PrivacyGuard Review

Our experts tested out PrivacyGuard and here's how well it worked.

Aliza Vigderman, Senior Editor, Industry Analyst

&

Aliza Vigderman, Senior Editor, Industry Analyst

&

Gabe Turner, Chief Editor

Last Updated on May 28, 2024

Gabe Turner, Chief Editor

Last Updated on May 28, 2024

What We Like

- Comprehensive credit and identity monitoring: PrivacyGuard hits all the major marks when it comes to protecting your identity and monitoring your credit.

- Affordable pricing: Starting at only $9.99 a month, PrivacyGuard has very reasonable pricing.

- Monthly contracts: Unlike many of its competitors, you won’t have to sign up for a year with PrivacyGuard.

What We Don't Like

- Poor customer support: You may not receive a response in a timely manner, or a response at all, for your support requests, based on my personal experience.

- Identity theft insurance not available with all plans: Of the three plans from PrivacyGuard, only Identity Protection and Total Protection include identity theft insurance. The Credit Protection plan, despite costing $19.99 a month, doesn’t offer insurance coverage.

Bottom Line

If you’re looking for a budget-friendly solution for protecting your identity, Privacy Guard might be the right provider. Starting at just $9.99 per month, their prices are cheap but their protections are comprehensive.It’s a tough pill to swallow, but the odds of falling victim to some sort of fraud are pretty good these days. The more we live our lives in digital spaces, the more opportunities criminals have to take advantage — collecting our sensitive information, draining our bank accounts, even taking out loans in our names.

It’s a terrible thing to consider, but if you want to protect yourself you need to be proactive. That’s why services like IdentityGuard exist. These services keep an eye on things for you so you don’t have to, and alert you if suspicious activity is occurring or if red flags are going up. If you do end up becoming a victim, these services will also do what they can to help make you whole again.

But does IdentityGuard follow through on this promise? We put them to the test, and here’s what we found out:

PrivacyGuard features

| Credit card monitoring | Yes |

|---|---|

| Bank account monitoring | Yes |

| Identification/ application verification | Yes |

| Registered offender locator | Yes |

| Email, phone, name, and birthday monitoring | Yes |

Overall Rating

- Monthly charges range from $9.99 to $24.99

- Monitoring for credit scores and reports, financial accounts, dark web and more

- Identity theft insurance with maximum reimbursement of $1 million

Other Options for Guarding Identities

We liked PricayGuard's comprehensive services and high-tech approaches to identity theft protection, but it's unfortunate that insurance isn't included with all of their plans. That said, identity theft protection isn't a one-size-fits-all exercise. Check out these three other favorites below to see if they might be a better fit:

Keep in mind that these services do more than just keep an eye on your credit. Identity monitoring services like PrivacyGuard are also helpful for monitoring other areas like public records, neighborhood reports, and other areas where your personally identifiable information might be found if stolen.

Let’s start by taking a look at some of PrivacyGuard’s key features.

PrivacyGuard Features

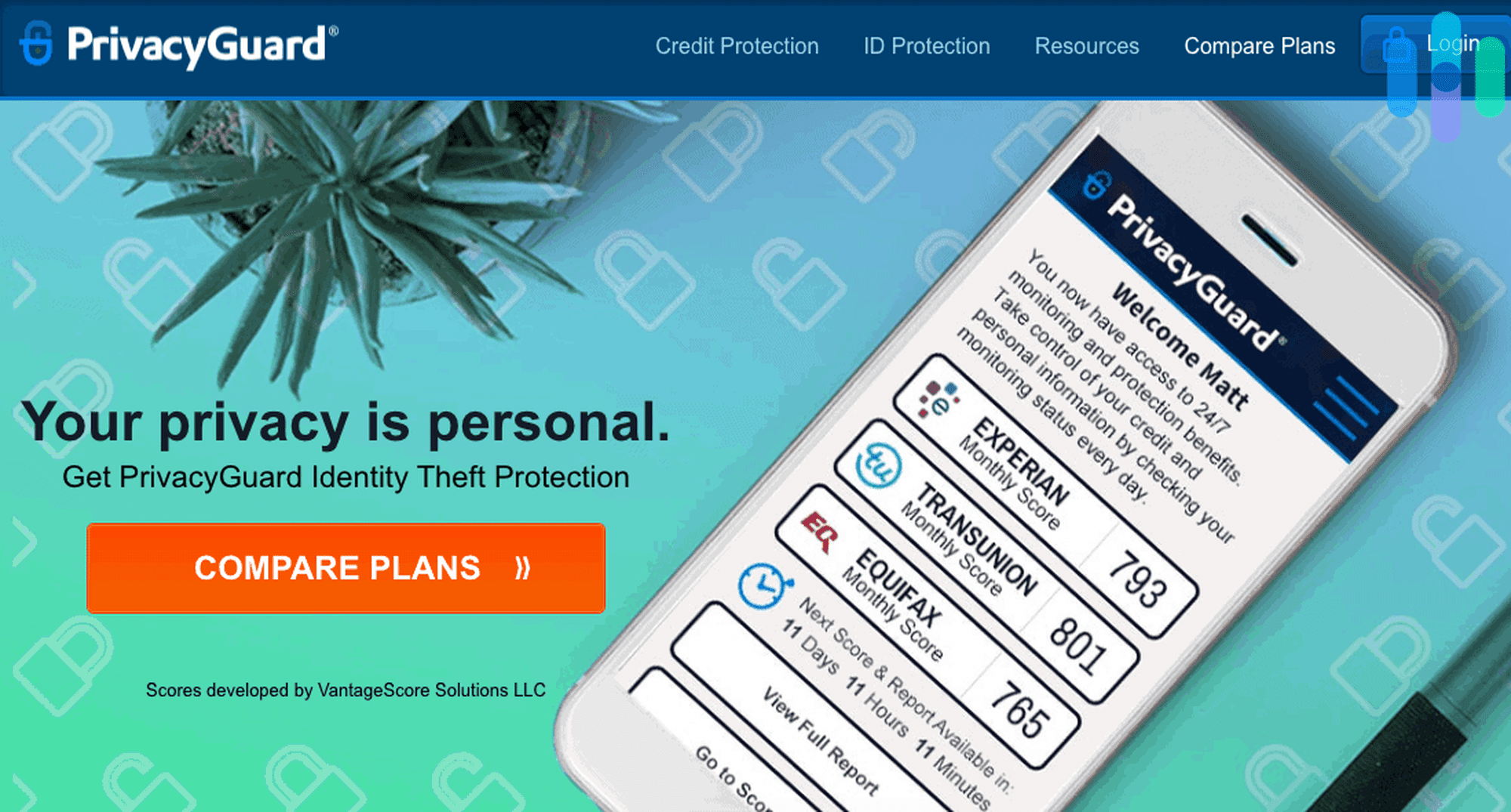

The main function of PrivacyGuard is to monitor your credit scores and reports from the three credit-reporting agencies, namely Experian, TransUnion, and Equifax.

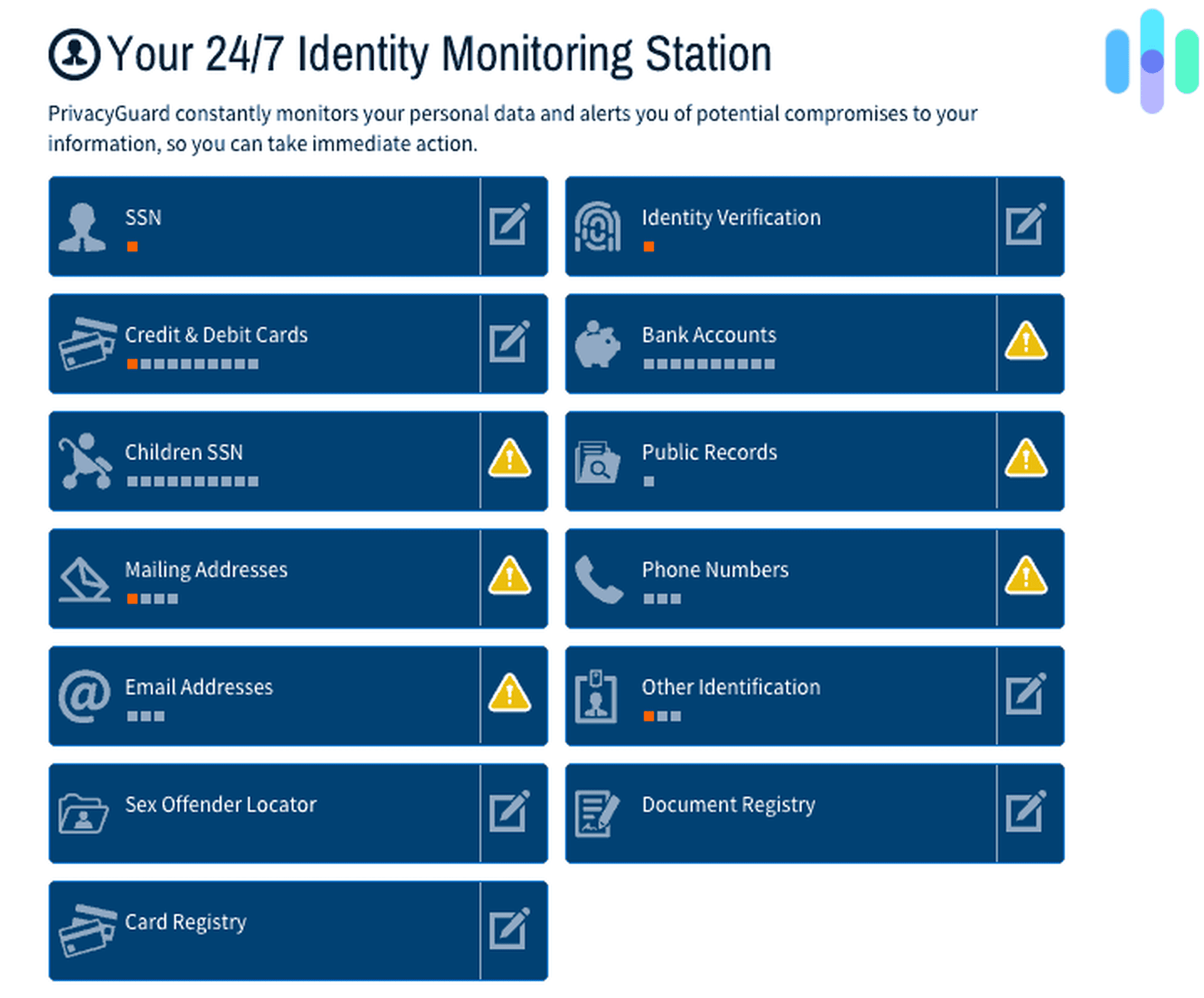

You’ll receive a monthly update, which is about as often as possible. Now, that’s just the basic credit protection, but PrivacyGuard also monitors for identity theft in these areas:

- Dark web

- Social Security numbers of adults and children

- Driver’s licenses and passports

- Bank account

- Debit and credit cards

- USPS address changes

- Email, phone, name and birthday

- Identification/application verification

- Public records

We’ll get into which features each subscription tier offers in just a bit, but overall their offerings are wide-sweeping. You’ll also get notified of anything that requires your attention via email or SMS notification, and if your identity is stolen, you’ll be eligible for up to $1 million — keep in mind, though, that’s only for the Total Protection tier, which is their most expensive. The two more affordable tiers don’t offer this protection, which might be a dealbreaker for some people.

Moving on, though. If you want the most protection, PrivacyGuard offers even more features like:

- Reduced pre-approved credit card offers

- Neighborhood reports

- Registered offender locator

- Emergency travel assistance

- Medical records reimbursement

- Lost and stolen wallet protection

- Annual public records report.

While these features may not have to do with identity or credit monitoring specifically, they put you in a good position when it comes to fielding credit card offers, keeping on top of neighborhood crime, and adding some insurance for traveling or lost wallets.

PrivacyGuard Privacy and Security

If you’re trusting PrivacyGuard to monitor your identity, then they’re going to need to know a lot of your personal information, from your Social Security Number to your bank account information, so it’s important that this information stays private. Now, one good thing that I’ll say right off the bat is that you can access PrivacyGuard’s app through multi-factor authentication, meaning fingerprint or face recognition. That prevents unauthorized users from accessing your account, which is a clear win, but is it enough to protect your data?

Something to keep in mind is that PrivacyGuard is based in the United States, which is a member of multiple international surveillance and data-sharing alliances. That means that under certain circumstances, the U.S. government or other partner countries could compel PrivacyGuard to give up your data. While that might not sound like a big deal to some people, privacy hawks might be concerned considering that this service collects and stores your:

- Social Security Number

- Name

- Address

- Phone Number

- Birthdate

- Payment information

- Service usage history, which could include your IP address, browser type, operating system, etc.

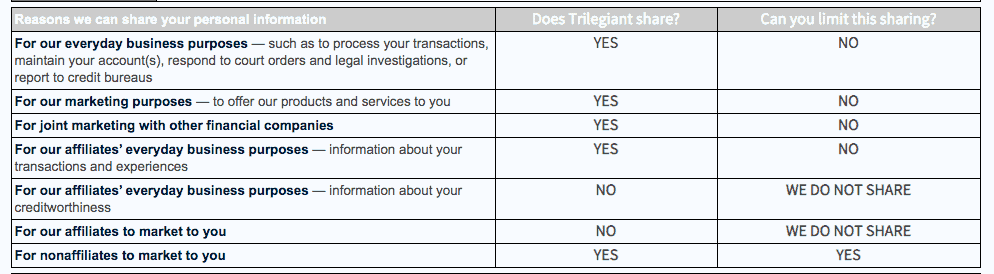

Trilegiant Corporation, which owns PrivacyGuard, maintains that while this information can be shared for joint marketing with other financial companies, only information about your “transactions and experiences” will be shared with affiliates for their “everyday business purposes,” not “information about your creditworthiness.” Unfortunately, this practice of collecting and selling data to third parties is incredibly common in our current digital landscape, so PrivacyGuard isn’t doing anything that every other identity monitoring service isn’t also doing.

While PrivacyGuard doesn’t offer any information about the methods they use to encrypt your data, this is also unfortunately pretty common when it comes to identity monitoring services. However, the company hasn’t had any security breaches in the past and has never gotten into trouble with the Federal Trade Commission for improperly storing customer data, which we can see as a plus.

To explore other options, read our review of Identity Guard and our review of IdentityForce, two popular services that have had similarly clean records.

Using PrivacyGuard

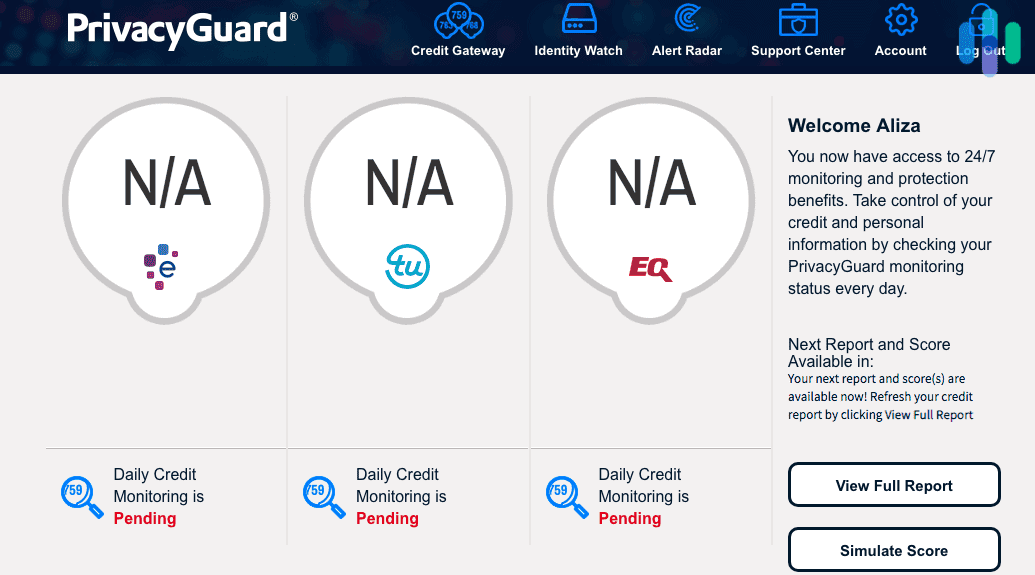

To begin using PrivacyGuard, first I had to select a plan. Then, I entered a username and password, along with some information like my name, address, birthday, Social Security number, and billing information. From there, I had to answer a few multiple-choice questions to verify my identity, and then, I had to call a phone line to answer even more multiple-choice questions. But even though I authenticated my identity over the phone, when I tried to log into PrivacyGuard, I received an authentication error.

I called back and it turns out I had to wait 15 minutes before logging in, which the woman on the phone hadn’t told me before. Oh, well. After about 15 minutes, I logged on successfully and was able to see my credit score along with any monitoring alerts. Overall, the setup process took about 20 minutes, which is a little longer than other services but for good reason, authenticating my identity.

It was super easy to navigate my alerts, although I must say that PrivacyGuard’s website is a bit passé in terms of aesthetics. But this isn’t a fashion show, and aside from the minor speed bump in the setup, I think PrivacyGuard is super user-friendly for the average consumer.

PrivacyGuard Subscriptions

| Credit Protection | Identity Protection | Total Protection | |

|---|---|---|---|

| Monitoring of 3 Credit Bureaus | Yes | No | Yes |

| Credit Score Alert | Yes | No | Yes |

| 24/7 Triple-Bureau Daily Credit Monitoring | Yes | No | Yes |

| Monthly Credit Status Updates via Text or Email | Yes | No | Yes |

| Credit Score Simulator | Yes | No | Yes |

| Financial Calculator Suite | Yes | No | Yes |

| Secure Browser and Keyboard | Yes | No | Yes |

| Public & Dark Web Monitoring | No | Yes | Yes |

| Social Security Number Monitoring | No | Yes | Yes |

| Driver’s License and Passport Monitoring | No | Yes | Yes |

| Bank Account Monitoring | No | Yes | Yes |

| Debit & Credit Card Monitoring | No | Yes | Yes |

| USPS Address Change Verification | No | Yes | Yes |

| Email, Phone, Name, DOB Monitoring | No | Yes | Yes |

| ID/ Application Verification Monitoring | No | Yes | Yes |

| Public Records Monitoring | No | Yes | Yes |

| Children’s Social Security Number Monitoring | No | No | Yes |

| Email and Text Alerts | Yes | Yes | Yes |

| Dedicated ID Fraud Resolution Agent | Yes | Yes | Yes |

| Online Fraud Assistance | No | Yes | Yes |

| $1 Million ID Theft Insurance | No | Yes | Yes |

| Lost & Stolen Wallet Protection | No | Yes | Yes |

| Annual Public Records Report | No | Yes | Yes |

| Reduced Pre-Approved Credit Card Offers | No | No | Yes |

| Neighborhood Reports | No | No | Yes |

| Registered Offender Locator | No | No | Yes |

| Emergency Travel Assistance | No | No | Yes |

| Medical Records Reimbursement | No | No | Yes |

| Monthly Price | $19.99 | $9.99 | $24.99 |

You can pay $19.99 a month for Credit Protection by itself, $9.99 a month for Identity Protection, or $24.99 a month for Total Protection. Total Protection combines the features of Identity Protection and Credit Protection, with some additional features, like Social Security number monitoring for children. If you have kids below the age of 18, PrivacyGuard will monitor the usage of their Social Security numbers. You can add up to 10 children per subscription. I recommend doing Total Protection, especially because PrivacyGuard doesn’t make you sign up for a long-term contract. And at $24.99 a month, the price is definitely fair, especially since I’ve seen other services charge all the way up to $40 a month.

Now, when I subscribed to PrivacyGuard, it automatically gave me a 14-day trial for $1. For the first two weeks, the company charged my card $1, nothing more, nothing less. If, for any reason, I decided to cancel my subscriptions within that 14-day period, I would have lost a dollar only. PrivacyGuard only charged my card the full amount of my subscription, which was $24.99, on the 15th day and then monthly thereafter.

PrivacyGuard Customer Support

Need help with any aspect of PrivacyGuard? You can check out their online FAQs, call their phone line, or email them. When I had a question regarding encryption, I emailed support, and I was told I’d receive a response within five business days. Seven days later, I got a response asking me why I was asking, so that was unhelpful. However, that may say more about their transparency than their customer support.

Good customer support in this industry isn’t always a given. For a service with stronger customer support, check out our review of IDShield.

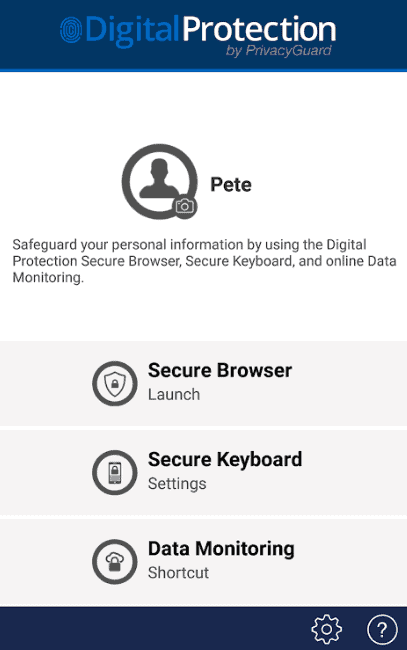

The Digital Protection App

If you have an iPhone, you’ll use the PrivacyGuard Identity Security app, while the app is called PrivacyGuard – Protection against Identity Theft on the Google Play store. The app is where you’ll monitor your identity and credit on the go. It provides a secure mobile browser that protects against phishing, plus a secure keyboard that protects against malware and makes sure that nothing is accidentally sent to the cloud.

Overall, the app makes for a great companion software for PrivacyGuard’s services. The app is well-received by iOS and Android users alike, having a 4.3 stars rating on the App Store and a solid four-star rating on Google Play.

The navigation alone made PrivacyGuard’s app much easier to use than Lifelock’s app, which was buggy and limited when we reviewed Lifelock. But it’s still a notch up from some other services, like IdentityIQ’s monitoring plans, that don’t offer a mobile app at all.

Our PrivacyGuard Research and Data

The following is the data and research conducted for this review by our industry-experts. Learn More.

Encryption

| In Transit | Yes |

|---|---|

| At rest? | Yes |

| All network communications and capabilities? | Yes |

Security Updates

| Automatic, regular software/ firmware updates? | No |

|---|---|

| Product available to use during updates? | Yes |

Passwords

| Mandatory password? | Yes |

|---|---|

| Two-Factor authentication? | Yes |

| Multi-Factor authentication? | Yes |

Vulnerability Management

| Point of contact for reporting vulnerabilities? | service@privacyguard.com |

|---|---|

| Bug bounty program? | No |

Privacy Policy

| Link | https://www.privacyguard.com/BCA/Generic/default/pdf/PPolicyPGNEWGeneric.pdf |

|---|---|

| Specific to device? | No |

| Readable? | Yes |

| What data they log | Social security number, name, address, telephone number, birthday, service usage history |

| What data they don’t log | n/a |

| Can you delete your data? | No |

| Third-party sharing policies | Shares information with third-parties |

Surveillance

| Log camera device/ app footage | n/a |

|---|---|

| Log microphone device/ app | n/a |

| Location tracking device/ app | No |

Parental Controls

| Are there parental controls? | No |

|---|

Company History

| Any security breaches/ surveillance issues in past? | No |

|---|---|

| Did they do anything to fix it? | n/a |

Additional Security Features

| Anything like privacy shutters, privacy zones, etc.? | n/a |

|---|

Recap

Despite PrivacyGuard’s shortcomings, I would definitely recommend it as an identity monitoring service overall. However, I think it really depends on what you’re looking for, which is why I broke it down below.

PrivacyGuard is good for you if you want…

- Comprehensive credit and identity monitoring: PrivacyGuard hits all the major marks when it comes to protecting your identity and monitoring your credit.

- Affordable pricing: Starting at only $9.99 a month, PrivacyGuard has very reasonable pricing.

- Monthly contracts: Unlike many of its competitors, you won’t have to sign up for a year with PrivacyGuard.

But don’t get PrivacyGuard if you are looking for…

- Stellar customer support: You may not receive a response in a timely manner, or a response at all, for your support requests, based on my personal experience.

- Identity theft insurance on all plans: Of the three plans from PrivacyGuard, only Identity Protection and Total Protection include identity theft insurance. The Credit Protection plan, despite costing $19.99 a month, doesn’t offer insurance coverage.

PrivacyGuard FAQs

-

What is PrivacyGuard?

PrivacyGuard is a credit and identity monitoring service.

-

How much does PrivacyGuard cost?

PrivacyGuard costs between $9.99 and $24.99 a month.

-

Are PrivacyGuard credit scores accurate?

PrivacyGuard credit scores are accurate, sourced through the three credit-reporting agencies Experian, TransUnion and Equifax.