62 Million Americans Experienced Credit Card Fraud Last Year

2025 Credit Card Fraud Report and Statistics

Key findings

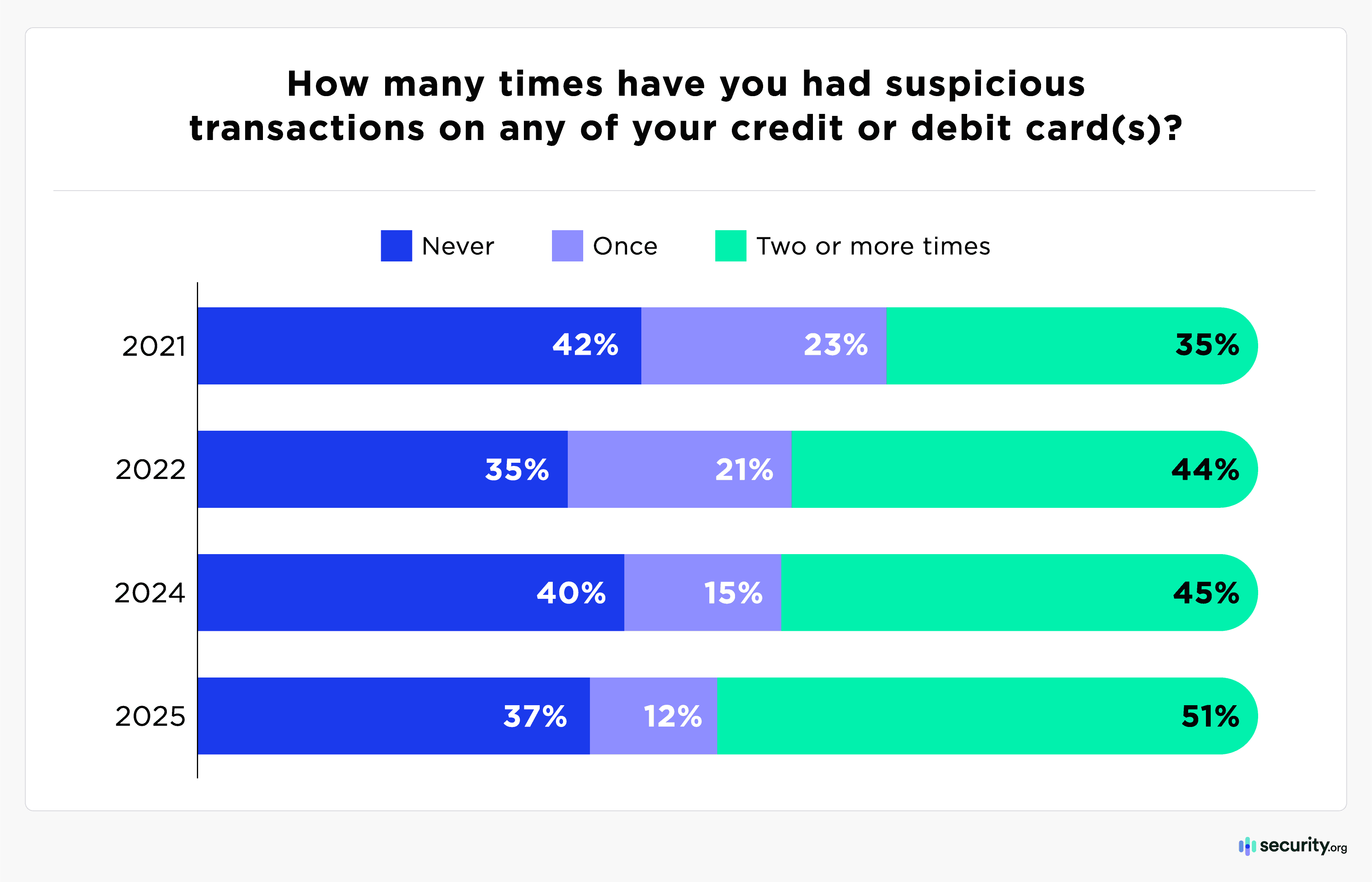

- 63% of U.S. credit card holders have been victimized by fraud, and 51% have experienced fraud multiple times.

- 62 million Americans had fraudulent charges on their credit or debit cards last year alone, with unauthorized purchases exceeding $6.2 billion annually.

- Only 8% of fraudulent charges involved stolen or lost credit cards; the rest accessed personal data and account information remotely.

- 8 in 10 cardholders admit to at least one risky credit card habit, making their accounts more vulnerable to fraud.

- 21% of victims had experienced recurring fraudulent charges from the same merchant, up from just 12% in our previous study.

Today, credit and debit card transactions are more common than cash in the United States. This gives digital criminals all the opportunity they could want to commit credit card fraud. And every year, they succeed at least some of the time with 62 million Americans experiencing credit card fraud in a one-year period.

But, when our digital safety experts looked into the causes and prevention methods Americans can use to avoid credit card fraud, we came up short. There weren’t many actual studies on this topic. So, our team surveyed nearly 1,000 Americans about their credit card experiences and habits. We used these results to pull insights into the habits Americans can change to improve their credit card security. Let’s dig in.

Nearly 2 in 3 Credit Card Holders Have Experienced Fraud

Credit card security has become increasingly critical as the U.S. edges towards becoming a cashless economy. American consumers rely heavily on credit cards, supplying fraudsters with a steady stream of potential targets.

Four out of five American adults today possess at least one credit card, and we found that three of five cardholders have experienced unauthorized charges. The total number of estimated victims has increased about five percent since our last study, rising to 134 million in total. Four out of five of those victims said they’ve had credit card fraud more than once. In fact, a shrinking number of people have only experienced fraud once.

Zooming in, we found that one-quarter of all cardholders were defrauded over the last year alone, which is an estimated 62 million Americans.

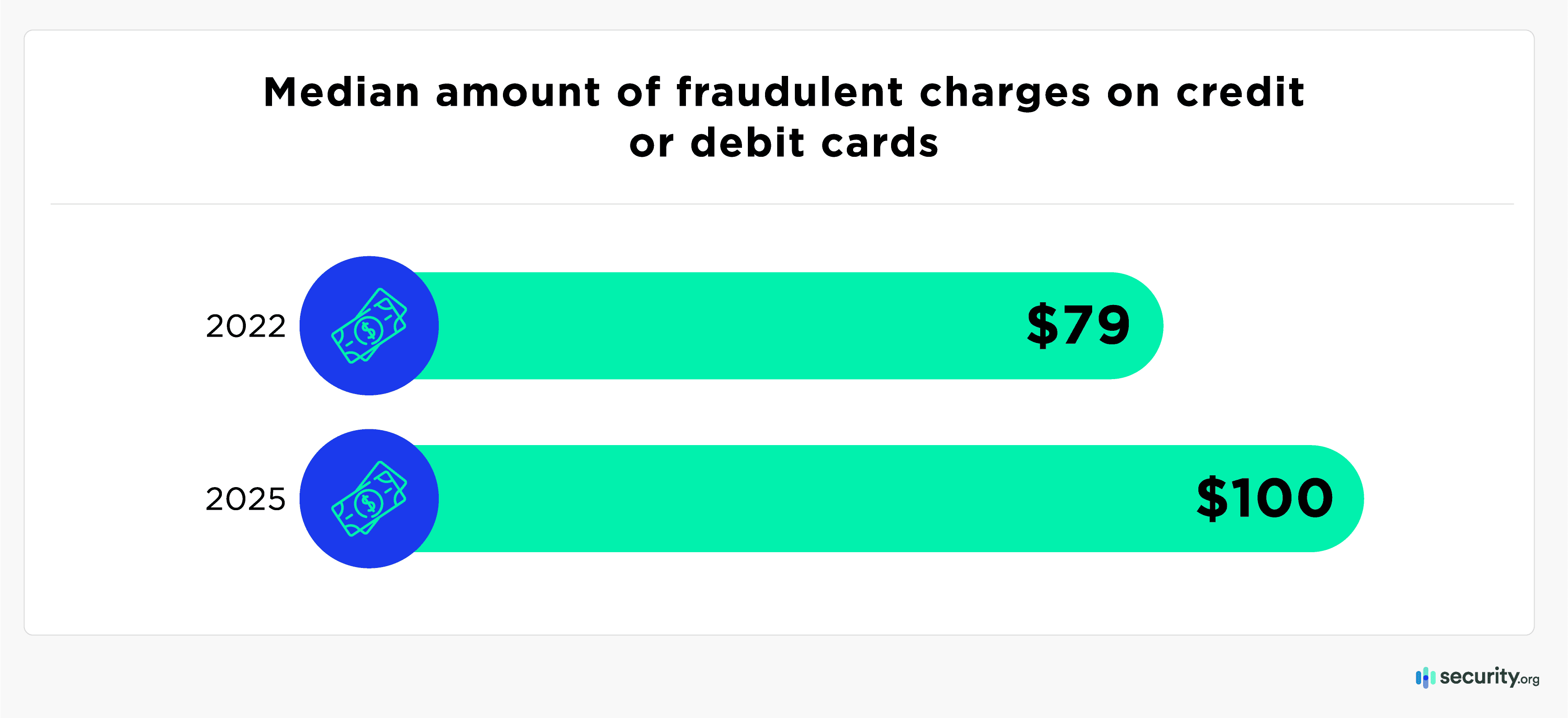

The median expenditure per fraudulent charge also jumped 26 percent in the previous two years. The typical unauthorized transaction is now $100, amounting to approximately $6.2 billion in criminal purchases yearly.

| Did you report your most recent fraudulent charge? | Percent of credit card fraud victims |

|---|---|

| Yes, to law enforcement | 10% |

| Yes, to my credit card company | 94% |

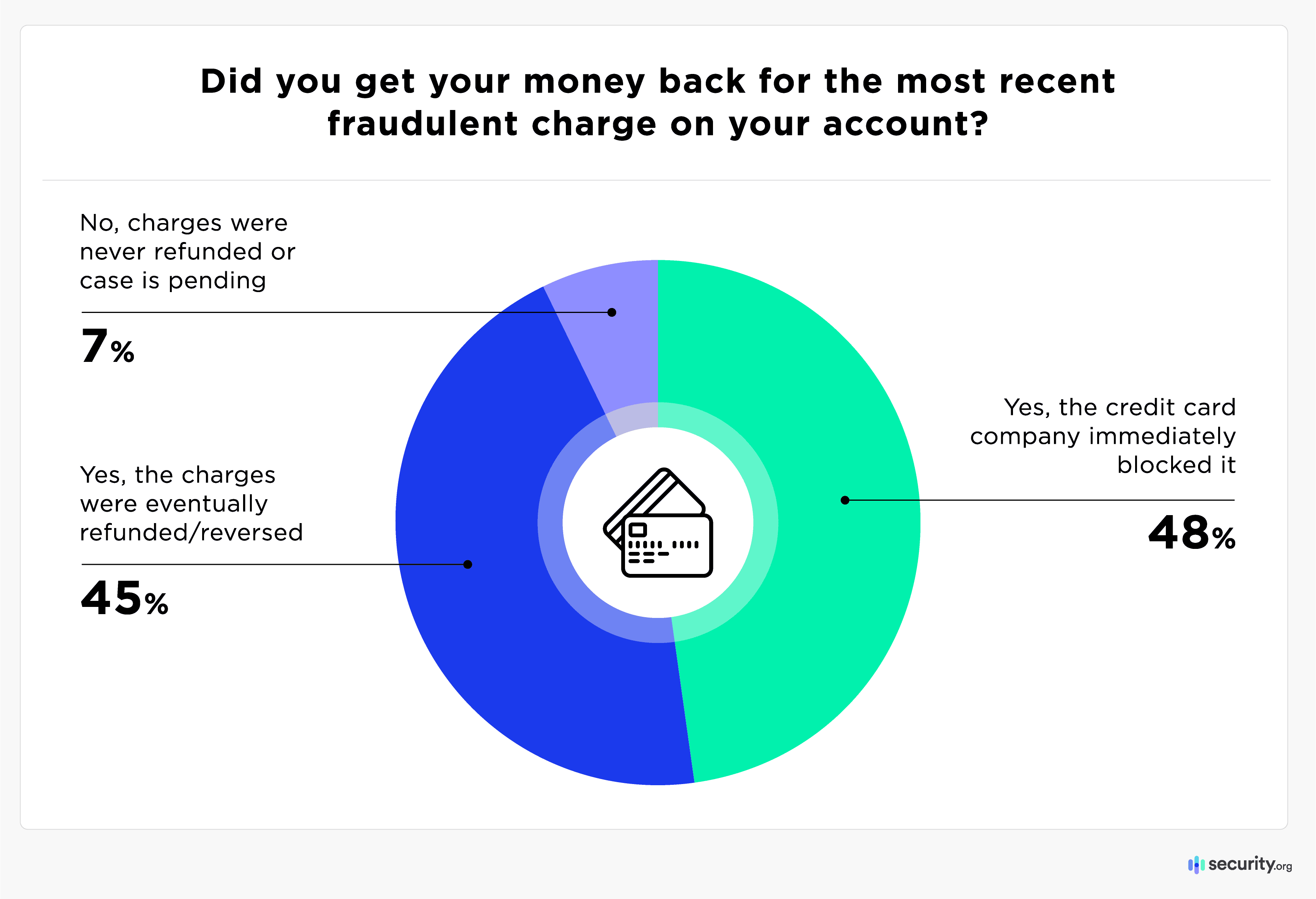

Ten percent of victims reported credit card fraud to law enforcement, up from four percent in our last report. However, many more people report fraud to their credit card provider or bank: 94 percent contacted their banks or card providers. Thankfully, this approach was generally sufficient to block unauthorized purchases or refund/reverse the charges – 93 percent of fraud victims got their money back.

Despite the widespread impact of this crime, credit card fraud remains somewhat misunderstood. Consumers may assume their accounts are protected as long as they keep their physical cards safe, yet in 2024, 92 percent of unauthorized transactions involve credit cards that weren’t lost or physically stolen.

Since criminals can commit fraud without stealing wallets, Americans must protect their digital information to avoid credit card fraud. How can they shore up their online security and avoid bad habits that put their finances at risk?

The Dos and Don’ts of Credit Card Security

With billions of dollars ripe for the picking, financial fraudsters have grown increasingly resourceful. Clever criminals have a toolbox of tactics to hijack accounts without ever touching your wallet or purse.

Some common methods for stealing credit card numbers are:

- Phishing: deceiving cardholders into divulging information, often through misleading links in texts or emails

- Skimming or shimming: copying card numbers from point-of-sale terminals

- RFID collection: digitally “reading” the signals that enable contactless payment

- Hacking personal data through malware or public Wi-Fi signals

- Accessing personal information leaked through data breaches of retailers and service providers

Unsafe credit card habits

While people who commit credit card fraud rely on several high-tech strategies, too many credit card holders have bad habits that expose their account numbers and make it easier for criminals to steal their financial information.

Unfortunately, 84 percent of cardholders confessed to at least one of these bad habits, and most people (59 percent) exhibited two or more unsafe practices. Though some bad habits have increased in frequency since our last study, most are still less common than they were in 2022.

| Bad habits | 2022 | 2024 | 2025 |

|---|---|---|---|

| Use the same credit cards for autopay and everyday spending | 58% | 52% | 54% |

| Use the same password for more than one online account | 50% | 40% | 48% |

| Store credit card info in your browser or websites | 46% | 41% | 42% |

| Use public Wi-Fi connections | 42% | 34% | 39% |

| Use a free VPN | 10% | 8% | 10% |

Common mistakes include reusing the same password across multiple cards (allowing one hack to jeopardize multiple accounts), storing passwords in vulnerable locations (including merchant websites and browsers), and submitting payments through public Wi-Fi networks or unreliable free VPNs.

Experts advise against putting daily purchases and automatic monthly billing on the same credit card. Every point-of-sale use requires a unique authorization, incurring greater exposure than recurring charges (which require submission only once every few years). By separating the transaction types between different accounts, risk is limited, and fraud is detected more easily.

Other tips for keeping cards safe involve precautions when making payments in person. Identifying card skimmers and consistently concealing PIN codes can also protect sensitive information.

Additionally, using credit accounts saved within digital wallets (like Apple Pay or Android Pay) is a convenient way to enhance security. These mobile apps automatically incorporate authentication, and their contactless NFC technology transmits encrypted tokens rather than account information, making them safer to use (and harder to lose) than physical cards.

You can also implement several strategies to keep your credit card information secure.

>> Also check out: Best Identity Theft Protection Services in 2025

Ways to keep credit card accounts secure

Financial institutions invest heavily to keep credit card systems safe. Still, a few simple good habits can go a long way to guarding one’s accounts. Experts recommend that every cardholder enact the following basic precautions:

Review credit card statements: Spending a few minutes to peruse monthly bills is a low-tech way to verify charges. Ensure all merchants and purchases are familiar while paying particular attention to recurring expenses. Some thieves skip big-ticket items and use bogus service charges or subscriptions to siphon less noticeable monthly amounts. We found that 21 percent of victims had experienced such recurring fraudulent charges, up from just 12 percent last year.

| Have you ever had a fraudulent recurring charge (such as a monthly charge) from the same merchant over a period of time? | Percent of victims in 2024 | Percent of victims in 2025 |

|---|---|---|

| Yes | 12% | 21% |

| No | 88% | 79% |

Subscribe to spending alerts: Most credit accounts can be enabled to notify cardholders about purchases via email, text, or app. You can set up alerts for purchases over a specific limit or transactions with high fraud potential (identified by unusual merchants, locations, or amounts). Real-time notifications let consumers know when their account has been compromised and may allow them to block unauthorized charges instantly.

Enable multi-factor authentication (MFA): All personal devices should require additional login verification before submitting online credit card purchases. This extra level of security (a one-time SMS code, an external passkey, or biometrics like face ID or fingerprints) prevents criminals who only possess your card number and password from completing fraudulent charges.

Use Online Password Managers: Utilizing password managers simplifies the generation/storage/use/updating of complex codes for credit card access across numerous devices. These services are safer than storing logins with a browser and often monitor the dark web for stolen credentials.

Enroll in a Credit Monitoring Service: Credit monitoring services serve as early warning systems for fraudulent activity by constantly tracking spending histories and habits. In addition to questionable purchases, they can alert clients to new accounts opened in their name, changes in credit scores due to unauthorized actions, and identify leaks on the dark web.

>> Related article: Aura Identity Theft Protection Review

An impressive 95 percent of cardholders incorporate at least one of these good habits, and 82 percent regularly employ two or more, but only eight percent check all the boxes. Reviewing credit card statements is the most common precaution practiced by four out of five consumers. This is important as it allows users to spot and report suspicious transactions quickly.

| Good habits | 2024 | 2025 |

|---|---|---|

| Regularly review credit card statements | 79% | 78% |

| Use multi-factor authentication or face ID to access credit card accounts online | 55% | 63% |

| Subscribe to email/text alerts for my credit and debit cards | 61% | 62% |

| Use an online password manager | 37% | 37% |

| Subscribe to credit monitoring service | 31% | 36% |

* Multiple responses allowed

Though consumers should adopt as many best practices as possible, setting up spending alerts may be the most essential protection. Just over half of recent victims said they received a call, email, or text from their credit card company regarding a suspicious transaction, and 62 percent of victims discovered unauthorized charges on their cards within minutes or hours. Every minute is critical when your financial information is being exploited.

Conclusion

Americans use credit or debit cards to make 60 percent of their payments, and that proportion is steadily rising. This continuing march towards a cashless society may reduce violent crime and corruption while elevating convenience but also expanding opportunities for fraud.

134 million Americans have been victimized by credit card fraud, 62 million in the last year alone — and more than 90 percent of those crimes employed remote technology without access to a physical card. Positive practices (statement reviews, card notifications, credit monitoring, and multi-factor authentication) improve financial safety but can be undone by risky consumer habits (poorly managed credentials, insecure networks, comingling of disparate card uses).

As more cardholders embrace digital wallets and institutions turn to artificial intelligence and quantum connections for next-gen security measures, the number of victims may decline. Unfortunately, criminals often adapt and stay one step ahead, so all credit card users should remain vigilant.

Methodology

In January 2025, we conducted an online poll of 995 Americans who had at least one credit card. Respondents’ ages and sexes were representative of the U.S. population based on Census data. Respondents were asked about their perceptions of, and experiences with, fraudulent credit card charges as well as their financial security habits.