In the last year, there were over 10,000 reports of medical identity theft.1 It’s a small number relative to the millions of identity theft cases being reported each year, but the impact of medical identity theft to its victims is huge.

That’s why we want to help bring that number down. We put our over 2,500 hours of research to use toward creating guides to identity theft protection. We’ll tell you how we protect ourselves against medical identity theft based on our personal experience. Since no method is 100 percent effective, we’ll also show you what we’d do if we became a victim. Let’s get started.

Key Findings

- Over 10,000 Americans reported medical identity theft in the past year.

- The U.S. holds over $220 billion in medical debt.

- Medical identity thieves get your insurance information any way they can, from looking over your shoulder in the hospital waiting room to dark web marketplaces.

- Protecting your confidential information by storing and disposing of it properly minimizes your risk.

- If you notice a sign of medical identity theft, take action immediately.

What is Medical Identity Theft?

Medical treatments are expensive. There’s over $220 billion of medical debt in the U.S.2 We don’t want to join that statistic because of someone else’s bill but that’s what happens when you fall victim to medical identity theft. Someone uses your health insurance or information to pay for their treatment and then you get a bill in your mailbox for a treatment you never received.

Did You Know: Your insurance information is considered personally identifiable information. That includes any information someone could use to identify who you are. We cover every type of personal information in our guide to personally identifiable information.

This type of identity theft can impact anyone with health insurance or Medicare. Although, some thieves use your Social Security number making it seem like you’re responsible for any debts they owe to their medical provider.

By using your information, you can end up with issues when you seek treatment. Doctors will think you had a treatment or health issue that never happened to you. This can cause misdiagnoses and subpar medical treatment. It also becomes a hassle as you decipher which bills are legitimate and which ones aren’t with your insurance provider.

Where Do Thieves Steal Insurance Information?

Nearly every item you take home from a medical provider contains enough information for someone to commit medical identity theft against you. Oftentimes, these documents are what someone uses to steal your information. They’ll get them through the trash where you throw them out or look over your shoulder while sitting next to you in the waiting room.

>> Read More: Securing Confidential Personal Data Both Online and Offline

It’s not always physical documents though. Other times, medical information gets compromised in data breaches and leaks. After these data leaks occur, the people who stole that data then sell it on dark web marketplaces. From there, the person who buys it uses it during their next visit to the doctor or set of prescriptions.

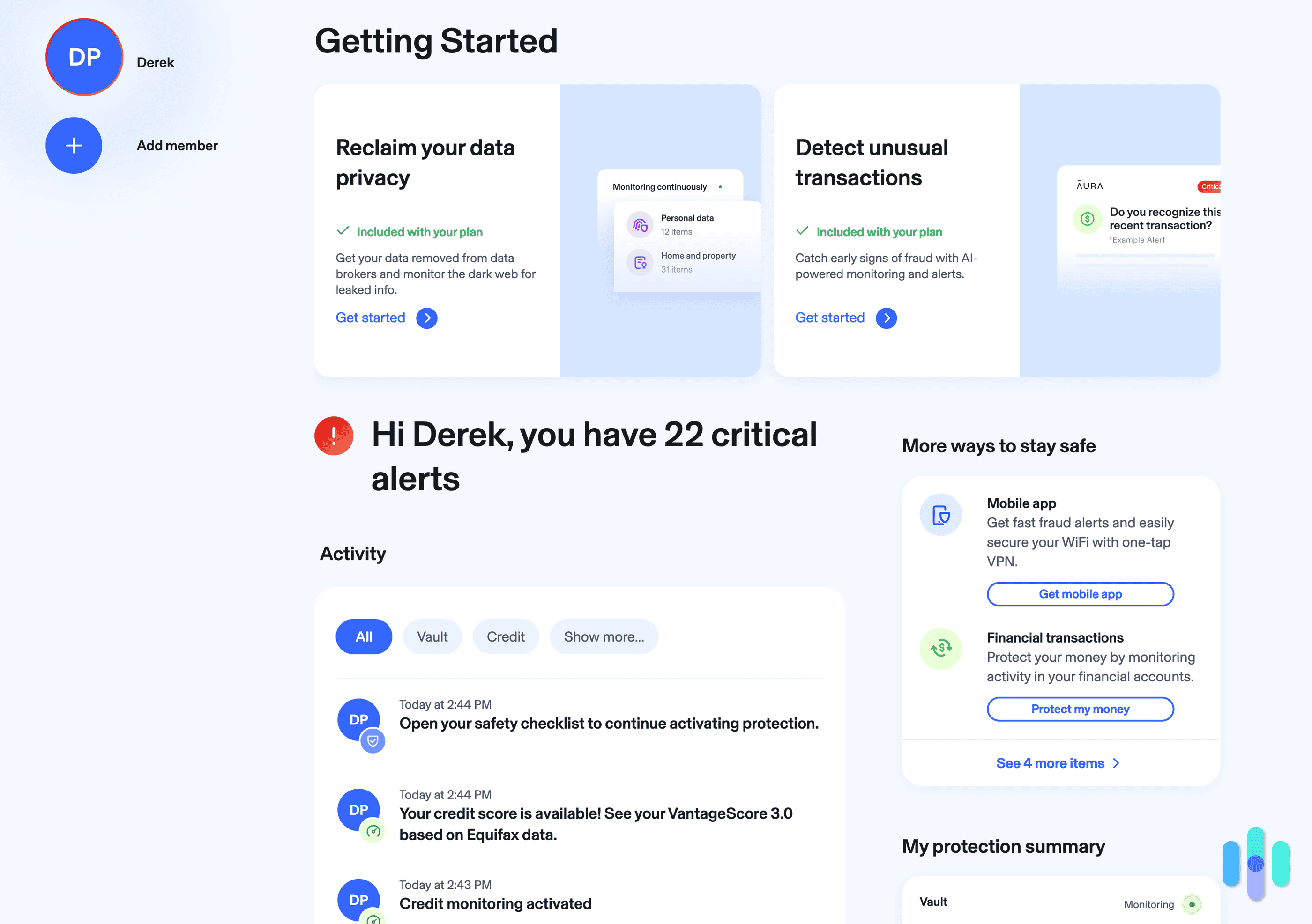

FYI: Some identity theft protection services monitor the dark web for your information so you can take action before it gets sold. We rounded up our favorite identity theft protection services with dark web monitoring so you can find the perfect one for your needs.

Get ID Theft Protection

Check out our favorite identity theft protection services.

How to Prevent Medical Identity Theft

While preventing regular identity theft focuses on securing your personal information on documents and devices, preventing medical identity theft takes a more specific approach. So, we focus entirely on our medical information. Here are our experts’ top tips for preventing medical identity theft:

- Protect medical documents in the waiting room — Do you ever get the feeling someone is looking over your shoulder while you fill out personal information? Take that feeling seriously and make sure nobody watches you fill out your entry paperwork while in the hospital waiting room.

- Limit the sharing of medical information — Only share your medical details when necessary and with people you can fully trust. It might seem innocuous to share a diagnosis with someone, but that paperwork could have enough information for them to use your insurance the next time they need medical care.

- Store medical documents securely — Always store medical documents in a safe. And while you’re at it, secure your home too with one of our favorite home security systems. For documents you need to keep on your person, make sure they’re securely tucked away and nobody can see them during any normal activity like taking money out of your wallet or fishing through your purse.

- Regularly review your Explanation of Benefits statement — Your insurance company sends you regular Explanation of Benefits statements. In these statements, they cover all of your doctor’s visits and how much they cost among other things. Verify the information in these statements to ensure you’re the only one using your insurance.

- Properly dispose of prescription bottles — Before throwing your empty prescription bottles in the recycling bin, completely remove the sticker containing your information. If you can’t get the sticker off, cover your information using a black permanent marker and then scratch off the parts of the label with your information.

- Shred documents before disposing of them — Just like you want to destroy the stickers with your information on any prescription bottles, you also want to destroy any documents with your information like medical bills or insurance statements. The best way to do that is with a shredder.

>> Learn More: The Internet and Data Privacy

Medical Identity Theft Warning Signs

If you keep an eye on your medical information and notice early signs of theft, you can take action and minimize the damage. Here are the oddities we see when assessing medical identity theft cases that can tip off a victim:

- Calls from a doctor you don’t recognize — If someone uses your health insurance, you might get a call from them as they sort out the billing to the insurance company. Whenever you get a call from a doctor, ask how they got your information to rule out identity theft.

- Medical receipts from treatments you didn’t receive — Most insurance carries some co-pay with it. The identity thief will need to make that payment while checking out with your insurance. A receipt for a co-payment you didn’t make could mean someone used your insurance.

- Data leak notifications — Now this one isn’t a guaranteed sign of medical identity theft, but if your doctor’s office or a hospital you’ve visited experiences a data leak, be on high alert for any of the other signs. Insurance companies can experience data leaks too. They have to notify you, usually by mail.

Pro Tip: Since data leaks are one of the main ways that identities get stolen, we conducted a comprehensive study on the public awareness of major data breaches. We wanted to figure out the best ways for you to stay aware of potential data leaks so you can better protect your identity.

- Inconsistencies with your deductible — Keep track of your deductible throughout the year. If it goes down when you didn’t use your insurance, that could mean someone else did. Call your insurance company immediately to find out the cause.

- Surprises on your Explanation of Benefits — As we said, always read through your Explanation of Benefits and account for every charge to your insurance company. That way, you know that you’re the only one using your insurance.

How to Recover From Medical Identity Theft

So, you noticed one of the warning signs we just told you about. Now what? Well, here are the exact steps our experts take when they notice any signs of medical identity theft:

- Notify our identity theft protection service — We always keep a subscription with one of our favorite identity theft protection services. So, they’re the first ones we call. They set us up with a specialist who guides us through the entire restoration process.

- Start a recovery plan — After notifying our identity theft protection service, we start to work on our recovery plan. They help us make one, but you can get help through IdentityTheft.gov if you don’t have a top identity theft restoration service.3

>> Learn About: How To Protect Yourself From Identity Theft

- Call our insurance company — One of the first steps in the recovery plan should be to call our insurance company. We notify them so they don’t authorize more fraudulent transactions.

- Contact the medical practice or hospital — Wherever the identity thief used your insurance, call them. The identity thief might go back for more treatments, in which case the organization will be ready to contact the authorities.

- File an identity theft report — If you created your recovery plan through IdentityTheft.gov, you already filed an identity theft report. Otherwise, head there now to file a report and document your case.

Final Thoughts

Even though medical identity theft doesn’t affect as many people as more common types of identity theft like synthetic identity theft, its impact can be just as devastating to an individual.

We can’t guarantee our protection against it either. But, we can reduce our risks. We showed you exactly how in this article. There are also steps you can take to minimize the damage caused by medical identity theft if you fall victim. With these insights, we can bring down the number of medical identity theft victims even further.

FAQs About Medical Identity Theft

-

What is medical identity theft?

Medical identity theft refers to the act of fraudulently using someone else’s health insurance or other medical benefits for treatments.

-

Can you prevent medical identity theft?

You can reduce your risk of becoming a medical identity theft victim by keeping your medical information secure. This reduces your exposure making you a harder person for an identity thief to victimize. That said, there’s no guaranteed way to prevent all medical identity theft attempts.

-

Should I report medical identity theft?

Yes, always report identity theft no matter what type it is. This way, the government can help you get your identity back. These reports also help organizations better understand identity theft and how to minimize risks.

-

How does someone get my health insurance information?

There are many ways a medical identity thief can steal your health insurance information. A few of the most common include medical documents that were improperly disposed of, someone snooping over your shoulder to look at your paperwork, and data leaks.

-

What are the consequences of medical identity theft?

Someone using your insurance fraudulently can impact your coverage which can leave you unable to receive recommended treatments. It can also cause inconsistencies with your medical records.