Aura Identity Theft Protection Cost in 2025

Aura protects individuals for as low as $12 per month and all kids in a household starting at $10.

- Criminal and court records monitoring

- Monthly credit scores

- $1 million identity theft insurance reimbursement maximum

Identity theft protection services are some of the hardest services to shop for. Subscriptions come at different price points with a wide variation of features, so it’s not easy to compare identity protection services. You have to really dig around to find the option that will give you the best value for your money.

When we reviewed Aura, we saw a comprehensive service with identity and credit monitoring, digital protection, insurance, and identity restoration. And when we compared its pricing to the most affordable options, we saw it measures up well against them:

- Individual plans start at $12 per month, when most services cost upward of $18.

- Family plans protect up to five adults, when most services cover two adults.

- There’s an affordable add-on plan for kids, when most services require you to sign up for a family plan if you want child identity theft protection.

In this guide, we’ll dive into Aura’s pricing to help you pick out the best option for you and your household. We’ll give you our expert recommendations regarding Aura’s plans and the features you’ll get. Let’s start!

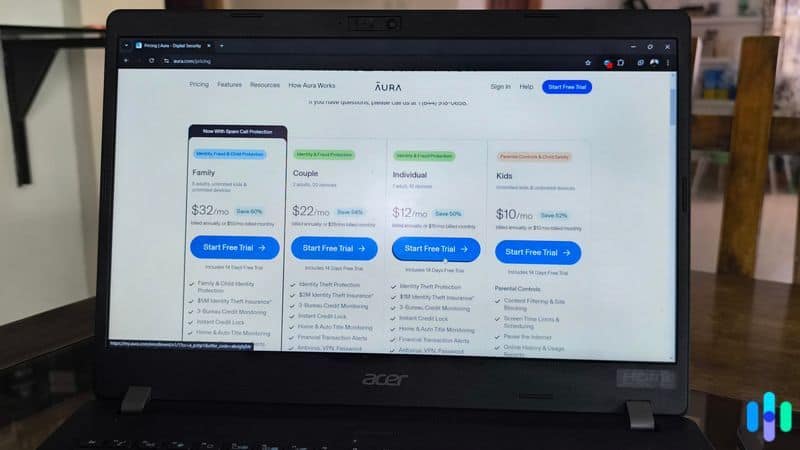

Aura Identity Theft Protection Pricing

With Aura, no matter which plan you choose, you’ll get the same features and benefits. That makes it easier to compare plans because you don’t have to worry about whether or not you’ll get enough protection from your pick. The only choice you’re going to make is who gets protection. Here are some more specifics:

| Aura Subscriptions | Individual | Couple | Family | Kids (add-on for Individual and Couple plans) |

|---|---|---|---|---|

| Number of adults covered | 1 | 2 | Max of 5 | 0 |

| Number of kids covered | 0 | 0 | Unlimited | Unlimited |

| Monthly price | $15 | $29 | $50 | $13 |

| Yearly price | $144 (avg. $12/month) | $264 (avg. $22/month) | $384 (avg. $32/month) | $120 (avg. $10/month) |

Note: Minors covered by the Family and Kids plans don’t get the same protection as adult members. The main feature of Aura’s child identity theft protection is digital security using tools, such as parental control software, and software designed to detect cyberbullying, scams and online predators. It’s less about identity monitoring and more about protecting kids online.

Our Recommendations

We’d like to give attention to the Kids plan — it’s a feature unique to Aura making it a top-notch identity protection service for families. The Kids plan is designed to be an add-on to the Individual or Couple plans, especially for households where the five-adult limit of the Family plan is too much.

For example, for single parents, it makes more sense to get an Individual plan and pay the additional $13 per month to cover their kids than buy a Family plan.

- Individual plan with Kids add-on: $28 per month or $264 per year

- Family plan: $50 per month or $384 per year

We recommend the same to couples, spouses or partners living with all minor-aged children but only if you’re looking to sign up for monthly billing. The monthly total of the Couple plan with the Kids add-on is $42, so you’d still save $8 per month.

FYI: We like how easy and safe Aura made it to share a subscription with other individuals. With the Couple and Family plans, each adult user gets a unique account dashboard. That means if you and your roommate are on the same subscription, you won’t have access to each other’s account and see each other’s personal information.

If you’re looking to pay yearly, go with the Family plan. The yearly total for the Couple plan with Kids add-on is $384 — the same as the yearly price of the Family plan. While you’ll get the same features with either, the Family plan offers digital protection like antivirus, VPN, and parental control software for unlimited devices. The Couple plan has a 10-device limit per adult member.

The rest of the plans are self-explanatory.

- Go with the Individual plan if you’re living by yourself.

- Choose the Couple plan if there are two adults in your household who need protection. You don’t have to be a romantic couple — you can share it with a family member, best friend, or roommate.

- Go with the Family plan to protect multiple adults in your household (at least three but up to five) and all children under the age of 18.

>> Read More: Securing Confidential Personal Data Online and Offline

Aura vs. The Competition

We love the straightforwardness of Aura, but its setup is not perfect. When we compared Aura and Identity Guard, we noted how the latter offers an option as cheap as $8.99 per month. Granted, Identity Guard subscription offers the bare minimum — identity monitoring with no credit protection. But it’s still practical for folks on a budget who don’t need the bells and whistles Aura provides. So if you’re looking for fewer features but more affordable plans, we suggest reading our Identity Guard review instead.

Here’s a comparison between Aura’s Individual Plan and Identity Guard’s Value Plan:

| Aura Individual Plan | Identity Guard Value Plan |

|---|---|

| 1 adult | 1 adult |

| $15/month or $144/year | $8.99/month or $90/year |

| Identity monitoring | Identity monitoring |

| 3-bureau credit monitoring | No credit monitoring |

| Monthly credit score and annual credit reports | No credit score and credit reports |

| High-risk financial transaction alerts | High-risk financial transaction alerts |

| Bank, credit card and investment account monitoring | No bank, credit card or investment account monitoring |

| Home and auto title monitoring | No home and auto title monitoring |

| $1 million identity theft insurance | $1 million identity theft insurance |

| Antivirus, VPN, password manager | Password manager |

Aura is best for those who want the ultimate identity theft protection. If that’s you, it’s also one of your most affordable options in the market.

Feature-wise, the $15 Individual plan offers a level of protection between LifeLock’s Advantage and Ultimate Plus plans. The two plans are $22.99 and $34.99 per month, respectively. Aura offers more monitoring features than LifeLock Advantage. Aura monitors home title, auto title, and investment account monitoring, but LifeLock Ultimate Plus offers more insurance coverage (up to $3 million per adult member). But no matter how we look at it, Aura comes out as the more affordable choice. We did a deep-dive comparison of Aura and LifeLock to see for yourself.

Pro Tip: Besides the greater insurance coverage, another reason one might pick LifeLock over Aura is the former’s digital protection features. LifeLock offers bundles that include Norton 360, one of the best antivirus software right now. Aura also includes antivirus software, but we found Norton 360 is more robust in that area. See our Norton 360 review.

So where does Aura stand? Well, Aura, LifeLock and Identity Guard are our top three identity theft protection picks for 2025 — in that order. Because Aura provides well-rounded subscriptions with balance between price and features, we believe it’s the top option right now.

Aura Free Trial, Money-Back Guarantee, and Other Pricing Factors

Throughout the time we tested Aura, we noticed it does a few things differently than traditional identity theft protection services like Identity Guard. For example, Aura is one of the few services we’ve seen offering an actual free trial — good for 14 days. That’s shorter than LifeLock’s 30-day free trial, but it gave us enough time to get to know the service before paying.

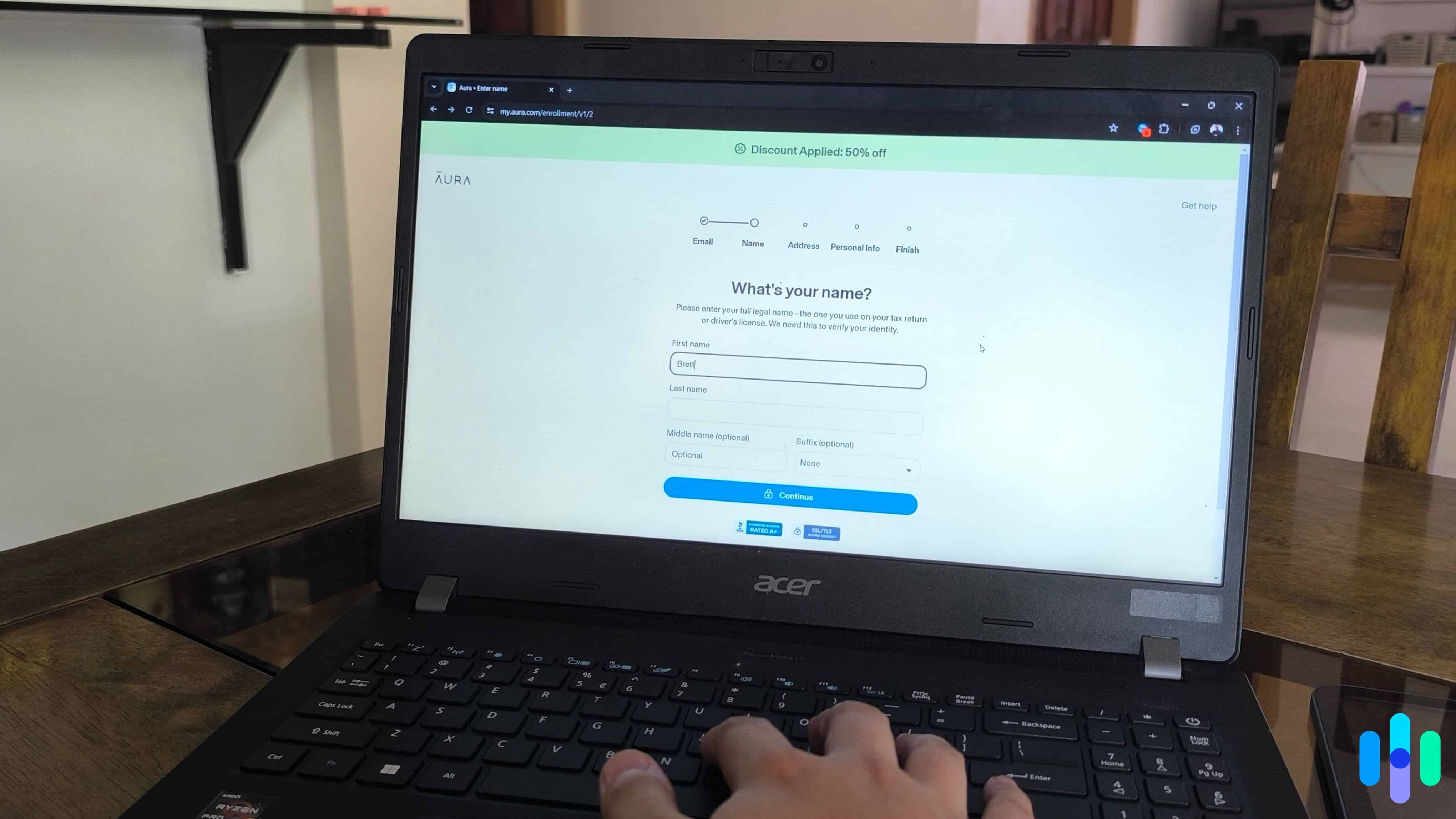

Here’s how we signed up:

- We chose our preferred plan.

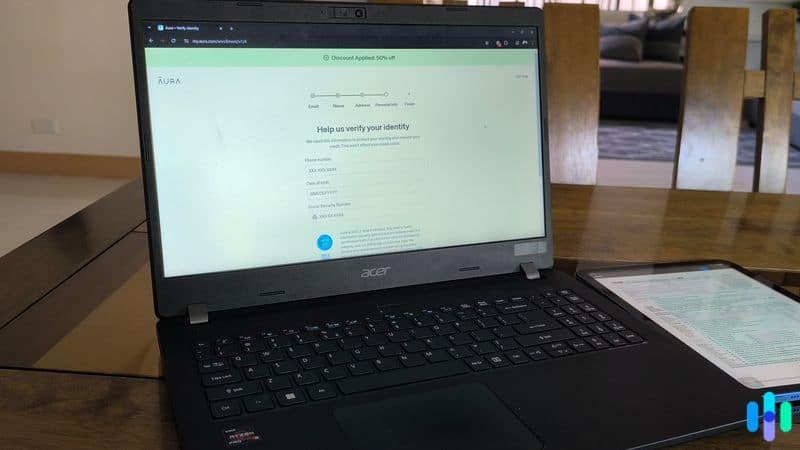

- We entered our personal information (name, email address, home address, phone number, Social Security number, etc.).

- We provided our payment information.

Our Aura plan activated right away, but our card wasn’t charged until the end of the 14-day trial. The bill came in automatically, which was fine because we were going to test Aura anyway. But should you wish to back out, there’s an option to cancel in the dashboard. If you cancel before your trial ends, your card will not be charged.

FYI: In our experience, canceling an Aura subscription is easy. You can either log on to your Aura dashboard, go to Membership, and manage your subscription from there, or call Aura at 1-833-681-7577.

On top of that free trial, Aura gave us 60 days from when our paid subscription started to change our minds. That money-back guarantee is exclusive to annual subscriptions. LifeLock and Identity Guard offer the same. That said, we’ve seen better offers from the likes of IdentityForce, which offers prorated refunds. If you cancel at any point of your subscription, you’ll get a refund for the unused portion.

>> Related: IdentityForce Pricing and Subscriptions

Back to Aura, we also liked that it doesn’t do “low introductory price” gimmicks, which is when companies offer you cheap prices for the first year with significant increases when you renew. We saw that from LifeLock and McAfee subscriptions. The $239.88 first-year price for LifeLock Ultimate Plus becomes $339.88 at renewal ($100 increase), while the McAfee+ Ultimate plan jumps from $199.99 to $279.99 ($80 increase). With Aura, unless there’s a general price increase, first-year and renewal prices are the same.

Expert Advice: Low introductory prices are not all bad; they allow you to use a service for less than what it normally costs. However, they could throw off your perception of how affordable (or not affordable) a service is. When shopping for an identity theft protection service, always check the renewal terms and prices.

Is Aura A Good Buy? Aura Features Overview

As we alluded to earlier, we believe Aura’s prices and features are well-balanced, but what do you get when you sign up for an Aura subscription? There are five areas here:

- Identity monitoring

- Credit monitoring

- Digital protections

- Identity theft insurance

- Identity restoration

The first two serve to alert you to early signs of identity theft. For example, you’d be alerted when your personally identifiable information appears somewhere it shouldn’t (e.g., criminal records) or when there’s suspicious activity in your credit file. Digital protections provide cybersecurity to protect you from digital identity theft through malware, online scams, and privacy breaches. And the last two are safety nets. Insurance reimburses you for stolen funds, legal expenses, and personal expenses resulting from identity theft, while identity restoration helps you get your life back on track with a dedicated case manager.

Let’s take a closer look at each.

Aura Identity Monitoring Best Features

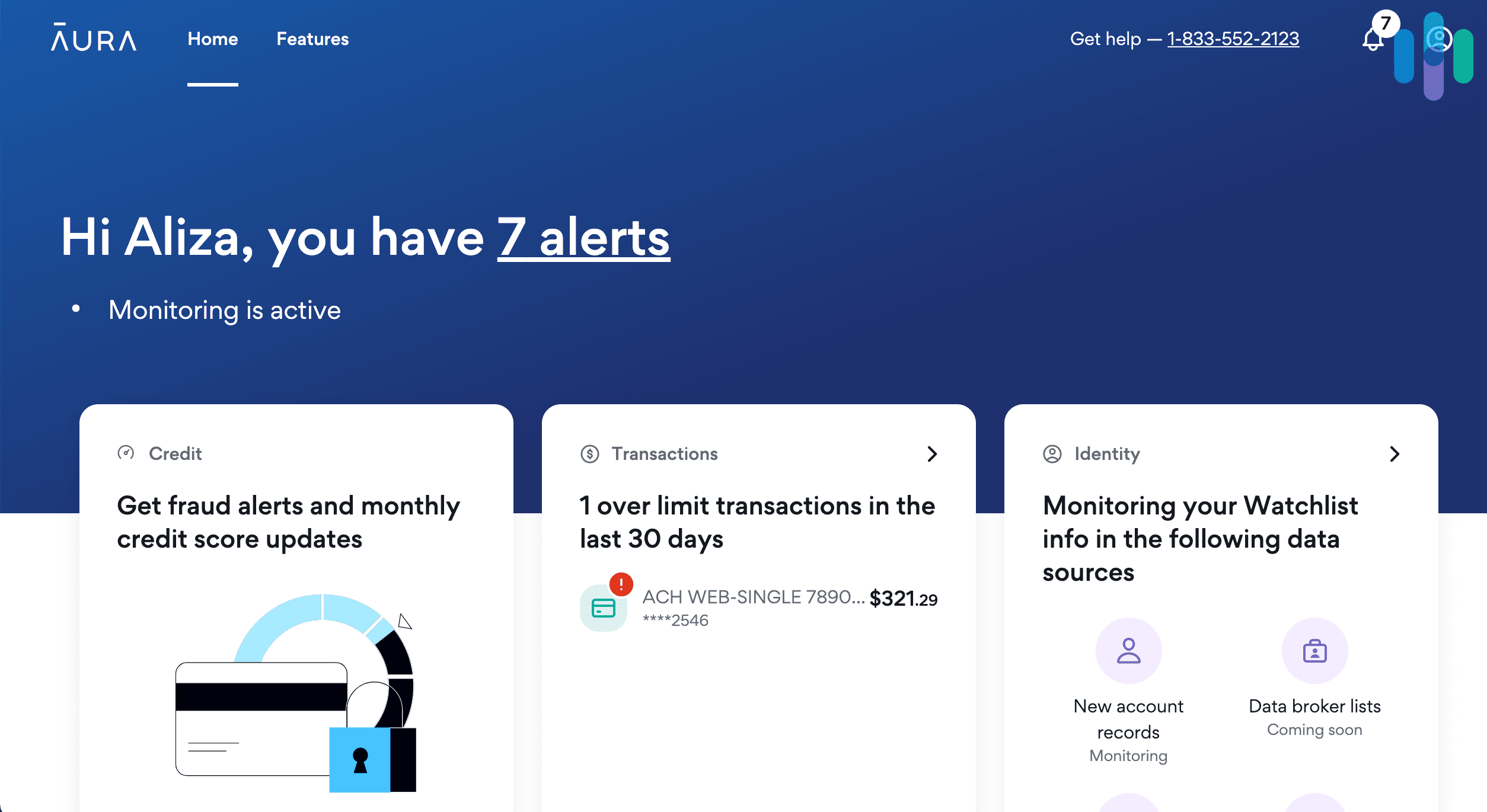

Identity monitoring from Aura is wide-ranging. We saw standard features like dark web monitoring and data breach alerts, but there were more types of monitoring, such as:

- Home and auto title monitoring: Aura alerts you if someone changes ownership of your properties to their names. Criminals do that to use home and auto titles as collateral for loans. Lots of services (like LifeLock) offer home title monitoring in their upper-tier plan but few monitor auto titles like Aura does.

- People search sites monitoring: Aura alerts you if your personal information appears in people search or data broker sites, and requests its removal. Having your information in such sites increases your risk of falling victim to identity theft, fraud and scams.

- Account breach monitoring: Aside from your personal information, Aura alerts you if your known online usernames and passwords appear on the dark web. This helps you avoid hacking of your online accounts, which might contain sensitive information like your birthday and payment information.

- Identity verification monitoring: Aura alerts you if your personal information (SSN, name, TIN, etc.) is used in high-risk transactions like payday loans and cash advances.

Aura Credit Monitoring Best Features

While there are some overlaps with identity monitoring, the credit monitoring and protection features we saw from Aura focused more on credit- and financial-related aspects. Here are some examples:

- Transaction monitoring: Aura alerts you to suspicious bank, credit card, and investment account transactions. We liked that Aura let us set a threshold for these alerts, i.e., we only got alerts for credit card transactions exceeding the limit we set.

- Bank fraud/account takeover monitoring: Aura alerts you in case someone tries to modify personal information tied to your bank account or change who has access to your financial accounts (e.g., adds a supplementary credit card). That type of identity theft is also known as account takeover, experienced by 29 percent of Americans according to our research.

- Credit lock: Aura lets you lock your Experian credit file so no one can use it in fraudulent transactions and loan applications. You can also do that without an Aura subscription, but Aura makes it easier.

On top of those features, we enjoyed the standard three-bureau credit monitoring, received credit score updates once a month, and accessed one free credit report every year. While most identity protection companies offer three-bureau credit monitoring, we rarely see it offered at the same price point as Aura ($15 per month for individuals). Even LifeLock’s Advantage plan ($22.99 per month for individuals) offers only one-bureau credit monitoring.

FYI: You can get a copy of your credit report for free as often as once a week from all three credit bureaus.

Aura Best Device Protection Features

This is a relatively new feature in identity theft protection, which is a response to the increasing threat of digital identity theft. Threat actors use malware, hacking, spyware, man-in-the-middle attacks, and other types of cyberattacks to get personal information from their victims’ devices. To protect against that, an increasing number of identity protection services now include cybersecurity tools like antivirus software, password manager, and VPN.

Aura proved to be a good-value pick here because device protections are included in all plans. With the Individual and Couple plans, each adult member gets antivirus software and VPN for up to 10 devices. Family plan users get access on unlimited devices.

Here’s a comparison of the device protections in Aura’s plans compared to LifeLock:

| Digital Protections | Aura Individual/Couple plan | Aura Family plan | LifeLock Advantage w/ Norton 360 | LifeLock Ultimate Plus w/ Norton 360 |

|---|---|---|---|---|

| VPN | 10 devices per adult user | Unlimited devices | 10 devices | Unlimited devices |

| Antivirus software | 10 devices per adult user | Unlimited devices | 10 devices | Unlimited devices |

| Cost per month | $15 or $29 | $50 | $24.99 | $34.99 |

Note: Not all LifeLock plans include digital protections. Look for bundled plans with Norton 360 to enjoy malware protection and access to the Norton Secure VPN and other cybersecurity tools.

In addition to the antivirus software and VPN, Aura gave us these cybersecurity tools:

- Password manager in the form of a browser extension

- Ads and tracker blocker

- Encrypted cloud storage to securely store confidential files

- Safe Browsing extension that blocks access to malicious websites

- Spam Call and Message Protection that screens potential scam calls and text messages

And for Family and Kids plans, Aura offers:

- Parental control software

- Cyberbullying and predator protection

- In-game voice and text monitoring

- Weekly gaming activity reports

>> Related Reading: The Best Password Managers for Families

Aura Best Safety Nets

We always say this when discussing identity theft protection services: No one can guarantee your protection. That’s why the main feature of most services is detecting early signs of identity theft, coupled with insurance and other safety nets.

In Aura’s case, we received identity theft insurance up to $1 million per adult member. That means if you’re on a Couple plan, each of you could get reimbursed up to $1 million for stolen funds, legal expenses, and personal expenses. This is the standard in identity protection services. However, other companies have been raising their identity theft insurance coverage as of late. For example, LifeLock Ultimate Plus currently offers:

- Up to $1 million for stolen funds

- Up to $1 million for legal expenses and fees

- Up to $1 million for personal expenses (e.g., lost wage, notary costs, postage costs, etc.)

That’s a coverage total of $3 million. Similarly, McAfee and IdentityForce both cover up to $2 million of losses and expenses with their top-tier plans. So while Aura meets the standard, there are options with more coverage.

On the other hand, we found Aura’s identity restoration service to be top-notch in the industry. It’s matched with Identity Guard because if you fall victim to identity theft both provide you with a U.S.-based case manager. That assigned case manager will help you with every step to recovery, from disputing fraudulent credit card charges to filing reports to the proper authorities.

>> More Information: What To Do If Someone Steals Your Identity (Step-by-Step)

Our Final Verdict On Aura

As we’ve demonstrated throughout this guide, Aura offers tremendous value. It’s robust and comprehensive, but it costs less than upper-tier subscriptions from brands with similar features. Aura provides protections we don’t see from other services too, like auto title monitoring, parental control software, and account takeover protection.

There are some holes in its service. For instance, while it offers digital protection, Aura’s antivirus software and VPN aren’t on the same level as those of LifeLock, McAfee, and IdentityIQ (which partnered with Bitdefender). But for the price of its subscriptions, we believe we got more than what we paid for from Aura.

>> Read More: Bitdefender Antivirus Review

Overall, we’d recommend Aura to:

- Big families with three or more members over the age of 18 because of its Family plan that can cover up to five adult members and unlimited children.

- Single parents because the Kids subscription option can be added to Individual and Couple plans.

- Individuals and couples looking for affordable but comprehensive identity theft protection.

Of course, getting a subscription from Aura isn’t enough to protect yourself from identity theft. See our identity theft prevention guide to learn more about keeping your personal information private and safe from fraudsters.

Aura Frequently Asked Questions

Want to learn more about Aura? Take a look at these Aura FAQs before you leave.

-

Is Aura the best identity theft protection service?

Our extensive testing of Aura has shown us that it’s the most well-rounded identity theft protection service right now. Add to that its affordable subscriptions and we got ourselves the best identity protection service. That said, there are services that do better than Aura in certain aspects. For example, LifeLock offers better digital protection through Norton 360 and greater insurance coverage, while Identity Guard offers more affordable entry-level subscriptions for budget-focused people.

-

Does Aura offer deals and discounts?

Aura occasionally offers discounts and deals to certain demographics, like seniors and military families. Most of these discounts are applied to annual subscriptions. Aside from that, Aura offers a 14-day free trial and a 60-day money-back option to annual plan users.

-

Can you trust Aura with your personal information?

Aura is SOC 2 Type II compliant, which means it has met all five trust criteria for managing customer data developed by the American Institute of Certified Public Accountants (AICPA). Those criteria are security, availability, processing integrity, confidentiality, and privacy. Aura met all requirements including encryption, access control, processing monitoring, intrusion detection, and disaster recovery.

-

How is Aura better than free identity protection services like Credit Karma?

Free services like Credit Karma don’t offer comprehensive protection. Instead, they provide free access to services like basic credit monitoring. While monitoring your credit is a great way to catch signs of identity theft, it doesn’t extend to activities like fraudulent bank transactions and account takeover. With Aura, you get credit monitoring as well as monitoring and protection for your personal information, personal finances, and devices. You also receive insurance and white-glove identity restoration if you fall victim to identity theft.

The cost of the family plan is $30 if you pay month-to-month, or $300 if you pay upfront for the entire year.

-

Do children need identity protection?

Yes, children need identity protection. The Social Security numbers of minors are a prime target. Most parents don’t monitor their children’s SSNs, so theft of that information could go unnoticed for years. Aside from that, children are more likely to fall for online scams than adults. Aura offers both SSN monitoring and online protection to adult and child Family plan members alike.

-

Tulane University. Students More at Risk of Identity Theft: Tips and Resources to Stay Protected.

sopa.tulane.edu/blog/student-loan-identity-theft -

National Archives. National Archives Court Records.

archives.gov/research/court-records -

Javelin. (2021). 2021 Identity Fraud Study: Shifting Angles.

javelinstrategy.com/coverage-area/2021-identity-fraud-study-scams