Best Identity Theft Protection for Families in 2025

Lifelock's affordable annual plan and protection against identity theft is why earned our top pick.

- Freeze your kids’ credit until they are adults, if necessary

- Installs on multiple devices so all your family members get alerts

- Lost wallet protection extends to all family members

- Freeze your kids’ credit until they are adults, if necessary

- Installs on multiple devices so all your family members get alerts

- Lost wallet protection extends to all family members

- Protects your family from credit fraud in addition to identity theft

- Protects your children in addition to you and your spouse

- With an annual plan, you can protect your entire family for just $37 a month

- Protects your family from credit fraud in addition to identity theft

- Protects your children in addition to you and your spouse

- With an annual plan, you can protect your entire family for just $37 a month

- Identity theft Insurance protection of up to $1 million per person

- Monitors the dark web for your children’s personal information

- Family plans include AI protection from IBM Watson

- Identity theft Insurance protection of up to $1 million per person

- Monitors the dark web for your children’s personal information

- Family plans include AI protection from IBM Watson

We always say that the scariest thing about identity theft is that it doesn’t choose its victims. Anyone with an identity and personal information can be targeted – even innocent toddlers and helpless aging seniors. It’s not enough to get protection for just the main breadwinners of the family. Everyone should be covered.

Now, we know what you’re probably thinking: Won’t that be expensive? It’s true that best identity protection services can charge more than $10 per month for each individual, but there are a few services out there that offer budget-friendly family plans. In fact, you can guard every member of your household’s identity for as little as $12.50 per month. And we’re not talking about just basic identity protection. We’re talking about services that offer full-service protection with insurance, credit monitoring, and even identity restoration. What are these services?

Quick Facts: The Best Identity Theft Protection for Families

| Adults covered | 1-2 or unlimited |

|---|---|

| Children covered | 5-10 or unlimited |

| Price range | $14.99-$48.99 monthly |

| Payment frequency | Monthly, yearly |

What’s Included with Family Identity Theft Protection?

The best family identity theft protection plans feature two main services: prevention and resolution. Some provide credit monitoring as well.

- One example of identity theft prevention is monitoring chat rooms on the “dark web” where thieves exchange stolen data and sending you instant notifications if your info is detected. Another example is notifying you in real-time if someone seeks a payday loan in your name.

- An example of theft resolution is a caseworker contacting credit bureaus to help restore your FICO rating. Another example is the company paying legal fees to help establish that your toddler did not, in fact, buy a yacht.

- Credit monitoring may be offered with daily, monthly, quarterly, or annual credit reports. Some theft prevention plans are focused on one credit bureau (TransUnion, Equifax, or Experian). Others provide FICO scores, which may reflect changes from all three major bureaus. Also, some plans go beyond theft prevention to help improve your household’s financial well-being. They feature credit improvement simulators and/or other financial tools and advice.

Rates are as low as $12.50/month with typical coverage being $1 million per family member. A million might sound high, but legal fees can add up quickly. Resolving ID fraud is time-consuming for the victims too, so plans may include lost wage replacement up to $7,500 per month.

Our favorites for family identity theft protection

- LifeLock - Best Senior Plans

- Aura - Most Comprehensive Family Plans

- Identity Guard® - Most Affordable Family Plans

- Surfshark Alert - Best Online Protection for Families

- IdentityForce - Best Identity Theft Protection for Children

- Experian IdentityWorks - Best Identity Theft Protection for Large Families

- Zander Insurance - Most Affordable Family Coverage

Detailed List of the Best Family Identity Theft Protection

-

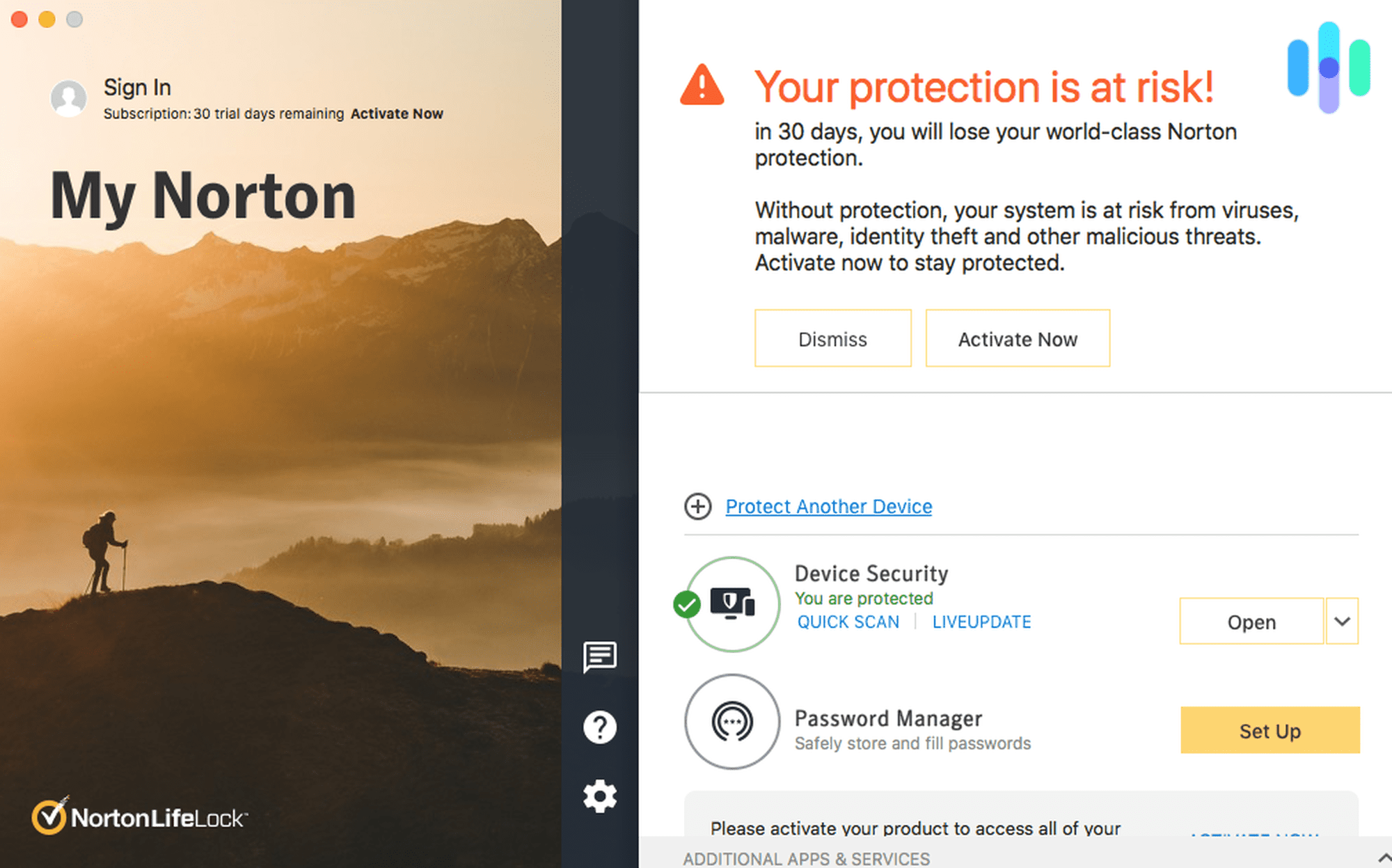

1. LifeLock - Best Senior Plans

Product Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 30-day Individual Monthly Plans $3.33 and up Family Monthly Plans $18.49 and up LifeLock is an identity protection company owned by Norton. This cozy relationship is reflected in LifeLock plans that include Norton 360 subscriptions. Overall the pricing isn’t necessarily best for big families, but LifeLock might be best for an elderly family member on their own. The top-tier LifeLock plan provides up to $1 million in ID theft protection for $25.99/month during the first year of service.

Each plan can send real-time privacy alerts to your mobile phone or email, and LifeLock lets you issue an instant credit freeze to help stop crime.

Courtesy of Norton is protection against cyberthreats. This is included for desktop and mobile devices, plus it’s active when you use public WiFi. By creating a virtual private network, Norton gives you the freedom to securely check email, bank accounts, and other sites even when you aren’t at home.

Other benefits of LifeLock’s subscriptions include credit monitoring, banking/credit card alerts, alerts about crimes committed in your name, and more.

Benefits

- Norton 360 online security

- Real-time alerts by text, phone, email

- Instant credit freeze

- Triple-bureau credit reports

- Dark web scans

- File-sharing site scans

- Bank account monitoring

- Crime alerts

- Lost wallet protection

- Up to $1 million restitution for ID fraud

LifeLock Family Prices

Month-to-month LifeLock rates range from $9.99 to $25.99 per adult. Children can be added to any LifeLock plan for $5.99 each. Again though, LifeLock seems best for an elderly person on their own; other companies have better rates for households with more than one adult and children.

What are the main differences among plans? Most important is the maximum coverage in case of identity theft:

- LifeLock Standard, $9.99/mo. – $25,000 reimbursement

- LifeLock Advantage, $17.99/mo. – $100,000 reimbursement

- LifeLock Ultimate Plus, $25.99/mo. – $1,000,000 reimbursement

Some other differences: Each LifeLock plan includes credit monitoring, but credit protection is more advanced with the pricier plans. The higher-priced plans protect more devices against malware, phishing, and other cyberthreats.

Discounts are given with yearly ID protection plans.

-

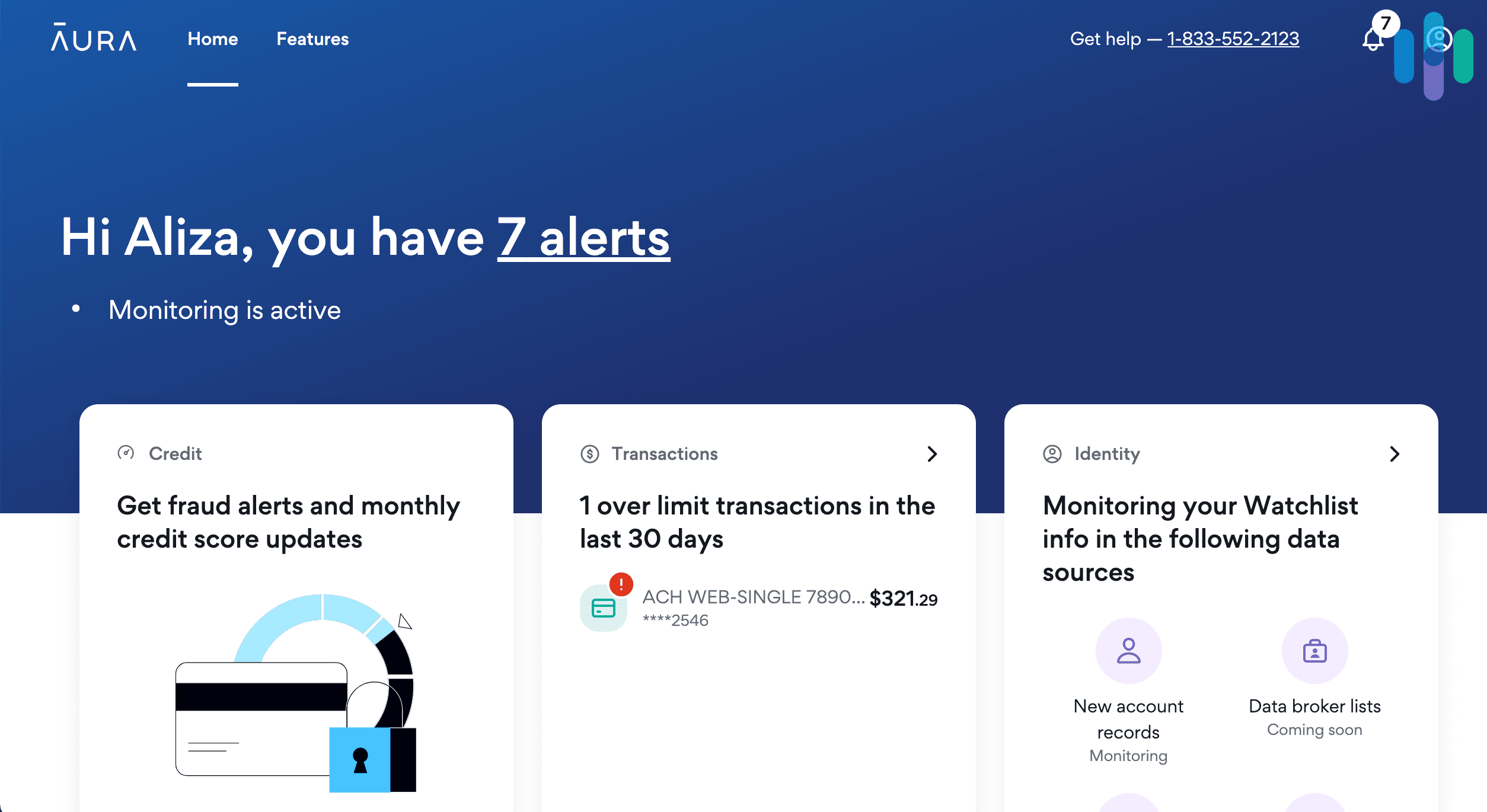

2. Aura - Most Comprehensive Family Plans

Product Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 14-day Individual Monthly Plans $12 Family Monthly Plans $45 Our favorite thing about Aura is how comprehensive the protection it provides. It’s so much more than just simple identity monitoring. In addition to monitoring SSNs and the dark web, it offers financial and credit monitoring. With that, your credit accounts with Transunion, Experian, and Equifax will all be covered, so will your bank accounts, investment accounts, and retirement fund.

That’s not all; when we signed up for an Aura account as a family, each member also got access to a VPN, antivirus software, and parental control software. Those can come in handy for preventing digital identity theft – one of the most common types of identity theft these days that affect children and less tech-savvy seniors who are more likely to fall for online scams.

Features aside, we think Aura’s family plans are worth the money. A family membership from Aura costs $50 a month, but that price falls to just $37 a month if you’re willing to sign up for an annual subscription. You get VPN and antivirus coverage for up to 50 devices and up to $5 million in identity theft insurance.

Benefits

Aura divides its benefits into three categories: identity theft, financial fraud, and device and online security.

- Flat rate to include up to five members of the household

- Child SSN monitoring

- Monthly VantageScore credit score

- Annual credit reports from all three bureaus

- Lost wallet remediation

- Online account monitoring

- VPN

- Password manager

- Antivirus protection

- White glove fraud resolution

- Up to $5 million in stolen funds reimbursement

Aura features a Virtual Private Network (VPN) which can keep you safe when you’re browsing online. A VPN routes your internet connection through an encrypted tunnel and assigns you an untraceable IP address. That means hackers can’t follow you and even the government can’t spy on what you’re doing.

Aura’s password manager doesn’t just maintain a secure record of all your passwords. It also alerts you if you happen to have any weak or breached passwords and offers suggestions for how to improve them.

Children are particularly vulnerable to identity theft. Thieves like the fact that kids have clean credit histories. Plus, often no one bothers to check those histories until it’s far too late. Aura runs constant checks for your children’s SSNs on millions of public records, including court filings, DMV records, and credit headers. Plus, if something should go wrong, all of your children are protected with up to $1 million of ID theft insurance.

>> Learn More: Best Password Managers for Families

Aura Family Prices

Aura charges $50 a month for its family plans if you’re paying one month at a time. However, you can get the same plan for just $37 a month if you sign up for 12 months of the service. That’s a savings of $156 a year. A single family plan can cover up to five adult members of the family and any number of children. Just take note that children don’t get as much protection as adult members, and they also have to share access to Aura’s digital security tools with their parents.

-

3. Identity Guard® - Most Affordable Family Plans

Product Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 30-day Individual Monthly Plans $7.50 and up Family Monthly Plans $12.50 and up Identity Guard offers extraordinary value for an ID theft family plan. The cheapest family plan is just $12.50/month with up to $1 million in stolen funds reimbursement per person. With a Better Business Bureau rating of A+, and more than 50 million customers having the opportunity to weigh in, Identity Guard has earned a solid reputation.

The main benefits available from Identity Guard are dark web monitoring, cyberbully alerts, credit monitoring, and safe browsing tools for desktop and mobile devices.

One membership can cover all adults and minors in your home. Each family member has a unique login. Adults may view minors’ information, but adults can’t see each other’s account information. Here is a list of main benefits:

Benefits

- Flat rate to include the entire household

- IBM Watson dark web monitoring

- Cyberbully alerts and response

- Monthly TransUnion credit score & annual three-bureau report

- Bank account alerts

- Tax refund alerts

- Facebook timeline analysis

- Dedicated case manager for ID fraud resolution

- Up to $1 million in stolen funds reimbursement

Online monitoring is one of Identity Guard’s biggest selling points. That’s because it uses state-of-the-art artificial intelligence to monitor billions of data points in an instant. The A.I. is from IBM, named Watson. It can monitor chat rooms and dark web forums where thieves trade stolen identities, check the internet for major data breaches, and alert you to data broker sites with your information. Thanks to its speedy alerts, you can respond to potential identity theft to prevent further damage. For example, it gives you the chance to change to more secure passwords if your online bank account credentials get leaked.

Cyberbullies can be caught by IBM Watson too. Artificial intelligence stays alert for signs of online harassment. Identity Guard sends cyberbully alerts to adults on the account, along with guidance about the next steps to take.

Credit monitoring comes with two of Identity Guard’s family plans. This provides a monthly Vantage score based on TransUnion data. You’ll also get an annual credit report with information from all three major credit bureaus (TransUnion, Equifax, and Experian). By law you can get annual credit reports for free; IdentityGuard streamlines the process.

Safe browsing tools are included with all Identity Guard family plans. These can help keep family members and their data protected online, whether with desktop computers or mobile devices. A main feature is anti-phishing software to screen out malicious emails and dangerous websites.

Identity Guard Family Prices

Family plan prices range from $12.50 to $34.99 per month. You can pay month-to-month, but the lowest rates come with 12-month deals; these reflect nearly 20 percent discounts. Choosing the Ultimate Plan for a year works out to $29.17 per month.

-

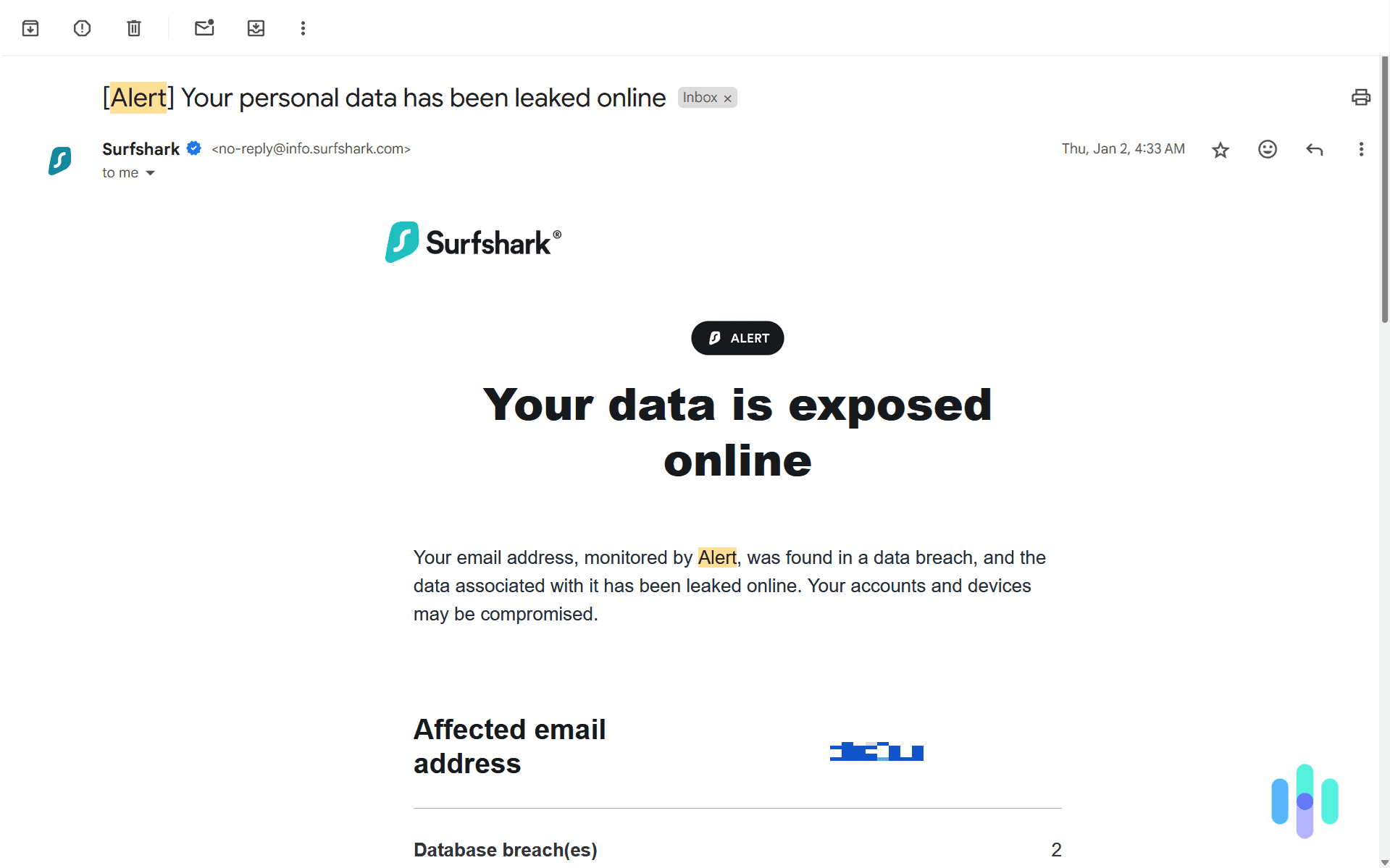

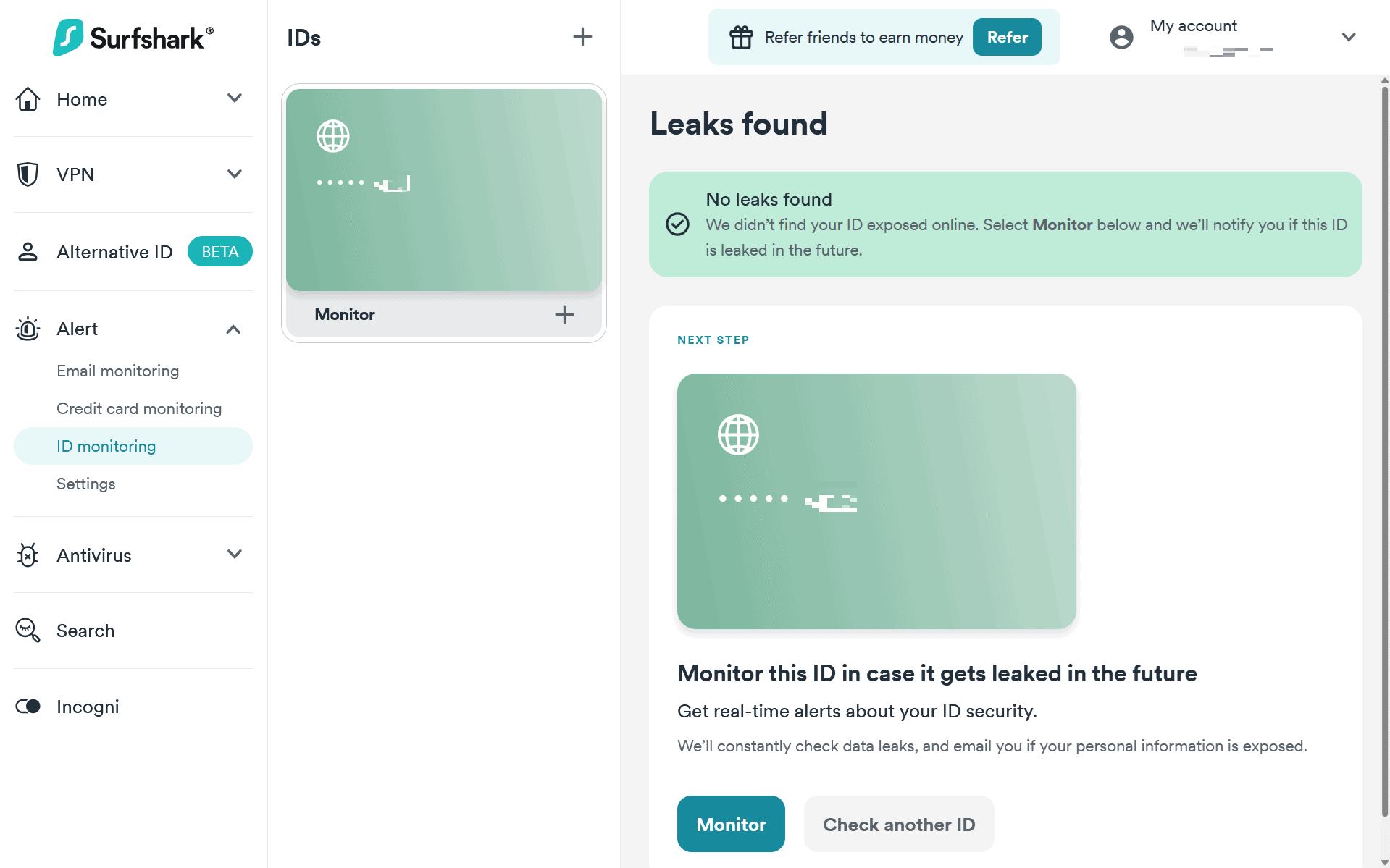

4. Surfshark Alert - Best Online Protection for Families

View Packages Links to Surfshark.comProduct Specs

Dark Web Monitoring Yes Credit Reporting No Insurance Coverage No Free Trial 30-day money-back guarantee Individual Monthly Plans $2.69 and up Family Monthly Plans $2.69 and up While we were testing Surfshark, we chose to have them actively monitor our SSN for leaks. To give it to you straight, Surfshark’s not known for their identity theft protection. They’re most known for their VPN and antivirus. Recently, they created Surfshark Alert to expand on their online privacy and safety services. We think of it as identity theft protection light for an affordable price. They offer monitoring for as many IDs, credit cards, and emails as you want. That means you can add your whole family’s information for monitoring under a single subscription.

Plus, Surfshark’s VPN and antivirus software is perfect for families since the VPN supports unlimited connections and the antivirus software supports up to five devices. Considering that iOS devices don’t need antivirus software, support for five devices during our tests of Surfshark Antivirus was enough for our family.

>> Learn More: Surfshark VPN Review 2025: A Fast and Versatile Option

Benefits

After adding our email address to Surfshark Alert’s active monitoring, we received alerts every time it was in a data breach. While Surfshark Alert doesn’t come with identity theft insurance like the other services on this list, it still has some unique benefits. Here are the key features we used when testing Surfshark Alert to keep our identities secure:

- Individual plan works for a full family and starts at $2.69 per month

- Monitors unlimited IDs, credit cards, and email addresses

- Cookie blocker helps prevent your data from leaking

- VPN supports unlimited connections

- Included antivirus software

- Scheduled data security reports for the whole family

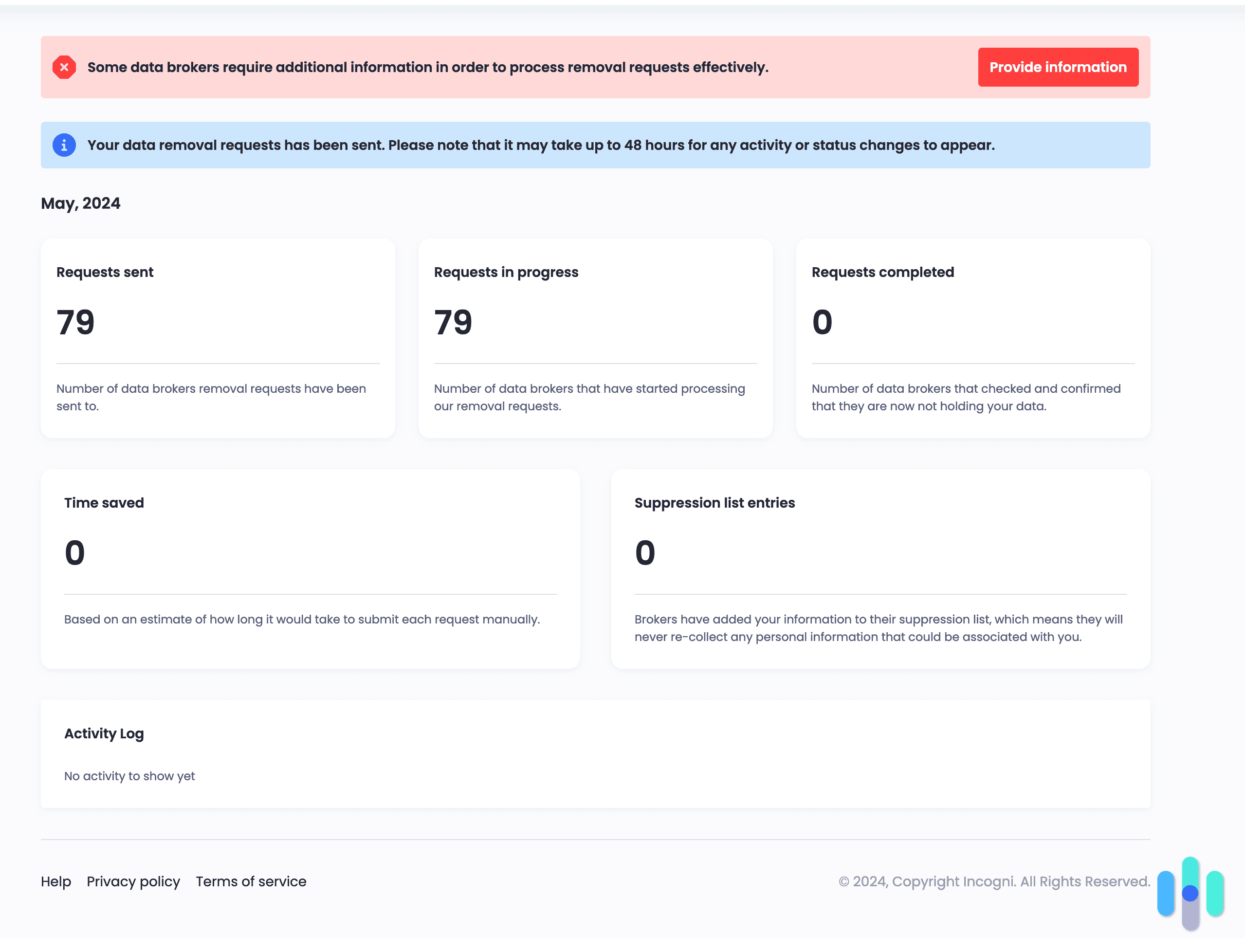

FYI: At $4.29 per month for a two-year plan of Surfshark One+, you get access to a VPN with unlimited connections, antivirus software, ID monitoring, and one of our favorite data removal services. In our opinion, this is one of the best value plans for online privacy available.

Surfshark Alert Family Prices

Given that Surfshark offers unlimited monitoring, they don’t actually have a family plan. Their main plans all work for families, although only the Surfshark One and One+ plans include Surfshark Alert. The Surfshark Starter plan just includes their VPN. Here’s an overview of Surfshark’s plans that include Alert:

Surfshark Subscriptions Surfshark One Surfshark One+ Monthly plan $17.95 $20.65 Annual plan $50.85 ($3.39 per month) $91.35 ($6.09 per month) Two-year plan $72.63 ($2.69 per month) $115.83 ($4.29 per month) We recommend at least an annual plan when buying any Surfshark subscription. It comes with a 30-day money-back guarantee, so if you decide you don’t like it after a month of using it, you can always get a full refund.

-

5. IdentityForce - Best Identity Theft Protection for Children

Product Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 30-day Individual Monthly Plans $19.90 and up Family Monthly Plans $39.90 and up Whether you have one child or enough for a baseball team, IdentityForce is a great value for family identity protection. Their Family ID Protection plans can support two adults plus any number of minors, giving each enrollee up to $1 million in ID theft compensation. Plans include cyber protection (Windows only) along with 24/7 monitoring of public records, the dark web, and your financial accounts. Credit monitoring is included only with the top-tier plan.

- If you don’t already have credit monitoring in place, then IdentityForce’s $35.90/month UltraSecure+ Family Plan is best. It provides a credit improvement simulator along with quarterly credit reports from the three major bureaus.

- If you already use a credit monitoring service, then the $24.90/month UltraSecure Family Plan is a better buy. You can try this plan free for 14 days.

Notably, IdentityForce uses two-factor authentication for account sign-in. Taking an extra step at sign-in helps ensure that only you can access your account, even if somebody else enters your login ID and password.

A partial list of perks:

Benefits

- Two-factor authentication

- Three-bureau credit reporting

- Lost wallet assistance

- Dark web monitoring

- Court records monitoring

- Social media identity monitoring

- Real-time alerts of potential identity fraud

- Bill payment history

- Credit-improvement simulator

- Financial advice

- Junk mail opt-out

- Up to $1 million in restitution

IdentityForce family rates aren’t published on the company’s website. You can order a plan by phone. As mentioned above, the cheaper plan is available with a two-week free trial.

-

6. Experian IdentityWorks - Best Identity Theft Protection for Large Families

Product Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 30-day Individual Monthly Plans Starting at $24.99 per month Family Monthly Plans $34.99 and up If your family something like Eight Is Enough? Experian IdentityWorks is a great value for large families, as up to 10 minors and two adults can share low-priced plans. Coverage is up to $1,000,000 per person with monthly rates starting at $14.99 for single adult households and $19.99 for two-adult households.

Experian IdentityWorks is a branch of the Experian credit monitoring bureau, and a big benefit of membership is daily updates of your Experian credit score. You’ll also get quarterly reports with your FICO 8 score, which reflects data from all three major credit bureaus, and access to a FICO score simulator.

Some features are especially useful if you have minors. These include local sex offender alerts, social media fraud monitoring, and checking popular file-sharing networks for accidentally shared data.

Furthermore, IdentityWorks surveils the dark web for data breaches, monitors payday lenders for your data, provides fraud resolution support, and more.

Benefits

- Daily Experian credit updates

- Instant Experian credit locking

- Quarterly FICO reports

- Real-time credit alerts

- Credit simulator

- Up to $1,000,000 in restitution

- Assistance with fraud resolution

- Dark web surveillance

- Payday loan fraud prevention

- Sex offender registry alerts

- Social media monitoring for fraud

- File-sharing network monitoring

- Monitoring court records for ID theft

Experian Family Plan Prices

The two family plans are called IdentityWorks Plus and IdentityWorks Premium. Each has two prices depending on whether one or two adults enroll. Overall the prices range from $14.99 to $29.99 per month. Up to ten minors can enroll with no extra charge.

- IdentityWorks Plus: $14.99 for a one-adult home, or $19.99 for a two-adult household. Provides ID theft prevention, detection, and up to $500K in resolution.

- IdentityWorks Premium: $24.99 for a one-adult home, or $29.99 for a two-adult household. Provides identity theft prevention, detection, and up to $1,000,000 in restitution. This plan also builds upon the Plus plan with file-sharing network scans, sex offender registry alerts, notifications of crimes committed in your name, and more.

You can try either Experian family plan free for 30 days.

-

7. Zander Insurance - Most Affordable Family Coverage

View Packages Links to Zander InsuranceProduct Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial No Individual Monthly Plans $6.75 and up Family Monthly Plans $12.90 and up Zander is a nearly century-old insurance group. Along with homeowners insurance and other traditional insurance products, Zander now offers the most affordable family coverage on identity theft protection. Their $12.90/month Family Plan covers minors for free, and the benefits are generous. Given Zander’s general insurance background, the company is well-positioned to guard against car title fraud, healthcare fraud, employment fraud, tax fraud, and other types of ID theft.

Each Zander Family Plan enrollee is guaranteed up to $1 million in restitution, plus wage earners secure up to $7,500/month in wage replacement. (For comparison, many competitors will cap monthly wage replacement at $5,000.) In the case of identity theft, a case manager will assist with resolution for up to three years.

Benefits

- Affordable family coverage

- 24/7 phone support

- Proactive monitoring for ID fraud in employment, healthcare, auto sales, tax refund filing, and more

- Three years ID restoration with a certified case manager

- Can save with other insurance products

Credit reporting isn’t available through Zander. It’s best to supplement a Zander plan with free annual credit reports and a free credit reporting service.

Disclaimer: This content is not provided or commissioned by the companies referenced in this article. Opinions expressed here are the author’s alone and have not been reviewed, approved, or otherwise endorsed by the companies mentioned. We may be compensated through advertiser affiliate programs.