We’re always going on about how to protect ourselves from identity theft, but the simple truth is that no matter what you do, you can’t completely guarantee your safety. You can lower your chances of falling victim, but there’s always going to be a slight risk. That’s why, aside from knowing how to protect yourself, you should also know how to respond in case someone steals your identity.

Recovering from identity theft isn’t easy, especially when it feels like your whole life is crumbling. But, at the same time, we know it’s not impossible. We outlined below what you should do step-by-step, starting from the moment you discover that your identity has been stolen all the way to how you can rebuild your identity protection.

What To Do if Your Identity Is Stolen

Experiencing something as bad as identity theft can throw your mind into chaos. That’s why having a detailed recovery plan helps. Here’s one curated by our identity theft experts, which you can use as an outline for creating your own based on your unique circumstances.

- Take immediate action. Take these steps as soon as you learn your identity has been stolen:

- File a claim with your identity theft insurer, if you have one. Aside from claims, some identity theft insurance companies provide help in managing the outcomes of stolen identity. Those insurance companies will do most of the legwork, including filing reports and contacting concerned parties (i.e. your bank, credit card company, etc.)

- File an identity theft report with the FTC. You should file a report with the FTC immediately. It takes about five to 10 minutes if you do it online via IdentityTheft.gov. Filing a report will start a paper trail for your case. If you don’t have identity theft insurance or access to an identity recovery service, the FTC will send you a packet with prefilled letters and forms you can use as you move forward.

- Contact any relevant companies regarding the identity theft. Contact any company where you know the thief used your identity. Close any accounts the thief opened in your name, and explain the situation to the company so it can remove any bogus charges from your account.

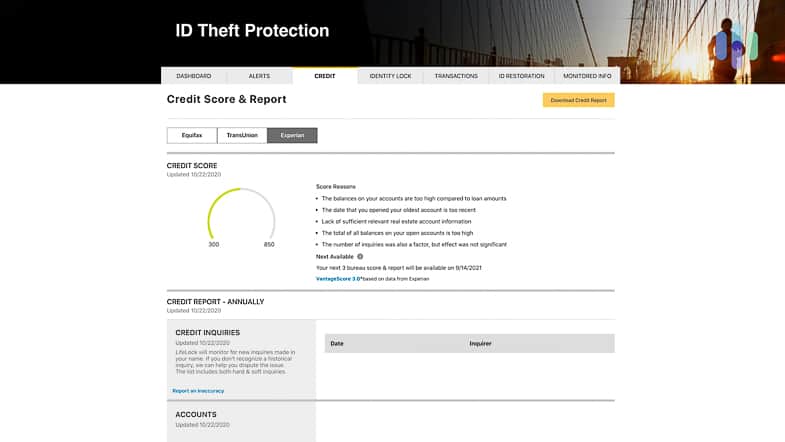

- Contact all three of the major credit bureaus. Contact Equifax, Experian, and TransUnion, the three major credit bureaus, 1and request copies of your credit reports. With these reports, you’ll be able to spot any suspicious activity quickly. In addition, set up fraud alerts for your reports. A fraud alert lasts for one year and encourages lenders and creditors to verify your identity before offering you credit. You can also put out an extended fraud alert for seven years. If you’ve subscribed to one of the best credit protection services, they will take care of this task for you. You can also get a free credit report from all three bureaus, but to automate the task of getting your reports from the credit reporting agencies, look for identity theft protection with credit monitoring.

Lifelock – Credit Monitoring Credit bureau Mailing address Phone number URL Experian P.O. Box 9554 Allen, TX 75013 1-888-397-3742 experian.com/fraud/center.html Equifax Equifax Information Services LLC P.O. Box 105069 Atlanta, GA 30348-5069 1-800-525-6285 equifax.com/personal/credit-report-services/credit-fraud-alerts/ TransUnion TransUnion Fraud Victim Assistance Department P.O. Box 2000 Chester, PA 19016 1-800-680-7289 transunion.com/fraud-alerts - Contact additional agencies. You’ve already reached out to the FTC, all three credit bureaus, and any affected companies. You may also want to consider contacting a few other agencies and organizations as well, such as these:

- IRS: Many identity thieves specialize in IRS refunds. Some file fake claims for refunds. Others try to get your check rerouted to their addresses. The IRS is also the place to discuss the theft of unemployment benefits.

- You can reach the IRS Monday through Friday, 7 a.m. to 7 p.m. at 1-800-829-1040. You can also go directly to the Identity Theft Affidavit, Form 14039 at https://www.irs.gov/pub/irs-pdf/f14039.pdf. Fill out the form and mail it to the IRS at:

- Department of the Treasury

Internal Revenue Service

Fresno, CA 93888-0025

You can also fax the IRS at 1-855-807-5720.

- Department of the Treasury

- You can reach the IRS Monday through Friday, 7 a.m. to 7 p.m. at 1-800-829-1040. You can also go directly to the Identity Theft Affidavit, Form 14039 at https://www.irs.gov/pub/irs-pdf/f14039.pdf. Fill out the form and mail it to the IRS at:

- Social Security Administration: If you suspect someone is using your Social Security number, you should also contact the Social Security Administration.2 You can’t file a report online, but you can file a report by calling the SSA at 1-800-772-1213. In extreme cases, the SSA can provide you with a new Social Security number. That would mean starting your credit history from scratch, but if the theft of your identity has wrecked things completely, that may be your best option.

- Health care providers: Letting your insurance company and health care providers know about the identity theft can prevent thieves from getting medical care and prescriptions in your name.

- DMV: Thieves can use your driver’s license number during a traffic stop or even to create fake IDs. If you alert the DMV to the situation, it can flag your number to alert law enforcement. The DMV can also replace lost or stolen IDs.

- Telephone and utility companies: Some thieves use your identity to get water, electric, gas, or telephone service. If you discover this has happened, you should contact each provider individually, explain the situation, and have the fraudulent accounts closed. Contact the National Consumer Telecom & Utilities Exchange (NCTUE) to get a complete data report, and if your telephone company refuses to respond to your requests, you can also contact the Federal Communications Commission (FCC) to file a complaint.

Agency Phone number URL IRS 1-800-829-1040 http://irs.gov/pub/irs-pdf/f14039.pdf Social Security Administration 1-800-772-1213 http://secure.ssa.gov/ipff/home NCTUE 1-866-349-5355 https://nctue.com/ FCC 1-800-225-5322 https://www.fcc.gov/ - IRS: Many identity thieves specialize in IRS refunds. Some file fake claims for refunds. Others try to get your check rerouted to their addresses. The IRS is also the place to discuss the theft of unemployment benefits.

- Improve your security measures. Once you’ve done those things, it becomes a waiting game. You’ll have to wait for the resolution from the concerned institutions as well as any claims you’ve requested from your insurance company. While waiting, though, you should use the time to rebuild and improve your security measures.

- Obtain information from debt collectors as well. You have the right to obtain information about any debt you incurred from identity theft. A debt collector must provide this information to you in writing.

- Change all affected account passwords. It’s a good idea to use strong, complex passwords on all your accounts and to update these passwords regularly. You might also want to use a password generator to create secure passwords and password manager to store all of them in one safe location.

- Use two-factor or multifactor authentication security when it’s offered. Two-step authentication means you must provide two pieces of identifying information before you can access an account. The two pieces can be the same type of authentication, such as two passwords, but they must be entered one after the other. Multifactor authentication is an even stronger form of security, since it requires you to provide two different types of authentication, such as a password and a retina scan.

- Delete your personally identifiable information (PII) from any website. Changing passwords and using two-step authentication aren’t as effective if you are willingly publishing information about yourself online. Delete your personal information from Google and social media.

- Enroll your number to the National Do Not Call (DNC) list. That will help you identify and avoid phone scams. Legitimate telemarketers do not contact phone numbers in the DNC list, so if you receive an unsolicited marketing call, that’s more than likely from a scammer.

Dealing With Special Accounts and Situations

What do you do if identity thieves go after your more specialized accounts? We’ve got you covered there too, with instructions on how to deal with any situation.

Government Benefit Fraud

If you’re having trouble with your government benefits because of identity theft, you should contact the specific government agency directly. In most cases, you’ll want to contact your state’s agency. These agencies might have different names, which can make the process difficult.

If, for instance, you want to check on unemployment benefits in New York, where we live, you’ll need to contact the New York Department of Labor. If you want to check on unemployment benefits in Arkansas, though, you’ll need to contact the Arkansas Department of Worker Services.

The one exception is military benefits. If you find you aren’t receiving your check each month, contact the U.S. Department of Veterans Affairs at 1-800-578-5492 or visit https://www.va.gov/identitytheft/.

Checking Account Fraud

Many instances of identity theft concern checking accounts. Follow these steps if you’re a victim:

- Get a ChexSystems report. ChexSystems is a banking-report agency that keeps track of all your checking accounts and helps you identify any false accounts. You can request a free copy of your report once every year or within 60 days of being denied a checking or savings account. There are four ways to get this report:

- Fill out a request form online at ChexSystems.com.

- Call 1-800-428-9623.

- Download and fax a request form to 602-659-2197.

- Download the request form and mail it to:

- ChexSystems Inc.

Attn: Consumer Relations

7805 Hudson Road

Suite 100

Woodbury, MN 55125

- ChexSystems Inc.

- Contact all financial institutions where thieves opened accounts and close those accounts.

- If someone is writing bad checks on an account you opened, fill out your bank’s paperwork to stop payment on these checks. Many banks allow you to stop payments online, and if the checks were lost or stolen, the service is usually free.

- Report the stolen checks to the bank’s check verification system. This will alert local businesses to refuse those checks.

- Contact businesses where thieves have written checks. Explain the situation and provide copies of your FTC report.

- Ask businesses to provide a list of all your purchases.

- Let businesses know of any fraudulent purchases and ask them to remove those charges.

- Ask each business to provide you with a letter confirming they removed the charges.

- If a business rejects a check you’ve written, ask why. They must give you an explanation.

Student Loan Fraud

Student loans are enough trouble as it is. Certainly, you don’t want to be paying on loans you never applied for. Here’s what to do if you find yourself a victim of this crime:

- Contact the business or organization that issued the loan.

- Explain that your identity has been stolen.

- Ask them to close the loan.

- Ask them to send you a letter for your records explaining you aren’t responsible for repayment. You can then send this letter to credit bureaus, educational institutions, and other loan companies as necessary.

- Write down the names and dates of each contact.

If the loan happens to be with the U.S. government, contact the U.S. Department of Education Inspector General at 1-800-647-8733.

Investment Account Fraud

Investment account fraud is a big deal. Unlike credit cards or bank accounts, investment accounts, including retirement funds, have little federal regulation when it comes to theft.

Unfortunately, if someone manages to steal your life savings from one of these accounts, there’s little you can do (unless, of course, you took our advice and signed up for identity theft insurance). Still, if you catch identity theft early, you can minimize the damage. Call your broker or account agent immediately to get advice on what to do with your accounts.

Bankruptcy Fraud

Declaring bankruptcy is one of the quickest ways to tank your credit. If an identity thief has filed a bankruptcy in your name, it can be a mess, but it’s a mess you need to deal with quickly.

Write to a U.S. trustee in the region where the bankruptcy was filed. You should also consider hiring an attorney.

Apartment/House Rental Fraud

Those who have skipped out on their rent in the past may find it easier to rent under someone else’s name. Follow these steps if someone rents an apartment or house in your name:

- Contact the landlord.

- Ask the landlord what tenant history service they used to verify the tenant’s history.

- Contact all of those tenant history services and ask for copies of your tenant history.

- Once you’ve identified fraudulent information, ask the tenant history service what steps you need to take to correct it.

Clearing Your Name of Criminal Charges

One of the simplest ways for a criminal to evade justice is to give the police a false identity. This means they won’t face additional jail time for previous offenses. This particular version of identity theft doesn’t just damage your credit; it can have a serious impact on your ability to rent a home or even get a job. Follow these steps if you discover you have a record for crimes you didn’t commit:

- Check court records to find out where the identity thief was arrested.

- Contact the law enforcement agency in that locale.

- File a police report about the impersonation.

- Provide copies of your fingerprints, a recent photograph of yourself, and other identifying documents.

- Ask the agency to compare records.

- Once you’ve established your identity, ask the agency to change the records and provide you with a clearance letter for the crime or crimes.

- Carry this letter with you at all times, as the U.S. Department of Justice recommends.

Tax Identity Theft

Usually, this form of theft involves someone filing a fraudulent tax return in your name. The thief is looking to claim a refund they aren’t entitled to. Luckily, the IRS has this sort of identity theft covered. All you need to do is:

- Complete the IRS identity theft affidavit at www.irs.gov/pub/irs-pdf/f14039.pdf.

- File your return as normal, and pay any taxes you owe.

- Check on the status of your case by contacting IRS specialized assistance at 1-800-908-4490.

- Write down the names and dates of each contact.

Child Identity Theft

As difficult as it is to believe, some identity thieves actually target children. Why? As we explain in our guide to child identity theft, most children don’t have credit histories, to say nothing of criminal histories. That means their identities offer a clean slate.

Follow these steps if one of your children has suffered identity theft:

- File an FTC identity theft report.

- Contact any businesses where fraud may have occurred.

- Explain the situation.

- Emphasize that your child is a minor and can’t enter into legal contracts.

- Ask the business to close the account.

- Ask the business to provide a letter confirming that your child isn’t liable.

- Send a follow-up letter to the businesses that includes your child’s FTC identity theft report number and a copy of your child’s birth certificate.

- Request credit reports for your child to find out if they have any accounts.

- Consider placing a credit freeze in your child’s name, which will prevent anyone from opening accounts with their name in the future.

- Write down the names and dates of each contact.

Here’s the good news: You can find great coverage for you, your spouse, and your children by checking out our best identity theft services for families.

FYI: In most states, minors can’t enter into contracts legally. This means they can’t be held liable for credit card charges.

Medical Identity Theft

Money isn’t the only thing thieves go after. Some use stolen identities to get medical treatment, prescription drugs, and even surgery. Follow these steps if you find yourself with medical bills or insurance statements for procedures you never had:

- Gather copies of your medical records from your health providers.

- Contact any health clinic where the thief used your name.

- Complete the care providers’ records request forms to get copies of your files.

- Review your records.

- Mail a report of any errors to the health care provider.

- Include a copy of each record inaccuracy in the letter.

- Explain each mistake and how to correct it.

- Include a copy of your FTC report.

- Send your letter as certified mail and ask for a return receipt.

- Notify your health insurance carrier of the situation.

- If any medical billing errors show up on your credit reports, contact the relevant credit bureaus.

The more you know: Many identity thieves don’t use your personal information themselves. Instead, they sell it to others, usually through the dark web.

Limiting the Damage

If you’ve suffered identity theft, your first concern is probably how to limit the financial damage. In the simplest terms, how do you get your money back?

- Act quickly. If you suspect someone has stolen your identity, take immediate action to protect yourself. This will help you limit how much is stolen, and in some cases, you may even stop the thief before they can spend your money.

- Know your state laws. Most states have laws protecting you from financial liability for identity theft. Check with the National Conference of State Legislatures to see how your state responds to identity theft.

- Know your federal laws. Federal law limits your liability on credit cards for up to $50. ATM and debit card losses are also limited to $50, as long as you report the loss within two business days. If a thief should use your debit card’s number but not the card itself, you are completely protected.3

How Common Is Identity Theft?

We’re not usually alarmists, but we’re starting to worry a little about the rate of identity theft in the U.S. The FTC reported 1.4 million new cases in 2020 alone.4 That’s a serious increase over the 0.7 million cases from the year before.

That increase may be linked to the pandemic. According to the Pew Research Center, 15 percent of adults lost their jobs as a result of the crisis.5 As Bruce Dorris, president and CEO of the Association of Certified Fraud Examiners (ACFE) notes, “fraud proliferates during recessions and times of economic instability” because people experiencing economic hardship are driven to extreme measures such as identity theft to survive.6

Additionally, the FBI explains that stay-at-home orders have meant more online commerce and consequently a rise in online scams. In total, the FBI says it received 791,790 complaints in 2020, an increase of 38 percent over 2019’s numbers.7

Local statistics can be even worse, as this chart of the worst states for identity fraud demonstrates:8

| State | Reports of identity theft per 100,000 people in 2020 | Percentage of the population who experienced identity theft in 2020 |

|---|---|---|

| Kansas | 2,297 | 2.30% |

| Rhode Island | 1,191 | 1.20% |

| Illinois | 1,066 | 1% |

| Nevada | 740 | 0.74% |

| Washington | 712 | 0.71% |

How Does Identity Theft Happen?

One way of protecting yourself against identity theft is to understand how it happens.

The Theft

First, identity thieves need to get their hands on your PII. As we’ve already discussed, that can happen in a variety of ways:

- Dumpster diving: Thieves will resort to anything, even going through your trash.

- Stolen purses and wallets: Not all identity theft happens online. Sometimes thieves take your PII out of your hands in a literal sense.

- Malware: Viruses and spyware on your computer can steal your bank account information, passwords, and more.

- Information interception: If you’re sending information over any unsecured public Wi-Fi connection, that information could be intercepted in transit.

- Data breaches: The companies you do business with keep lots of your personal information, like your credit card data, your mailing and email addresses, and your phone number. When one of these companies suffers a data breach, all that information can quickly wind up for sale on the dark web. That’s one reason why it’s a good idea to subscribe to identity theft protection for the dark web.

- Stolen mail: Some identity thieves specialize in pilfering letters from your mailbox.

- Phishing: Phishing scams work by convincing you to turn over your personal information willingly. Maybe you get an email from a cousin, for instance, claiming she needs a loan and asking for your bank account information. These schemes get more sophisticated and harder to spot every day.

The Identity Fraud

Once they’ve obtained your PII, identity thieves use it for a variety of nefarious purposes, such as these:

- Establishing new lines of credit

- Establishing services in your name

- Opening bank accounts

- Getting auto loans

- Committing crimes

- Filing IRS returns

- Accessing your bank account

- Making purchases with your credit cards

Federal Laws Surrounding Identity Theft

If you fall prey to identity theft, you should know that you have some important rights that can help you put your life back together. Some of the most important rights are enshrined in the Fair Credit Reporting Act. This federal act governs how business can obtain and use your credit information, giving consumers certain rights:

- You must be told any time credit information is used against you, such as to reject you for a loan or raise your interest and insurance rates.

- You have the right to an accurate credit report.

- You have the right to contest any errors on your credit report.

- You have a right to know what is in your credit file.

- Employers cannot access your credit report file without your consent.

- Credit bureaus can’t include outdated information in your credit file.

- You may seek damages for violations of your rights.

The Fair Credit Reporting Act isn’t the only federal protection you have against identity theft. These are some of the additional federal laws that protect you:

- Identity Theft Assumption and Deterrence Act

- Identity Theft Penalty Enhancement Act

- Fair and Accurate Credit Transactions Act of 2003

- Fair Credit Billing Act

- Electronic Fund Transfer Act

- Crime Victims’ Rights Act

Collectively, these laws give you:

- Protection from an accused identity thief

- Reasonable notice of any court proceedings that involve the accused

- The right to be included in any court proceedings

- The right to be heard during court proceedings

- The right to discuss with government attorneys any cases that involve you

- The right to complete and timely restitution

- The right to be treated with fairness and respect9

Your State Rights

In addition to the U.S. government, every state has laws requiring businesses to notify you if they suffer any data breaches. Where does your state stand?

| State | Data breach notification law | Maximum time businesses have to notify customers |

|---|---|---|

| Alabama | Yes | As soon as possible |

| Alaska | Yes | As soon as possible |

| Arizona | Yes | 45 days |

| Arkansas | Yes if it affects 1,000 or more residents and causes “a reasonable likelihood of harm” | As soon as possible |

| California | Yes if it affects 500 or more residents | As soon as possible |

| Colorado | Yes | 30 days |

| Connecticut | Yes if it will likely result in harm | 90 days |

| Delaware | Yes | 60 days |

| Florida | Yes if it affects 500 or more residents | 30 days |

| Georgia | Yes | As soon as possible |

| Hawaii | Yes | As soon as possible |

| Idaho | Yes | 1 day |

| Illinois | Yes | As soon as possible |

| Indiana | Yes | As soon as possible |

| Iowa | Yes if it affects 500 or more residents | 5 business days |

| Kansas | Yes | As soon as possible |

| Kentucky | Yes | As soon as possible |

| Louisiana | Yes | 60 days |

| Maine | Yes | As soon as possible |

| Maryland | Yes | 45 days |

| Massachusetts | Yes | 10 business days |

| Michigan | Yes | 3 business days |

| Minnesota | Yes but only applies to government agencies | As soon as possible |

| Mississippi | Yes | As soon as possible |

| Missouri | Yes | As soon as possible |

| Montana | Yes | As soon as possible |

| Nebraska | Yes | As soon as possible |

| Nevada | Yes | As soon as possible |

| New Hampshire | Yes | As soon as possible |

| New Jersey | Yes | As soon as possible |

| New Mexico | Yes | 45 days |

| New York | Yes | As soon as possible |

| North Carolina | Yes | As soon as possible |

| North Dakota | Yes if it affects 250 or more residents | As soon as possible |

| Ohio | Yes | 45 days |

| Oklahoma | Yes | As soon as possible |

| Oregon | Yes if it affects 250 or more residents | 10 days |

| Pennsylvania | Yes | As soon as possible |

| Rhode Island | Yes | As soon as possible |

| South Carolina | Yes if it affects 250 or more residents | 3 days |

| South Dakota | Yes | 60 days |

| Tennessee | Yes | 45 days |

| Texas | Yes if it affects 250 or more residents | 60 days |

| Utah | Yes | 20 days |

| Vermont | Yes | 45 days |

| Virginia | Yes | As soon as possible |

| Washington | Yes if it affects 500 or more residents | 30 days |

| West Virginia | Yes | As soon as possible |

| Wisconsin | Yes | 45 days |

| Wyoming | Yes | As soon as possible |

Preventing Identity Theft

Going forward, there are many steps you can take to reduce the likelihood that you’ll become a victim again:

- Don’t carry your Social Security card with you. If you should lose your Social Security card, follow our complete list of steps on what to do.

- Don’t give out your Social Security number. Unless it is absolutely necessary, such as for a W-9, keep this piece of personal information to yourself.

- Don’t share personal information just because you’re asked. This includes your birthdate, mother’s maiden name, and bank account numbers.

- Collect your mail every day. Don’t give thieves a chance to get information from your mail. Check it every day.

- Pay attention to billing cycles. If you can figure out when your bills come every month, you’ll know right away if one goes missing from your mailbox.

- Use your mobile device’s security features. Most modern phones have strong security features. You can, for instance, hide your location from Android apps unless they are in use, or put your phone into “guest mode” when you let someone else use it. iPhones include a feature that blocks intelligent advertiser tracking. However, if you disable these features, or don’t bother to turn them on in the first place, they can’t do much good.

- Use a VPN on public Wi-Fi. When you’re on public Wi-Fi, any information you send through your mobile device is insecure. A VPN hides your connection in an encrypted tunnel.

VyprVPN App - Review your credit card and bank statements every month. Take a close look at all your statements, and be on the lookout for any unfamiliar entries. With online account information, you may even want to get in the habit of checking your accounts every few days.

- Update your firewall settings. Make sure you configure your firewall filters to prevent suspicious files from getting onto your computer. Both Windows and Apple, for instance, recommend you set their firewalls to block all inbound internet traffic except for sites you approve specifically.

- Use a paper shredder. Shred any materials that contain your PII so thieves can’t steal them from your trash. Don’t forget receipts, credit card offers, and expired credit cards.

- Create complex passwords. Use passwords that are at least 16 characters long. Make sure they contain combinations of characters, numbers, and symbols. They shouldn’t include any repeated characters or personal information.

- Review your credit reports once a year. It’s a good habit to check out all three of your credit reports at least once every year to make sure everything on them belongs there.

- Install and use antivirus software on your computer. Good antivirus software protects you against not only viruses but all forms of malware. It will also ensure you don’t fall victim to phishing scams and fake websites. For more information, see our guide to antivirus protection.

Kaspersky Antivirus App Home Screen - Store your PII in a safe place. We all keep PII somewhere. After all, you need that information to apply for loans, rent apartments, and file insurance claims. A safe or locked file cabinet works well.

Finally, if you don’t already have an insurer, you may want to consult our lists of the best identity theft protection and the best identity theft protection with fraud detection.

For more great tips, check out our page on how to protect yourself from identity theft.

The Bottom Line

If your identity has been stolen, getting your life back in order can seem like an enormous mountain to climb. If you follow the steps we’ve outlined here, however — such as filing a report with the FTC, contacting businesses that are involved, and removing false entries from your credit reports — you can make that mountain far more manageable.

FAQs

Last, but certainly not least, we’ve provided answers to some of the most frequently asked questions we hear about identity theft.

-

What do you do when someone steals your identity?

Take these steps as soon as you discover someone has stolen your identity:

- File a claim with your identity theft insurer, if you have one.

- File an identity theft report with the FTC at IdentityTheft.gov or call 1-877-382-4357.

- Contact any relevant companies you’ve done business with and let them know about the theft.

- Contact all three of the major credit bureaus and let them know about the theft.

Credit bureau Phone number URL Mailing address Experian 1-888-397-3742 https://www.experian.com/fraud/center.html P.O. Box 9554

Allen, TX 75013Equifax 1-800-525-6285 https://www.equifax.com/personal/credit-report-services/credit-fraud-alerts/ Equifax Information Services LLC

P.O. Box 105069

Atlanta, GA 30348-5069TransUnion 1-800-680-7289 https://www.transunion.com/fraud-alerts Transunion

Fraud Victim Assistance Department

P.O. Box 2000

Chester, PA 19016 -

How do I check to see if someone is using my Social Security number?

You can see if someone is using your Social Security number by checking your Social Security account on the Social Security Administration’s website and looking for suspicious activity.

-

How do you know if your identity has been stolen?

According to the FTC’s guide to identity theft, these are some clues that your identity has been stolen:

- Unexplained withdrawals from your bank account

- Bills that don’t arrive when they should

- Merchants refusing to take your checks

- Debt collectors inquiring about debts you don’t owe

- Unfamiliar charges or accounts on your credit reports

- Medical bills for services you didn’t get

- Health plans rejecting claims because you’ve reached your benefits limit

- Insurers refusing to cover you because of a medical condition you don’t have

- Notification from the IRS that you’ve filed multiple claims in a single year

- Notification from a company that they’ve suffered a data breach

-

What are you liable for if your identity is stolen?

If your identity is stolen, you have very limited liability. Most state laws protect you from liability in terms of your checking accounts. Federal law limits your credit card, ATM, and debit card liability to $50.

There are some exceptions, of course. For instance, investment accounts are not protected from identity theft.