Is money missing? Have you noticed a weird file on your devices? Maybe you’ve had an unsettling phone call from someone claiming to be from the government saying you owe taxes.

Over $10 billion was lost to fraud in 2023, which was a 14% increase from 2022.1 Scammers are getting smarter and using more elaborate schemes to steal personally identifiable information. Some even adopt AI voice clones to make it sound like a loved one is distressed.

Hitting the reject call button is just one step you can take. But we recommend reporting any suspicious call, text, or social media message so you can stop these scams from tricking other people. But who should you talk to? We’ve listed the best places to report a scam and the information you need to provide. We’ve even thrown in some tips to keep you safe online.

Here’s what you need to know.

>> Read More: What Is a Scam, and How Can You Avoid One?

Where to Report a Scam?

The first place to report a scam is to the proper authorities. Here are the best places to start.

| Who | Contact Information |

|---|---|

| Federal Trade Commission | ReportFraud.ftc.gov

1-877-438-4338 |

| Federal Bureau of Investigation | Internet Crime Complaint Center

1-800-CALL-FBI |

| Local law enforcement | Use non-emergency contact numbers in your local area |

If you’re reporting a gift card scam, we recommend contacting the card issuer. Here are some of the most popular gift card companies that are negatively impacted by these scams.

| Gift Card Company | Contact Information |

|---|---|

| American Express | 1 (877) 297-4438 |

| Visa | 1 (800) 847-2911 |

| Mastercard | 1 (800) 307-7309 |

| Vanilla | 1 (833) 322-6760 |

| Amazon | 1 (888) 280-4331 |

| Apple | 1 (800) 275-2273 |

| Best Buy | 1 (888) 237-8289 |

| eBay | Contact eBay customer support |

| Contact Google customer support

Use this form if you don’t have a Google account |

|

| Walmart | 1 (888) 537-5503 |

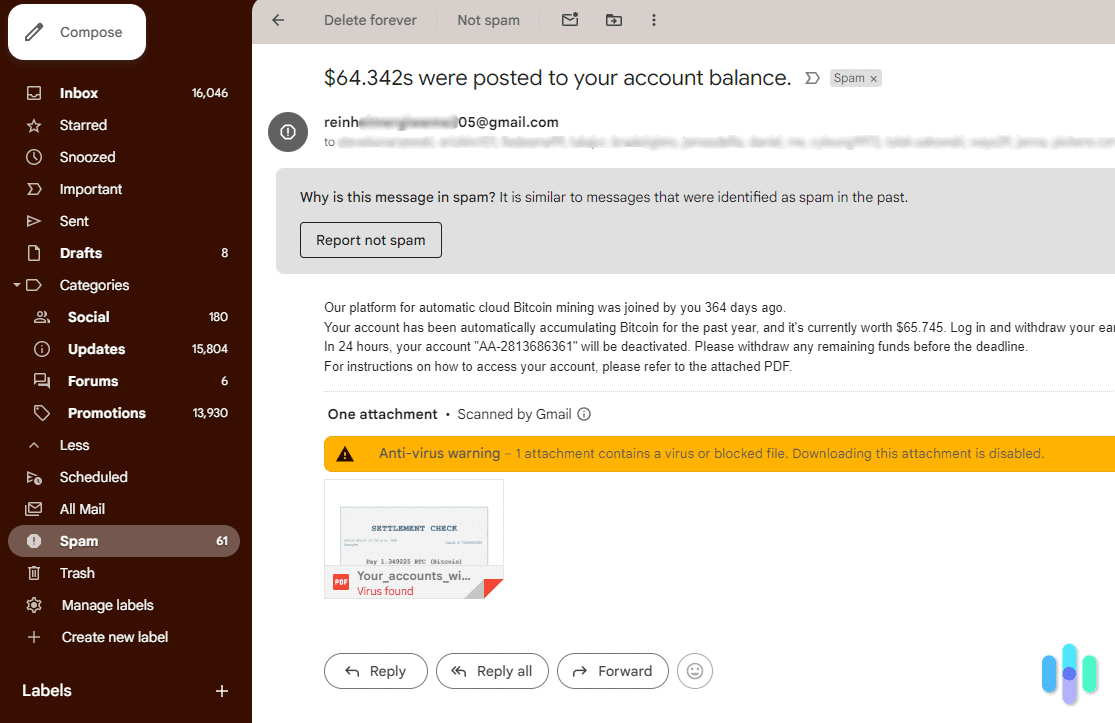

FYI: According to Egress, 94% of organizations had email security instances, with 79% of account takeover attacks starting from phishing scams. The report also shared that 95% of cybersecurity leaders are stressed about email security.

What Information Do You Need to Provide?

The more information you can provide authorities and companies about the scam, the better. Some of the most helpful details are:

- The method the scammer contacted you (phone calls, text messages, social media, dating apps, etc.)

- The time of contact

- Details about the call or message

- What they asked for (personally identifiable information, gift cards, money, etc.)

- If you paid them (how much money, when you paid them, and the method you used to send the funds)

- Any identifying information about the scammer (their name, contact number, email address, etc.)

How to Spot a Scam

While it can be tough to tell if something is a scam, there are some warning signs to look out for:

Unexpected Calls or Messages

You might get a call or message out of the blue from a governmental department or business you’ve never dealt with before. It might be the IRS or a utility company. The details are generally the same: you need to pay a lump sum to avoid a fine or having your services disconnected.

Did You Know: The FTC revealed that $76 million was paid to government impersonation scammers in 2023. In the first quarter of 2024, $20 million had already been lost.3

Another unexpected call or message you might get involves winning a prize – even if you haven’t entered a competition. The only catch is you’ll need to pay a fee to cover the release of the funds and taxes.

Sense of Urgency

Almost all scams involve a race against the clock. You’ll only have 24 hours to meet the conditions or something terrible will happen. The threat is designed to scare you into rushing and not looking too closely into the details.

Unusual Requests

Another scam telltale sign is if it involves unusual requests. For example, you might only be able to pay your electricity bill with Walmart gift cards or collect your prize after transferring a bunch of bitcoins. If the steps sound weird, your best move is to ignore the message or hang up the phone.

Bad Spelling or Grammar

Scammers don’t make it a habit to check their spelling or run the text through Grammarly. If you notice weird words or non-US language within messages or emails, you can add it to your spam folder.

Low-Quality Images

Most businesses and government departments use high-resolution images when sending emails. If the photos are so pixelated that you’re questioning whether you need glasses, don’t blame your eyes. It’s just a scam.

Signs You’ve Been Scammed

Sometimes, it’s not apparent that you’ve been scammed. You may need to investigate before you contact the authorities and report a scam. Look out for these signs:

- Unusual transactions on your bank and credit card statements

- Weird entries on your credit report

- Notifications that someone is claiming benefits in your name

- Invoices or bills for purchases you never made

- Rejected credit applications despite having a good history

- Unexpected parcels arriving at your home

- Two-factor authorization requests are sent to your phone or email

- Blocked access to streaming services

- You’re locked out of your computers and devices

- Your personal information has changed on accounts

- New posts appear on your social media profiles you didn’t create

- Products you purchased never arrive

>> Learn More: What Type of Fraud is Most Common in Your State?

How to Protect Yourself From Future Scams

Whether you have already been scammed or managed to avoid one, you can take steps to reduce the number of calls and messages coming your way.

- Turn on spam call detection: There’s a setting on iPhones and Android devices that detects whether an incoming phone call or text message is from a scammer. You can instantly reject it and report the call simultaneously so others will know to ignore it.

- Block phone numbers: Unfortunately, these settings aren’t perfect, and a call or message might slip through the cracks now and then. We recommend blocking these calls and marking them as spam so you don’t get bothered again.

- Mark emails as spam: Any suspicious emails should immediately be sent to your spam folder. It should stop them from arriving in your inbox, so you won’t accidentally click on unusual links or download dangerous files.

- Access identity theft protection services: Trying to keep scammers away can feel like a full-time job. We rely on tools like identity theft protection services for assistance. They can remove your name from spam lists, monitor your credit file and scan the dark web for your personal information.

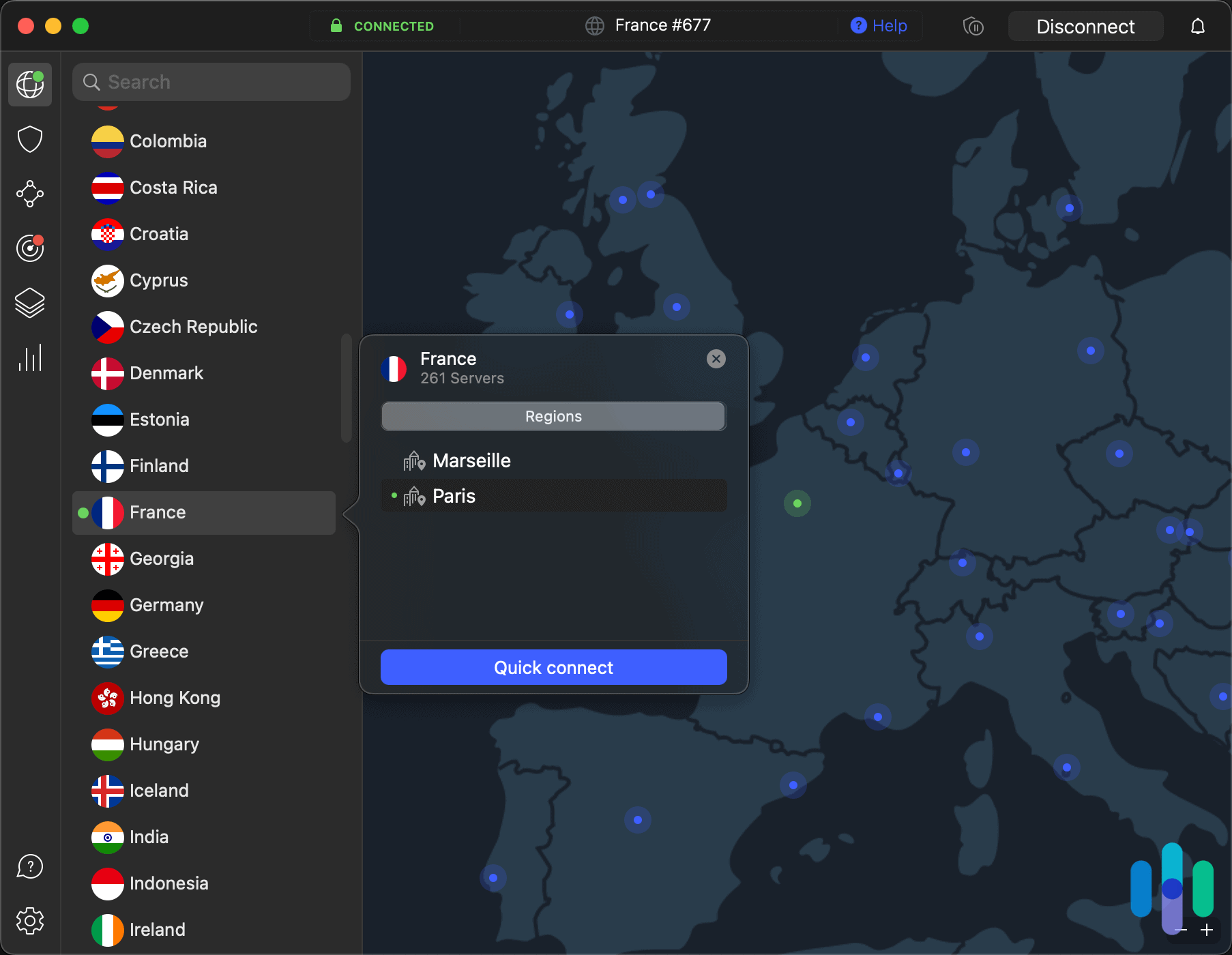

- Use VPNs while online: Using a Virtual Private Network can encrypt your internet traffic and keep you anonymous online. Some of the best VPNs have kill switches, which means traffic will stop transmitting if your connection drops out.

- Regularly scan devices with antivirus apps: We recommend scheduling regular scans for malware and viruses on your devices. Antivirus apps update their databases regularly to protect you from the latest threats.

Related reading: How to Stop Spam Calls

FYI: You don’t need antivirus protection for everything you own. For example, most iOS devices aren’t targeted for ransomware attacks. But if you’re using Windows, an Android, or Macbook, you should install one immediately.

Is It Worth Reporting a Scam?

If you’ve had any interaction with a scammer, you should report it. Your experience can help reduce the chances of other people becoming a victim. Online forms have made reporting the details with the FTC and FBI easier. You no longer have to wait on hold listening to elevator music to speak to somebody.

We also recommend a proactive approach, even if you haven’t been scammed. Defending yourself with identity theft protection services, VPNs, and antivirus software means you don’t have to constantly check your credit file or bank statements. Plus, if a scammer does strike, it’s easier to reclaim your identity and reduce the damage they can cause.

>> Up Next: A 2025 Guide to Identity Theft Protection

Frequently Asked Questions

-

How do you get your money back from a scammer?

If you notice unauthorized transactions on your bank or credit card statement, contact your financial institution to report it. They should be able to reverse the transaction and get your money back.

-

Where do you report scam emails?

You can report phishing emails to reportphishing@apwg.org and the FTC. We also recommend contacting the company or government department the email is impersonating so that they can alert their customers.

-

Can you report a scammer from another country?

Yes, you can. Head to the International Consumer Protection and Enforcement Network website to report international scams. They partner with over 60 consumer protection agencies worldwide.

-

Can a scammer access your bank account with your phone number?

Scammers can use your phone number to hack into online accounts, including your bank account. We recommend setting up two-factor authentication and changing your passwords to reduce the risk of unauthorized transactions.

-

How often do people get their money back after being scammed?

The results can vary. It will depend on your bank’s policies, the type of scam, how much you’ve lost and how quickly you report it. There is a federal law that banks must reimburse you for unauthorized transactions. But they don’t have to if you were tricked into sending the money by a scammer.