Identity Guard ID Theft Protection Review

If you value timely and detailed alerts, we found that Identity Guard is one of the best options in the industry

Aliza Vigderman, Senior Editor, Industry Analyst

&

Aliza Vigderman, Senior Editor, Industry Analyst

&

Gabe Turner, Chief Editor

Last Updated on Jun 10, 2025

Gabe Turner, Chief Editor

Last Updated on Jun 10, 2025

What We Like

- Affordable basic protection: Basic plans start at $7.50 per month for individuals and $12.50 per month for families, which is at the low end of the market. Additionally, family plans can cover a lot of people: up to five adults and unlimited children.

- $1 million reimbursements: We felt good knowing that we were insured for up to $1 million if anyone should manage to hijack our identities.

- Powerful identity monitoring: Identity Guard had used IBM’s powerful Watson computer to provide identity monitoring, but the company recently switched to a partnership with its parent company Aura to provide top-notch protection.

What We Don't Like

- Cheapest plan doesn’t include credit monitoring: If you’re looking for comprehensive identity theft protection, the cheapest plan isn’t a good choice due to its lack of credit monitoring. Credit monitoring is available starting at $16.67 per month for individuals and $25 per month for families.

- Unimpressive app: While it’s easy to use, Identity Guard’s app isn’t as comprehensive as we had hoped.

- Limited proactive protection:: Although all plans include a Safe Browsing feature and password manager, Identity Guard has yet to offer a VPN, which is becoming an increasingly common feature included with identity theft protection services.

Bottom Line

With an Identity Guard subscription, you get a comprehensive approach to identity theft protection, including a data removal service to keep your personal information off data broker sites, dark web monitoring, and credit monitoring. These features don’t come for free, and it can be hard to know if Identity Guard will provide you with enough value in return for your subscription fees.

Between its multifaceted protections and reasonable price, we think Identity Guard is one of the best identity theft protection services of 2025. However, there are some drawbacks, with the biggest being the limited protection offered by the Value plan. Let’s go into detail and see if Identity Guard is for you.

>> Learn More: A 2025 Guide to Identity Theft Protection

Overall Rating

- Identity theft protection powered by AI

- Impressive $1 million in identity theft insurance

- Multiple service levels, from basic to advanced

Video Review

Identity protection services are complex, so this review is going to be long. If you prefer watching to reading, see our Identity Guard video review below. Gabe Turner, an attorney and our Chief Editor, breaks down Identity Guard’s features and app, and shows just how well it works in protecting identities and personal information.

Features

Identity Guard and services like it are designed to catch telltale signs of identity theft so you can quickly react and mitigate or prevent damage. Identity Guard does that by monitoring credit accounts, financial accounts, the dark web, and news reports, and other areas where signs of your identity being stolen could pop up.

When we signed up for the top-tier Ultra protection plan from Identity Guard, we got both credit monitoring and identity theft monitoring services. The coverage was comprehensive, including features like home title monitoring, social media monitoring, and a credit lock with the Experian bureau. We also got protections for our devices and $1 million in identity theft insurance.

>> Read More: A 2025 Guide to Personal Digital Security & Online Safety

From Our Experts: Identity theft protection services don’t offer a magic bullet solution that stops all attempts to steal your identity. In fact, their main purpose is to detect signs that your identity might have been stolen. While they can help lower your chances of falling victim, identity protection services like Identity Guard can’t completely prevent identity theft.

Credit Monitoring

According to our Identity Theft Consumer Shopping Study, credit monitoring is a core function most shoppers look for. Fortunately, it’s also a common feature in identity protection services.

During our tests, we applied for a student loan, and Identity Guard promptly alerted us of activity at one of the major credit bureaus. If we were worried about an individual line of credit, we could have used Identity Guard to put a fraud alert on that credit account, which checks for suspicious activity. Unfortunately, credit and debit card monitoring is only available with the Ultra plan we were testing. Considering the scale of credit card fraud, it’s disappointing that this protection is a premium feature with Identity Guard.

Unfortunately, the lowest-tier plan doesn’t include credit monitoring. As you can see in our LifeLock cost assessment, they offer one-bureau credit monitoring for the same price as Identity Guard’s Value plan. However, once you get up to the mid-tier plans, Identity Guard offers three-bureau credit monitoring, whereas LifeLock still only offers one-bureau monitoring. Learn more in our LifeLock and Identity Guard comparison.

Financial Monitoring

Identity thieves won’t stop at attacking your credit score. They’ll also try to get a hold of your finances. That means any bank accounts and credit cards in your name. But the thieves won’t stop there. They’ll go after your investments and 401K as well.

For instance, Identity Guard notified us and showed us a list of the personally identifiable information entered into our bank’s system when we set up a new account. This would have been helpful if it had been a case of identity theft, as we would have known which details were compromised, tracked where the leak came from, and avoided future incidents.

Once again, the Value plan offers limited coverage for high-risk transactions. The middle-tier plan expands financial monitoring to include bank accounts. Our Ultra plan was the only one that provided comprehensive coverage, including monitoring credit cards, investment accounts, and retirement accounts.

Identity Protection

When we started setting up our Identity Guard account, we were asked for the information we wanted it to monitor, such as our name, address, birth date, and Social Security Number. Identity Guard then began scanning the internet, the dark web, and anywhere else stolen information shows up. This feature is running 24/7 and alerts us the moment Identity Guard finds something so we can take action.

Here’s exactly what we got from our Identity Guard subscription.

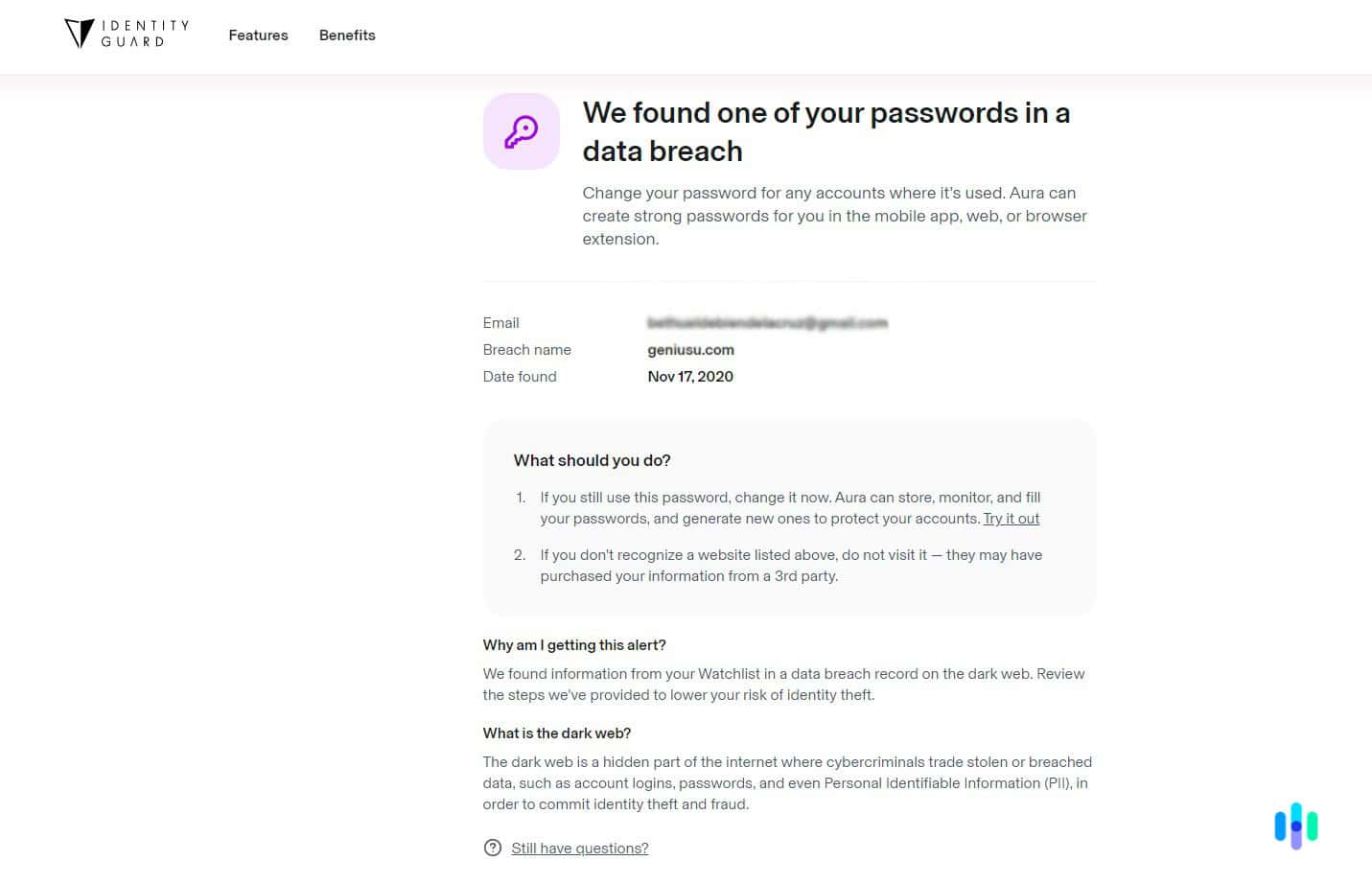

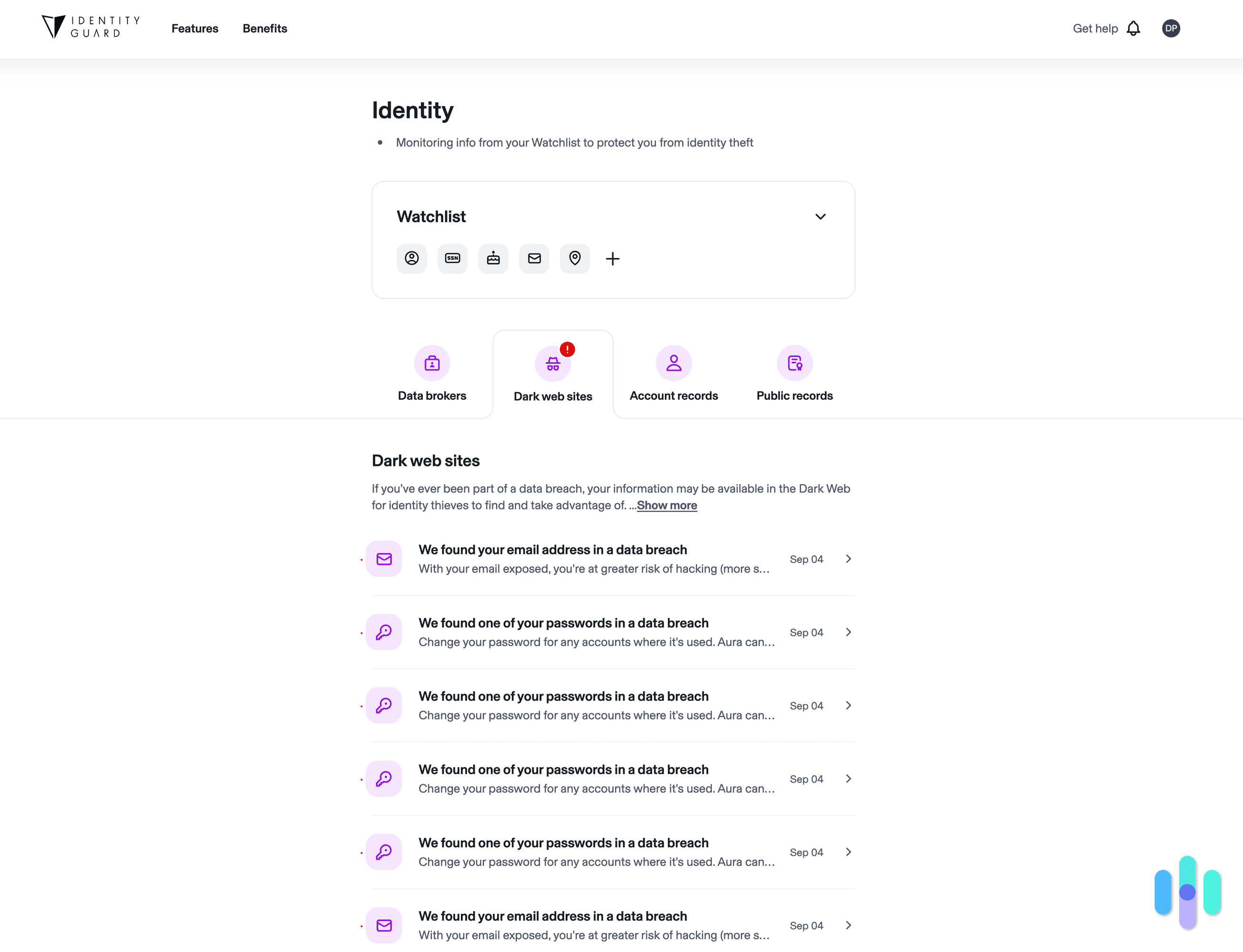

- Dark web scan: The dark web, an area of the internet in which all users remain anonymous, is a hotbed of cybercrime. As part of our membership, Identity Guard sent us alerts if it found our credentials on the dark web. The one time this occurred, Identity Guard explained the situation plainly and prompted us to change our passwords.

- Criminal and sex offense monitoring: If the system found our names on a sex offender registry or police report, it would have notified us right away, but thankfully, this didn’t happen to us.

- USPS address change monitoring:We moved apartments while testing Identity Guard, and of course, we had to change our address registered to the USPS. The same day we did, Identity Guard notified us that an address change was filed. If it were a real thief trying to forward our mail (which contains tons of personal information) to their address, we would have been alerted.

- Home title monitoring: If someone opened a home title in our names, or tried to transfer a home title from our names to theirs if we ever had one, Identity Guard would let us know immediately.

- Risk management report: Identity Guard produced a report that showed us how at risk we were for identity fraud.

- Safe browsing tools: Identity Guard even had a browser extension that helped protect our privacy online, fighting against phishing attacks, blocking ads, flash, trackers, and mining.

- Anti-phishing mobile app: Aside from the Identity Guard Classic app, the company offered us the Anti Phishing by Identity Guard mobile app, which detected and blocked phishing websites on Chrome, Dolphin, and Samsung Internet.

One aspect we liked was the detail in every alert we received (see screenshot above). Right after signing up, Identity Guard used the information we provided to do an initial scan and found a data breach where the email entered was involved. It shows where and when the breach happened, where it found the breached information (dark web), and how it could impact us.

Identity Guard even provides tips on how to fix the problem. There’s a section titled “What Should You Do?” with a list of steps you can take to reduce the impacts. If it’s your first time dealing with identity theft or data breaches, these tips are invaluable and save you Googling for suggestions.

Pro Tip: Some people prefer receiving fewer alerts and reminders, and if that’s the case for you, Aura might be a better fit. When we tested Aura, we found that it sends fewer non-emergency notifications than Identity Guard. We still had the option to see tips and security areas we could improve on in the app, but it didn’t bother us with notifications and email alerts.

Insurance and Restoration

Like we said from the start, no identity protection service can truly prevent identity theft. That’s why insurance and identity restoration should be included in all identity protection packages.

Identity Guard offers to reimburse up to $1 million in losses to customers who suffer an identity theft. Those losses could include stolen funds, legal fees, and personal expenses. While $1 million identity theft protection sounds like a lot, it’s actually the industry standard. There are some plans from companies like LifeLock and McAfee that offer more, up to $3 million in the case of LifeLock.

If you’re on the Ultra plan, Identity Guard will also assign you a dedicated case manager to resolve the case. They’ll send letters and file disputes to your credit card companies on your behalf. This service is a time-saver and another reason to consider upgrading to the Ultra plan.

Identity Guard Identity Theft Protection Features

| Monthly cost for first-year plan | $7.50 – $25.00 |

|---|---|

| Credit score monitoring | Yes |

| Sex offender registry monitoring | Yes |

| Risk management report | Yes |

| Identity theft insurance reimbursement maximum | Up to $1 million |

| Live chat customer support | No |

| Customer information shared with third parties? | Yes |

Privacy and Security

When we were signing up for Identity Guard, we were thinking, “Boy, they are collecting a lot of our sensitive, personal information.” That got us thinking about the famous quote from bank robber Willie Sutton, who said he robbed banks because “that’s where the money is.” The idea that Identity Guard keeps our personal information is a big reason why we took a close look at the company’s data security and privacy policies.

As for guarding against data breaches, Identity Guard uses robust security measures to your data stored on its servers. It encrypts all data using “military-grade” 256-bit AES bit encryption.Also, Identity Guard doesn’t share any information with third-parties unless absolutely necessary. For example, if you receive a scam call, Identity Guard may share your phone number with relevant government agencies such as the FCC and CFPB.

>> More ID Theft Reviews: Lookout Identity Protection

Identity Guard, however, does share some types of information with its corporate partners and service providers, but these types of information come from when you visit its website or sign up for a plan. That includes your email address, device information, and IP location — things that other websites you visit already likely collect and share.

Pro Tip: Want to keep your browsing data, device information, and IP location private? Use a VPN or virtual private network. A VPN will encrypt your traffic and hide your IP address for your privacy, so you can browse the internet more anonymously.

User Experience

Identity theft protection services are pretty much a set-and-forget type of service. Once you’re done setting it up with all the information you want to protect, you can just let it be. It will monitor data points and key areas to make sure the information you provided doesn’t fall into the wrong hands.

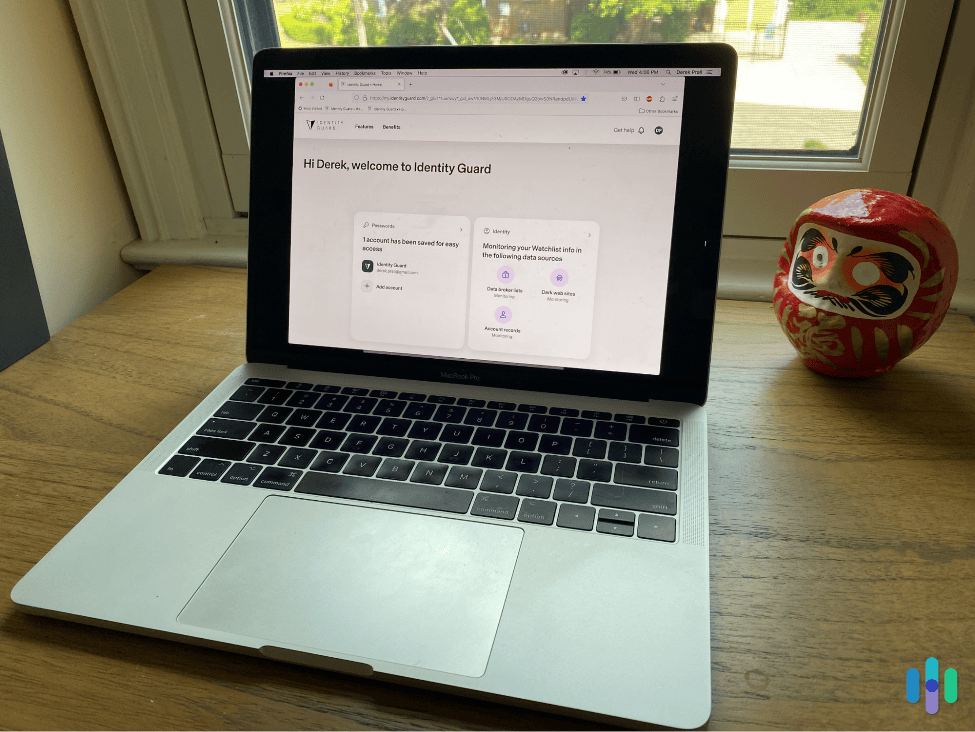

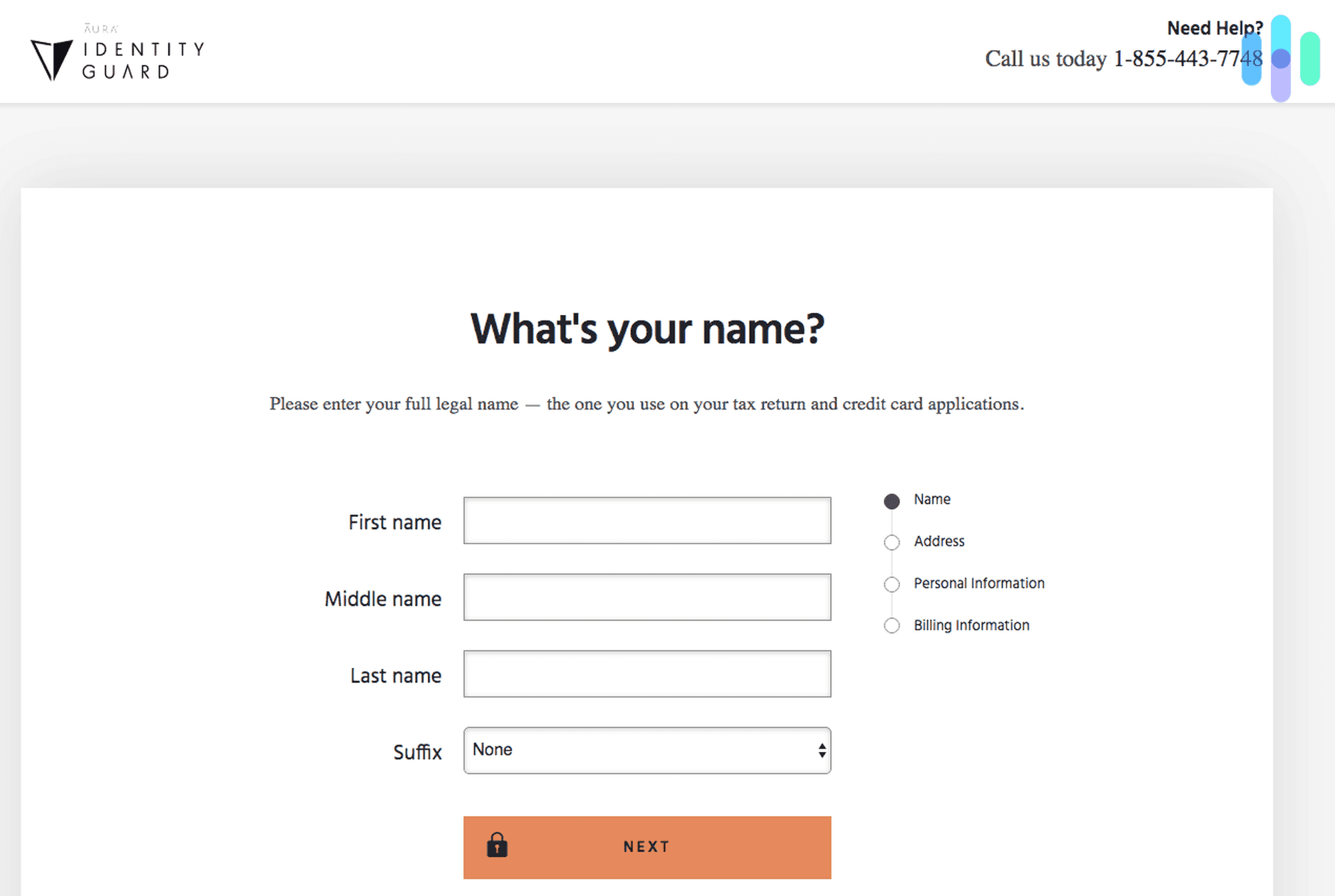

As such, the user experience hinges heavily on the set up process. Identity Guard wasn’t the simplest to set up, but the process was streamlined enough that we could call it user-friendly.

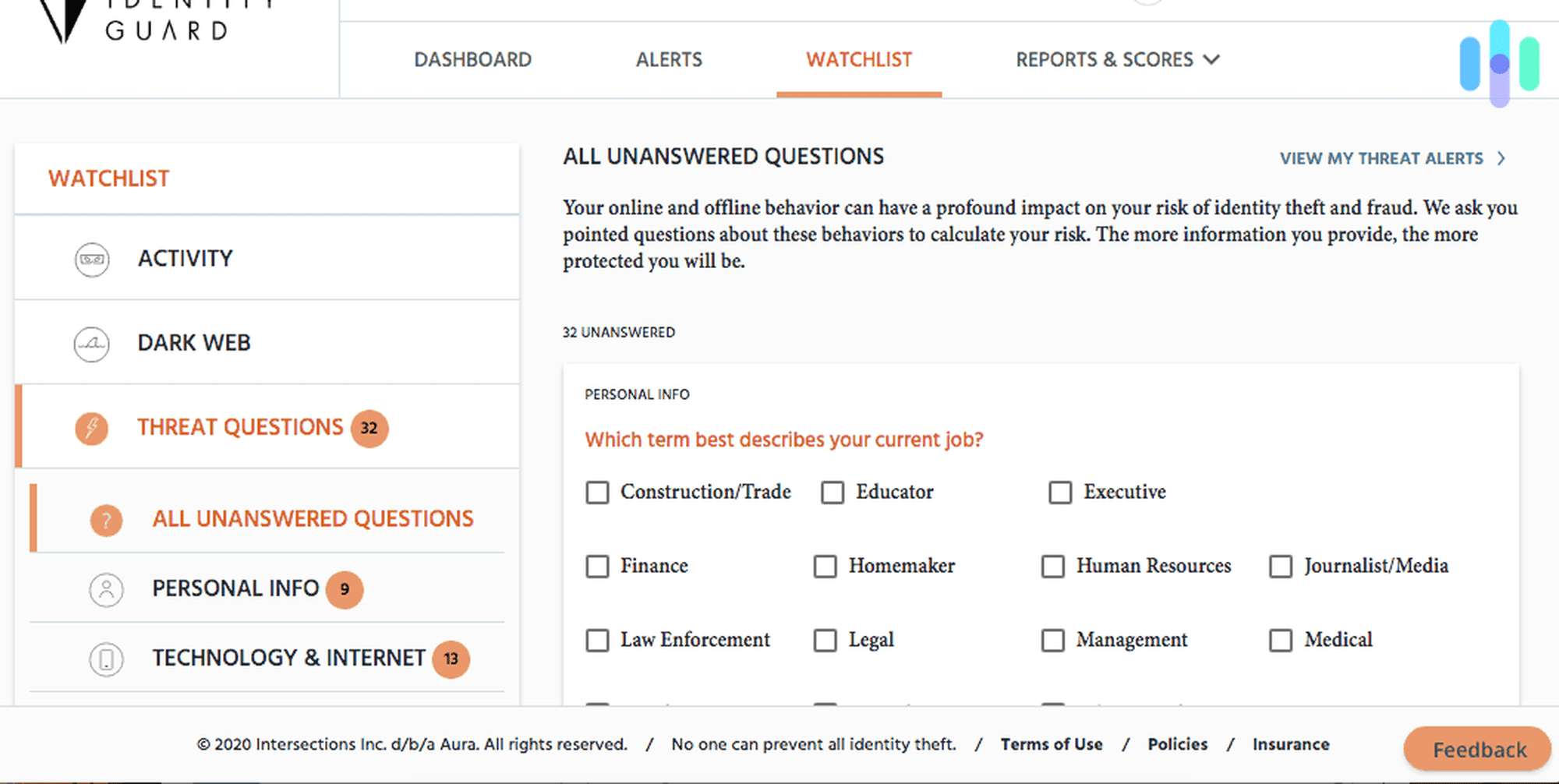

Here’s how it went: First, we filled in our information and bought a subscription. After that, we gained access to our Identity Guard Dashboard, but to fully unlock all features, we had to fill in some more information. This part took the most time as we had to enter our personal details one by one. Identity Guard also had us answer a few multiple-choice questions and a couple of threat-related questions to fine-tune our service.

The more information we gave Identity Guard, the more data they could spit back at us, especially for the AI-powered features like the social insight and risk management reports.

Once we’d input all our information, we navigated between the Dashboard, the alerts, and Watchlist, plus, our credit reports and scores*.

How Much Does Identity Guard Cost?

Identity Guard offers a significant discount for the first year of a subscription if you pay all of it upfront. Monthly, an individual plan with basic protection costs $8.99, but the upper plans can actually range up to $29.99 per month as they get more comprehensive. That said, you can sign up for your first year and save as much as $5 per month. The first-year individual plans, paid all upfront, average out to between $7.50 and $25 per month.

Besides individual plans, Identity Guard offers family plans, which covers up to five adult individuals and an unlimited number of children. Prices for family plans range from $14.99 to $39.99 if paid monthly, but again, discounts are available for first-year plans, as low as $12.50 to $33.33 per month if the year is paid upfront.

FYI: Identity Guard’s identity protection for minor members of family plans isn’t as comprehensive as its protection for adults. That’s why we strongly recommend teaching them five basic but crucial digital safety habits for teens. Identity protection starts at home, and with our help, the younger generation will learn how to best protect themselves from online dangers and identity theft.

Here’s a breakdown of Identity Guard’s regular prices and features for the three plans available: Value, Total, and Ultra.

| Features and pricing | Value | Total | Ultra |

|---|---|---|---|

| 401k and Investment Account Monitoring | No | No | Yes |

| Annual Credit Report from 3 Bureaus | No | No | Yes |

| Bank Account Monitoring | No | Yes | Yes |

| Credit and Debit Card Monitoring | No | No | Yes |

| Credit Monitoring from 3 Bureaus | No | Yes | Yes |

| Criminal and Sex Offense Monitoring | No | No | Yes |

| Customer Support Based in U.S | Yes | Yes | Yes |

| Dark Web Monitoring | Yes | Yes | Yes |

| Data Breach Notifications | Yes | Yes | Yes |

| High Risk Transaction Monitoring | Yes | Yes | Yes |

| Home Title Monitoring | No | No | Yes |

| Identity Theft Insurance with $1 Million Maximum Reimbursement | Yes | Yes | Yes |

| Monthly Credit Score from 3 Bureaus | No | Yes | Yes |

| Risk Management Report | Yes | Yes | Yes |

| Safe Browsing Tool | Yes | Yes | Yes |

| Social Media Insights Report | No | No | Yes |

| USPS Address Change Monitoring | No | No | Yes |

| White Glove Resolution Concierge | No | No | Yes |

| Monthly plan for individuals | $8.99/month | $19.99/month | $29.99/month |

| First year plan for individuals (price increases to the monthly rate after the first year) | $90/year | $200.04/year | $300/year |

| First-year savings with the annual plan | $17.88 | $39.84 | $59.88 |

| Monthly plan for families | $14.99/month | $29.99/month | $39.99/month |

| First-year plan for families | $150.00/year | $300/year | $399.96/year |

| First-year savings with the annual plan | $29.88 | $59.88 | $79.92 |

Identity Guard offers plans for business and personal use, and within those two categories, individuals and groups. Regardless of which subscription plan we selected, we chose between annual or monthly contracts. We had no trouble finding an Identity Guard plan that worked for us. Identity Guard has a plan for spouses as well, a rarity in the identity monitoring industry.

There are three Identity Guard plans to choose from – Value, Total, and Ultra. We chose the Ultra plan as it has the most coverage and was only $29.99 per month or $25 per month when paid annually for individuals. For families, it’s $39.99 per month or $33.33 per month when you pay for a year upfront.

All plans come with $1 million in identity theft insurance, so you don’t need to pay for the most expensive subscription for this protection. But you will need the Total or Ultra plan for bank account monitoring, three-bureau credit monitoring, and a monthly credit score check.

Identity Guard doesn’t have a free trial like Aura, but it does come with a 60-day money-back guarantee. Unfortunately, it’s the closest thing to a free trial for Identity Guard you’ll get.

We appreciated Identity Guard’s 60-day guarantee as a substitute for a free trial. If you’d rather go the try-before-you-buy route, our IdentityIQ review and our LifeLock review are good places to start.

Customer Support

Identity Guard has impressive customer support, whether you’re looking to get more identity theft prevention tips or answers to your account-related questions. Identity Guard publishes several helpful guides and blogs on a monthly basis. Plus, if you’re looking to get more personalized customer support, you can call their phone hotline; it’s available 24/7.

That said, if you have an aversion to making business phone calls like most of us do these days, you have no other option but to send a ticket or send an email. Identity Guard is slower in responding to those. You have to wait for 24 to 48 hours. We sent an email Tuesday morning and got a response Wednesday afternoon.

Additionally, Identity Guard’s email support doesn’t handle concerns that might involve sensitive information such as updating personal details, accounts, and billing. So yeah, you will have to pick up your phone if your concern involves those.

Identity Guard: How It Compares to the Competition

Having discussed what Identity Guard does and how it helps protect its users’ identities, let’s see how it compares to other top options. In particular, let’s compare it to LifeLock and Aura.

Right off the bat, we’d like to mention one thing that both LifeLock and Aura offer, but not Identity Guard: antivirus software. LifeLock is owned by the iconic Norton antivirus company, and select LifeLock plans do include Norton antivirus protection. Aura includes antivirus software and VPN in every all-in-one subscription. If you go with Identity Guard, you’ll need standalone antivirus software.

On the bright side, though, Identity Guard’s use of AI puts it on the same level as Aura and LifeLock in terms of detecting identity theft. Identity Guard’s AI and LifeLock and Aura’s broad monitoring coverage equally provide formidable identity theft protection.

Identity Guard, however, stands out for its price, especially if you’re looking to protect the entire family. The $12.50 per month starting price for the Value family plan is hard to beat. Although it’s not as comprehensive as Aura’s family plan, it offers tremendous value for those who want identity protection (without credit protection) on a budget.

All things considered, we’d say that Identity Guard holds up well against LifeLock and Aura, our two highest-rated identity protection services.

Can Identity Guard stand toe-to-toe with other brands? Find out below.

We tested Identity Guard and compared it side-by-side with other brands to give you the full picture.

Our Identity Guard Research and Data

The following is the data and research conducted for this review by our industry-experts. Learn More.

Encryption

| In Transit | Yes |

|---|---|

| At rest? | Yes |

| All network communications and capabilities? | Yes |

Security Updates

| Automatic, regular software/ firmware updates? | Yes |

|---|---|

| Product available to use during updates? | Yes |

Passwords

| Mandatory password? | Yes |

|---|---|

| Two-Factor authentication? | On mobile app, but not on browser |

| Multi-Factor authentication? | Yes |

Vulnerability Management

| Point of contact for reporting vulnerabilities? | customersupport@identityguard.com |

|---|---|

| Bug bounty program? | No |

Privacy Policy

| Link | https://www.identityguard.com/legal/privacy-policy |

|---|---|

| Specific to device? | No |

| Readable? | Yes |

| What data they log | Name, mailing address, email address, phone number, social security number, birthday, payment information, location information, credit reports, information from social media accounts, like Facebook friends, city specified you live in, content of posts and comments and cookies. |

| What data they don’t log | n/a |

| Can you delete your data? | No |

| Third-party sharing policies | Yes, Identity Guard shares information with third parties. |

Surveillance

| Log camera device/ app footage | n/a |

|---|---|

| Log microphone device/ app | n/a |

| Location tracking device/ app | Yes |

Parental Controls

| Are there parental controls? | Under family plan, can get alerts about child’s information on the dark web |

|---|

Company History

| Any security breaches/ surveillance issues in past? | No |

|---|---|

| Did they do anything to fix it? | n/a |

Additional Security Features

| Anything like privacy shutters, privacy zones, etc.? | n/a |

|---|

Recap

Overall, Identity Guard is a strong identity protection service. It covers a wide area to monitor for signs of identity theft, it uses artificial intelligence to increase the efficiency of its service, and it values people’s privacy.

It’s not the cheapest service around, especially if you want the whole nine yards, but you get the right value for your money.

Overall, we appreciated Identity Guard’s comprehensive features and low prices on the lower-tiered plans. However, we still felt anyone concerned about privacy might want to find an identity monitoring service that does not share information with third parties.

** Identity Theft Insurance underwritten by insurance company subsidiaries or affiliates of American International Group‚ Inc. The description herein is a summary and intended for informational purposes only and does not include all terms‚ conditions and exclusions of the policies described. Please refer to the actual policies for terms‚ conditions‚ and exclusions of coverage. Coverage may not be available in all jurisdictions.

* The score you receive with Identity Guard is provided for educational purposes to help you understand your credit. It is calculated using the information contained in your TransUnion credit file. Lenders use many different credit scoring systems, and the score you receive with Identity Guard is not the same score used by lenders to evaluate your credit.

Identity Guard® FAQs

-

Is Identity Guard any good?

Overall, we appreciate Identity Guard’s comprehensive features and low prices. However, we have some privacy concerns as a result of the service sharing user information with third parties.

-

Which is better, LifeLock or Identity Guard?

We rate Lifelock higher than Identity Guard. However, there are pros and cons to each service. While LifeLock offers more comprehensive coverage, that can mean higher costs and more complexity compared to Identity Guard. On the other hand, the budget plans from Identity Guard offer very minimal protection, even compared to similar cheap plans from LifeLock.

-

What does Identity Guard do?

Identity Guard monitors changes in our credit file as well as our checking and savings accounts. If changes are detected, Identity Guard alerts us through email, SMS, or the Identity Guard Classic app. There are also more cybersecurity features available, like dark web monitoring and anti-phishing software.

-

How much does Identity Guard cost?

Identity Guard plans range from $8.99 to $29.99 per month for individuals and $14.99 to $39.99 per month for families. If you pay for the first year upfront, you get 16 percent off the monthly rate.

-

Which identity protection tool is best?

Based on our tests, LIfeLock is currently the best identity theft protection tool, followed by Aura and Identity Guard. All of these services offer robust identity and credit protections, but LifeLock offers the most comprehensive coverage. It’s worth pointing out that Aura owns Identity Guard, so whichever service you choose, you’ll be dealing with the same parent company.

-

Where is Identity Guard located?

Identity Guard is located in the United States. That means that they’re under the jurisdiction of the three international surveillance alliances, Five Eyes, Nine Eyes and 14 Eyes. If there’s reasonable cause, the company could be forced to hand over customer information.