In the tech space, there are few bigger names than Apple Inc., launched by Steve Jobs, Steve Wozniak, and Ronald Wayne. Apple has created a suite of products through the years from the well-known iPhones and Macbooks to lesser-known Apple Swiss Army knives. (Who knew?) Apple has also been in the payment processing game for a decade, joining forces with Visa, Mastercard and AMEX. The result in 2014 was Apple Pay, unveiled to the world by CEO Tim Cook.

Today, Apple Pay is the most popular contactless payment platform with over 500 million users.1 But while having a powerful service right at your fingertips is enticing, it’s important to consider safety and security, especially when dealing with such a powerful service.

Payment apps often collect some pretty sensitive information about you. We’re talking about your address, your credit card information, and even your passwords. Can you trust Apple Pay to keep this data safe? We know your security matters to you, so we took a close look at this question. Below you’ll find all the details on what we discovered.

| Who owns Apple Pay? | Apple Payments Inc. is a wholly owned subsidiary of Apple |

|---|---|

| When was Apple Pay launched? | 2014 |

| How many users does it have? | More than 500 million globally |

Is Apple Pay Safe?

First off, let’s think about how people used to make payments in the halcyon days where cash or debit/credit cards without enhanced security ruled the land. While there are some pitfalls, today transactions are safer than they’ve ever been.

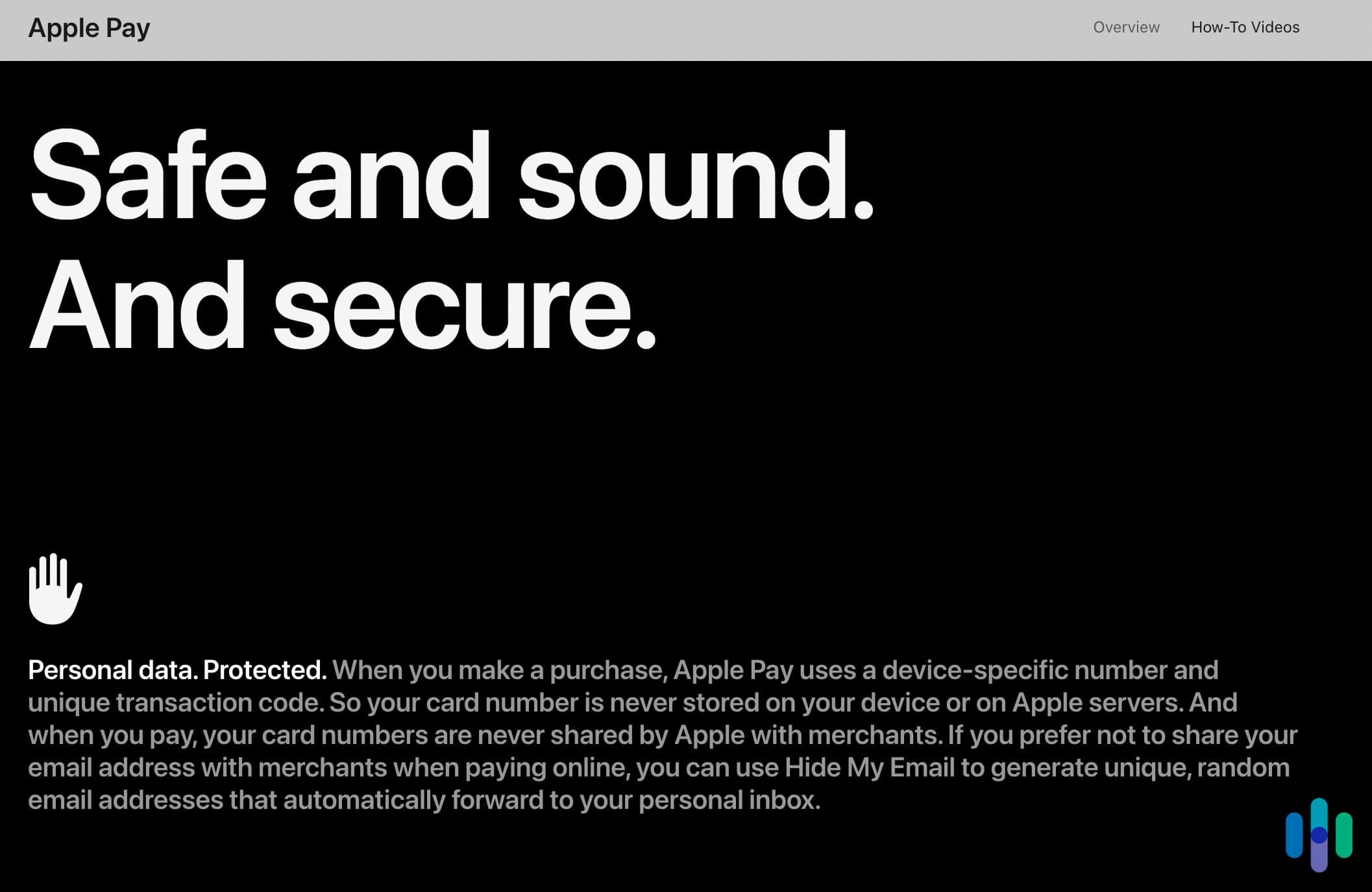

Apple Pay is even safer than using a physical credit, debit or prepaid card thanks to features like Face and Touch ID and your passcode on your iPhone, Apple Watch, Mac, or iPad. It’s also important to emphasize that when you use Apple Pay, your card number and identity aren’t shared with merchants. Your actual card numbers are neither stored on your device nor on Apple servers. And when you pay in stores, your actual card number won’t be sent to merchants. Phew!

>> Also See: Are Mobile Hotspots Safe?

Apple Pay Scams

While Apple Pay is generally safe to use, there are some scams to look out for. Unfortunately, this is the reality of using any app or online service. The Federal Trade Commission (FTC) emphasizes that no real business or government agency will ever tell you to buy a gift card to pay them.2 This is the hallmark of scammers. Knowing what to look out for and avoid will go a long way toward keeping you from falling victim to these scams.

FYI: Newly released Federal Trade Commission data show that consumers reported losing more than $10 billion to fraud in 2023.3

Part of making sure you’re safe while using Apple Pay is about a broader commitment to keeping your Apple device safe and following best practices. Here are a few things you can do and that you need to look out for:

- Protect your Apple ID. Use two-factor authentication, always keep your contact information secure and up to date, and never share your Apple ID password or verification codes with anyone. As security experts, we also recommend you use a six-digit passcode instead of the familiar four-digit passcode for better protection.

- Download only from trusted sources. Only download software from sources you can trust. Also never follow links or open or save attachments in suspicious or unsolicited messages.

- Watch out for phishing. These are fraudulent attempts to get personal information from you, often by email. Through this practice, scammers aim to trick you into sharing information or giving them money. This can come in many forms, including fraudulent emails that look like they’re coming from real companies, scam phone calls, or even unwanted calendar invitations.

Pro Tip: While many Apple users faithfully rely on iCal across different devices as they go about their day, they should keep an eye out for phishing in this context, too. Harmful attached invitations usually have an .ics or .ical extension. Never open a file you do not recognize or if it’s from a sender you do not know. Do not even select to “decline” the invite. The only thing you need to do is delete that email and invitation completely.

Apple Pay and Your Privacy

Any discussion about digital safety needs to include privacy and security. Before you dive in with Apple Pay, make sure you understand and agree with its privacy policy. Apple doesn’t mince words when it comes to its dedication by calling privacy a “fundamental human right” and one of its “core values.”

Apple Pay taps Apple’s broader suite of Apple security features, including passkeys, the ability to lock hidden albums, app tracking transparency, and mail privacy protection. It works directly from your device. Meanwhile, each purchase you make using the service requires Face ID, Touch ID, or a passcode. Apple Pay uses a device-specific number and unique transaction code each time you make a purchase so your card number is never stored on Apple services or on your device.

What Kind of Data Does Apple Pay Collect?

Apple Pay does collect data from its users. Some of the data it collects is used to improve Apple Pay and other products and services. Here are a few things to keep in mind:

- Apple Pay keeps transaction information. However, it’s important to note that all of this transaction information remains anonymous, including the approximate purchase amount and the approximate date and time of the purchase.

- Apple Pay might share additional data. Apple Pay might share additional data that can no longer be tied to you. In this case, Apple Pay shares this information because it wants to improve its (and other Apple) products and services.

- Apple Pay might share device information. Apple Pay might share information about your device and, if using Apple Watch, the paired iOS device (e.g., an iPhone).

- Apple Pay might share account-related information. Apple Pay might share account related-information and paired-device details with your card issuer or bank to determine eligibility and for anti-fraud purposes.

>> Check Out: Is PayPal Safe?

How to Stay Safe on Apple Pay

Staying safe on Apple Pay, as stated above, should involve best practices that you incorporate across all of the Apple devices you use. Here are a few tips:

- Keep passwords strong and unique. Don’t use the same passwords for different accounts. That way, if your account becomes compromised, your password security on your other online accounts will remain intact. Here’s a password generator.

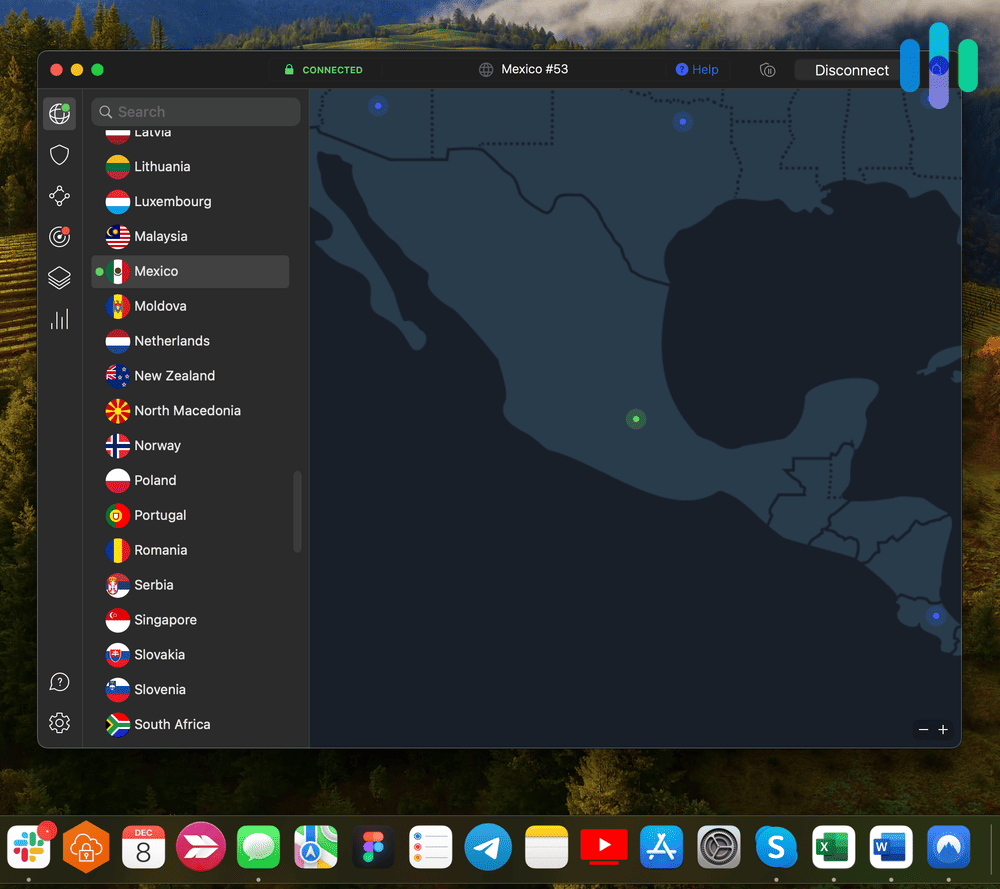

- Use a VPN (virtual private network). This way you can hide your IP address and prevent tracking by advertisers. Here’s a guide on some of the best VPNs of 2025, as reviewed by our experts.

- Get a good antivirus program. While there is still the myth that Mac products are immune to viruses, the fact of the matter is that all devices can be susceptible to viruses and malware. Get a good antivirus service to protect against threats.

Pro Tip: Check out our rundown of the Best Antivirus Software in 2025 to stay ahead of the digital security curve throughout the year.

Wrapping Up: The Bottom Line on Apple Pay

Since we know you’re a fan of random facts, here’s another: Back in 2016, a customer used their fingerprint to authorize the purchase of a 1964 Aston Martin DB5 priced at over $1 million. While we’re assuming your transactions won’t be quite this large, we do know that it’s important for you to feel safe and secure as you navigate Apple Pay.

And we’re glad to report that Apple Pay is one of the safest services out there. Your card number and identity are never shared with merchants. Apple Pay also taps the suite of security features available across many different popular devices, including Face ID and passkeys, which have offered top-of-the-line protection for years and are constantly being updated. We are also high on Apple Pay’s Advanced Fraud Protection, which makes your three-digit Apple Card security code change intermittently after it’s been viewed in the Wallet app or auto-filled from Safari.4

As of 2023, Apple Pay boasts more than 507 million users worldwide, a testament to the quality and security of the service.

Apple Pay FAQs

Before you use Apple Pay for something as mundane as paying for a subway to as profound as buying an NBA playoffs ticket, here are some of our frequently asked questions about Apple Pay’s safety and security. You might find the answers you’ve been looking for.

-

Is it safe to add my payment information to Apple Pay?

Yes! Apple Pay keeps transaction information anonymous, including the approximate purchase amount, app developer and app name, approximate date and time, and whether the transaction completed successfully.

-

Is Apple Pay a bank?

No. In addition, it’s important to note that Apple Pay does not directly use Bank accounts. Instead, you need a debit card or credit card you can add to Apple Pay to make use of it. Meanwhile another service called Apple Cash is debit card.

-

Who owns Apple Pay?

Apple was launched by Steve Jobs, Steve Wozniak, and Ronald Wayne. Apple owns Apple Pay, a mobile payment service that allows users to make payments in person, in iOS apps, and on the web.

-

Does Apple Pay have fraud protection?

Apple Pay has Advanced Fraud Protection as a way to keep your Apple Card information even more secure. After turning on the service, your three-digit Apple Card security code will change on a rotating basis.