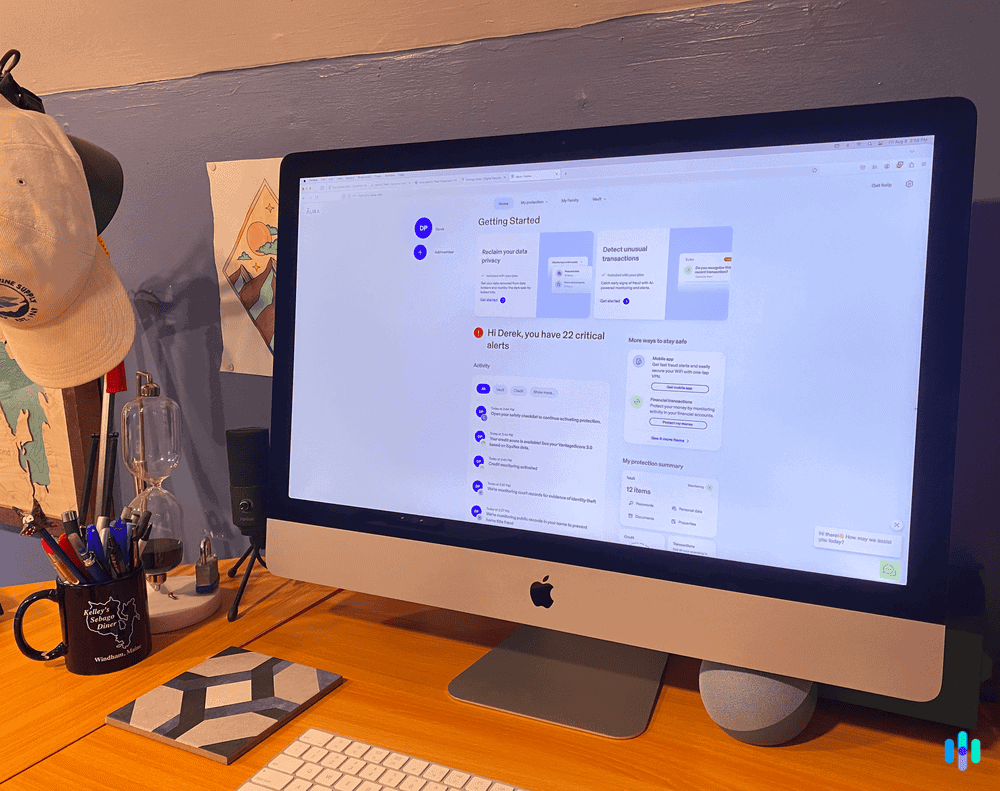

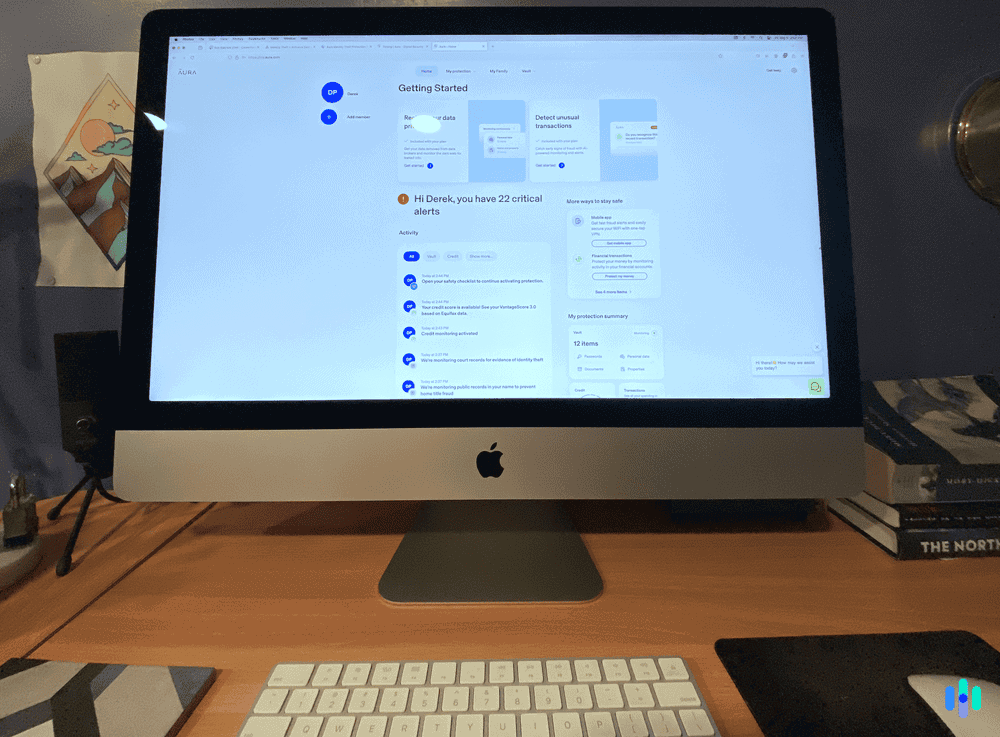

So does it work? We’d say so. When we first set up an account, Aura alerted us to 22 critical issues we had to address. A worrying number? Sure, but fortunately, most of them stemmed from old data breaches involving online accounts we don’t even use anymore. Still, we were glad to see Aura doing its job and picking up on those so quickly.

And for context, here’s everything we tested out under Aura’s identity theft protection umbrella:

- Personal information and ID monitoring: We definitely don’t want our personally identifiable information floating around the internet. Aura notified us if this registered information fell into the wrong hands.

- Social Security and ID authentication monitoring: Aura monitored the internet to see if anyone used our Social Security numbers or conducted transactions using our information identity.

- Online account monitoring: Aura was the first to know of any breaches to our online accounts or passwords. If you don’t want that happening to you, here are some tips for creating a strong password.

- Home title and address monitoring: Aura ensured no one stole our identities by forwarding our mail or used our home title to get a collateral loan.

- Auto title monitoring: Similar to home title monitoring, Aura monitored our car ownership titles.

- Criminal and court records monitoring: Aura even monitored criminal registries and court records to notify us in case our identities appear on any of those. Did you know individuals charged with crimes can use your name to implicate you in crimes you didn’t commit? Yikes!

Now, keep in mind, these protections are reactive, not preventative. That means when it comes to identity theft, Aura isn’t going to stop someone from stealing your identity, but will let you know if someone is trying to do so. That way, you can take the necessary steps to thwart them and avoid bigger damages.

The backstop of this reactive approach is identity theft insurance. If you’ve been hurt by identity theft, Aura’s insurance policy covers up to $1 million in losses per adult plan member. While this is an industry-standard amount of coverage, Aura’s is one of the more comprehensive policies we’ve seen. It even covers damages related to lost wages, CPA costs, and related childcare.

FYI: Aura’s coverage isn’t the most comprehensive. That recognition goes to LifeLock’s Ultimate Plus plan, which we took for a test drive in our LifeLock review. It gives users coverage of up to $1 million for stolen funds, $1 million for legal expenses, and $1 million for personal expenses. That’s $3 million in total – $3 MILLION!

Fraud Protection

Aura protects users from credit fraud by monitoring their credit accounts across the three major bureaus: Experian, Equifax, and TransUnion. We consider three-bureau monitoring a premium feature in the industry. For example, the lowest tier of Identity Guard’s subscription plans doesn’t cover credit monitoring at one bureau, much less three. Three-bureau monitoring is reserved for Identity Guard’s mid-tier and top-tier plans, which start at $16.67 per month.

On top of that, Aura helps prevent financial loss by keeping track of personal finances from bank accounts to investment accounts. Credit protection covers a wide scope, but these were the highlights of our tests.

- Credit monitoring: Aura alerted us to new inquiries on our credit files, like new credit cards or bank loans, across the three major bureaus — Experian, Equifax, and TransUnion. Aura says it sends fraud alerts up to four times faster than its competition, and from our experience, that seems believable.

- Monthly credit score updates: Aura sent us monthly updates on our VantageScore credit score, which helped us track our creditworthiness and pick out inconsistencies. If our score had dropped without us taking out a loan or missing a payment, it could indicate someone was using our credit file. If you’re looking to take out a mortgage or other big loan, we suggest checking our list of the best credit protection services.

- Credit lock: Aura lets you lock your credit with Experian, but not with the other two major credit bureaus: TransUnion and Equifax. You can independently lock your credit with TransUnion and Equifax, just not through your Aura subscription.

- Financial fraud monitoring: We linked our financial accounts, including credit cards, bank accounts and investment accounts, and set alerts for unusual spending activity. Remember, stopping financial fraud is a race against time. The sooner you can report unusual activity, the sooner you can put a stop to unauthorized spending.

- Annual credit report: Finally, we were able to retrieve a copy of our credit reports from the three reporting bureaus, thanks to Aura. It’s worth noting, though, that getting credit reports is free, regardless of whether you’re an Aura user. Check out our guide on how to get a free copy of your credit report for more information.

To be clear, it’s a little difficult to test identity theft protections without breaking the law or posting our personal information all over the dark web. Based on the tests we can conduct, such as applying for a loan with a credit lock on, Aura’s protections are effective. We compare them favorably with LifeLock, which is backed by antivirus giant Norton. For more information on that, you can read our side-by-side Aura vs. LifeLock comparison.

Device and Network Protection

Most of the identity and credit protection features involve reactive monitoring; however, with device and network protection, Aura becomes proactive. This means it can actually protect your personal information from getting stolen in the first place rather than just alert you after the fact. Here’s what you’ll get:

- Antivirus: Did you know that there are over 677 million known malware programs, and over 350,000 are discovered each day? Scary stuff. What’s more, some types of malware are designed specifically to steal sensitive information, like account passwords and personal files. Thankfully, Aura’s antivirus protection can scan, detect and isolate threats for removal. Yes, Aura includes an actual antivirus.

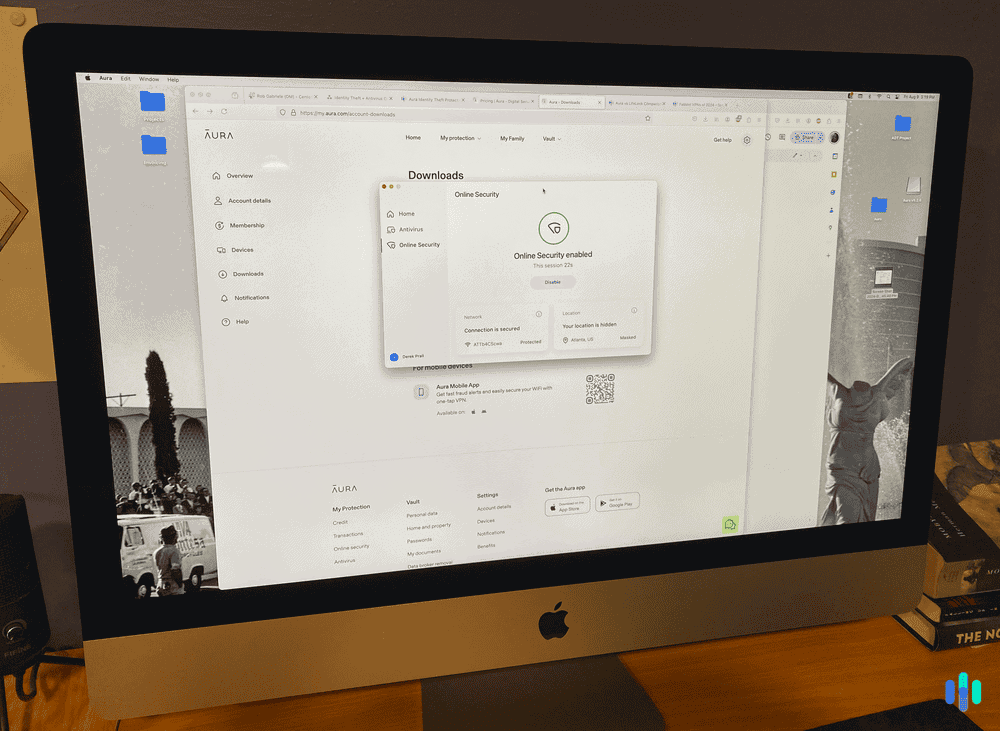

- VPN: Aura’s VPN protected our internet connection with military-grade encryption to hide our activity from cybercriminals. And if you’re thinking, “What does an identity protection brand know about VPNs,” well, Aura actually owns a number of VPN services, like the Hotspot Shield VPN we tested. Protecting your identity is all about staying private, and with a VPN, you can hide your browsing activity, encrypt your traffic and stay anonymous.

- Safe Browsing: Visiting malicious websites is another leading cause of online identity theft, and with the Safe Browsing extension, Aura prevents you from entering questionable sites that could endanger your identity. Some of the sites Aura blocked for us were phishing sites, which are sites known to contain malware.

- Password manager: Our online accounts contain sensitive details, from personal information to payment specifics. Aura locks those up by generating strong passwords and securely storing passwords using encryption. Aura’s password manager worked across all our devices, from desktops and laptops to tablets and smartphones.

- Smart Vault: In addition to a password manager, Aura offers Smart Vault, an encrypted file storage that lets you store sensitive and important files and share them with your trusted contacts. Each adult member of all Aura plans gets 1 GB of secure storage. We used ours to store sensitive work files and digital copies of important paperwork.

- Anti-Track and ad blocker: Websites use trackers to see what you’re up to online — the websites you visit, items you purchase, shows you watch and more — and use the information they gather to profile you. While they generally don’t get personal information from trackers, it’s a good idea to block those to prevent them from being used to target you with ads.

- Email alias: Data breaches have been a problem for the past few years. To help keep your email address from being included in databases of scammers, Aura can generate an email alias for you to hide your real email address and protect it from such breaches. This is similar to Surfshark’s Alternative ID feature, which we tested when we got a Surfshark One subscription.

So these are a lot of digital protections all packaged in one place. That got us thinking: Would we have been better protected by doing everything piecemeal? The long and short of that, though, is a resounding … maybe. Here’s why:

A piecemeal approach requires hunting down the best antivirus software, the best VPN, and more. Then, you have to right-size each individual subscription to make sure you’re getting the most for your money. That’s a lot of work and there’s no guarantee that the cost of one of your services will increase when you go to renew it. By packaging together all services you need, you’re saving yourself a lot of hassle that often translates to minimal benefit.

Was Aura’s antivirus software the most powerful we’ve ever tested? No. Was their VPN the fastest? Also no. Did either of these come with the bells and whistles we saw when we reviewed NordVPN or put TotalAV to the test? Nope. We’re not faulting Aura for any of that though. We give credit where credit is due, and we appreciate Aura for putting together a service that conveniently includes most if not all features you need to protect your identity.

The Drawbacks of Using Aura

One of the primary drawbacks of using Aura is that its web portal is a little difficult to navigate. Based on our experience with various identity theft protection services, we think Aura could have spent more time developing a better user interface. Although it is powerful, it’s not exactly intuitive. By comparison, our review of Identity Guard lays out what a good interface looks like. That said, we eventually got used to the quirks of the Aura web portal.

The other disappointment, we’d say, is that the supplemental features don’t feel as well-rounded as they could have. The main features of an identity theft protection service are identity monitoring, credit and financial monitoring, identity theft insurance, and identity restoration. Now, we do appreciate Aura for including a VPN, antivirus software, password manager, and other supplemental tools, but we wish those tools were a little bit better.

For example, we couldn’t select the server we wanted to connect through on the VPN. It automatically selected a US server every time, which means we couldn’t change our virtual location with it. Again, this is a forgivable offense in our opinion — these services aren’t marketed as being world-class; they perform the function they’re meant to, and that’s all.

Is Aura Worth It?

In our opinion, Aura is a great option for anyone looking for comprehensive digital security and identity theft protection.

Consider Aura if you…

- Are looking for an all-in-one identity theft protection that monitors a number of data sources and transactions.

- Want identity theft insurance that covers you for up to $1 million for eligible losses.

- Value antivirus and a VPN at home and on the go.

- Would like to add up to five adult members to your plan.

- Are looking for a password manager and parental control features.

Reconsider Aura if you…

- Are looking for basic identity protection and don’t want to pay a lot. Aura plans start at $12 per month for individuals. While that’s definitely affordable given the comprehensive protections you’re getting, it is on the higher end compared to basic protections from other companies that run less than $8 per month.

- Already have antivirus software or a VPN of your own, as you can likely save money by choosing a service that excludes those features.

With Aura, we feel like all of our bases are covered, and we would absolutely recommend the service to anyone looking to protect themselves from multiple online threats, both passively and proactively.