Identity theft, fraud and cybercrime are, sadly, routine in our modern world. Nearly two-thirds of American adults say they have been personally caught up in a major data breach, and more than 4 in 10 have dealt with fraudulent charges on their credit cards.

And it’s only getting worse, according to the newest report from the Federal Trade Commission. The federal agency’s annual Consumer Sentinel Network report details the millions of reports received from consumers every year, ranging from fraud to identity theft to bank and utility schemes.

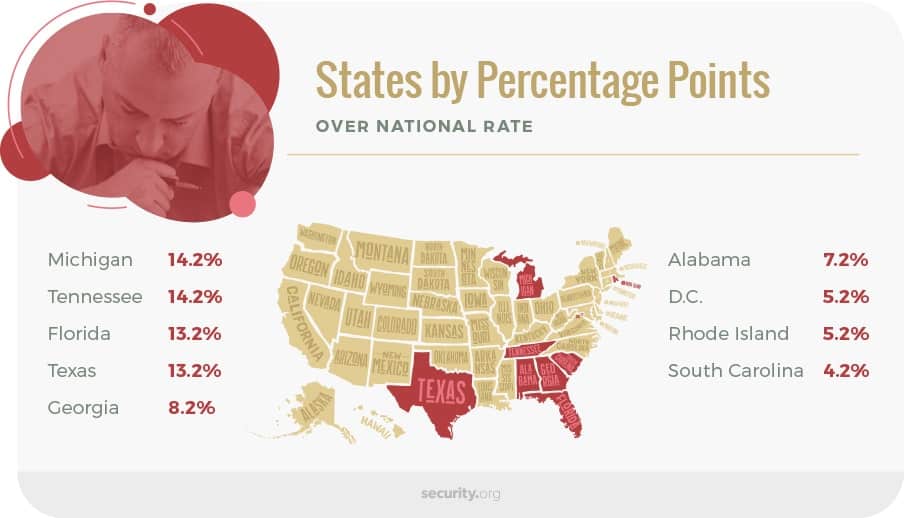

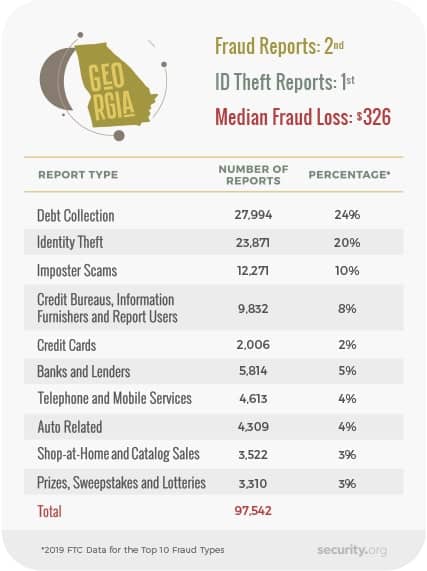

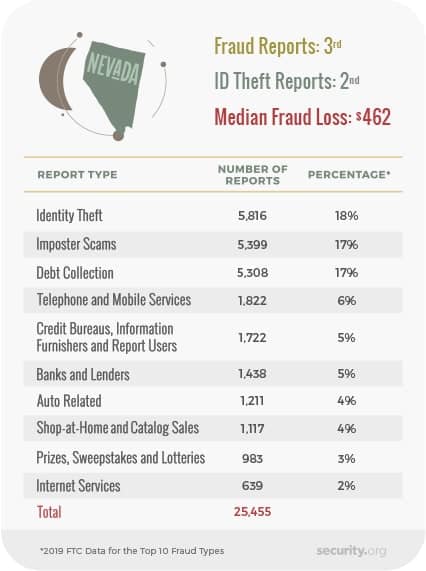

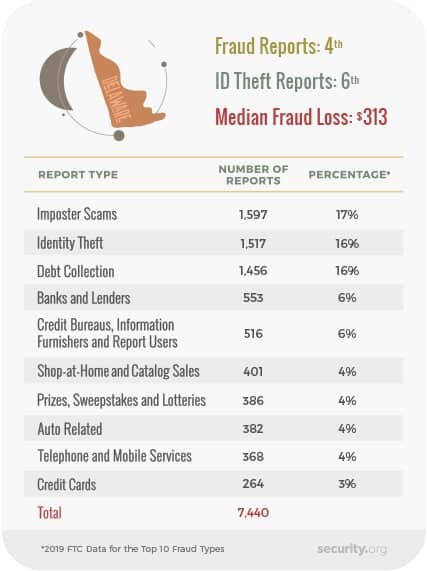

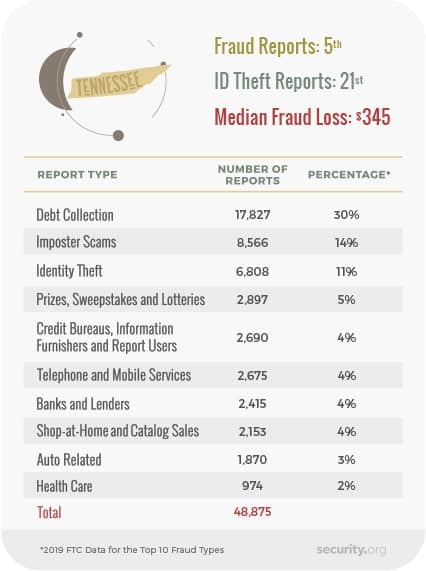

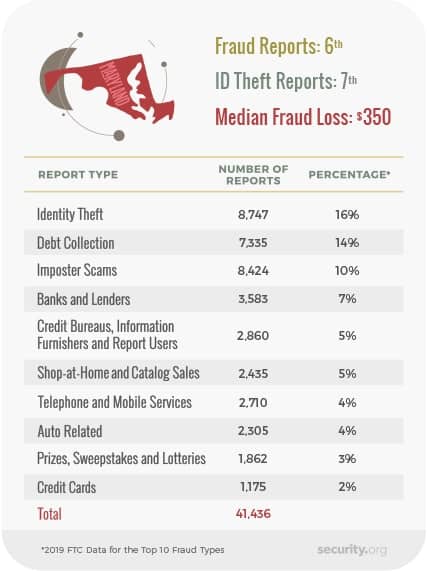

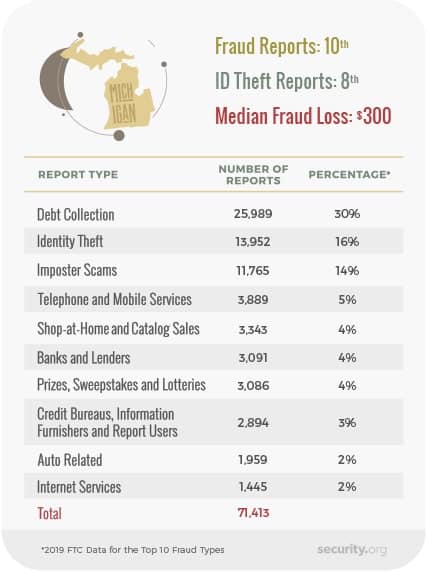

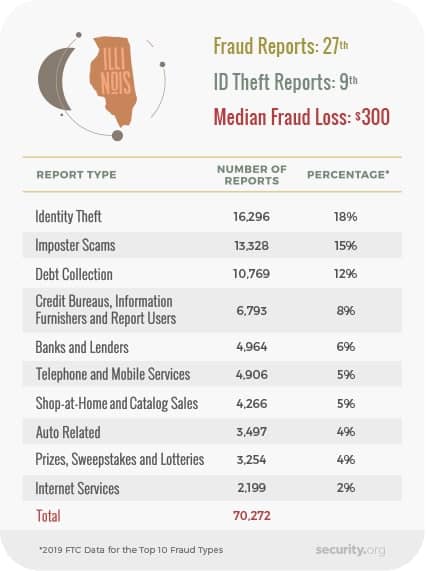

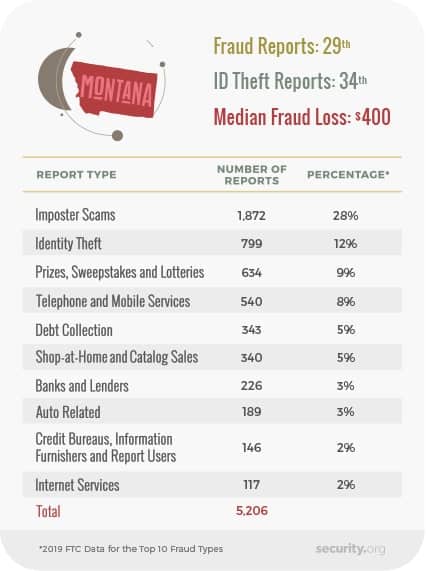

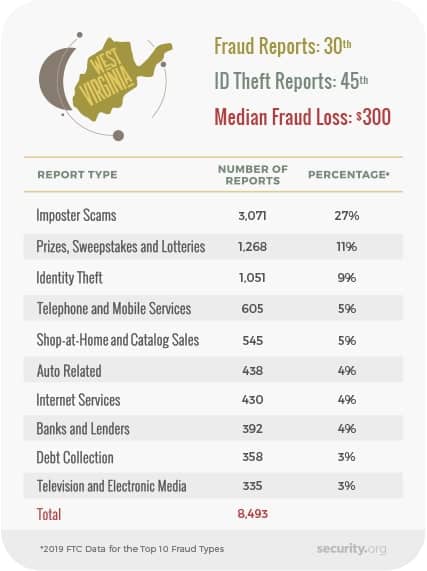

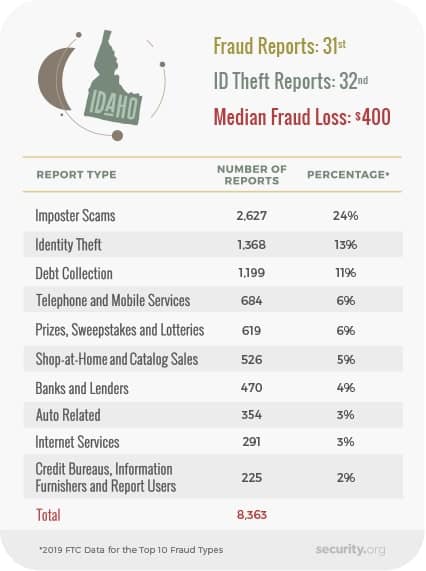

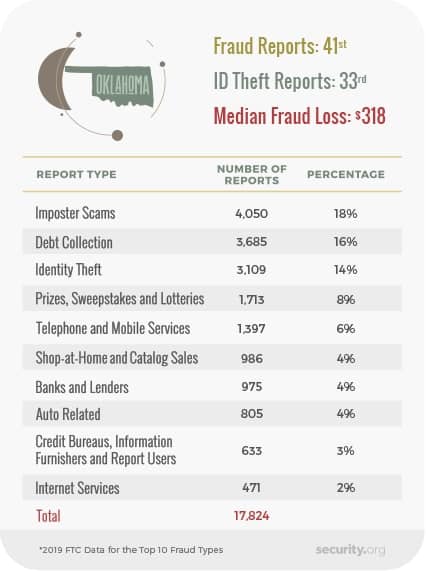

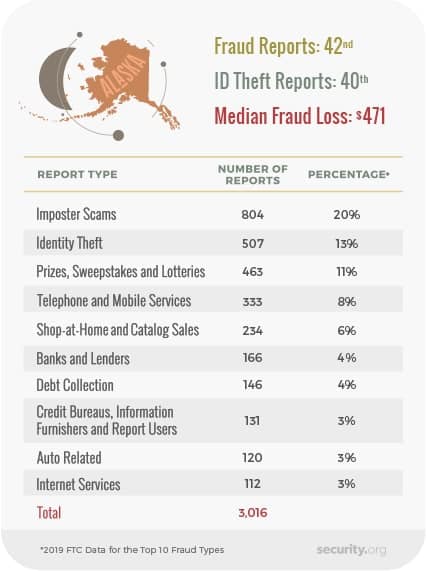

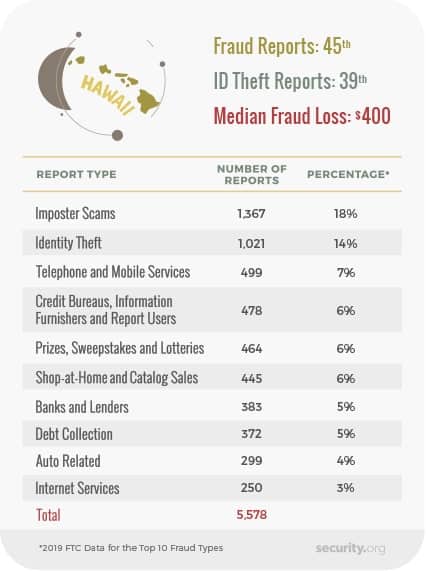

While some general conclusions can be drawn about the state of ID theft, fraud and financial scams in the United States based on this data, the truth is that the picture is very different when you zoom into the state level, as residents in some states report far more of certain types of incidence. For instance, debt collection fraud is reported at about 16 percent of all types of fraud and theft reported to the FTC nationally, but in two states — Michigan and Tennessee — debt collection scams are nearly twice as likely.

Nationally, the top three categories reported were imposter scams, debt collection fraud and identity theft. Not only were imposter scams one of the most common types of schemes, they also were costly, as nearly 1 in 5 victims reported losing money in such scams.

Let’s first take a look at the 10 most common types of scams overall.

Imposter Scams

I remember when I was in high school, someone called my grandfather pretending to be me. They told him that I got arrested and needed money to post bail. Of course, I was sitting in class slightly bored at the time. Thankfully, he thought to call my dad before sending any money to see what the situation was. But, not everyone takes that step. I now know that this was an attempted imposter scam.

Accounting for 17.9 percent of all incidents reported by the FTC, imposter scams are the most common single type of financial fraud or theft in the United States. The agency received more than 530,000 reports of imposter scams in the covered year, making it more common than some other better-known scams like debt collection and ID theft.

Debt Collection

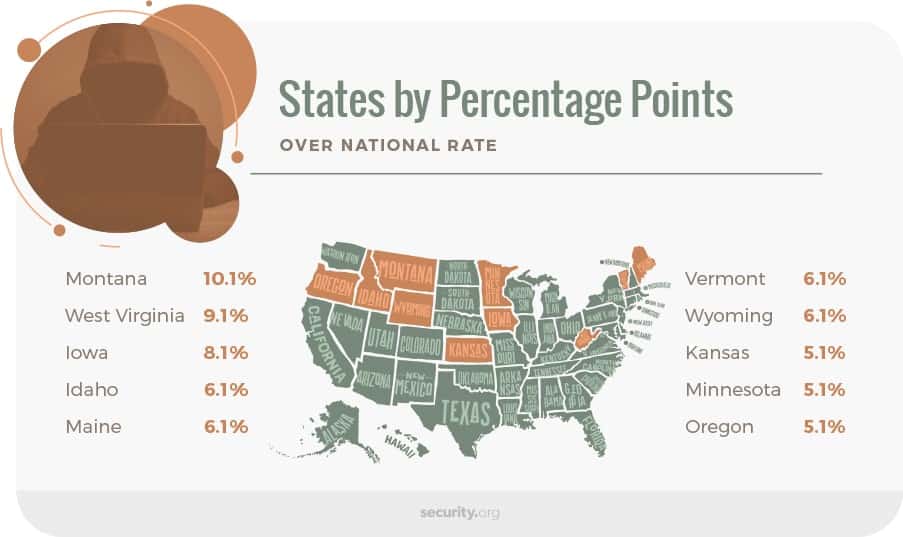

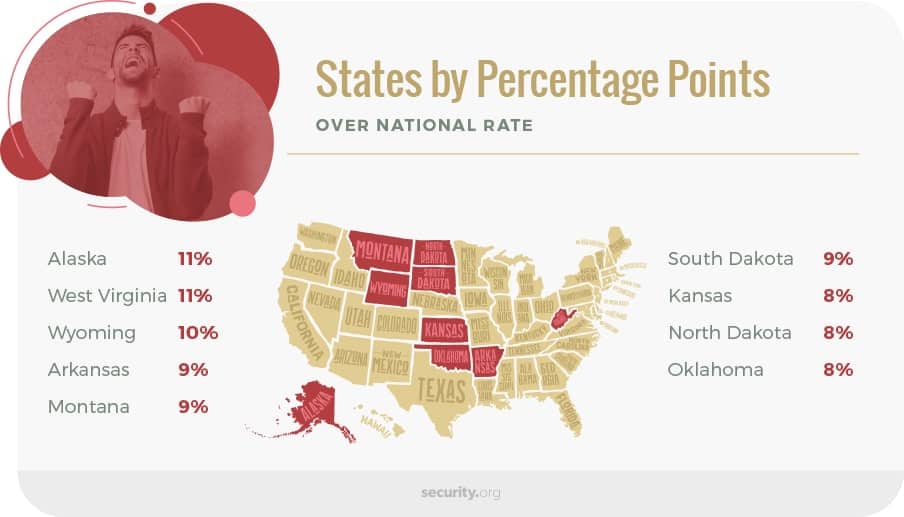

We all know that debt collectors can be relentless. Scammers use this knowledge to their advantage by trying to use the same pushy tactics except with a debt you don’t actually owe. These scammers might even have access to your actual debts and pretend to be the collection agency. Sadly, debt collection scams are easy to run making them the second most commonly reported type of scam. Debt collection cases accounted for nearly 16 percent of the national mix, with more than 475,000 cases reported to the FTC. The good news is these types of reports saw a 24 percent decline over the levels reported two years prior. Still, in several states, debt collection schemes are much more common than in other places.

Identity Theft

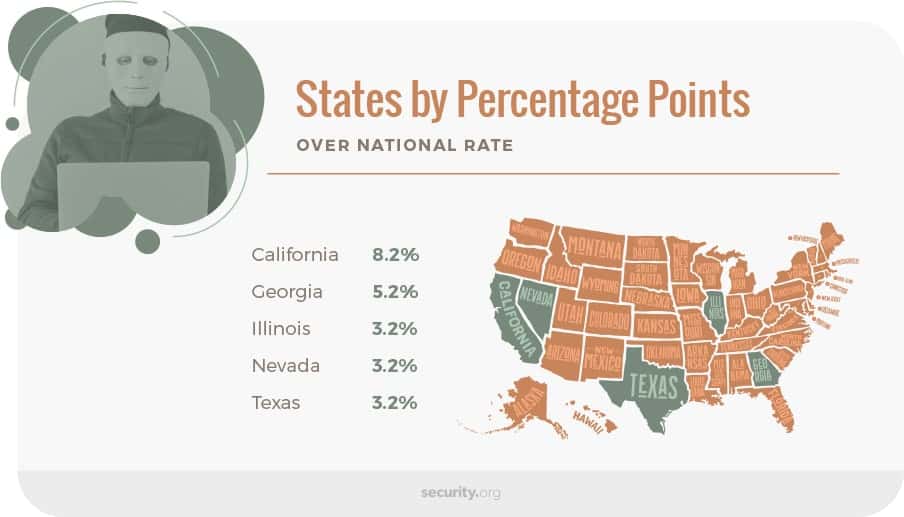

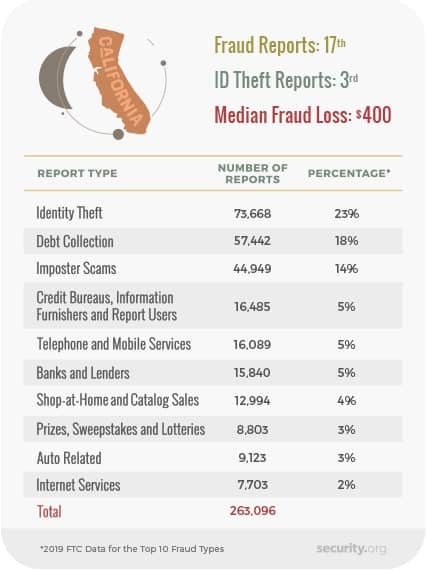

Accounting for about 15 percent of all reports, identity theft cases are the third most common report type noted by the FTC. With the agency receiving more than 440,000 reports during the covered year, ID theft is a huge and complex problem, but in a few states, residents are much more likely to be impacted by it.

Did You Know: We've tested all of the top ID theft brands out there. To find out how they performed see our best identity theft protection page and even our list of the best ID protection with fraud detection. It's important to protect yourself from identity theft!

Telephone and Mobile Services

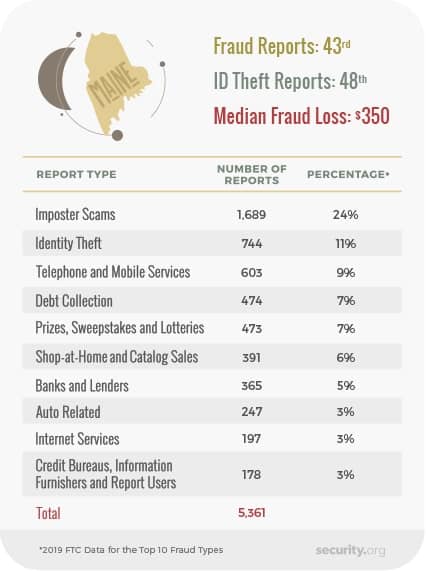

In these schemes, someone tries to infect your phone or get you to tell them private information. They then use this to extort money or commit other types of fraud. While they make up just about 5 percent of all cases nationally, telephone and mobile services scams impact more than 100,000 people every year. In no state do these types of scams make up more than 10 percent of the overall scam reports, but Maine is close, as these cases make up about 9 percent of all reports in that state.

Shop-at-Home and Catalog Sales

Accounting for less than 5 percent nationally, these schemes impacted more than 140,000 people in the report year. This type of scam includes fake catalog advertisements that trick someone into sending money to a scammer thinking they’re buying a legitimate product. No state had a case mix where these schemes accounted for more than 7 percent of all cases.

Banks and Lenders

With about 138,000 cases reported nationally, these scams make up about 4.6 percent of all cases. Basically, these scams are any type of incident where someone tricks a victim into signing up for a loan or bank account under a false pretense. In a few states, the prevalence of these types of scams approached double the national rate:

Credit Bureaus, Information

Furnishers and Report Users

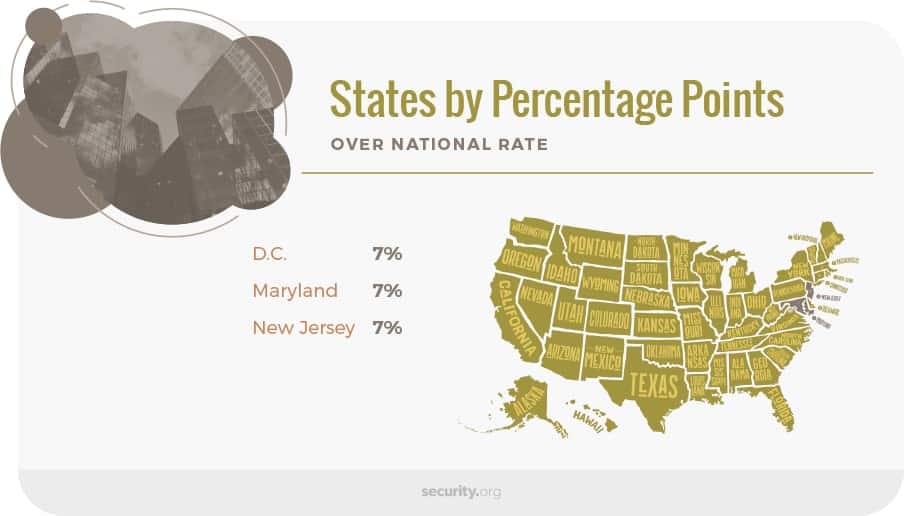

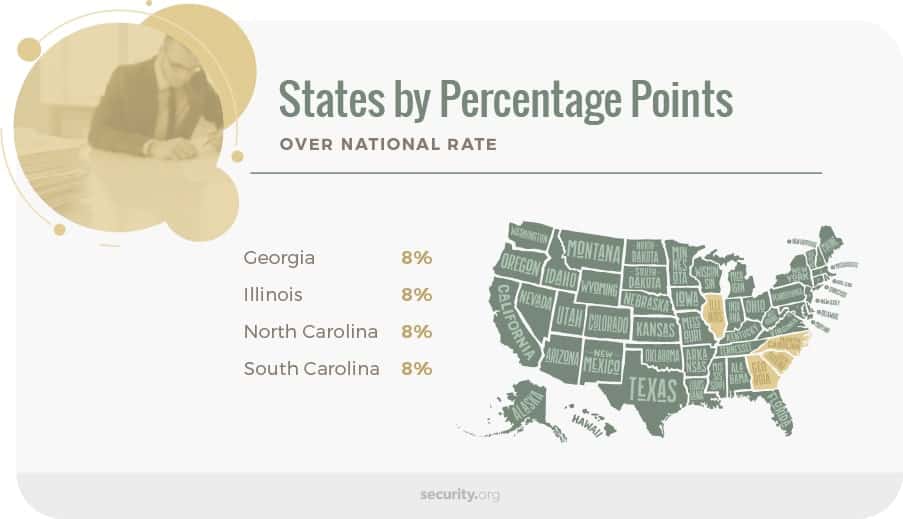

Scams related to credit reports and other personal financial data accounted for about 4.6 percent of all reports or 136,000 cases. Four states report rates at nearly double the national rate for such cases:

Prizes, Sweepstakes and Lotteries

Impacting more than 130,000 Americans in the FTC’s report year, these scams make up about 4.4 percent of all reports, but there are a handful of states with much higher rates.

Auto-Related

With just over 100,000 cases reported, auto-related scams are the ninth most common category, accounting for about 3.5 percent of all scams. No state reported auto-related scams at a percentage over 5 percent, but, interestingly, the state of Michigan, the birthplace of American automobiles, had the lowest mix of auto-related scams at just 2 percent of all cases.

Internet Services

Rounding out the top 10 scam types, internet services scams accounted for about 2 percent of all types of scams, impacting more than 60,000 people throughout the country. Internet service scams involve someone pretending to be an internet service provider and getting you to pay a bill to them instead of your actual provider. Sometimes they even hook the victim with a fake offer related to a discounted rate or better service. These types of scams are more prevalent in West Virginia, where the rate was about double the national rate.

What’s Most Common

In Your State?

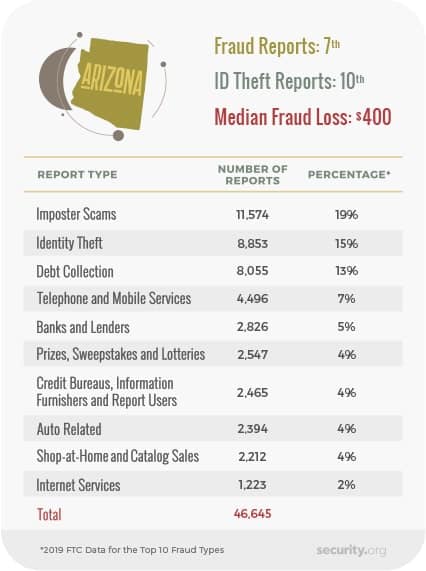

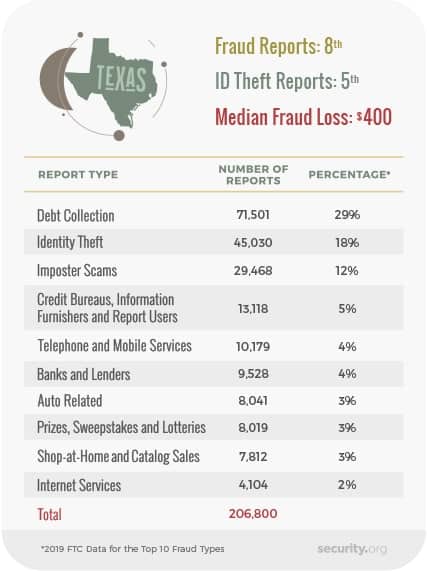

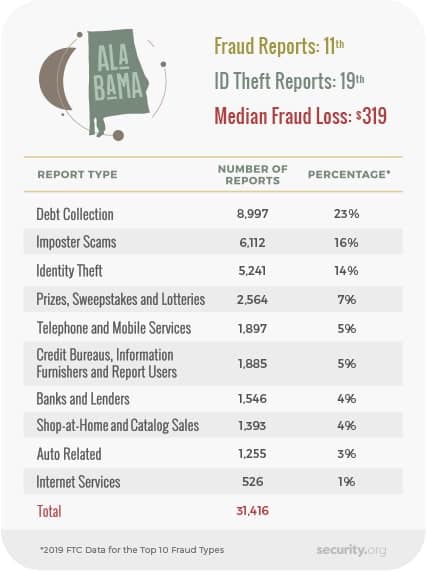

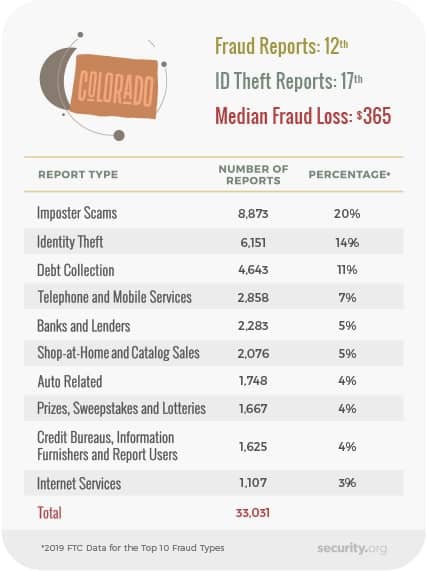

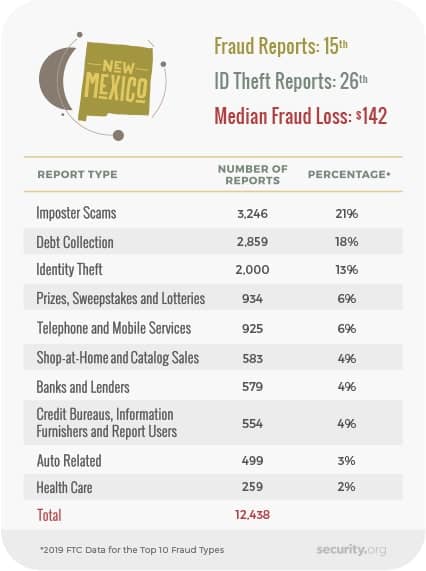

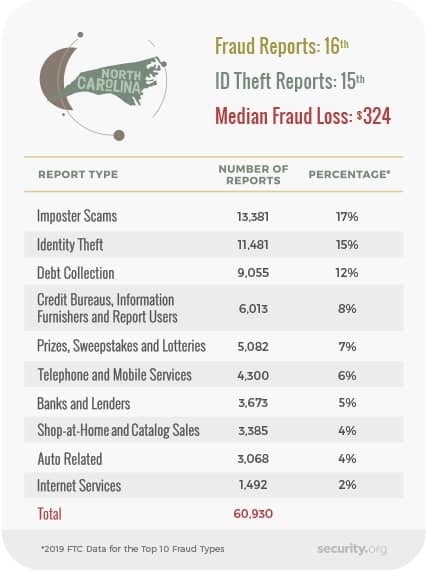

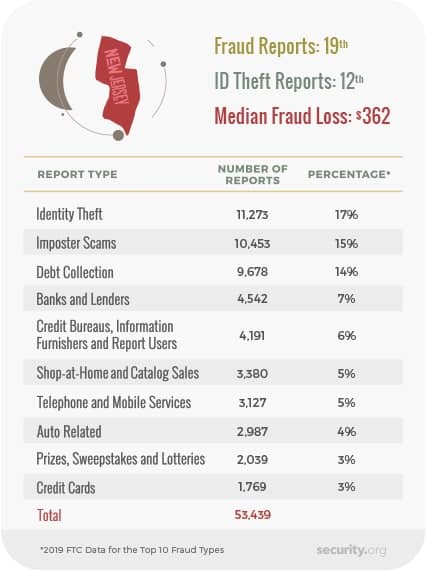

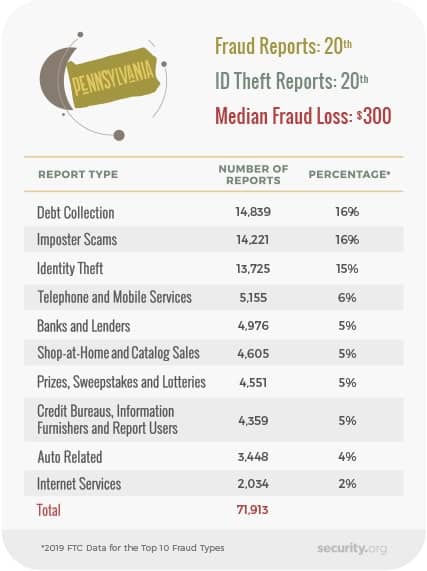

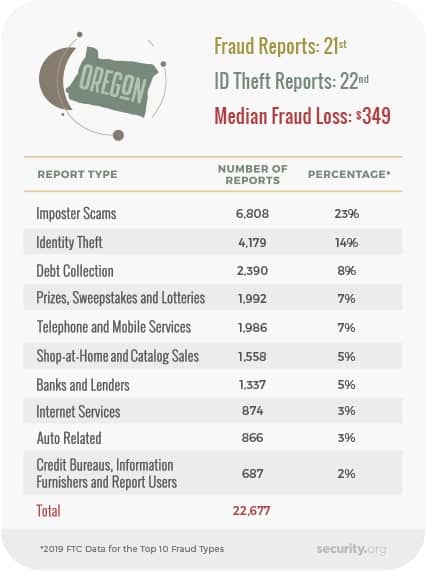

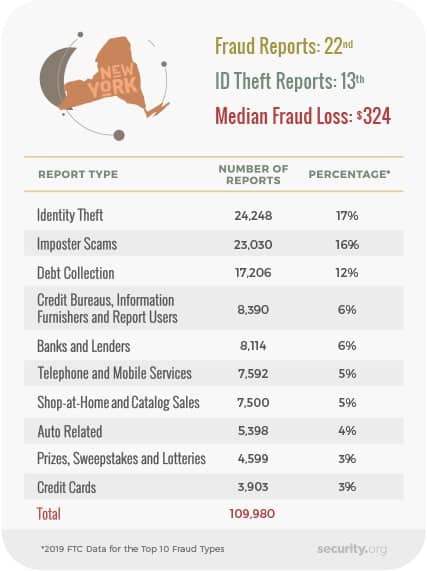

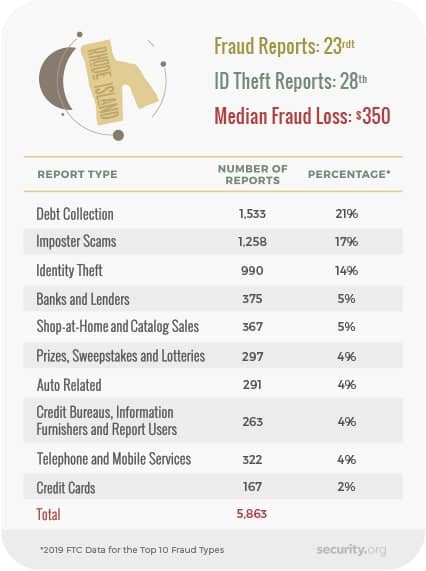

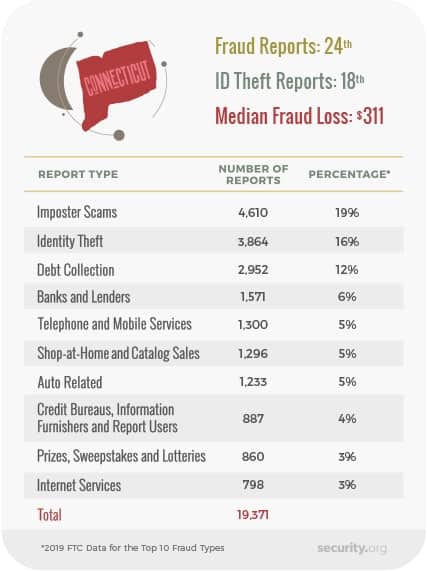

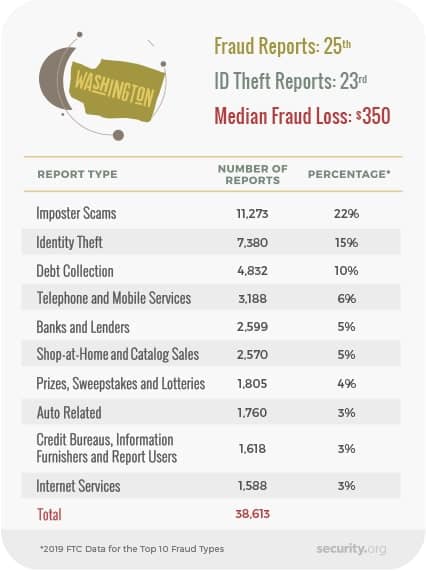

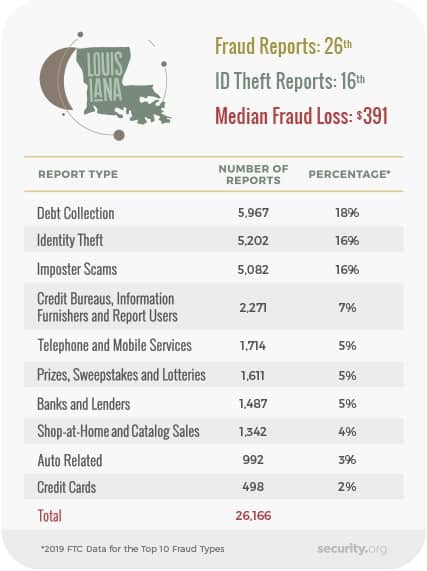

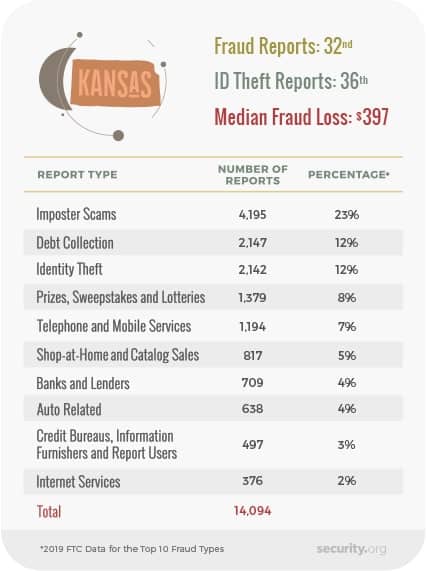

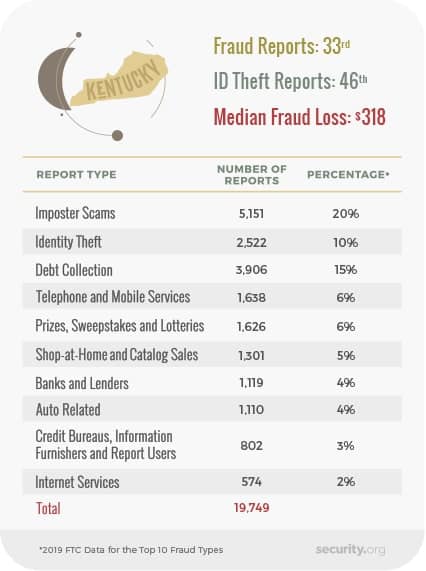

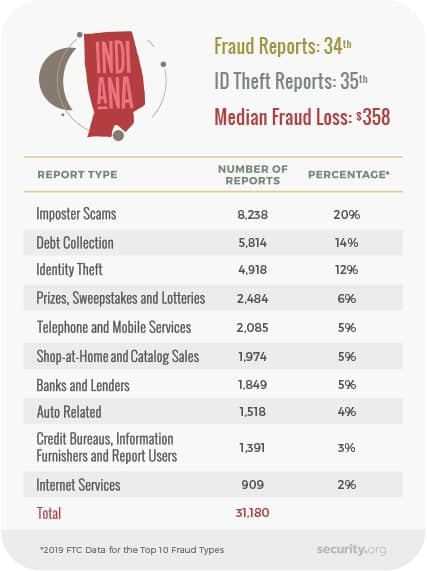

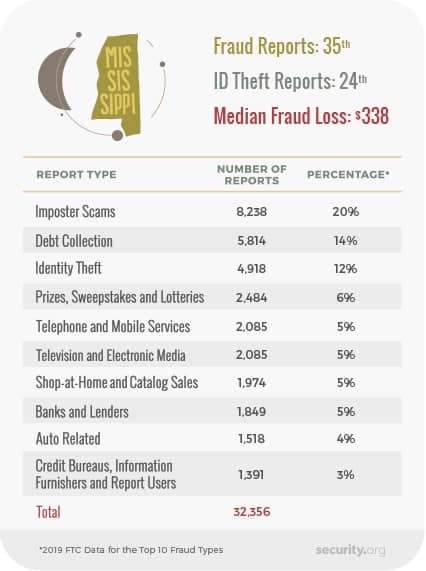

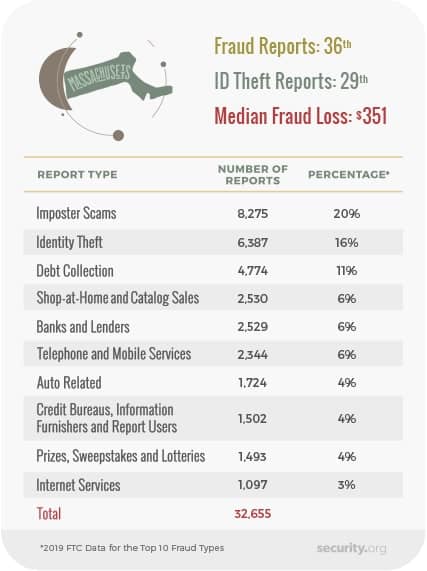

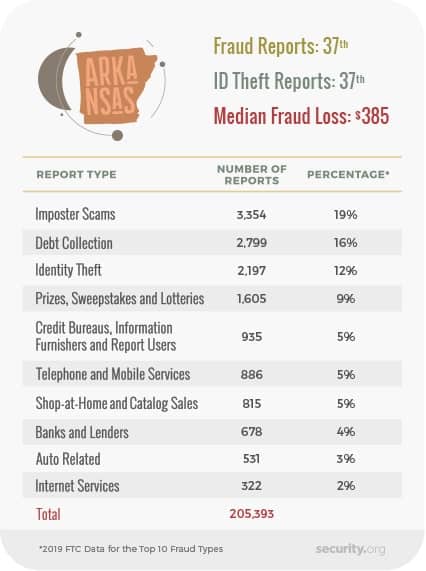

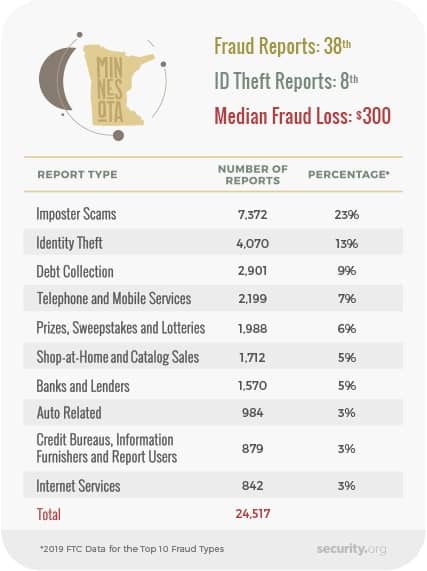

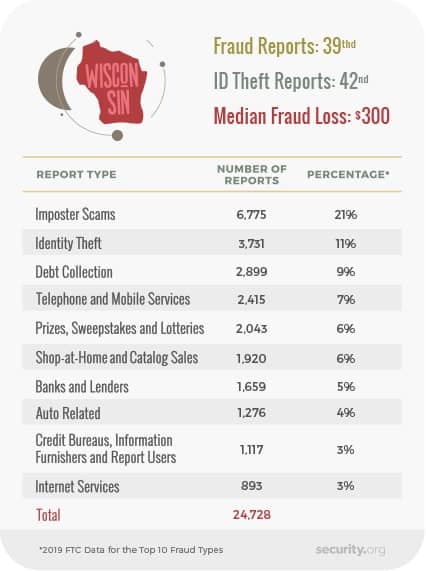

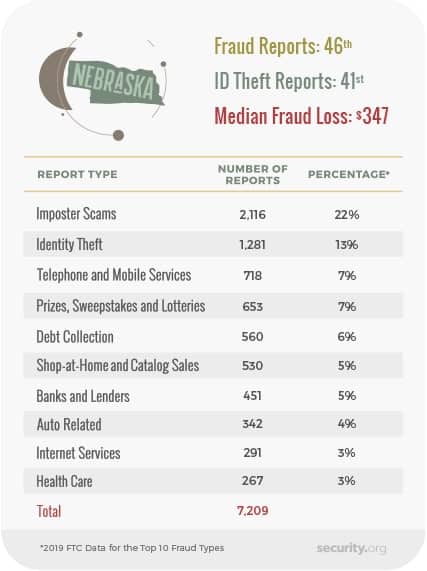

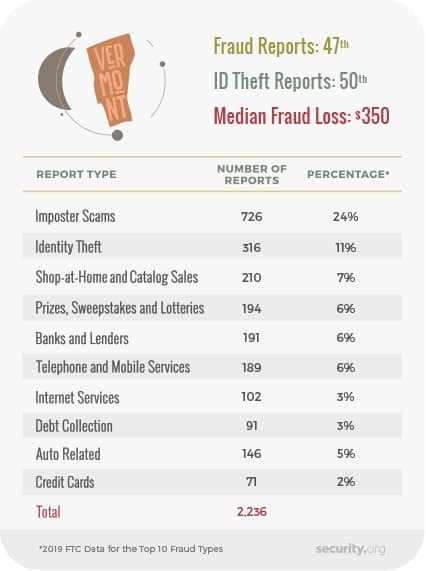

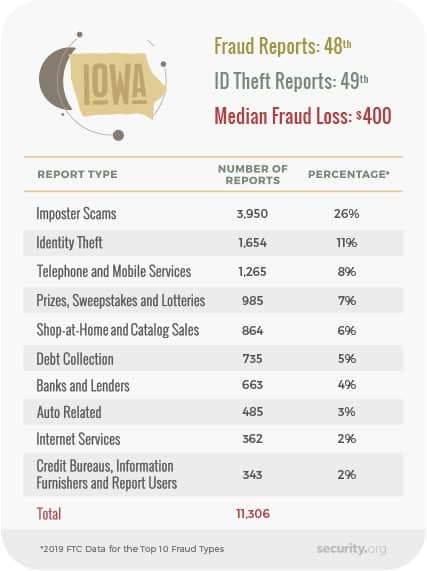

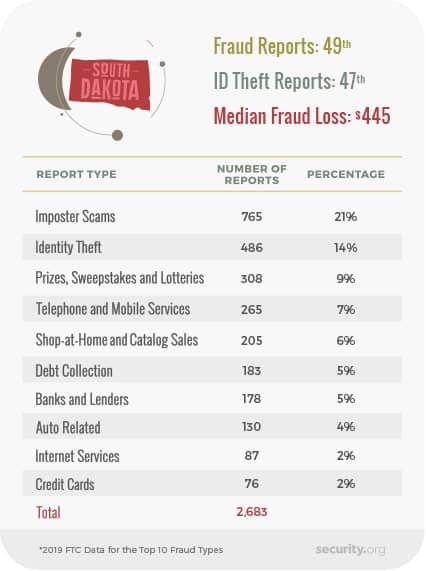

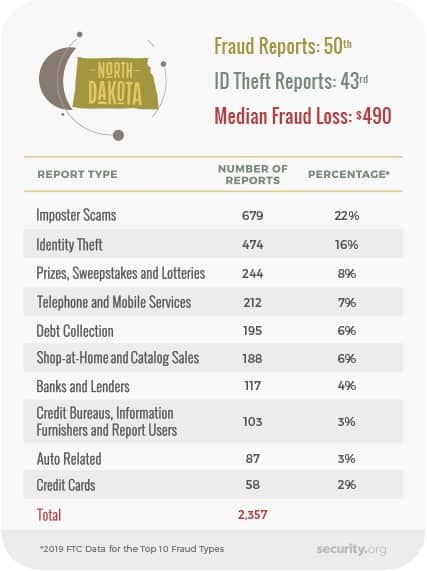

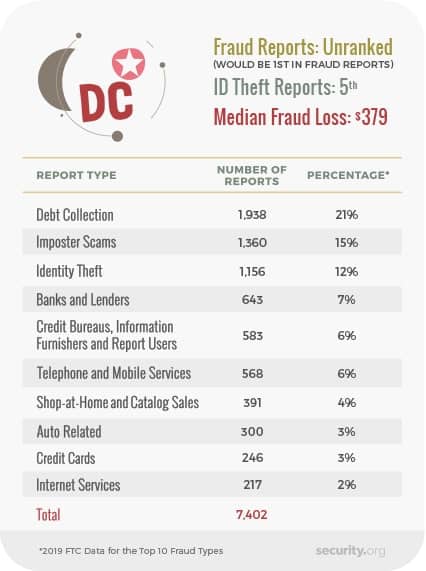

We’ve already seen a preview of the states where certain types of fraud are most common, but let’s take a look at each state’s mix of fraud types, according to the FTC’s report.

About This Report

To create our state-by-state breakdowns of the prevalence of various fraud types around the country, we explored the data files published as part of the Federal Trade Commission Consumer Sentinel Network Data Book.

We also wanted to understand how common ID theft and other types of fraud are, so we also looked at data from the Pew Research Center, which polled adult Americans on their attitudes toward cybersecurity. That survey can be found here.

Fair Use Statement

You’re free to share the material on this page for noncommercial purposes and if you believe your identity may be stolen, see our guide on what you do if your ID is stolen. When using the text or images from this page, please be sure that you properly attribute it with a link back to the URL of this page.