ID Watchdog Review

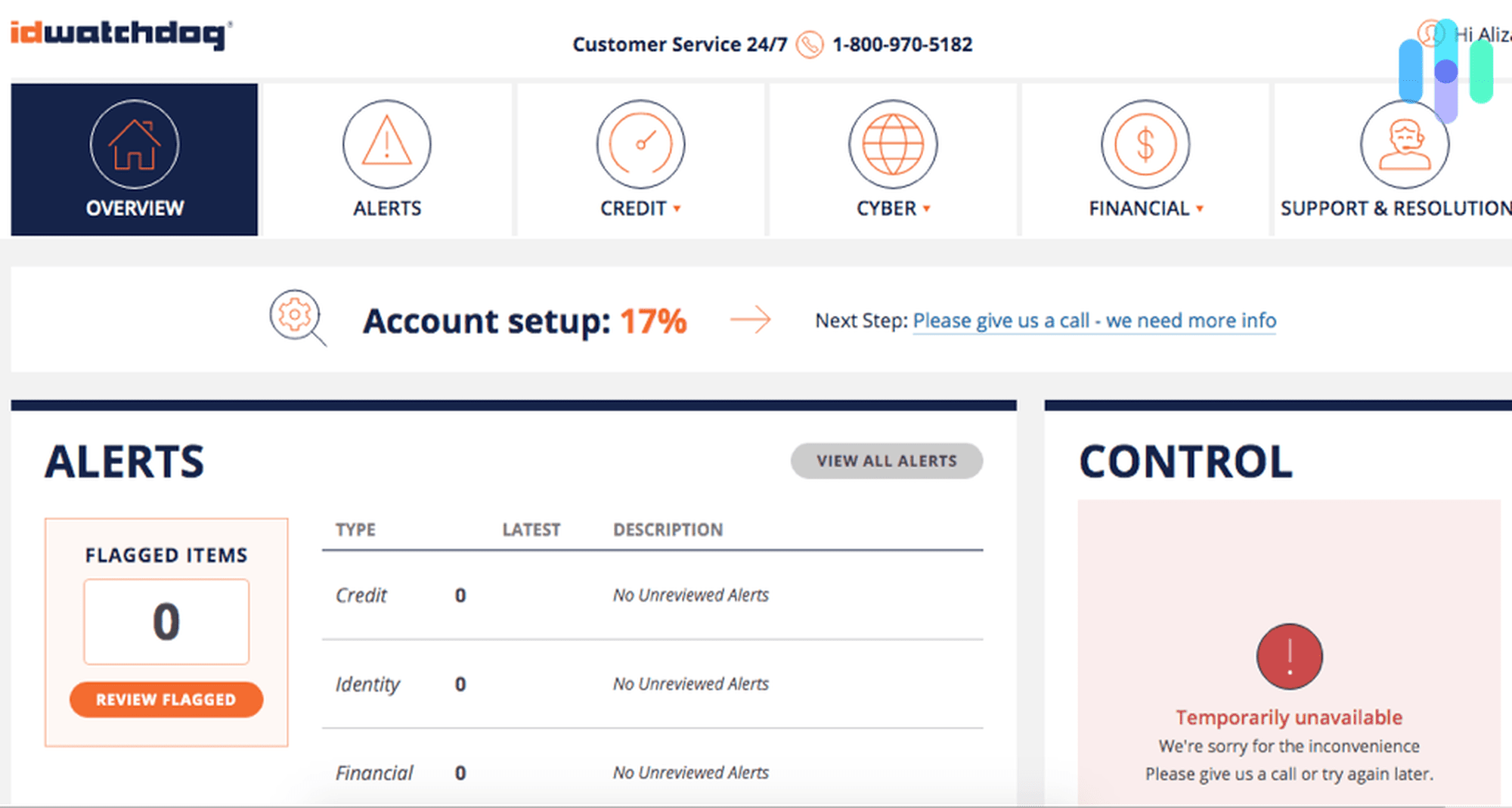

Owned by Equifax, ID Watchdog is known for their comprehensive ID theft restoration services

What We Like

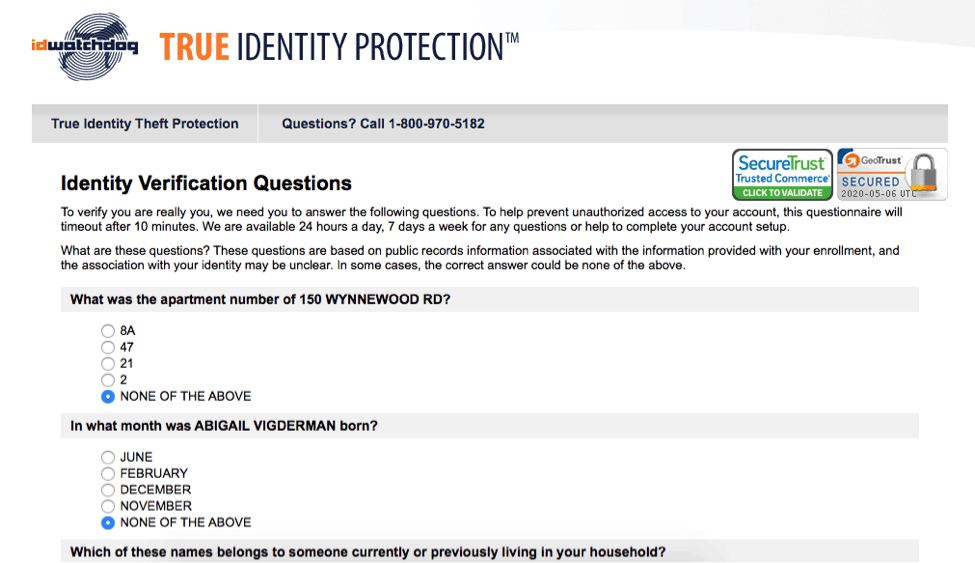

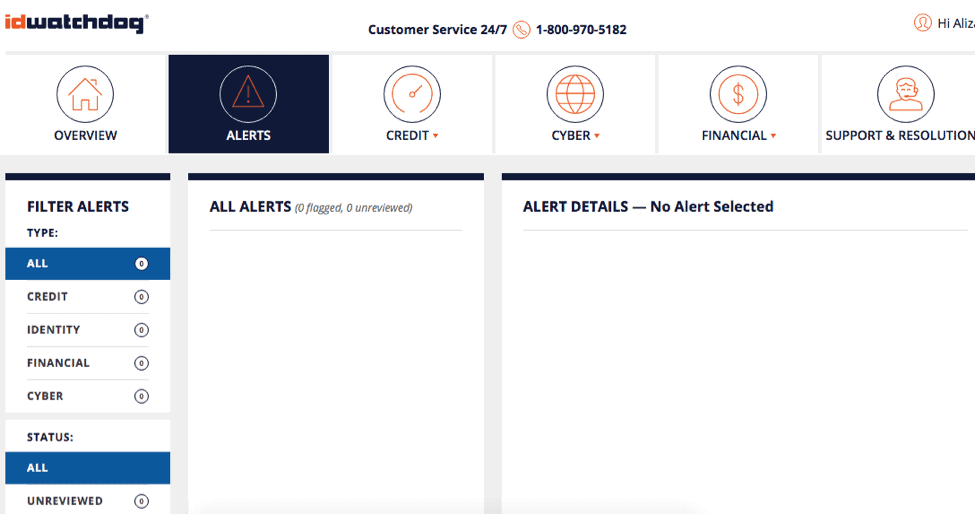

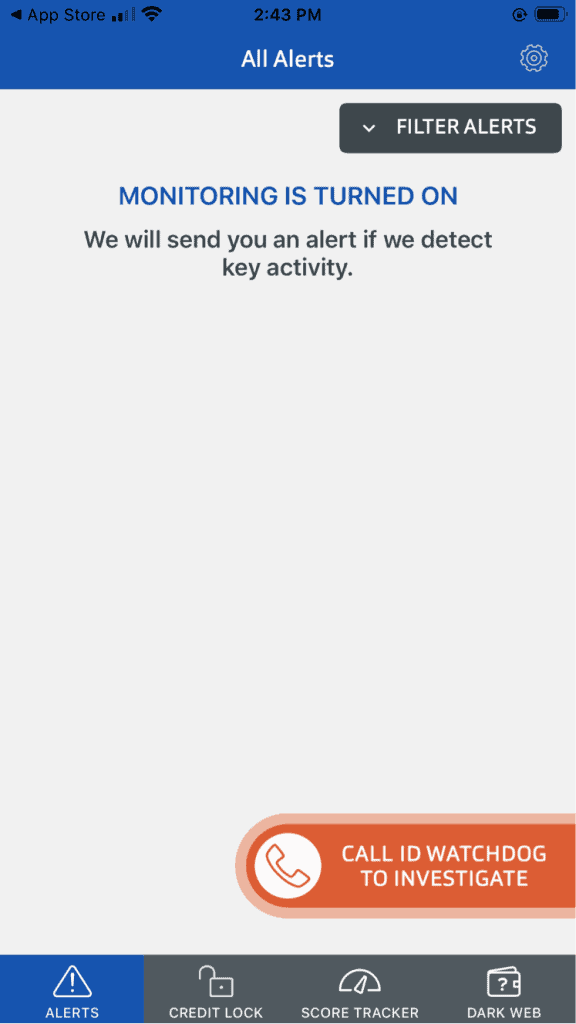

- Extensive monitoring and alerts: ID Watchdog’s service included dark web monitoring, breach alerts, and even social network alerts.

- Excellent Insurance: If somebody stole our identities, we could count on up to $1 million in identity theft reimbursement plus an extra $1 million in HSA or 401K reimbursements.

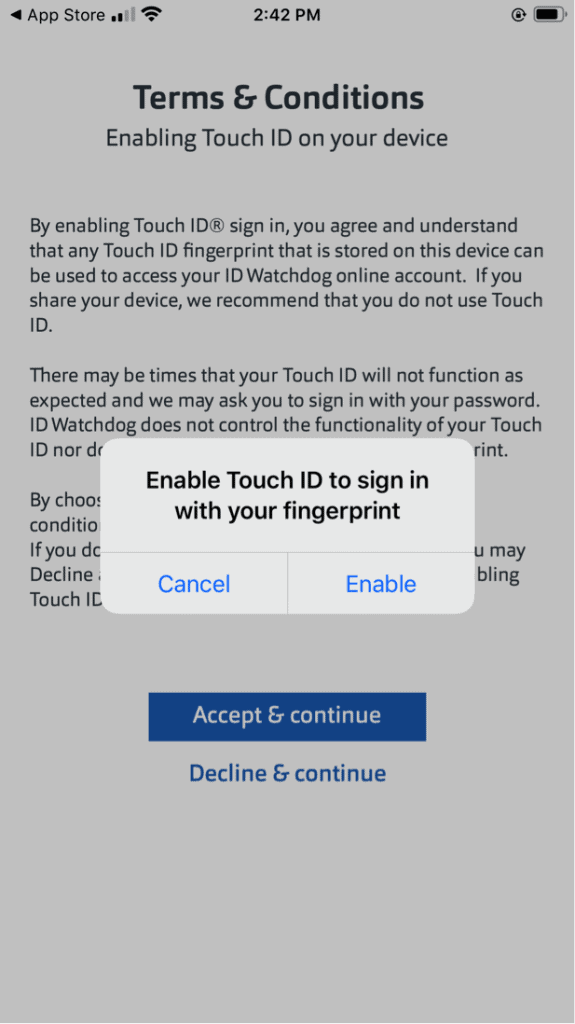

- Top-Notch Security Features: ID Watchdog made it super easy to freeze credit or to prevent certain types of loans from being opened in our names.

What We Don't Like

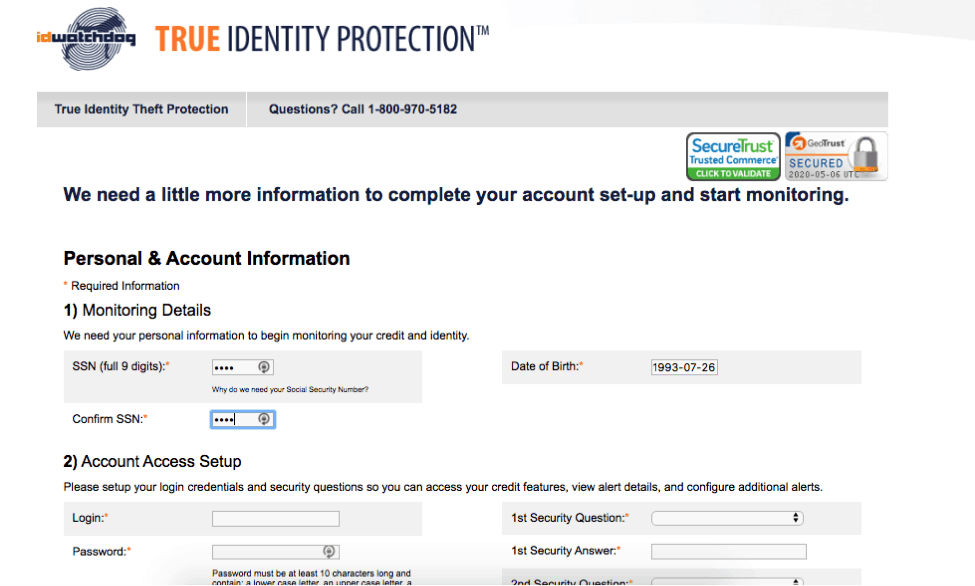

- Data Insecurity: Equifax, the credit bureau which owns ID Watchdog, has experienced its share of data breaches, leaving us unsure whether we could trust the company with our information or not.

- Upgrades Required: To get full monitoring, such as monitoring financial accounts, we had to pay for the Premium plan.

Bottom Line

-

ID Watchdog. (2020). Contact Us. idwatchdog.com/contact-us

-

CNBC. (2019). Equifax to pay $700 million for massive data breach.

cnbc.com/2019/07/22/what-you-need-to-know-equifax-data-breach-700-million-settlement.html -

Experian. (2019). The Difference Between VantageScore Scores and FICO Scores.

experian.com/blogs/ask-experian/the-difference-between-vantage-scores-and-fico-scores/ -

The U.S. Sun. (2020). Hidden Web.

the-sun.com/lifestyle/tech/271948/what-is-the-dark-web-drugs-and-guns-to-the-chloe-ayling-kidnapping-a-look-inside-the-encrypted-network/ -

Federal Trade Commission. (2003). Identity Theft Survey Report.

ftc.gov/sites/default/files/documents/reports/federal-trade-commission-identity-theft-program/synovatereport.pdf -

Federal Trade Commission. (2020). Equifax Data Breach Settlement.

ftc.gov/enforcement/cases-proceedings/refunds/equifax-data-breach-settlement -

Equifax. (2020). What Does ID Watchdog Do With Your Personal Information?

assets.equifax.com/idw/pdfs/idwatchdog_consumer_privacy_notice.pdf -

Cloudflare. (2020). What Is Transport Layer Security (TLS)?

cloudflare.com/learning/ssl/transport-layer-security-tls/