Child Identity Theft: Parent Awareness, Behaviors, and Attitudes

More than one-third of parents don’t follow best practices such as shredding documents or storing online records securely.

Childhood is supposed to be a carefree time where kids can learn and grow in a safe environment, without having to worry about (or even know about) things like identity theft. However, children can fall victim to identity theft, especially if a parent isn’t monitoring their credit or personally identifiable information (PII) like their Social Security numbers (SSNs).

But, we couldn’t find much information on the steps parents take to secure their child’s identity. So, our digital security experts decided to get together and create a study of our own. We aimed to gather insights into parental awareness, attitudes, and behaviors related to preventing child identity theft. In these efforts, we learend taht most parents are aware of child identity theft and many follow best practices. With that said, at least a third of parents say they aren’t very concerned or aren’t concerned at all or don’t take commonly suggested preventative measures.

How Common Is Child Identity Theft and Fraud?

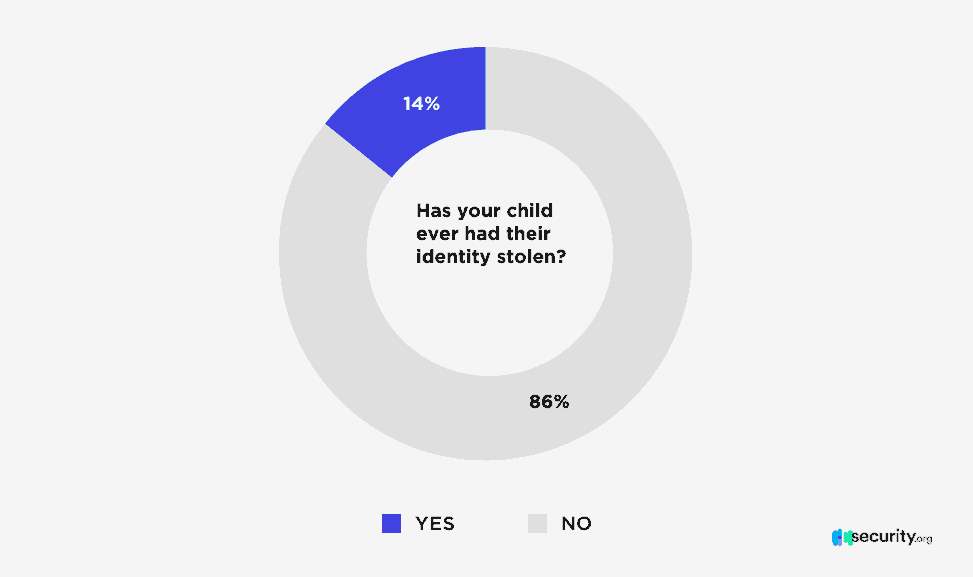

In 2017, over one million children were victims of identity theft 1 according to the research firm Javelin Strategy. In our research of more than 600 parents of children under the age of sixteen, 14 percent responded that their child’s identity has been stolen, which would equate to roughly 10 million children.

We expect children are targeted more often because they are less likely to discover identity theft before adults who apply for loans, file tax returns, and other actions that require the use of their SSNs. Most people who have their identities stolen as children don’t discover the theft until they are adults, so stealing children’s identities gives the thieves a wider window to use their credentials versus adults.

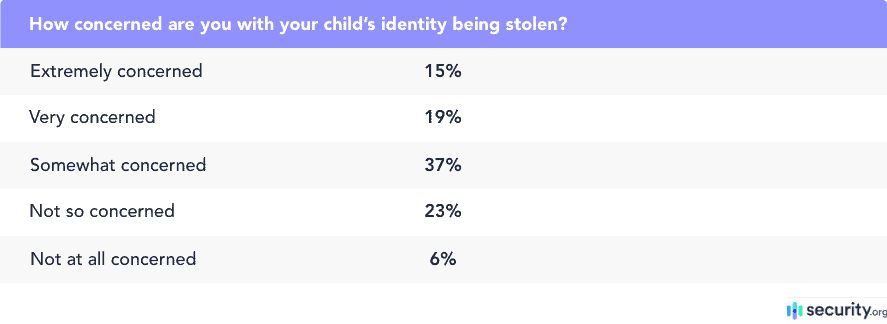

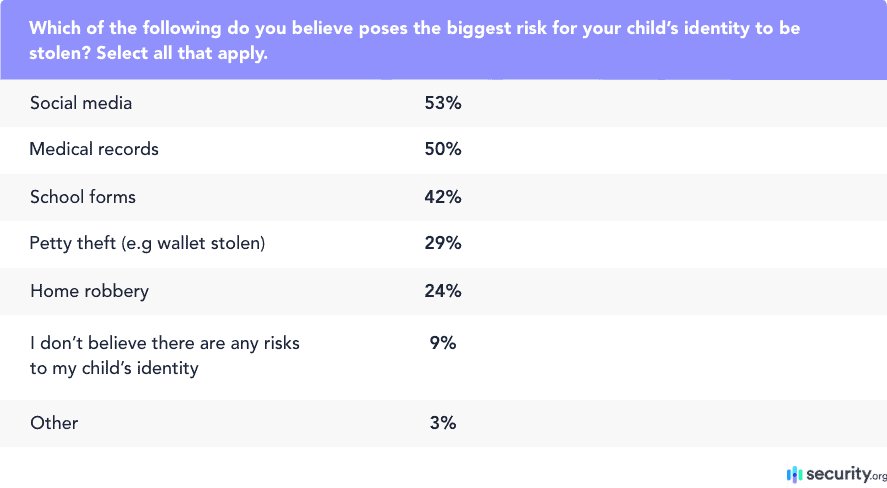

Nearly two-thirds of parents are concerned about child identity theft, with the most frequently cited risks being social media, medical records, and school forms. Interestingly, about a third of parents were either not so concerned or not at all concerned about child identity theft, even though most parents do take measures to prevent their children’s identities from being stolen.

Adherence to Best Practices

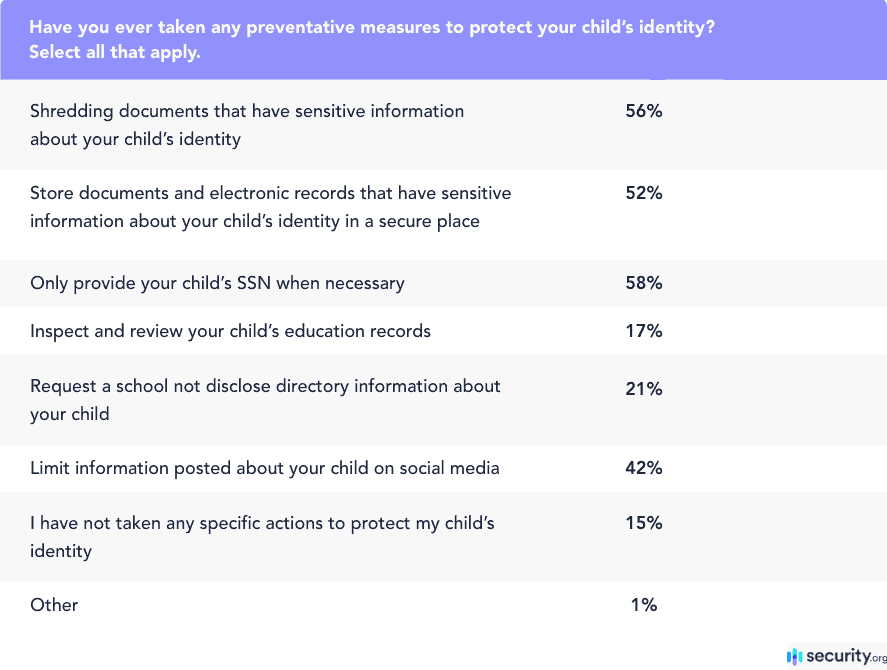

Regardless of the level of concern regarding child identity theft, most parents reported that they shred documents with their children’s PII, store these types of documents and electronic records securely, and only provide their children’s SSNs when necessary. However, 15 percent of parents didn’t take any action to prevent child identity theft, which is striking considering its potential consequences.

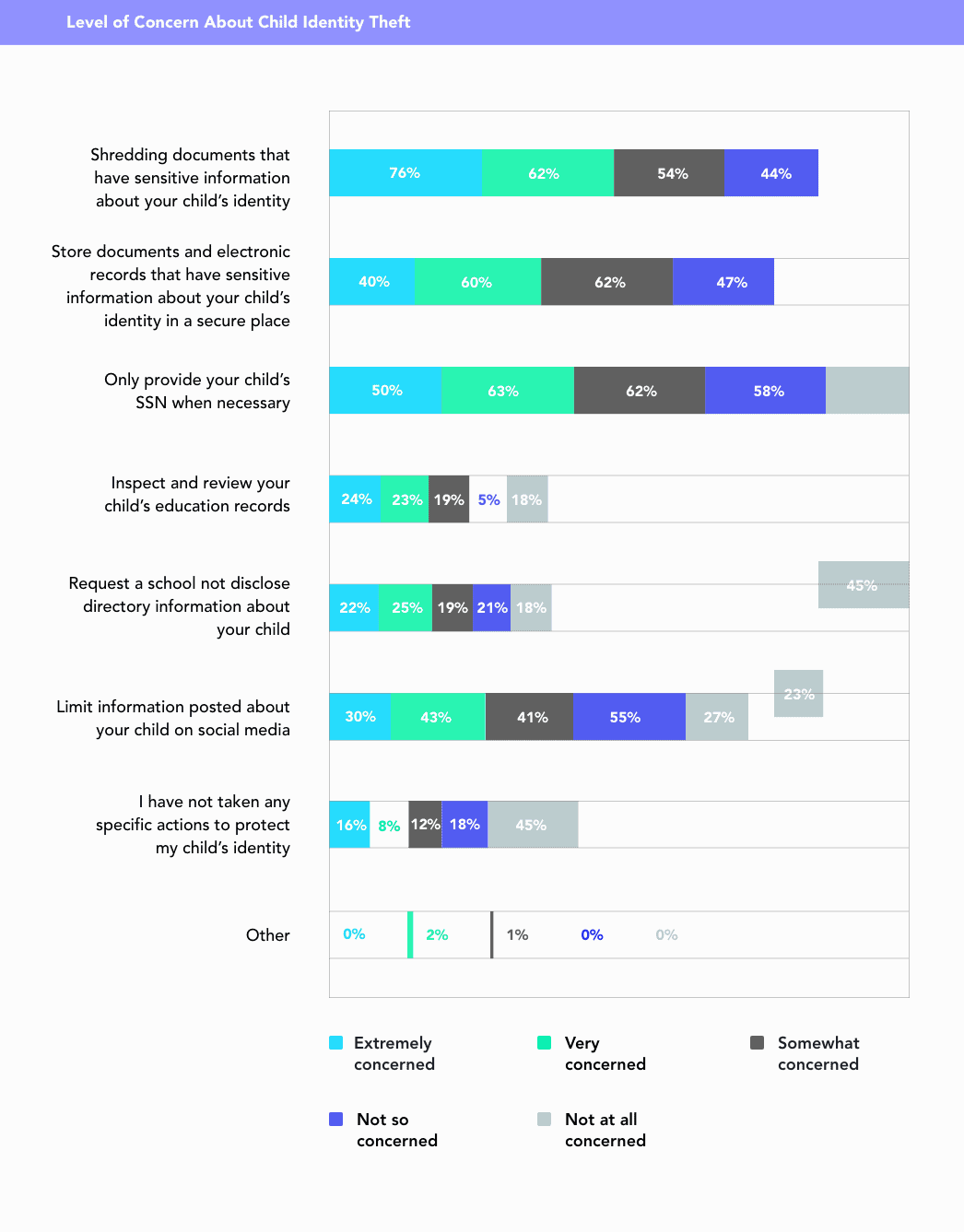

We looked specifically into how parental concern affects the measures parents took to protect their children from identity theft.

Even parents who were not at all concerned about child identity theft take preventative measures to protect their children’s PII; 45 percent shredded documents that contained sensitive information and only provided their child’s SSN when necessary. Parents that fell in this not so concerned group were also more likely than more concerned parents to limit information posted about their children on social media, which was counterintuitive, seemingly. Why aren’t more concerned parents supervising and controlling information about their kids on social networks like Facebook, Instagram, and the increasingly popular Tik Tok?

It’s unclear from our research why more concerned parents aren’t limiting information posted about their children on social media; overall, less than half of the more concerned parental groups limited this information, which seems low compared to the other precautions they take. Similarly, in a study conducted by the University of Michigan2 regarding parental rules about their children’s use of technology, only 18 percent of parents said that they had rules about oversharing which required their children to get explicit permission before sharing information online.

In the same vein, only seven percent of parents supervised their children online to ensure that they were following their established rules. However, this study did not connect parental supervision or rules surrounding their children’s Internet usage with child identity theft, so more research needs to be done to demonstrate the connection between the two, or lack thereof.

In general, however, parents not so concerned or not at all concerned with child identity theft were less likely to shred documents with PII and store documents and electronic records securely than more concerned parents, which was not surprising.

The Victims of Child Identity Theft

Identity theft can happen to any child that has a Social Security number, but some groups are more likely than others to fall victim.

Cyberbullying and Child Identity Theft

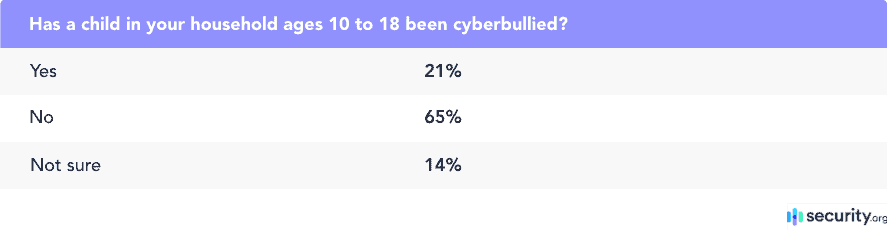

Being online necessarily means using your personal information to create accounts, whether that’s your name, email, bank account information, and more, so it stands to reason that kids who are online more are more susceptible to identity theft and even cyberbullying. However, we were surprised to find out that kids who are the victims of cyberbullying are nine times more likely to be fraud victims than kids who weren’t cyberbullied, according to Javelin Strategy. In our recent research on cyberbullying, we found that about a fifth of parents with kids ages 10 to 18 said their children had been cyberbullied before, making this sizable portion of the population more susceptible to identity theft as well.

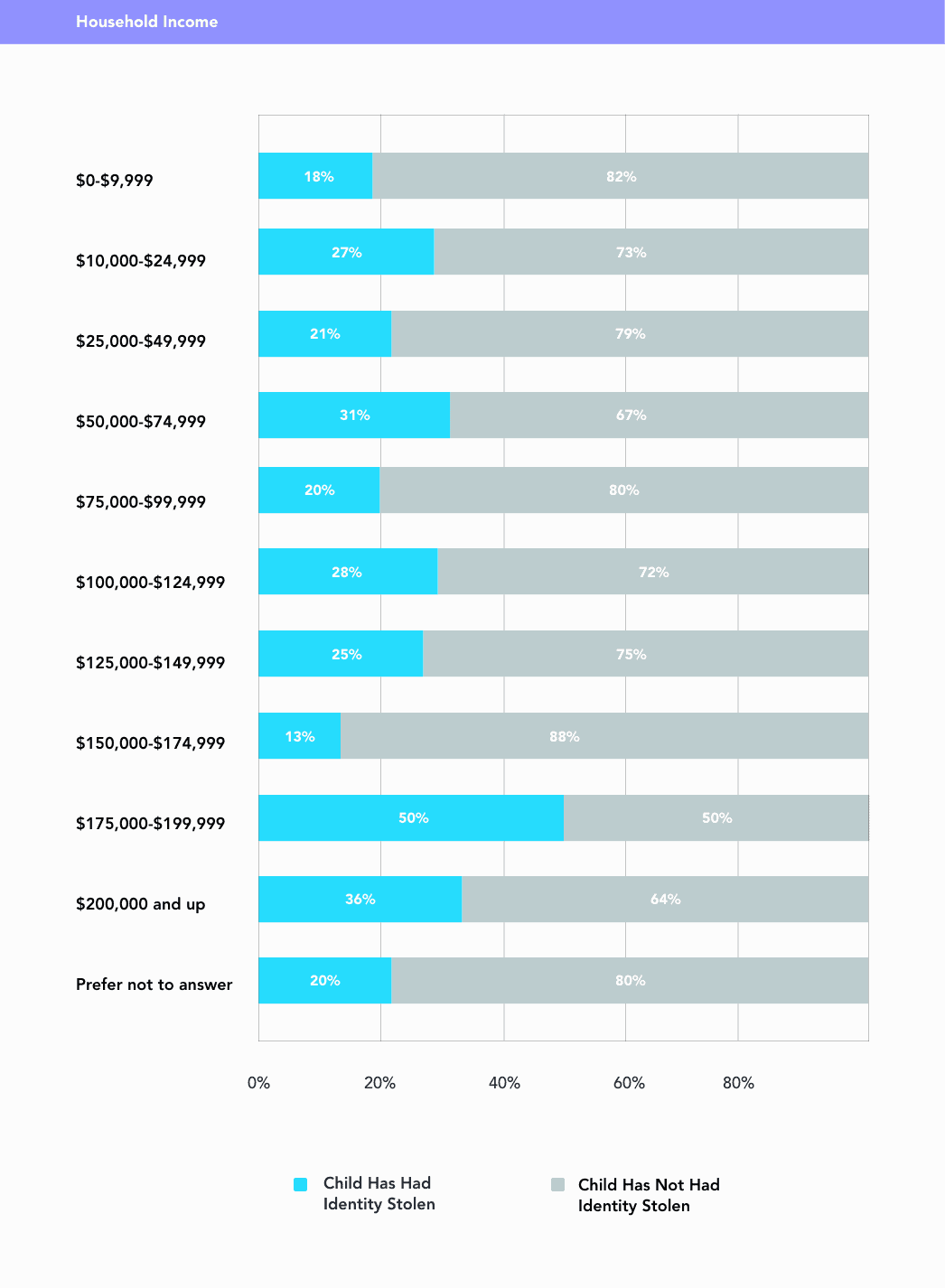

Household Income and Child Identity Theft

At the beginning of our research, we hypothesized that parents with larger household incomes would be more likely to report child identity theft, as thieves would rather steal from more affluent people versus less affluent. This proved to be the case for the highest household income brackets on our survey, $175,000, and up. On average, 43 percent of parents of these household income brackets reported child identity theft, higher than the average reported child identity theft of 23 percent from households with incomes of $174,999 and below. While household income and reports of child identity theft weren’t perfectly correlated, in general, parents of children from households with higher income brackets were more likely to report child identity fraud than parents of children from households with lower income brackets.

Warning Signs

Oftentimes with child identity theft, the child in question doesn’t find out that their identity has been stolen until they are adults trying to apply for a loan or something of that nature. By that point, the thief could have used their Social Security number to get PayDay loans, file tax returns, and even get unemployment benefits in their name, which is why it’s best to look for warning signs early.

- Government benefits: If you are turned down for government benefits and you don’t think you should have been, it’s possible someone is already using your child’s Social Security number to obtain benefits.

- IRS notice: Did you get a notice from the IRS that your child hasn’t paid their income taxes or that their Social Security number was used on a tax return? If so, your child’s identity has likely been stolen.

- Unfamiliar bills: Finally, if you receive unfamiliar bills or collection calls for products or services you haven’t purchased, that could also be a sign of child identity theft3.

How To See If Your Child’s Identity Has Been Stolen

If you think your child’s identity has been stolen, you can check by reading their credit report from all three major bureaus: Transunion, Experian, and Equifax. Ask them for files relating to your child’s name and Social Security number to see if there are any changes you aren’t aware of; they could be a good indication of identity theft, according to the Federal Trade Commission.

Consequences of Child Identity Theft

The main consequence of child identity theft is financial losses. In 2017, the total losses from child identity fraud were $2.6 billion in the United States, which translated to $540 million in out-of-pocket costs for families. Your child could also experience difficulty getting loans, renting apartments, or doing any activity that requires a credit check. This could seriously delay or even impede them from taking out school loans, buying a mortgage, or even leasing a car.

Recovering from Child Identity Theft

That’s not to say that it’s impossible to recover from child identity theft. Once you find out that your child’s identity has been stolen, here’s how to recover it most efficiently:

- Contact companies and bureaus: First, get in contact with the companies where the fraud occurred as well as those three major credit-reporting agencies we mentioned earlier, alerting them of the situation.

- Freeze credit: Have the bureaus freeze your child’s credit so no further changes can be made, temporarily.

- Report to FTC: Finally, report the theft to the Federal Trade Commission by going to IdentityTheft.gov4.

Best Practices for Preventing Child Identity Theft

Fortunately, there are a few steps you can take to dramatically reduce your child’s risk of identity theft, although it’s not 100 percent preventable. Adhere to the following best practices:

- Secure storage: Any paper or electronic record that includes your child’s Social Security number should be stored securely, whether that means in password-protected, encrypted cloud storage or a locked file cabinet or safe.

- Be careful with SSN: On top of that, only share your child’s Social Security number when it’s necessary; inquire about how it will be protected and why it’s needed and if possible, use a different identifier or the last four digits of the Social Security number only.

- Shred documents: If you’re disposing of any papers that contain your child’s PII, shred them before putting them in the garbage or recycling.

- Hold onto your purse: This is an obvious one, but try to avoid losing your purse, wallet, or any papers that contain your kid’s Social Security number.

- Identity theft protection: Several identity theft protection services monitor your child’s SSN in many financial and criminal areas. Many of these services have subscription options aimed at families specifically, usually covering two adults and up to 10 children.

Recap

Child identity theft is unfortunately not uncommon. According to a 2021 Javelin Strategy & Research report, one in 50 children in the U.S. falls victim to identity theft every year. Our research of over 600 parents found that 14 percent of them reported the identity theft of their children. Unfortunately, children can be more vulnerable to identity theft given that it can go unnoticed until they reach adulthood.

Taking preventive measures can be life-changing though, so basic security practices should be appreciated. Social media, school forms, and medical records are some of the most cited risks, which means parents should be careful in saving and distributing this information. Some preventive measures include shredding sensitive documents, limiting social media exposure, and only sharing information with authorized parties. The less that is shared the better.

To reiterate, child identity theft is no joke. It involves severe consequences like financial losses, trouble securing loans or rentals, and so much more. If you suspect your child’s identity has been stolen, immediately contact involved companies, request credit freezes with all major bureaus, and report it to the FTC.

FAQs

What should I do if my child’s identity is stolen?

Immediately report this to your local police precinct, report it to the FTC, and request a credit freeze for your child with all major credit bureaus.

How do I find out if someone is using my child’s SSN?

To find out if your child’s social security number is being used, you can pull a credit report from the three credit bureaus and then look for suspicious activity.

Can a parent use their child’s SSN?

No, using your child’s social security number is considered identity theft and is a crime.

Can I freeze my child’s Social Security number?

Yes, if your child is underage you can request a credit freeze. Contact the three credit bureaus for more information.

Can I open a credit card in my child’s name?

Parents cannot open a credit card for children under the age of 18. However, you can add your child to your account and provide them with a card of their own, which will be paid and monitored by you. This will make them an authorized user on your account.

Sources:

- https://www.javelinstrategy.com/coverage-area/2018-child-identity-fraud-study

- http://yardi.people.si.umich.edu/pubs/Schoenebeck_FamilyTechRules16.pdf

- https://identitytheft.org/types/child/ (Link removed from site)

- https://www.identitytheft.gov/Assistant (Link removed from site)