LifeLock Identity Theft Protection Review 2025

This feature-stacked contender offers device protection with the Norton 360 antivirus add-on.

Aliza Vigderman, Senior Editor, Industry Analyst

&

Aliza Vigderman, Senior Editor, Industry Analyst

&

Gabe Turner, Chief Editor

Last Updated on Jul 11, 2025

Gabe Turner, Chief Editor

Last Updated on Jul 11, 2025

What We Like

- Identity, credit and investment monitoring: LifeLock provides monitoring for identity, credit and financial accounts, including the dark web, all three credit bureaus and investment accounts.

- Valuable insurance: LifeLock’s top-tier protection plan promised to reimburse us for up to $1 million of stolen funds and personal expenses from identity theft.

- Norton security + VPN: The Norton 360 and LifeLock pairing provided us proactive protection from online threats, including malware that can steal our digital identities. Courtesy of Norton Secure VPN, the virtual private network encrypted our connections and let us browse the internet anonymously.

What We Don't Like

- Expensive after the first year: Once LifeLock’s one-year promotional period expires, prices go up. For example, LifeLock’s most expensive individual plan goes from $239.88 in the first year to $339.99. The same plan for families is $467.88 in the first year and renews at $799.99.

- Lower cost, less insurance: Only LifeLock’s expensive plans cover up to $1 million in losses and personal expenses related to identity theft. The least costly plans reimburse up to $25,000 in stolen funds. All subscribers are covered for up to $1 million in fees for lawyers and other experts.

- Confusing purchasing process: Since they offer so much, it can be difficult to figure out where to purchase exactly what you need.

Bottom Line

As a Norton product, LifeLock has the backing of one of the best antivirus software platforms. But iconic branding doesn’t mean something is a quality product or service. So, is LifeLock true to the Norton brand, or is it riding on its coattails?

In this situation, our tests have confirmed that LifeLock is one of the best identity theft protection services right now. While the budget plan offers strong protection at a competitive price, the top-tier plans provide comprehensive coverage that translates into peace of mind. That being said, LifeLock’s comprehensiveness is a bit of a double-edged sword. There are so many different options that it can be hard to dial in the exact amount of coverage you need. Let’s examine the pros and cons to see if LifeLock should be your identity theft protection service.

Overall Rating

- Full-service identity theft and credit monitoring

- Device protection with Norton 360 antivirus

- Reputation for outstanding customer service

LifeLock’s Plans

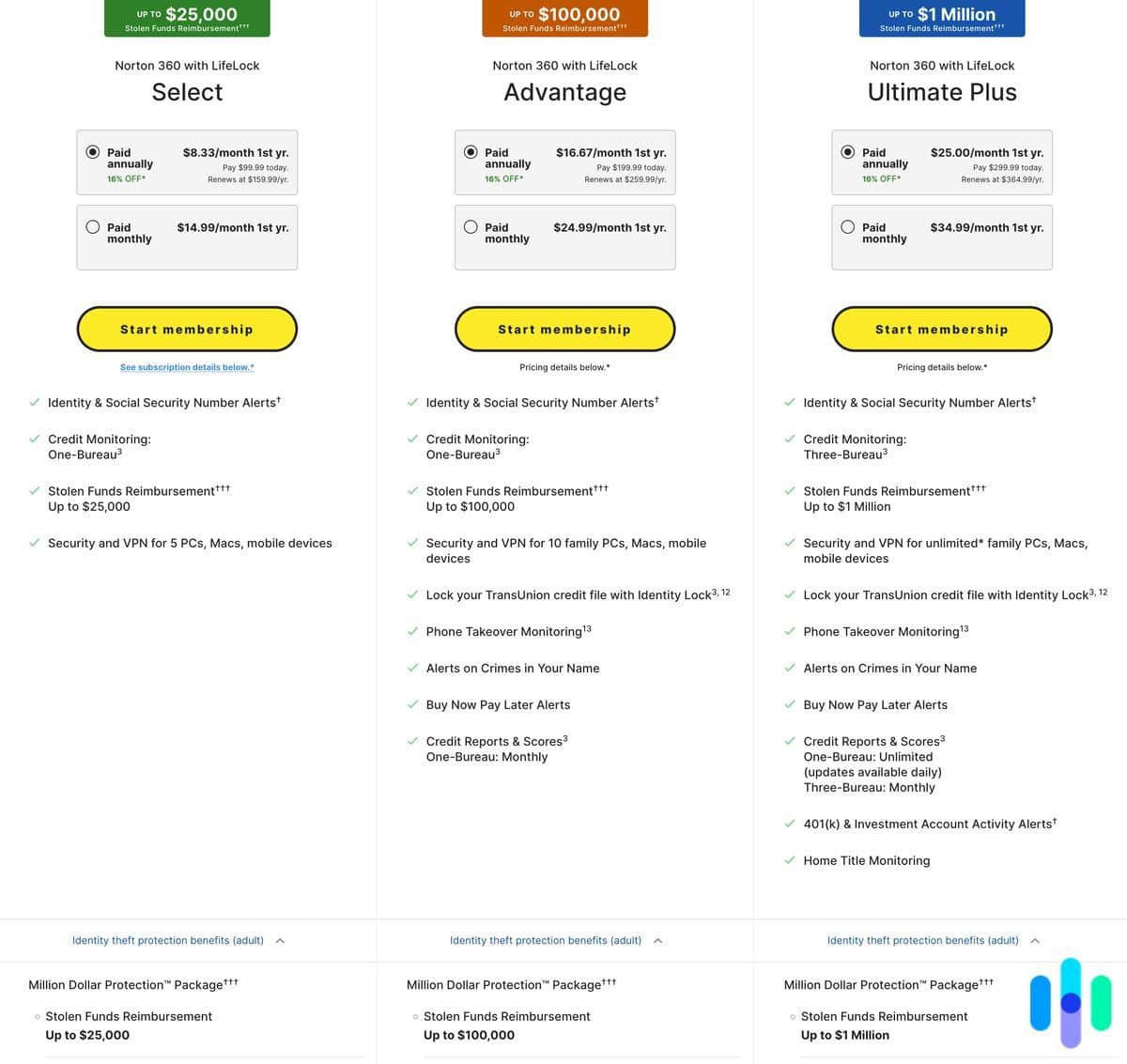

LifeLock is packed with services and features. We go into more detail in our LifeLock subscriptions guide, but here’s a taste of what’s available. Each plan is priced for individuals, couples, and families. The family option covers two adults and up to five kids. Here’s what the plans include.

| Feature | Identity Advisor | Standard | Advantage | Ultimate Plus |

|---|---|---|---|---|

| Identity and Social Security number alerts | Yes | Yes | Yes | Yes |

| Credit monitoring | No | Single bureau | Single bureau | Triple bureau |

| Stolen funds reimbursement | No | Up to $25,000 | Up to $100,000 | Up to $1M |

| Credit lock | No | No | Yes | Yes |

| Phone takeover monitoring | No | No | Yes | Yes |

| Crimes in your name protection | No | No | Yes | Yes |

| Buy now, pay later alerts | No | No | Yes | Yes |

| Credit reports and scores | No | No | Single bureau, monthly | Single bureau, daily; triple bureau, monthly |

| Investment account protection | No | No | No | Yes |

| Home title monitoring | No | No | No | Yes |

| Norton 360 Add-On (antivirus and VPN) | Not available | +$1.33 per month for five devices | Not available | +$5.01 per month for unlimited devices |

| Monthly price average | $3.33 | $7.50 | $14.99 | $19.99 |

| Annual price | $39.99 | $89.99 | $179.99 | $239.99 |

| Annual price renewal | $49.99 | $124.99 | $239.99 | $339.99 |

Just to be clear – this is a list of the primary features for each plan. There are other extras like password managers, and ad-tracker blockers included as well. Another thing to note is that these prices only cover one person. If you want protection for you and your partner or the whole family, you’ll pay more. Here’s how much it costs for couples:

| Standard | Advantage | Ultimate Plus | |

|---|---|---|---|

| Monthly price average | $12.49 | $23.99 | $32.99 |

| Annual price | $149.87 | $287.88 | $395.88 |

| Annual price renewal | $249.99 | $479.99 | $679.99 |

And here’s a breakdown of those costs for families:

| Standard | Advantage | Ultimate Plus | |

|---|---|---|---|

| Monthly price | $18.49 | $29.99 | $38.99 |

| Annual price | $221.87 | $359.88 | $487.88 |

| Annual price renewal | $359.99 | $579.99 | $799.99 |

A good way to understand this pricing is to compare it to the competition. When we compared LifeLock to Aura, we noticed that Aura’s equivalent to Ultimate Plus costs just $32 per month. While the Standard and Advantage plans are cheaper, they have fewer tools and monitoring features. The newly released Identity Advisor plan is a basic option that includes monitoring and restoration features.

LifeLock’s Features

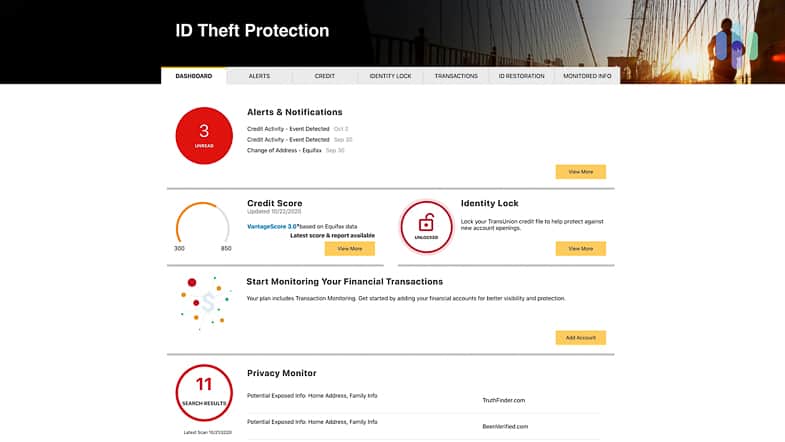

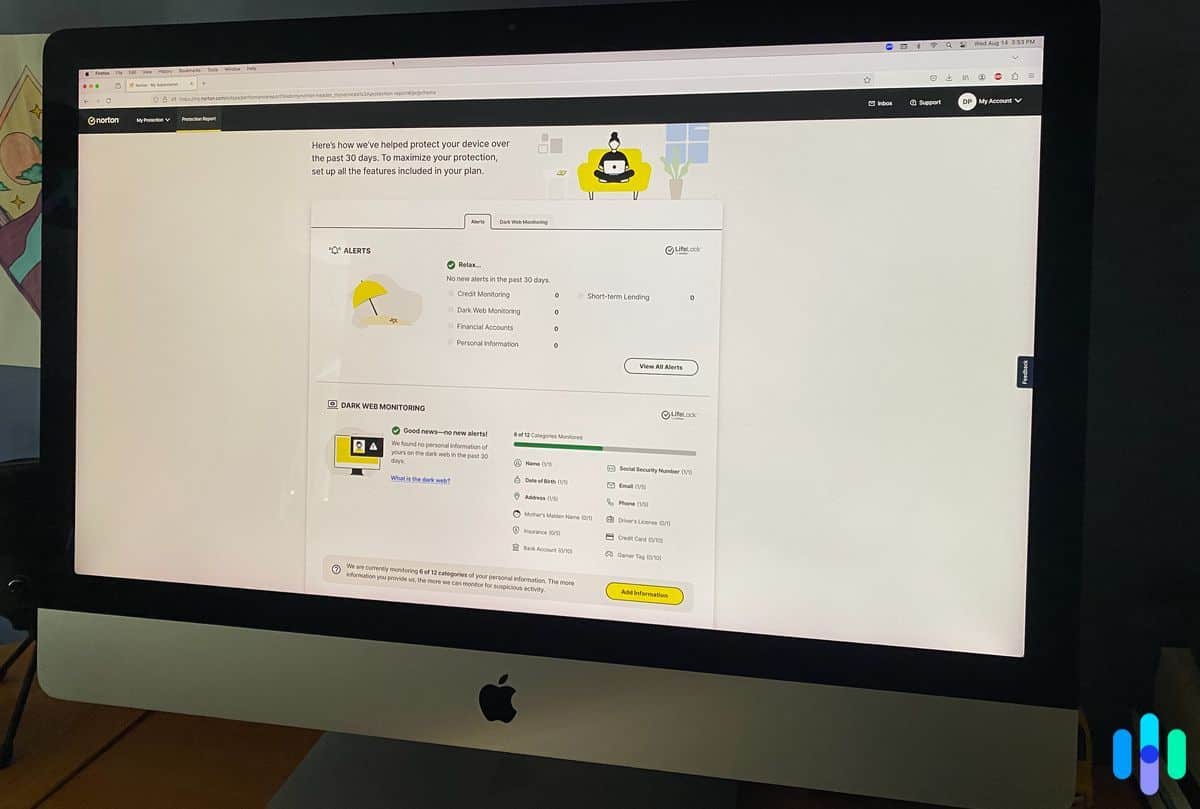

During our testing, we noticed each feature is categorized into alerts, identity monitoring, credit monitoring, financial monitoring, and digital protections. This made it easy to navigate through the menus to find the service we were looking for.

Even the cheapest LifeLock plans offer a wealth of features, so let’s discuss them one category at a time and see what you can expect from each.

Monitoring and Alerts

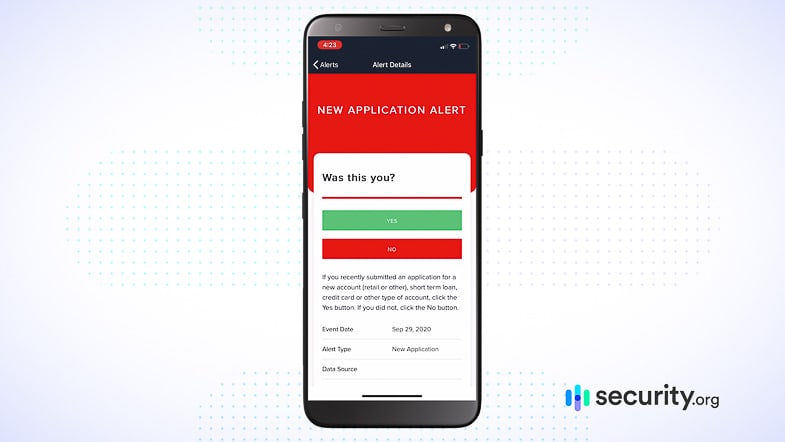

LifeLock and similar services protect your identity by monitoring activity related to your identity and alerting you when something pops up. Ideally, you want a service that catches suspicious activity and alerts you as quickly as possible, so any damage can be avoided or minimized.

Most identity protection services monitor credit bureaus and financial institutions for activity. When we tested LifeLock, we applied for a mortgage and quickly were alerted that our Social Security Number might have been used to secure a loan. Okay LifeLock!

The extent of credit monitoring depends on your subscription. With our Ultimate Plus plan, we had monitoring at all three major credit bureaus. However, the Standard plan only has one bureau monitoring. To be clear, some people say monitoring one bureau is adequate, but we feel that monitoring all three agencies eliminates concerns about credit fraud.

>> Compare: A Comprehensive Comparison of Identity Guard and LifeLock

Identity Monitoring

All LifeLock plans have the standard identity monitoring features we expect, like dark web monitoring, ID verification, and data breach notifications. LifeLock has also added utility account creation monitoring, which requires a credit check but doesn’t impact your score. Some of the identity monitoring features are:

- USPS address changes

- Crimes registries

- Court records

- Sex offender registries

- Dark web content

- Data breach notifications

If any changes occur or if your personal information appears in places like data breach lists, LifeLock will let you know. That is vital, because if any of those identity theft signs appear, someone likely got ahold of your personal information. With LifeLock keeping watch, you stand a fighting chance to prevent identity theft, or at least minimize the damages of an identity theft.

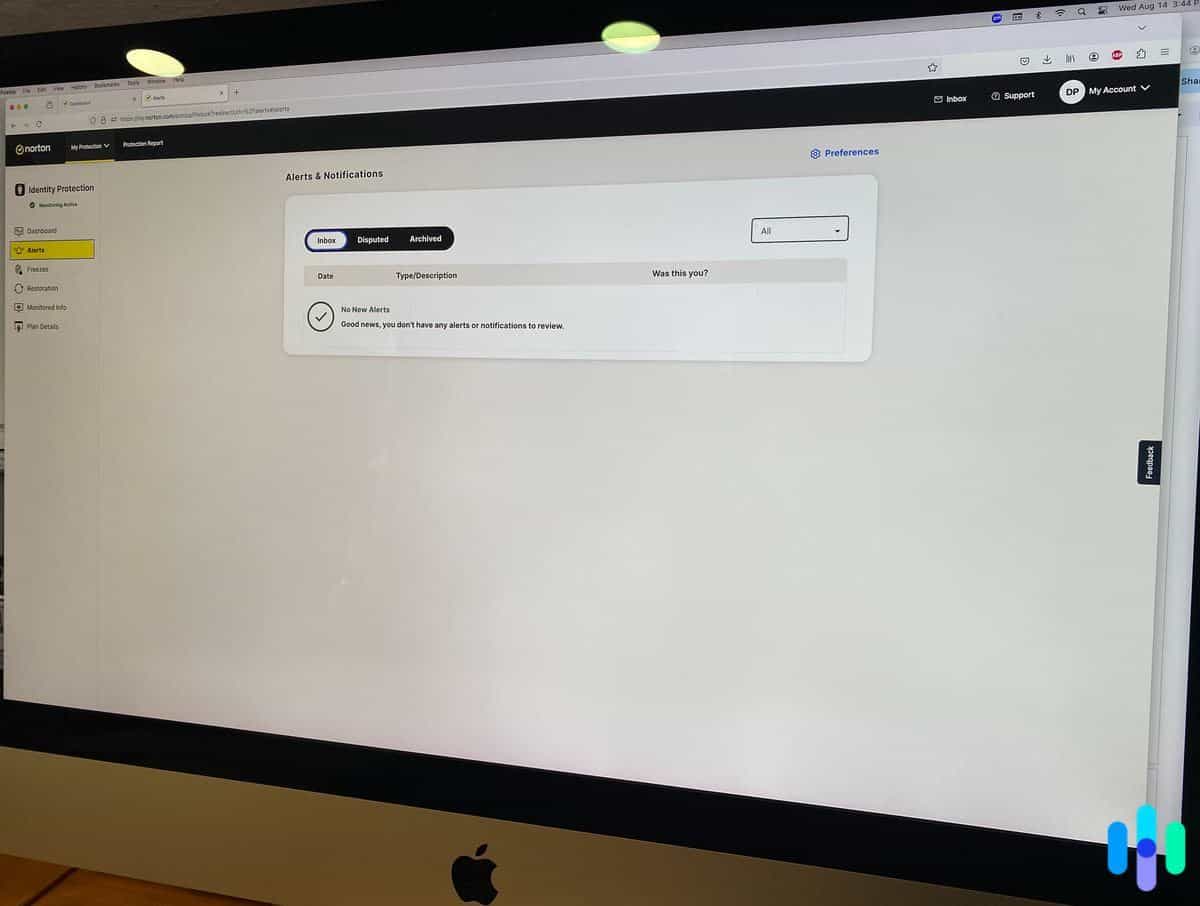

We didn’t receive a lot of notifications during our testing period, but that doesn’t mean LifeLock didn’t work. We take our privacy seriously and do our best to mitigate our online exposure. We did receive some notifications about past data breaches involving old accounts we no longer use, so we headed to those websites and deleted our accounts permanently. Knowing that LifeLock was constantly scanning gave us peace of mind.

Good to Know: One of LifeLock’s best identity monitoring features is fictitious identity monitoring, which works to detect synthetic identity theft. That type of theft steals portions of your personal information to create a fake persona and use it for fraud. It’s harder to detect because not all details of that fake identity matches yours, but LifeLock’s fictitious identity monitoring is designed exactly for that.

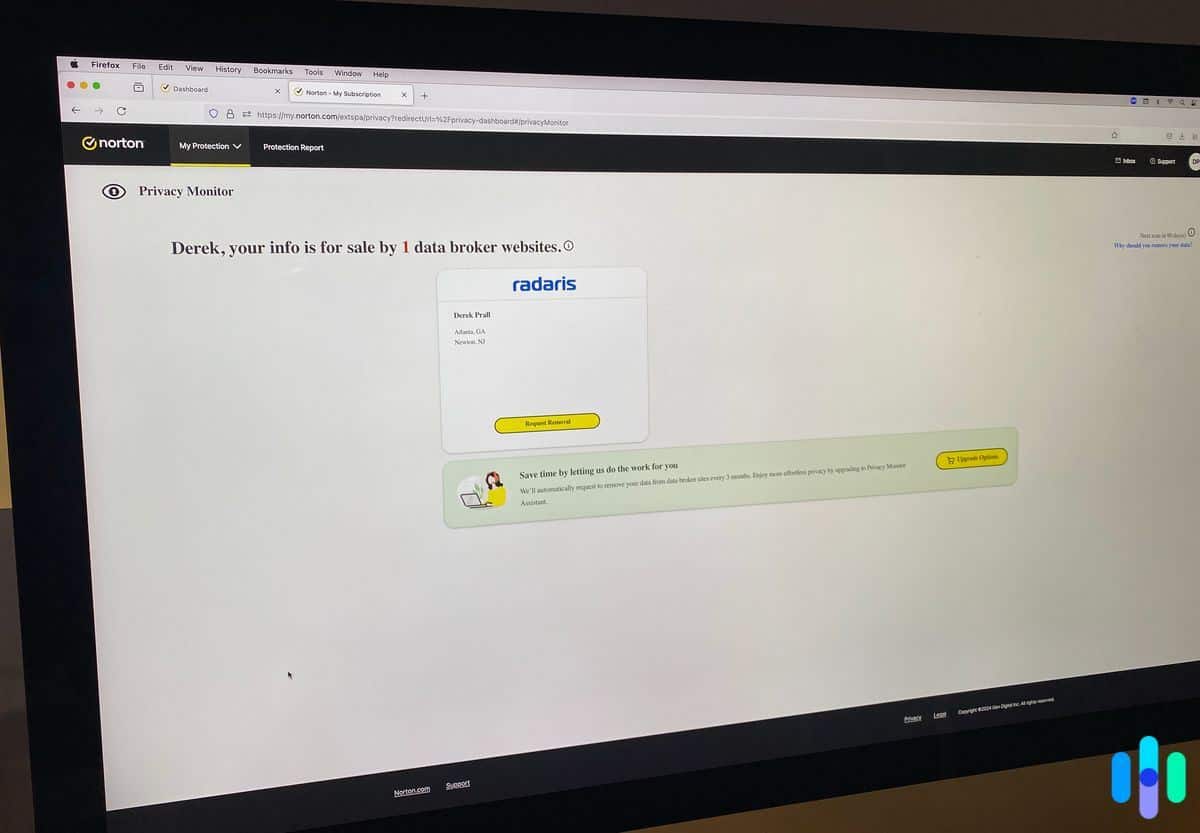

In addition to monitoring, LifeLock takes a proactive approach with their Privacy Monitor feature that acts as a data removal service. It helps you scrub personal information off people-search sites that cobble together public information to create profiles that list your name, age, address, phone number, and more. During our tests, Privacy Monitor found a website with our personal information so we could have it taken down.

Word to the wise, keep a list of the data broker sites. Some sites grant opt-out requests but don’t remove your information from their databases. They just take it off the site. That means your data might reappear again. Or you can invest in one of our favorite data removal services — they automate the process, so you don’t have to think about it.

Pro Tip: Privacy Monitor is a feature from Norton, so only LifeLock with Norton 360 plans enjoy this feature. On the bright side, it highlights the value of adding Norton 360. It adds antivirus software, a VPN, Privacy Monitor, and a bunch of other digital protection tools for as low as $1 per month when added to your LifeLock plan, while data removal services like Incogni cost about $13 per month.

Credit Monitoring

With our Ultimate Plus subscription, LifeLock provided us with comprehensive triple-bureau credit monitoring complete with credit reports and score updates from all three bureaus. Credit reports arrived monthly, while the credit score on the app updated daily.

By identity theft protection standards, three-bureau credit monitoring is the industry best. In fact, that’s one of the reasons why LifeLock is one of the best identity protection services with credit monitoring and reporting.

Not all LifeLock plans include three-bureau credit monitoring. Only the Ultimate Plus plan offers it. The lower-tier plans will only monitor one credit bureau, and with the most basic subscriptions, free credit reports are not included.

Pro Tip: You can get free credit reports every week. They’re not automatic, though, like they are with LifeLock. You need to request them each time from Annual Credit Report’s website.1

LifeLock also offers a proactive approach to protecting your credit by helping you file a TransUnion credit lock. This prevents anyone, including yourself, from opening new credit lines without filing a request to unlock your credit. Taking this step might sound like a hassle, but it stops credit fraud before it happens.

We found out this works by accident. We were trying to set up a joint savings account with our partner, and the bank said it couldn’t access our credit file. We logged on to our computer, switched the lock off and it was smooth sailing from there. Happy to know that LifeLock’s functionality works in that regard.

Of course, for complete protection, you’ll also need to freeze or lock your accounts with the other two major credit reporting bureaus: Experian and Equifax. You can’t do that with the help of LifeLock, unlike with TransUnion, but you can contact Experian and Equifax directly to freeze your credit for free.

FYI: One-bureau credit monitoring is still better than none. Identity Guard’s Value plan doesn’t include any credit monitoring and is the same price per month as LifeLock Standard for individuals. You need to upgrade to a more expensive Identity Guard plan for in-depth financial and identity monitoring.

Financial Monitoring

With an Ultimate Plus subscription, LifeLock monitored our credit, checking, and savings accounts. We could get alerts when our money moved in those accounts, or someone requested information changes. LifeLock also monitored for new accounts with our name and changes to our 401(k) investment accounts.

During our test period, we didn’t get many of these alerts. We still recommend turning them on, though, as any of these activities could be a major red flag that your identity is being stolen.

LifeLock also offers reimbursement in the event that we experienced losses due to identity theft. Our Ultimate Plus subscription covers up to $1 million in losses, which is standard across the identity monitoring industry. Also worth noting — LifeLock covers $1 million in personal expense compensation and another $1 million for legal expenses. That’s a $3 million coverage total.

The $1 million legal fee coverage is included in every LifeLock plan, but the compensations for personal and legal expenses scale with the plan you have. It starts at $25,000 for each if you have the lowest-tier plan and increases to $100,000 each for the mid-tier Advantage plan. The $1 million coverage we mentioned applies only to the Ultimate Plus plans.

FYI: If you want a service that provides the same coverage for every subscriber, check out Aura’s plans, which all provide $1 million coverage for stolen funds and legal reimbursements.

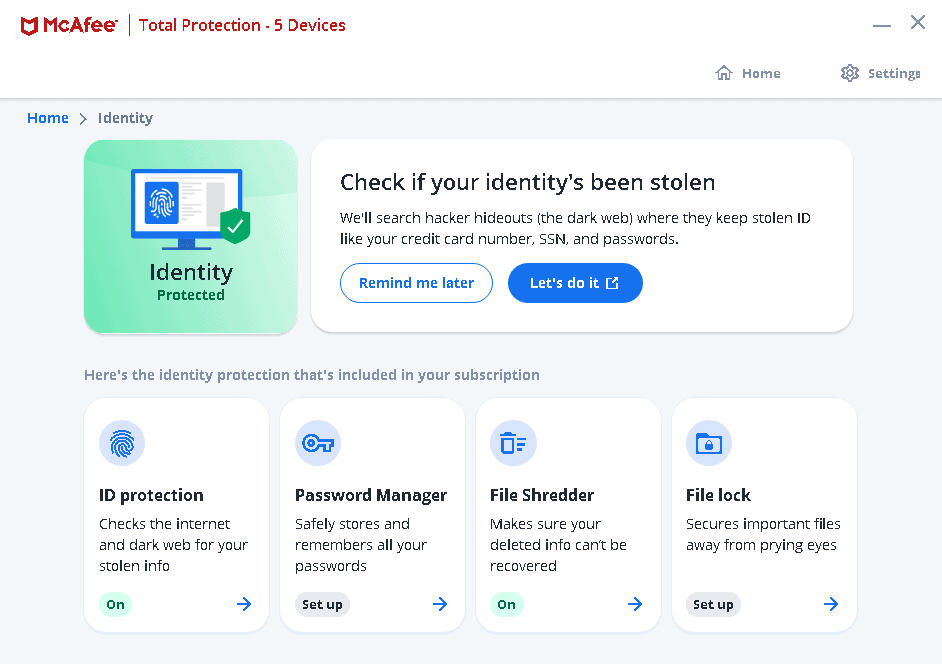

Digital Protections

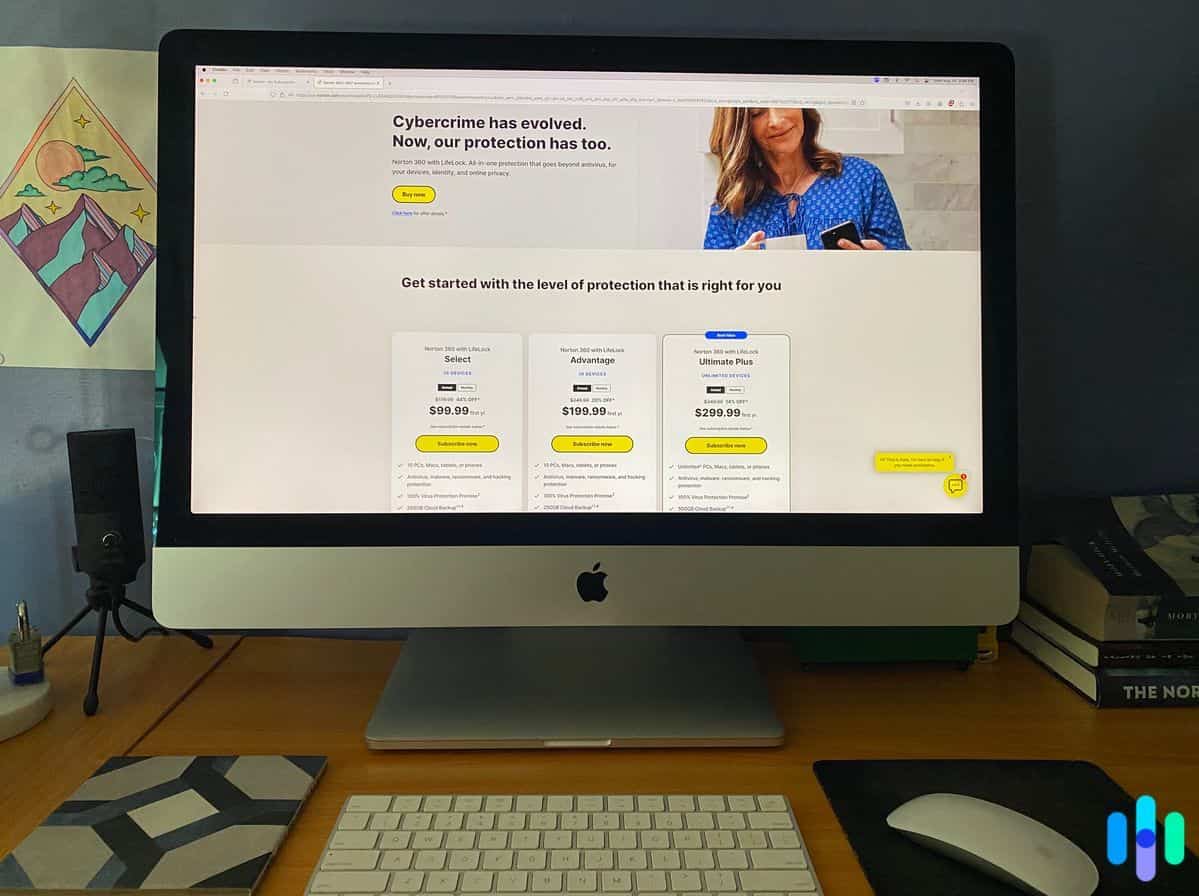

Although we’re talking about identity theft protection services, Norton is best known for its Norton antivirus software. You can bundle in the Norton 360 software with LifeLock’s Select and Ultimate Plus plans.

While the monitoring features from LifeLock help you react to early signs of identity theft, Norton 360 is more proactive. The antivirus software offers protection from devastating viruses and malware, including those used to steal your information from your devices.

Norton 360 also includes tools like a VPN, which is the same as the Norton Secure VPN we reviewed. It doesn’t have the bells and whistles of some of our favorite VPNs, but it does function well in helping you stay anonymous online. There’s also a password manager, which can help you secure your passwords and online accounts from hacking.

These tools can help you secure your identity, but you have to use them regularly. They’re not the set it and forget it type of software. You need to run regular virus scans and connect to your VPN when you go online to maximize your protection.

Did You Know: We made a roundup of the best antivirus and VPN bundles. These are great for pairing with a standalone identity theft protection. For instance, even though we bought the premium plan when testing Identity Guard, it did not come with online or device protections.

Now that you have a good idea of the features included with LifeLock, let’s change gears and talk about what it’s like to use this service on a daily basis.

Setting Up and Using LifeLock

As with other identity theft services we’ve tested, we lived with LifeLock for several months to get a sense of the daily experience. This started with the setup process and continued as we attempted to get the most value out of our sizable investment.

To set up LifeLock, we created a password and entered our basic information. Then, we entered our billing information and paid for the year. Once we made the purchase, the LifeLock dashboard appeared on our screen.

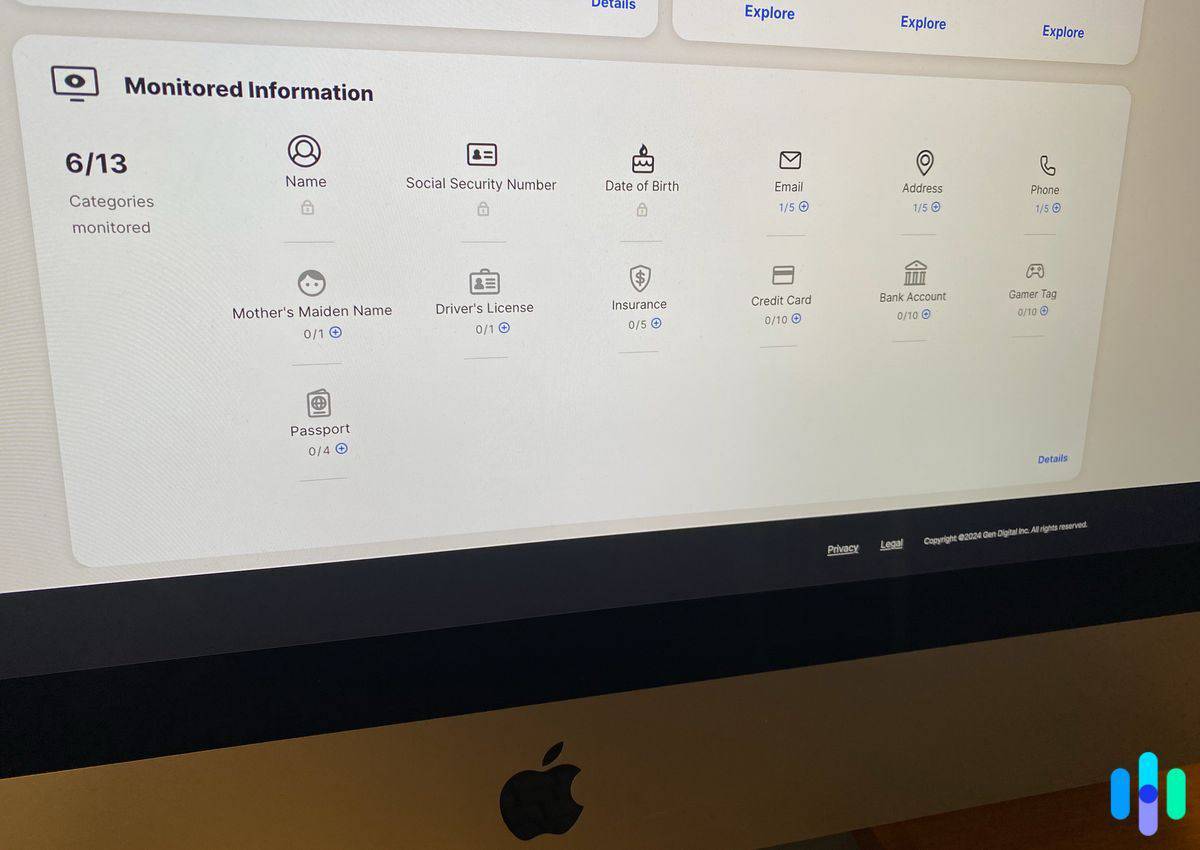

Once at the dashboard, we were asked if we wanted to add more personal information including:

- Insurance information.

- Bank account numbers.

- Driver’s license number.

- Credit card numbers.

We recommend putting in as much personal information as possible. This gives LifeLock a better chance at catching signs of identity theft. Remember: LifeLock — and other identity theft protection services — can only protect the information it has on you.

It took us about an hour to get everything up and running. After that, we found the desktop app and its intuitive dashboard easy to use. A lot of providers have convoluted apps that make it harder to protect yourself, so we’re glad Norton 360 prioritized ease-of-use.

That said, let’s take a minute to discuss some of the potential drawbacks of using LifeLock.

>> Further comparison: Lookout Identity Protection Review

LifeLock Drawbacks

One of the biggest drawbacks of LifeLock is that it can be confusing. When you’re purchasing your subscription package, you need to pay close attention to make sure you get the features you want because there are so many options.

Technically, Norton and LifeLock are two different entities, so it can get confusing if you’re trying to use these features on your mobile device — you’ll have to download two separate apps. Ultimately, we didn’t mind this during our testing period, but it did cause some confusion when we were looking around for the right functionality.

The second drawback is the price. Like we said above, these services aren’t cheap. They aren’t outrageous, but make sure you understand what your security needs are and budget accordingly. Also, if you pay annually — which you should, as you’ll save in the long run — the price goes up after a year. In some cases, the increase is almost double.

We don’t consider this a bait and switch, but it’s definitely something to be aware of when you’re making your purchase. Whichever identity theft protection service you go with, you’re likely going to want to keep it for the long haul. If you go with LifeLock, you want to make sure you can afford it.

With those two drawbacks in mind, let’s move on to the final word. Do we recommend LifeLock or not?

Is LifeLock Worth It?

Whether or not LifeLock is worth it comes down to your individual needs and budget, but here are a few key factors to consider when deciding if it’s right for you.

We’d go with LifeLock if you’d like…

- Identity monitoring and device security: LifeLock, through its Norton 360 with LifeLock plans, offers more features than any other similar service we’ve reviewed.

- Powerful protections: From credit freezes to dark web monitoring, LifeLock’s protections are comprehensive.

- User-friendly dashboard: LifeLock’s online dashboard is easy to navigate.

But you might consider…

- Convoluted purchasing process: Since they offer so many features, it’s easy to get overwhelmed.

- Confusing app: With two apps, it can be confusing to know which one to use and how to sign in.

- Price increase: After the first year, all of LifeLock’s plans increase in price.

LifeLock FAQs

-

How much does LifeLock cost?

Lifelock has one of the biggest spreads of prices, ranging from $14.99 per month for basic service, up to $819.99 per year for the second year of a family plan.

-

How does LifeLock work?

LifeLock alerts customers to potential indicators of identity theft from changes in credit reports to instances of their names being used in court documents. LifeLock also offers reimbursements for identities that are stolen while you have a subscription.

-

Is LifeLock good for families?

Yes, LifeLock offers a family plan that covers two adults and up to five children. That plan offers child-specific protections and can help alert you if your child is the victim of identity theft or fraud.

-

Is LifeLock a scam?

LifeLock had legal trouble in the past related to overpromising on services and incorrect handling of customer data, but they’ve since cleaned up their act. So much so that we don’t have a problem recommending them.

-

What are some alternatives to LifeLock?

LifeLock offers some of the most comprehensive identity theft protection in the business, but we’d say Aura offers better value.

-

Annual Credit Report. (2024). Review your credit reports.

https://www.annualcreditreport.com/index.action