We all know someone who has lived through a burglary, reported a package theft, or had their email compromised in a data breach. But someone whose identity was stolen, lock, stock, and barrel? That isn’t the kind of story you hear every day, which is exactly how cybercriminals want to keep identity theft: out of the conversation and off our radars.

Here are the facts about ID theft: More than 950,000 Americans have lost nearly $2 billion to identity thieves in 2023.1 The average loss was just shy of $1,000, but it’s the outliers — the 70,000-odd folks who lost over $10,000 and will spend months, if not years, of their lives getting back on their feet — who make identity theft worth taking seriously.

>> Read More: A Parent’s Guide to Child Identity Theft

Fortunately, the techniques cybercriminals use to get their paws on our identities aren’t a mystery at all. They’re actually preventable if you take some fairly simple, inexpensive precautions.

In this digital security guide, I’ll explain what identity theft is in everyday language and lay out the most effective measures you can take to keep the internet’s shadiest grifters far away from your sensitive data.

Did You Know: Most victims of ID theft aren’t seniors. They’re between the ages of 30 and 39.

What Is Identity Theft?

When a grifter steals your identity, they’re essentially gathering enough of your personal information to pass themselves off as you. They may buy your data on the dark web. They may hack into or steal one of your devices. They may even get you to give it to them through a phony email or telephone call.

When they have enough pieces of the puzzle, they may even apply for a driver’s license or credit card in your name — sent to a new address, of course, so you won’t have a clue.

>> Also Check Out: How to Spot and Stop Online Phishing

At that point, if they sense no one is keeping score, they’ll go on a spending spree, trashing your credit score along the way. The crooks out to fry bigger fish may even take out a sizable loan in your name, which they have no intention of paying off.

And that, as they say, is all she wrote.

Pro Tip: Never give any personal details — such as your Social Security number, birthdate, or driver’s license number — over the phone. No legitimate entity will ever ask for those. Only criminals will.

Types of ID Fraud and Number of Reports in 2025

| Fraud | Number of reports |

|---|---|

| Bank | 107,469 |

| Credit card | 318,142 |

| Employment or tax | 74,322 |

| Government documents or benefits | 74,986 |

| Loan or lease | 114,783 |

| Phone or utilities | 60,585 |

| Other | 202,174 |

| Total | 952,461 |

How to Prevent Identity Theft Online

Obviously, finding out that a fraudster is committing crimes in your name is icky and psychologically devastating. It’s even worse if they’ve targeted your kids, which they like to do.

>> Learn More: Best ID Theft Protection Services for Families

But what happens when you find out, three, five, ten years down the line, that you can’t buy your dream house because your credit rating, which you’ve never actually looked at before, is a big fat 300?

Here’s what you can do to make sure you never get to that point.

FYI: Social media is the number one point of contact for victims (age 20-70) and ID thieves.2

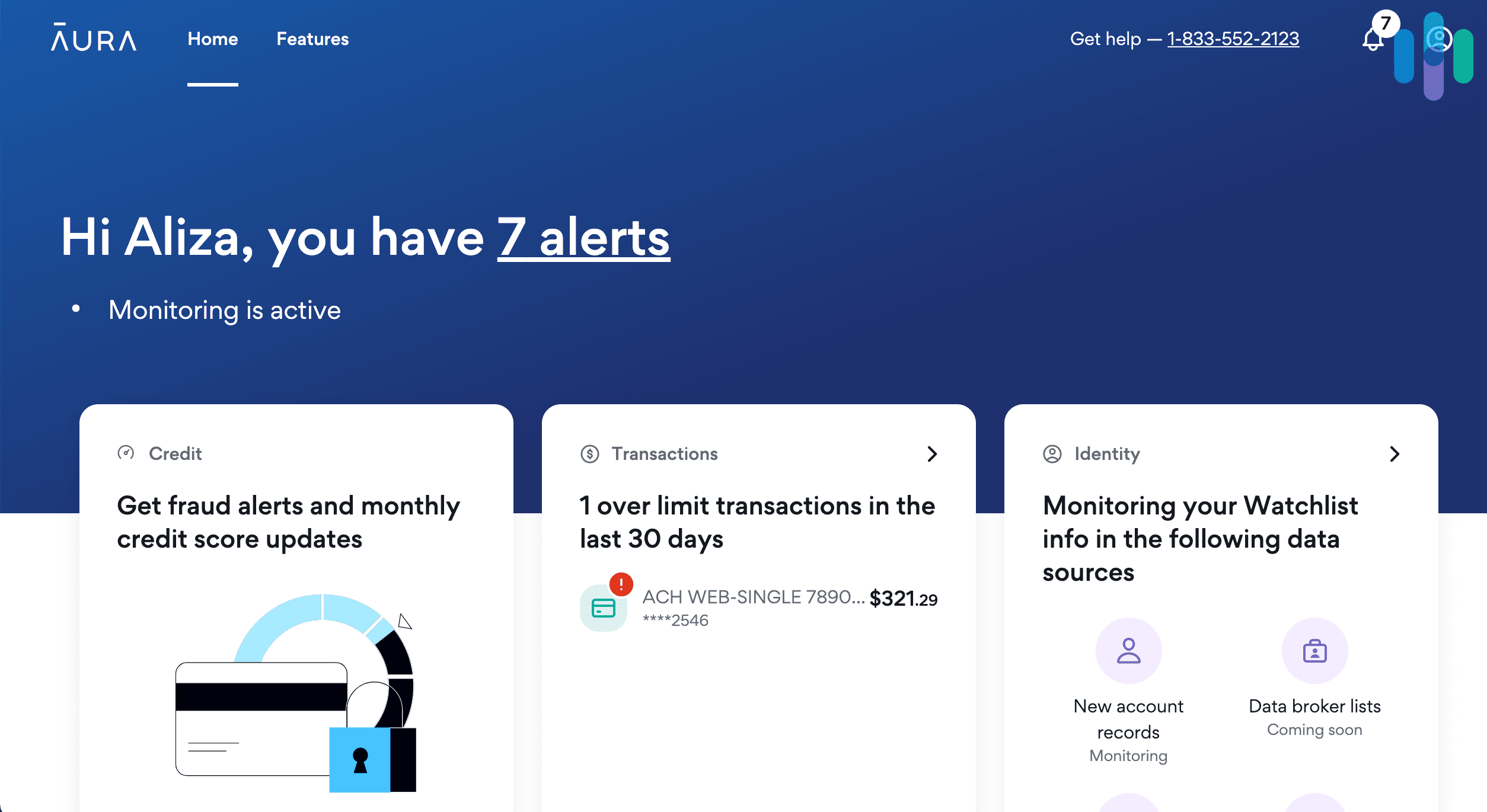

Get ID Theft Protection

This is the easiest way to stop identity thieves. ID theft protection services are like secure banks for most of the personal information thieves could filch and use against you. Your data sits in their digital vaults. The second someone walks in and tries to take it and use it for anything — to apply for a loan or credit card, say — you get an alert on your cell phone and can put the kibosh on the transaction.

>> We Recommend: The Top ID Theft Protection Providers

There are three key advantages to shielding your data this way. First, all your sensitive details are in one place, so you don’t have to spend hours a week keeping tabs on your Social Security number, credit reports, passwords, etc.

Second, if something happens, you have identity theft restoration specialists on your side with the experience and budget to help get your money and identity back.

Finally, top identity theft protection providers, such as Aura and LifeLock, bundle other useful digital-security tools — VPNs, antivirus software, and password managers — with their plans to offset some of the costs of their subscriptions and shore up access to the other main channels ID thieves use to steal your data.

>> Read More: Aura Identity Theft Protection Review

Did You Know: Easy-to-crack, reused passwords could be giving thieves easy access to your bank accounts and identity. Think yours are fraudster proof? Run them by our free password checker.

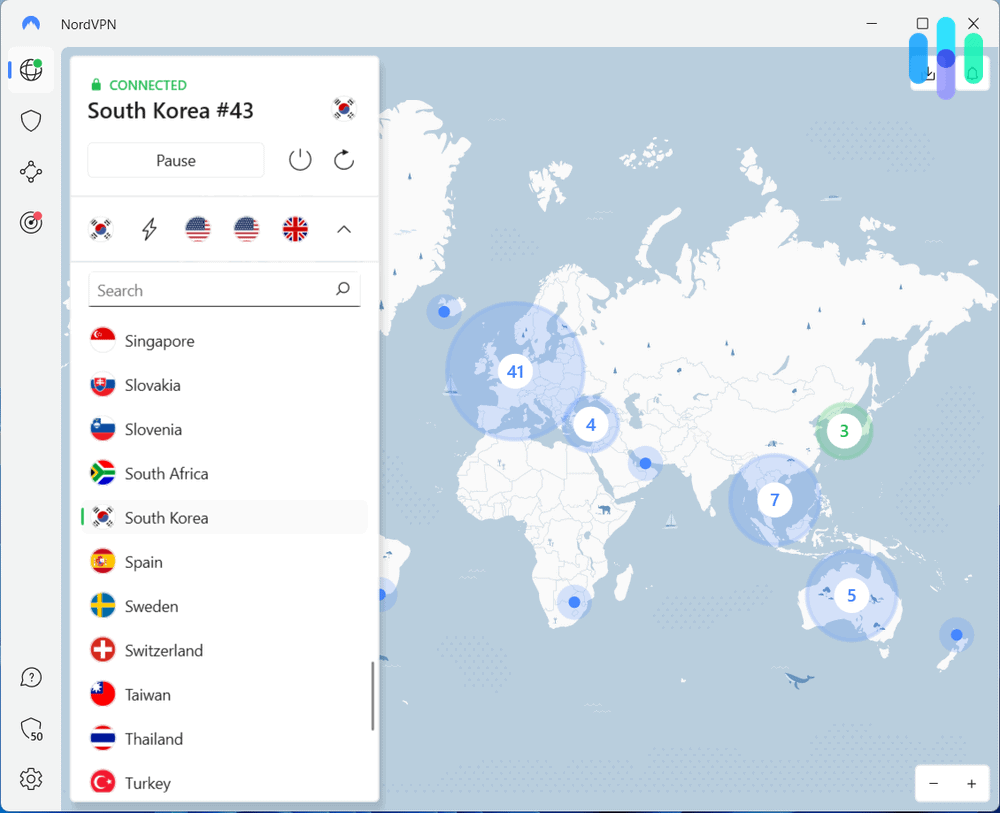

Use a VPN and Malware Protection

ID theft protection makes it nearly impossible for cybercriminals to steal your identity, but it can’t prevent a hacker from stealing your data if you don’t take any steps to keep them off your devices.

Imagine you’re sitting in a cafe, and you find a link to a contest where you could win free shoes. You click the link and end up on a fake website designed to swipe your birthdate and other sensitive details. Not realizing it’s a trap, you hand over the info.

Stupid? Nope. It happens unbelievably often. If you were running quality antivirus software in the background, however, you would have almost surely gotten a warning not to click the link.

>> Go Deeper: Does Antivirus Really Stop Hackers?

A VPN, on the other hand, would have sealed off your very public cafe internet connection so even if you’d been entering a legitimate contest, no hackers lurking in the shadows could have intercepted your info in transit.

Pro Tip: Want to make sure no one but you can log in to your accounts? Enable two-factor authentication, or 2FA, for all your apps. With 2FA, you’ll need a unique, time-sensitive code delivered to your phone to log in. Unless a thief has your phone, in other words, he’s out of luck.

>> Also Check Out: Our Experts Rate the Top VPNs of the Year

Shop Carefully

There have been nearly 78,000 reports of online shopping fraud so far this year, and they’ve raked in upwards of $85 million for grifters.3 By the end of the holiday season, those numbers likely will have gone through the roof.

Losing money to bogus e-retailers is easy. If a shady character emerged from an alley selling $2 iPhone covers, you’d move on. Online, in a snazzy-looking storefront, those same covers may strike you as a deal and, what the heck, you need a few extra stocking stuffers. So you give them your credit card details.

The same MO — sham storefront or other entity asking for your bank info — works on PayPal, Venmo, Facebook, or any fraudulent website. Finding a good deal always feels good, but stay away from online merchants operating in the wild with just a form to enter your credit card info. It may very well be a scam.

FYI: Also be wary of giving your credit card info to smaller legitimate outfits that may not be thieves themselves, but don’t maintain adequate online security to prevent breaches.

Online Shopping Fraud by Age

| Age | Most common payment methods | Most common contact method | Average loss |

|---|---|---|---|

| 20 to 29 | Payment app | Social media | $500 |

| 30 to 39 | Payment app or credit or debit card | Social media | $492 |

| 40 to 49 | Credit or debit card | Social media | $482 |

| 50 to 59 | Credit or debit card | Social media | $482 |

| 60 to 69 | Credit or debit card | Social media | $500 |

| 70 to 79 | Credit card or gift card | Phone call | $800 |

| 80+ | Credit card or gift card | Phone call | $1,500 |

Keep an Eye on Your Bank Statements (and Activate Push Notifications)

In the past, the only way you could zero in on suspicious bank activity was to wait until the end of the month when your statement came in the mail. Once banks went online, you could check your e-statements whenever you wanted. These days, we have something even better: instant app, SMS, or email notifications whenever our cards are used.

Your bank’s fraud department should be keeping an eye on your account for you. That’s their job. But you should be on guard too. If you haven’t enabled push notifications for your bank activity, do it right now.

>> Learn More: 2025 Credit Card Fraud Report

Pro Tip: Living off the radar isn’t protection against online fraud. Case in point: Alaska, which had the most victims of imposter scams per capita in the U.S. this year.

The Takeaway

You’d be hard pressed to find a porch that’s completely immune from package theft or a home that’s 100 percent burglar-proof. That’s why we have home security systems. The same goes for identity theft. To keep safe, most of us need a little help — especially when we’re online.

The simplest approach is to place your sensitive details under lock and key (and 24/7 alarm) with a reputable identity theft protection service. You can usually find a package that includes two more key pieces of online protection: a VPN and antivirus software.

After that, safeguarding your identity is just a matter of staying vigilant and making “reasonable suspiciousness” your default mode whenever you go online.

FAQs

-

What does an identity theft protection service do?

Identity theft protection providers are a combination hub and vault for your personally identifiable information. The main service they provide is notifying you the second someone has used your information to do something suspicious like apply for a driver’s license, credit card, or loan.

-

How much does ID theft protection cost?

The top services we’ve reviewed range from $9 to $30 per month.

-

Do I need a VPN?

We recommend using one. ID theft protection by itself doesn’t seal off your devices from attack, but a virtual private network does. Check out our top pick, NordVPN.

-

What is phishing?

Phishing is when a grifter sends you a bad link through an email or text that leads you to a website or page set up to steal your data.

-

How can I protect older loved ones from identity theft and fraud?

The same way you protect your younger loved ones. Have the “scams and predators” talk with them. Explain how fraudsters operate and have regular check-ups so you can stay on top of suspicious activity. You can also check out these ID theft protection services for seniors.