When setting up some financial apps, you’ve likely had your screen taken over by something called Plaid.

Once it asks for your bank account information, your first instinct might be to uninstall the app, contact your bank, withdraw all your money, and secure it under a mattress for protection.

Ok, that might be a little extreme even for us as personal digital security and online safety experts.

Plaid actually simplifies your financial interactions by acting as a bridge between your bank and the app you’re using, so transactions are seamless and secure.

But can you trust it? Our experts are here to take a close look at how Plaid works and its security policies to help you figure out if Plaid is safe to use or if your instincts are correct.

What is Plaid?

Plaid provides apps or sites with the necessary information from your financial institution while preventing access to other sensitive data. It can make using Venmo safe for authorizing transactions or depositing money safely to Robinhood. But Plaid is not 100-percent safe. We take extra precautions by using tools like antiviruses to protect our devices from keylogging spyware and malicious links. Below are three we recommend installing on your devices when conducting financial transactions.

Is Plaid Safe to Use?

Plaid provides apps or sites with the information they need from your financial institution and prevents them from being able to access other sensitive data.

For example, if you transfer cash to your friends using Venmo or dabble in investing with Robinhood, Plaid can authorize transactions between the app and your bank. Find out if these platforms are safe to use as well in our guides to how safe Venmo is and how safe Robinhood is.

Did You Know: Plaid says that almost 25% of adults in the U.S. have used its services through apps like Acorns, Pillar, and Coinbase.

How Do You Use Plaid?

The good news is that you don’t need to learn how to use Plaid. You don’t even have to install anything.

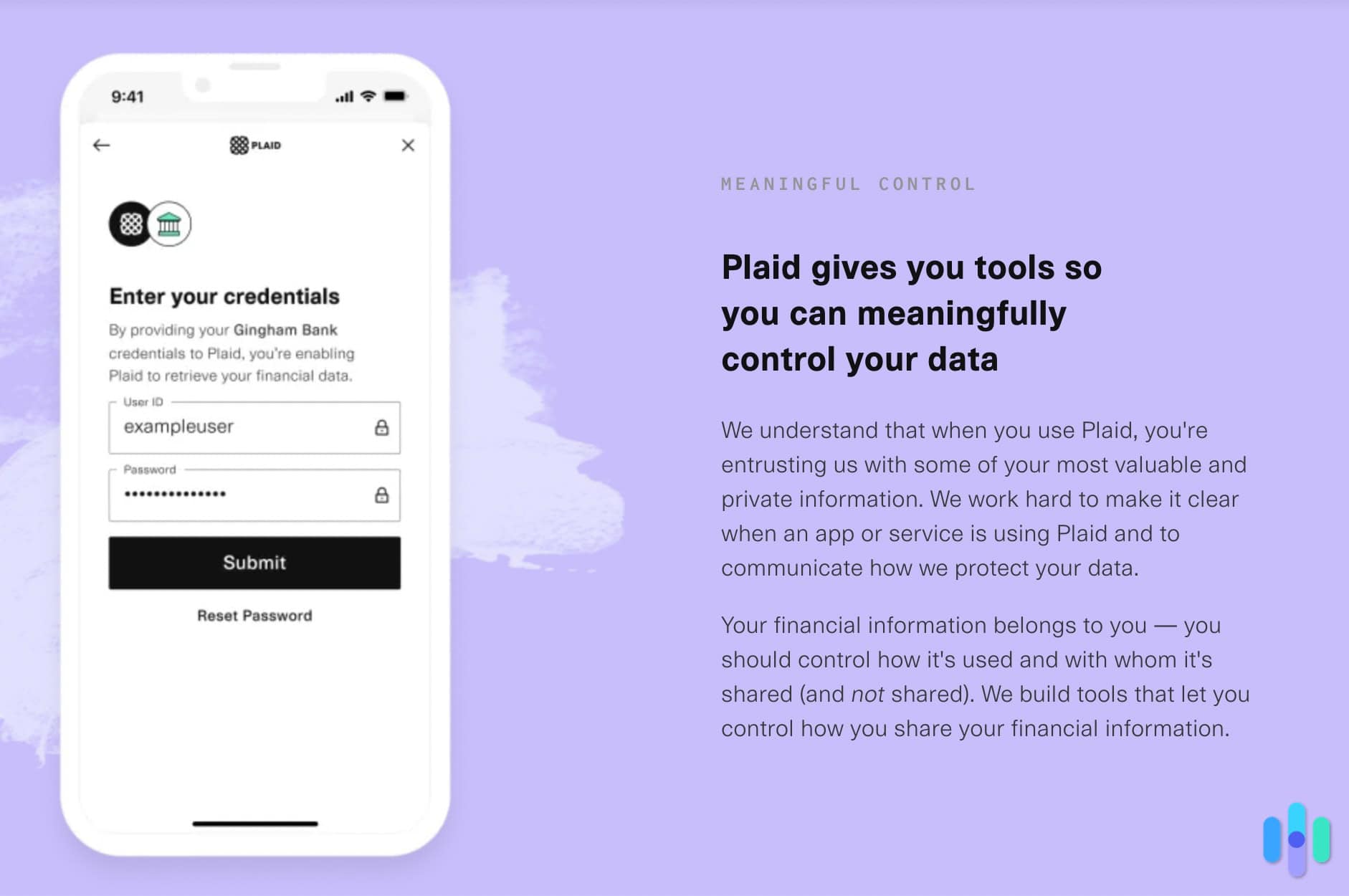

You will be sent to Plaid through an app to establish a connection between your bank and the service you want to use. Plaid verifies the credentials and enables the secure transmission of the data you’ve authorized.

We last used Plaid when setting up our Rocket Money account to better budget our money. With all of the security products we regularly buy (that dent in our bank account from testing Vivint’s home security system was still there), it was about time we set a budget. Once we opened up the Rocket Money app, all we had to do was sign into our financial accounts using Plaid and Rocket Money had our monthly expenses immediately listed. That’s the point of Plaid. It shares your financial information for you so you can skip the data entry all without exposing your credentials.

How To Connect Plaid to Your Bank

When connecting Plaid to your bank, you’ll be directed to your financial institution’s login portal. Here, you’ll need to enter your username and password and, in some cases, set up multifactor authentication. This process ensures that only you can authorize the connection and helps to prevent account takeover fraud.

Once verified, the bank will list the information you agree to share with Plaid and the app. You will have to agree to the terms and conditions and hit the Share My Data button to continue. If successful, you’ll return to your app and receive confirmation of the connection.

What Information Can Plaid See?

In case you skip the page about the information you agree to share with Plaid as if it were agreeing to the latest Apple terms and conditions, we’ve simplified the list to help you understand what you’re giving permission to.

| Financial Information | What You’re Sharing |

|---|---|

| Account Information |

|

| Transactions |

|

| Account Details |

|

Put simply, Plaid is not going to help you stay anonymous online with the amount of information it collects. But, it’s not too bad either compared to other tech companies we’ve reviewed. For example, when we assessed Cash App’s safety levels, we found out they also store the last four digits of your social security number.

>> Read More: Securing Confidential Personal Data Both Online and Offline

How to Manage Your Bank Information

There is a way to check the specific data you’re sharing with Plaid and the financial apps you’re connected to. Simply set up an account to connect to the Plaid Portal. Once you’ve logged in, you can view and manage your connections. You can even disconnect services if you’re no longer using them or weren’t aware a connection existed. Keeping an eye on these connections is a great way to avoid being scammed online.

How Plaid Handles Your Information

In addition to the transparent details regarding the data you’re sharing with other apps via the Plaid Portal, you can also review the privacy policy to review how they use your information.

The cliff notes are that Plaid uses your details to:

- Develop new and existing services

- Prevent fraud

- Protect your privacy

- Provide customer support

- Investigate misconduct

- Comply with legal obligations

- Other purposes (but only with your consent)

All in all, we were pleasantly surprised with the consumer data security Plaid provides. Unlike most big tech companies, Plaid minimizes the exchange of your personally identifiable information (PII) to only the necessities. This helps minimize the risk of a data breach and keeps your information more private.

>> Read More: The Data Big Tech Companies Have On You

What Apps Use Plaid?

Plaid is used by over 12,000 financial institutions globally, as well as other apps like money transfer and investment services. We’ve highlighted some of the most popular ones where you’ll likely see the Plaid logo appear.

| Type of App | Examples |

|---|---|

| Banking |

|

| Cash Advance |

|

| Money Transfer |

|

| Investment |

|

| Business |

|

Did You Know: Plaid also works with shopping apps like Drop. When connected, customers earn rewards for the money they spend. The app reviews your transaction history to apply these prizes.

Verdict: Is Plaid Safe?

It’s normal to feel a little nervous about providing your banking login details to a portal different from your financial institution and the service you’re trying to access. In fact, instincts like those are crucial for preventing identity theft. But Plaid is safe to use.

It facilitates communication between the bank and the app so that only necessary data is shared. And at the end of the day, Plaid keeps your login information private and uses top-of-the-line encryption to secure your details.

You also have complete visibility of what Plaid is sharing with other services, and you can control what data they can see. Plus, they don’t rent or sell your personal information, which is always a bonus.

Plaid FAQs

-

Should I give Plaid my bank login?

Yes, it’s OK to provide your bank login information to Plaid! Plaid uses very high quality security protocols to keep your information safe and secure. It instantly encrypts sensitive data once it is shared and only uses secure connections with the apps it’s integrating with.

-

Why does Plaid need my bank password?

The platform requires your bank username and password to provide the services you use with the relevant information from your financial institution. When one requests specific data, Plaid will share it via a secure connection. Its state-of-the-art encryption protocols ensure these credentials are protected at all times.

-

How do I unlink my bank account from Plaid?

The good news is that it’s easy to delete your bank information from Plaid. Here’s how you do it:

- Log in to the Plaid portal.

- Go to the Accounts page.

- Click on the financial institution you would like to unlink from Plaid.

- Select “Delete From Plaid.”

- Read the disclaimer about what happens if you remove your bank account and select “Continue.”

- You’ll see the apps connected to your bank. If you still want to proceed, select “Continue.”

- Type “delete” in the field, and finalize the process by selecting “Delete Data From Plaid.”

-

Can Plaid pull bank statements?

You can retrieve bank statements through Plaid. The transactions can go back as far as two years and are helpful if you apply for a rental or a loan. It will even display your bank’s logo instead of the Plaid logo.

-

Does Plaid charge a fee?

Plaid doesn’t charge customers for using their service. It’s also free for developers who want to test the product and become familiar with the APIs. Once you request production access, pricing plans are enabled.

-

Does PayPal use Plaid?

PayPal does use Plaid to enable easy, secure access to a customer’s bank account. We even made a complete guide on if PayPal is safe that talks about how PayPal connects with your bank account. Using Plaid reduces the need to manually input routing and accounting numbers when conducting financial business. Some of the scenarios where Plaid is useful are:

- Quickly transfering money to friends, family, and associates using PayPal

- Managing subscription services, such as Netflix or Spotify

- Overseeing payment processing, invoicing, and account reconciliation for small businesses and freelancers

- Conducting financial planning services, including budgeting, expense tracking, and goal setting

-

Why is my bank blocking Plaid?

Plaid doesn’t integrate with every financial institution. Some banks may not allow you to connect to the service or let you integrate your details with third-party apps. You may need to do this manually, which comes with several risks.