Best Identity Theft Protection with Dark Web Monitoring

Its antivirus, VPN, dark web monitoring, and restoration services make Lifelock the most comprehensive option.

- Powerful app lets you know any time it finds your information on the dark web

- Installs on up to 10 devices, ensuring you never miss alerts

- Constantly scans the dark web for your personal information

- Powerful app lets you know any time it finds your information on the dark web

- Installs on up to 10 devices, ensuring you never miss alerts

- Constantly scans the dark web for your personal information

- Available antivirus and a VPN prevent your information from showing up on the dark web in the first place

- All plans include dark web monitoring

- Full-service white glove resolution if your information should wind up on the dark web

- Available antivirus and a VPN prevent your information from showing up on the dark web in the first place

- All plans include dark web monitoring

- Full-service white glove resolution if your information should wind up on the dark web

- Dark web scans take advantage of IBM Watson AI technology

- Provides real-time alerts of dark web activity

- Up to $1 million in insurance against dark web identity theft

- Dark web scans take advantage of IBM Watson AI technology

- Provides real-time alerts of dark web activity

- Up to $1 million in insurance against dark web identity theft

Cyberspace is like the Wild West. Honest pioneers build upstanding communities, yet there’s lots of room for criminals to roam free! Identity thieves can connect on the dark web, a network of sites not found through Google or other search engines. There a person can sell stolen Netflix logins, for example, and be pretty confident that authorities won’t find their location.

Some common sorts of data to sell on the dark web are account logins, SSNs, driver’s license data, medical account numbers, bank account numbers, and credit card numbers. If this data is leaked on the dark web, mitigating the damage can be pretty difficult. You’ll likely need to change your passwords and keep an eye on your accounts and credit scores for a few months to make sure no one is using it for nefarious purposes.

The best identity theft protection services include dark web monitoring and alerts about stolen records. With timely notification you can change your passwords, freeze your credit, and/or take other steps to avoid serious consequences of ID theft.

Types of Information Leaked on the Dark Web

| Credit/debit card information | Numbers, CVVs |

|---|---|

| IDs | Licenses, passports, etc. |

| Account logins | Emails and passwords |

| Medical records | Insurance, history, prescriptions |

| Certifications | Fake diplomas |

Each plan below combines dark web monitoring with a wealth of other features. Comparing ID protection plans, you’ll see that some include $1,000,000 in stolen funds insurance with no deductible. The best plans also guarantee expert US-based help 24/7 in case your identity is stolen.

Best Dark Web Monitoring

- LifeLock - Best Web Alerts

- Aura - Most Comprehensive

- Identity Guard® - Best With AI Protection

- Surfshark Alert - Best for Monitoring Unlimited Identities

- IdentityForce - Best With Credit Monitoring

- ID Watchdog - Best Value Dark Web Monitoring

- Experian IdentityWorks - Best Dark Web Scan

Detailed List of the Best Dark Web Monitoring

-

1. LifeLock - Best Web Alerts

Product Specs

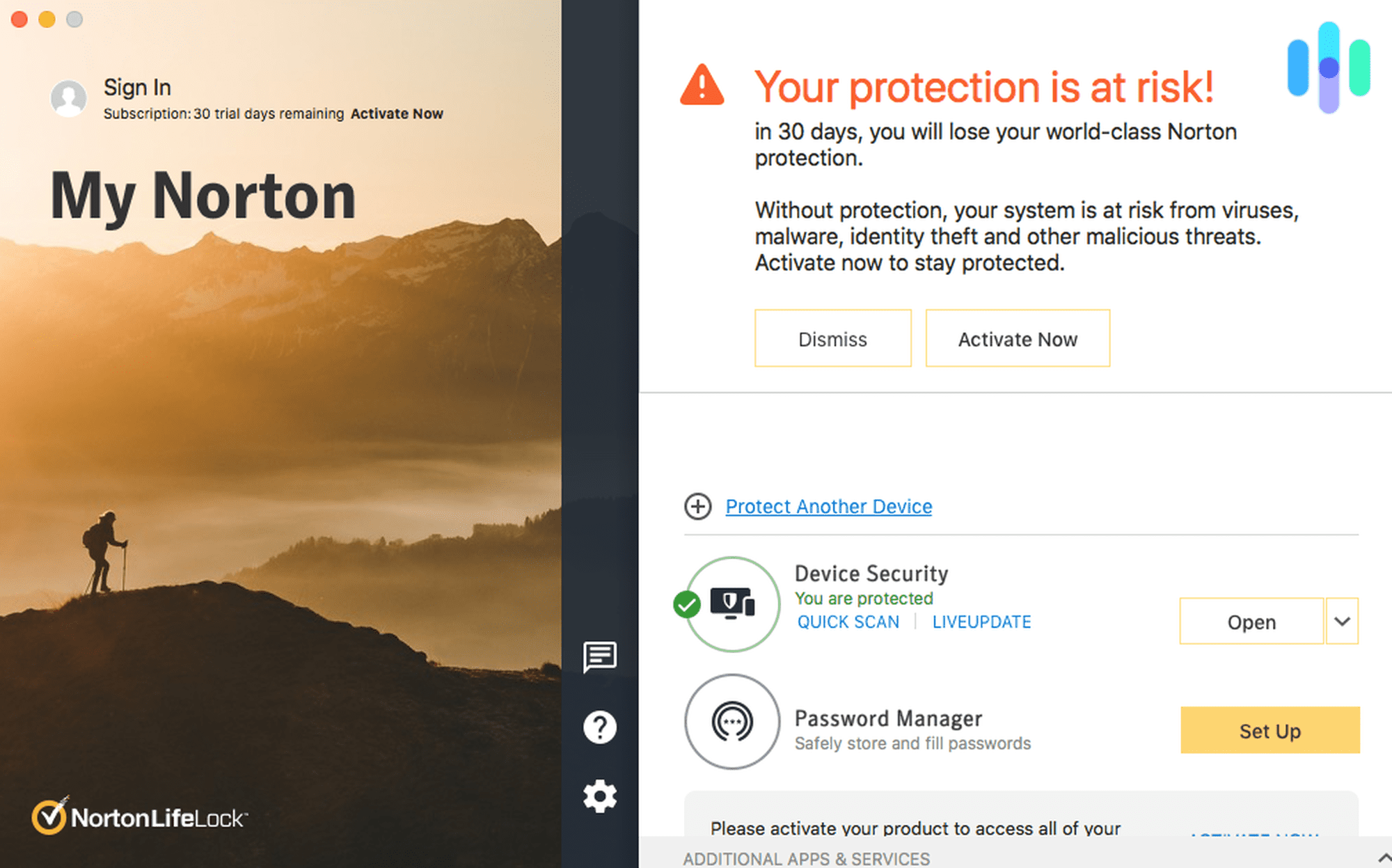

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 30-day Individual Monthly Plans $3.33 and up Family Monthly Plans $18.49 and up LifeLock is an ID protection company owned by Symantec, the maker of Norton antivirus software. This relationship helps LifeLock offer excellent proactive identity protection, as every subscription includes Norton 360 to strengthen your online privacy and quickly alert you about data breaches found with dark web scanning.

A LifeLock subscription can protect five, 10, or unlimited desktop and mobile devices with a VPN (virtual private network) and other Norton 360 features such as:

- The industry’s best dark web alerts about identity breaches

- Anti-phishing technology for desktop and mobile devices

- Cloud storage to backup your files

Prices start at $9.99/month with LifeLock Select. This affordable plan covers up to five devices. Additionally it provides:

- Credit alerts based on Equifax data

- Lost wallet protection (Get help cancelling and replacing cards)

- $25K in stolen funds insurance

- $25K insurance for personal expenses compensation

- $1M policy for expert assistance with your identity restoration

Upgrading to LifeLock Ultimate Plus for $25.99/month is worth considering. It adds real-time credit monitoring and frequent reporting. Features are listed below.

List of LifeLock Ultimate Plus Features

The main types of services from LifeLock can be categorized as credit monitoring and reporting, dark web scanning, cybersecurity, ID theft insurance, and expert identity restoration. Furthermore LifeLock can check social media and crime databases for imposters.

Here are some main benefits with the Ultimate Plus deal:

- Norton 360 for dark web monitoring, anonymous browsing, anti-phishing, device backup and more

- Three-bureau credit monitoring

- Monthly one-bureau credit report

- Annual three-bureau credit scores and reports

- Banking and investment alerts

- Lost wallet protection

- Alerts about crimes tied to your name

- Alerts about convicted sex offenders near your home

- Social media monitoring for fake accounts

- Stolen funds reimbursement up to $1M

- Personal expense compensation up to $1M

- Payment for lawyers and other experts up to $1M

You can also sign up for a special LifeLock remediation service for expert assistance if you’ve been a victim of identity theft within the past 12 months. This involves giving LifeLock power of attorney to handle the mess. It can save you lots of time and stress.

To review, LifeLock is a top choice for ID protection with Norton 360 on all your desktop computers and mobile devices. Norton 360 for LifeLock scans the dark web, sends mobile and desktop alerts, gives you a VPN and more. The LifeLock Ultimate Plus deal adds three-bureau credit monitoring, social media monitoring and more, along with a generous compensation/assistance package in case of fraud.

-

2. Aura - Most Comprehensive

Product Specs

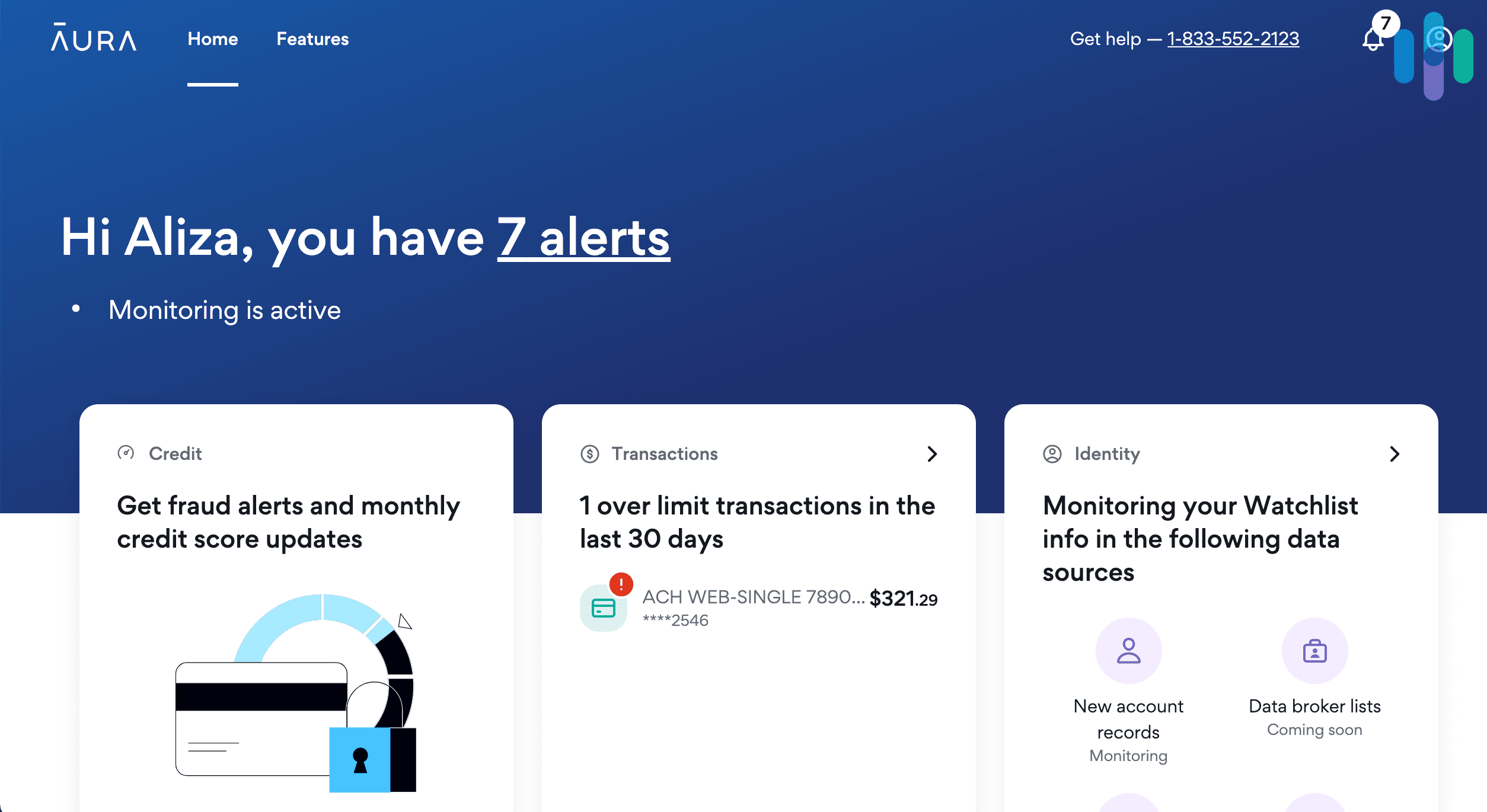

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 14-day Individual Monthly Plans $12 Family Monthly Plans $45 Aura is an all-in-one service, offering identity theft monitoring, credit monitoring, and preventative measures like antivirus software and a VPN. The company keeps a close eye on the dark web, and it searches for data breaches from companies you do business with. Finally, it provides near-real time notification so you can respond immediately to any problems. We can that comprehensive coverage.

Three Kinds of ID Protection

Lots of identity theft companies monitor the dark web to make sure no one is trafficking your PII (personally identifiable information). Aura goes further. It isn’t just looking PII like your Social Security number and birthdate. It’s also scanning constantly for information about your bank accounts, credit cards, and property titles.

In addition to protecting from identity theft and financial fraud, Aura safeguards you before your data winds up on the dark web, with antivirus software, a password manager, and a fully equipped VPN. If you’re keeping count, that’s three distinct levels of protection: identity, financial, and device protection.

Aura Pricing

Aura pricing is simple. The company offers three plans: one for individuals, one for couples, and one for families. You get the same great features with all three plans, including criminal and court records monitoring, credit lock, and lost wallet protection. The only difference between them is that you get more ID theft insurance and more device coverage with the larger plans. Of course, you’d expect that since these plans cover more people.

Plan Individual Couple Family Monthly cost $12 $20 $30 Monthly cost with annual plan $9 $17 $25 Number of individuals covered $1 $2 5 Number of devices covered $10 $20 50 ID insurance $1 million $2 million $5 million Child SSN monitoring No No Yes List of Aura Features

Aura’s features can be divided into three categories. They offer identity theft monitoring, financial fraud protection, and device and online security. Features include:

- White glove fraud resolution

- 24/7 phone and email customer support

- Online account monitoring

- SSN monitoring

- Spam call, junk mail, and people search site removal

- ID verification monitoring

- Criminal and court records monitoring

- Home title and address monitoring

- Lost wallet remediation

- Antivirus software

- VPN

- Bank account monitoring

- Financial transaction monitoring

- Credit lock

- 401k investment monitoring

- Monthly credit score

- Annual credit reports

To sum it all up, Aura provides total identity theft protection, including dark web scanning. In addition, though, the company provides financial monitoring services plus some preventative features like a VPN and antivirus. The pricing structure is simple, and plans start at just $12 a month for individuals.

-

3. Identity Guard® - Best With AI Protection

Product Specs

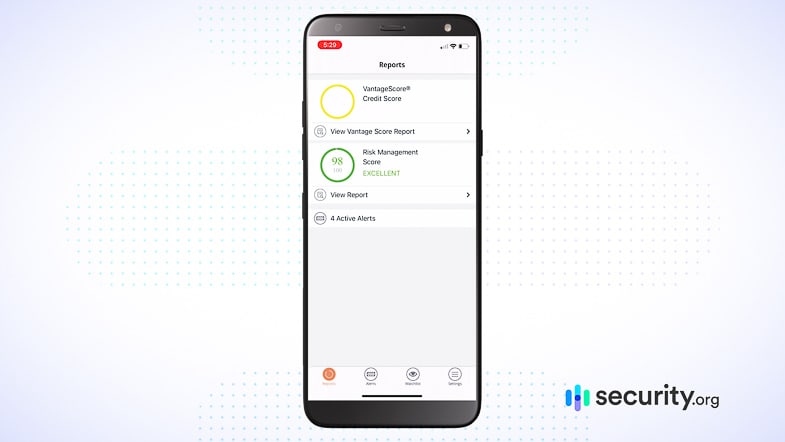

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 30-day Individual Monthly Plans $7.50 and up Family Monthly Plans $12.50 and up Identity Guard is a longstanding ID protection company based in Fairfax County, Virginia. Nearly 50 million individuals and families have chosen Identity Guard, and the company has an A+ rating with the BBB. It’s our winner for best dark web monitoring overall since they have IBM Watson on their team. For as low as $7.50/month you can get an ID protection suite that includes the benefit of IBM Watson’s dark web scans. Upgrading to an Identity Guard Premier plan, you’ll additionally get the benefit of real-time alerts from all three credit bureaus.

About IBM Watson

IBM Watson is a world-renowned brand of supercomputer with advanced artificial intelligence. Six Watson supercomputers are in use as of 2019. Working for the security industry, IBM Watson artificial intelligence constantly scans the dark web for data about identity fraud. Identity Guard subscribers can get virtually real-time personalized alerts with a mobile app.

For instance, IBM Watson might tip off Identity Guard that your password to a particular site is for sale online. In response you can change your password and take other steps that Identity Guard might recommend with its alert. Watson also checks for news about data breaches that may affect you, and it can warn you about new email phishing trends and other identity fraud scams to avoid.

Identity Guard Prices

Monthly plans with the benefit of IBM Watson start at just $7.50 for individuals or $12.50 for families with the Identity Guard Value Plan. A Value Plan can also:

- Alert you to suspicious activity noted by all three credit bureaus

- Provide up to $1M in lost funds compensation

- Pay for identity theft recovery

Upgrading to Identity Guard Premier, you’ll also get monthly TransUnion credit scores and will automatically receive three-bureau credit reports annually.

Premier service costs $20.83 for one adult, or $29.17/month for all family members at one address.

List of Identity Guard Features

The main categories of Identity Guard benefits are credit monitoring and reporting, dark web scanning, cybersecurity, identity theft insurance, and coverage for expert identity restoration. Features of Identity Guard Premier include:

- IBM Watson artificial intelligence

- Three-bureau credit change monitoring

- Monthly TransUnion credit score

- Annual three-bureau credit reports

- Bank account monitoring

- Mobile app

- Safe browsing and anti-phishing tools

- Social media risk report

- $1 million insurance (combined) for stolen funds and legal assistance

- $10,000 insurance for lost wages

- $2K family care expenses related to ID theft

- $1K travel expenses

- Dedicated case manager

To review, Identity Guard is a top recommendation for ID protection with the power of IBM Watson artificial intelligence for detecting dark web data caches. The Premier plan is most proactive with real-time alerts from Equifax, Experian, and TransUnion. It costs about $20/month for an individual and $30/month for a family.

-

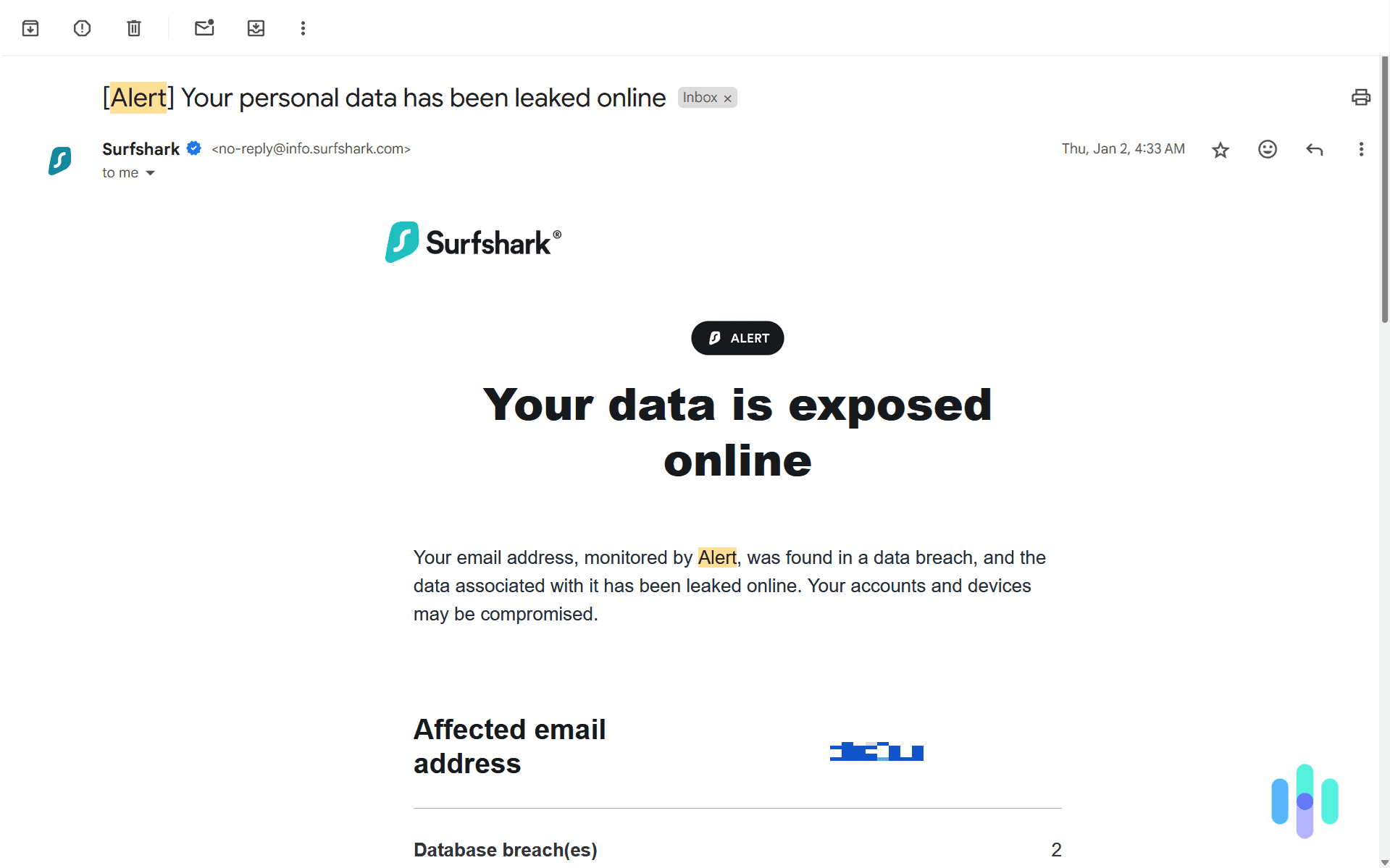

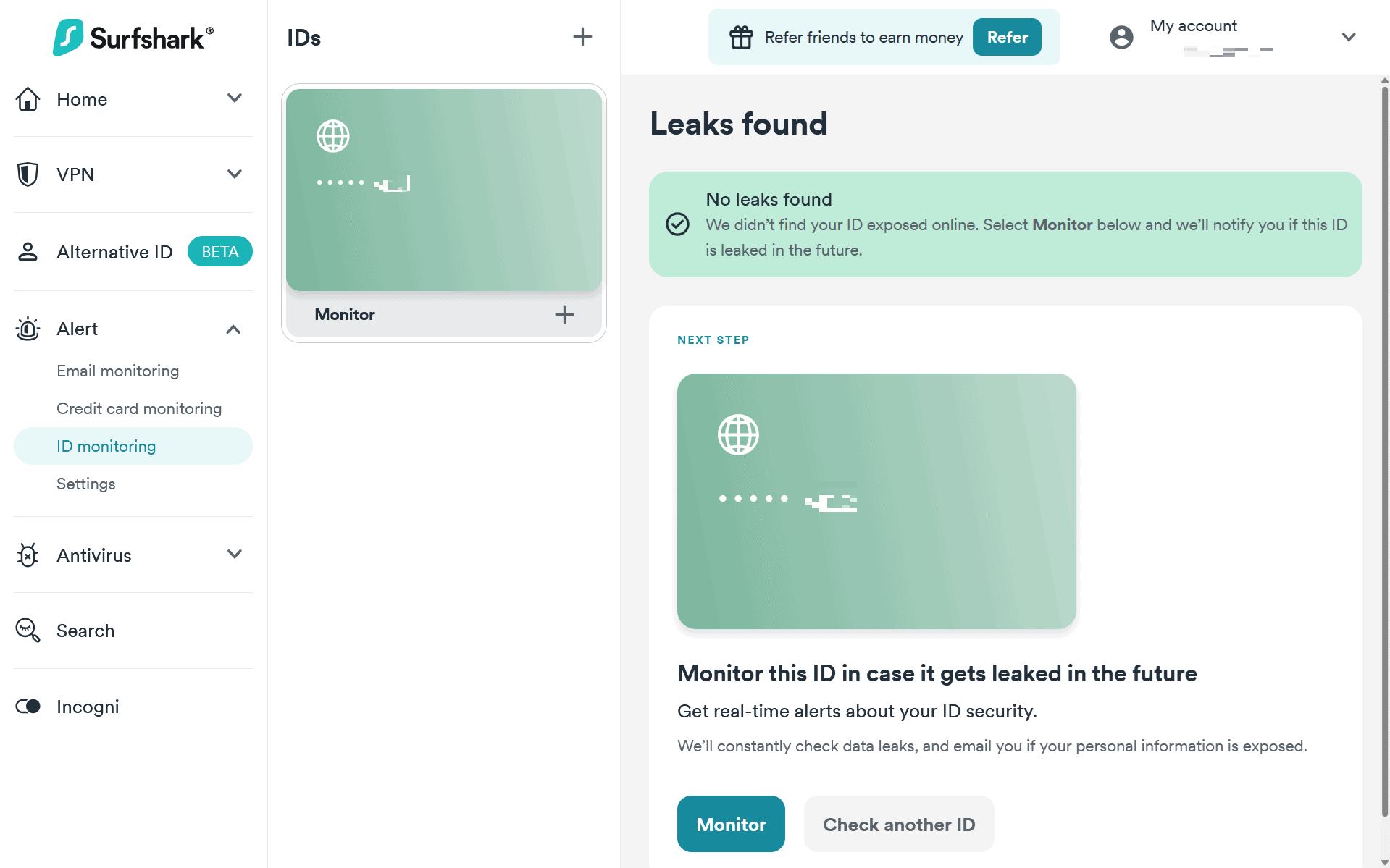

4. Surfshark Alert - Best for Monitoring Unlimited Identities

View Packages Links to Surfshark.comProduct Specs

Dark Web Monitoring Yes Credit Reporting No Insurance Coverage No Free Trial 30-day money-back guarantee Individual Monthly Plans $2.69 and up Family Monthly Plans $2.69 and up After running a scan on our SSN and finding no leaks, we added it to Surfshark Alert’s active monitoring. With Surfshark Alert, you can monitor as much information as you want. They let you monitor any ID numbers, credit cards, or email addresses. That extends to other people as well. So, one subscription can get you and your entire family dark web monitoring. While we were testing Surfshark Alert, we chose to have our SSN and our passport number actively monitored. When Surfshark finds a piece of your information in a compromising spot, they send you an email and notify you on their web dashboard.

Surfshark Alert Prices

Buying a Surfshark Alert subscription means buying a subscription to Surfshark VPN and Surfshark Antivirus at a minimum. Check out our Surfshark VPN review and our Surfshark Antivirus review to see how much value they add. You might think that means it’s expensive, but we spend less on Surfshark than any other identity theft protection service we test. Here’s an overview of Surfshark’s plans that include Alert:

Surfshark Plan Surfshark One Surfshark One+ VPN Yes Yes Antivirus Yes Yes Alert Yes Yes Incogni No Yes Monthly plan $17.95 $20.65 Annual plan $50.85 ($3.39 per month) $91.35 ($6.09 per month) Two-year plan $72.63 ($2.69 per month) $115.83 ($4.29 per month) FYI:

After we tested Incogni, it became one of our favorite data removal services. It uses an automated algorithm to quickly request the removal of your information from data brokers and people search sites. That can help prevent your information from ending up on the dark web.

List of Surfshark Alert Features

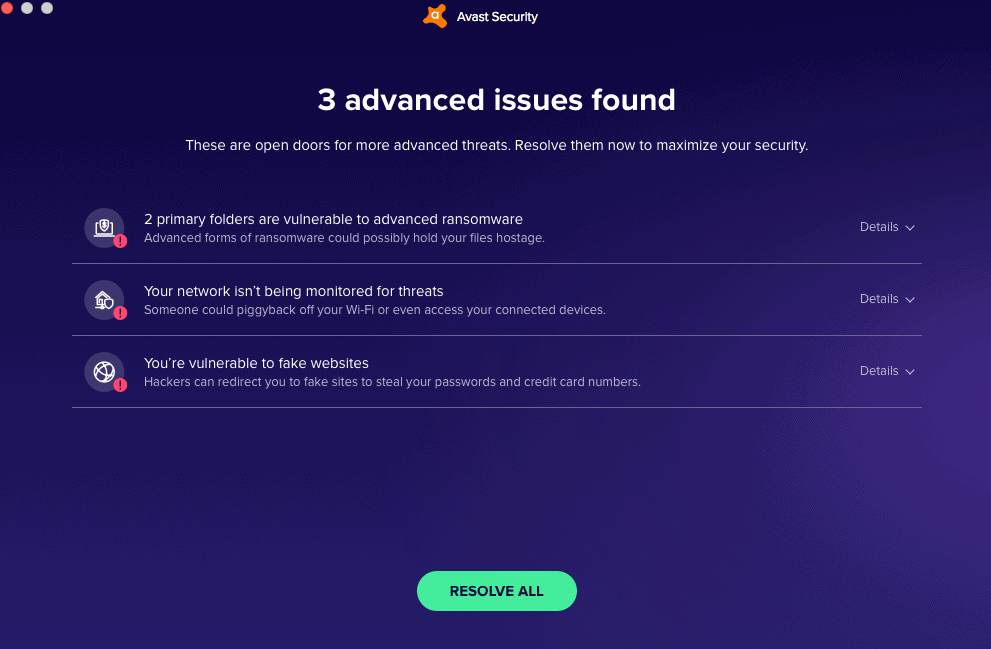

While we were testing Surfshark Alert, our data was found in a data breach. Here’s the notification they sent. Where Surfshark excels is in their online protections to prevent your data from showing up on the dark web in the first place. Here are the features included in a Surfshark Alert subscription:

- Email monitoring

- Credit card monitoring

- ID monitoring

- Scheduled data breach reports

- VPN with over 3,200 servers

- Antivirus software

- Pop-up and ad blocker

- Masked email generator

- Personal detail generator

- Data broker and people search site removal (if subscribed to Surfshark One+)

Pro Tip: The masked email and personal detail generators came in handy more than once during our tests. Using them, you can sign up to test new services without giving out any of your actual details. That reduces the risk of your data becoming compromised in a data breach.

-

5. IdentityForce - Best With Credit Monitoring

Product Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 30-day Individual Monthly Plans $19.90 and up Family Monthly Plans $39.90 and up IdentityForce is an antifraud company that serves individual, family, and corporate accounts. It’s our favorite option for comprehensive ID protection that includes dark web monitoring, online protection, on-demand credit scores, stolen funds insurance, and more.

One benefit to subscribers is IdentityForce’s scanning of indexed and unindexed or “dark” sites. For instance, a scan might find that your medical insurance ID number is for sale, and IdentityForce will inform you quickly by text alert. With their highly secure mobile app you can immediately get details and take recommended actions. This service is part of the IdentityForce UltraSecure Plan, which costs $14.99/monthly if you choose yearly service, or $17.99 month-to-month.

The best ID theft protection plan, UltraSecure + Credit, augments dark web searches with three-bureau credit alerts. Furthermore it lets you check your credit scores with all three bureaus anytime. Obviously this can help alert you to trouble, plus it lets you know when it’s best to apply for more credit. A credit improvement simulator included with this plan can also help raise your credit score. The rate is $19.99/month with a yearly deal, or $23.99 month-to-month.

Both IdentityForce plans include up to $1,000,000 in stolen funds insurance and fully-managed ID restoration.

Online Protection with IdentityForce

A subscription to IdentityForce can provide dark web monitoring, real-time credit scores, anti-phishing software, stolen funds insurance, cyberbully detection, and more. Here are the main features of the best plan, UltraSecure + Credit:

- Dark web scanning

- Social Security Number tracking

- Change of address alerts

- Anti-phishing and anti-keylogging software

- Three-bureau credit monitoring

- Banking and investment alerts

- Three-bureau credit reports anytime

- Credit simulator to guide financial choices

- Lost wallet assistance

- Medical ID fraud protection

- Alerts about registered sex offenders

- Social media fraud monitoring

- Cyberbully alerts and support

- $1M stolen funds insurance

- Fully managed identity restoration

To review, IdentityForce is a top value for comprehensive identity theft protection. It’s especially appealing if you like to check your credit scores often. A free 14-day trial lets you experience their service with credit monitoring, cyberbully alerts, dark web scans and more.

-

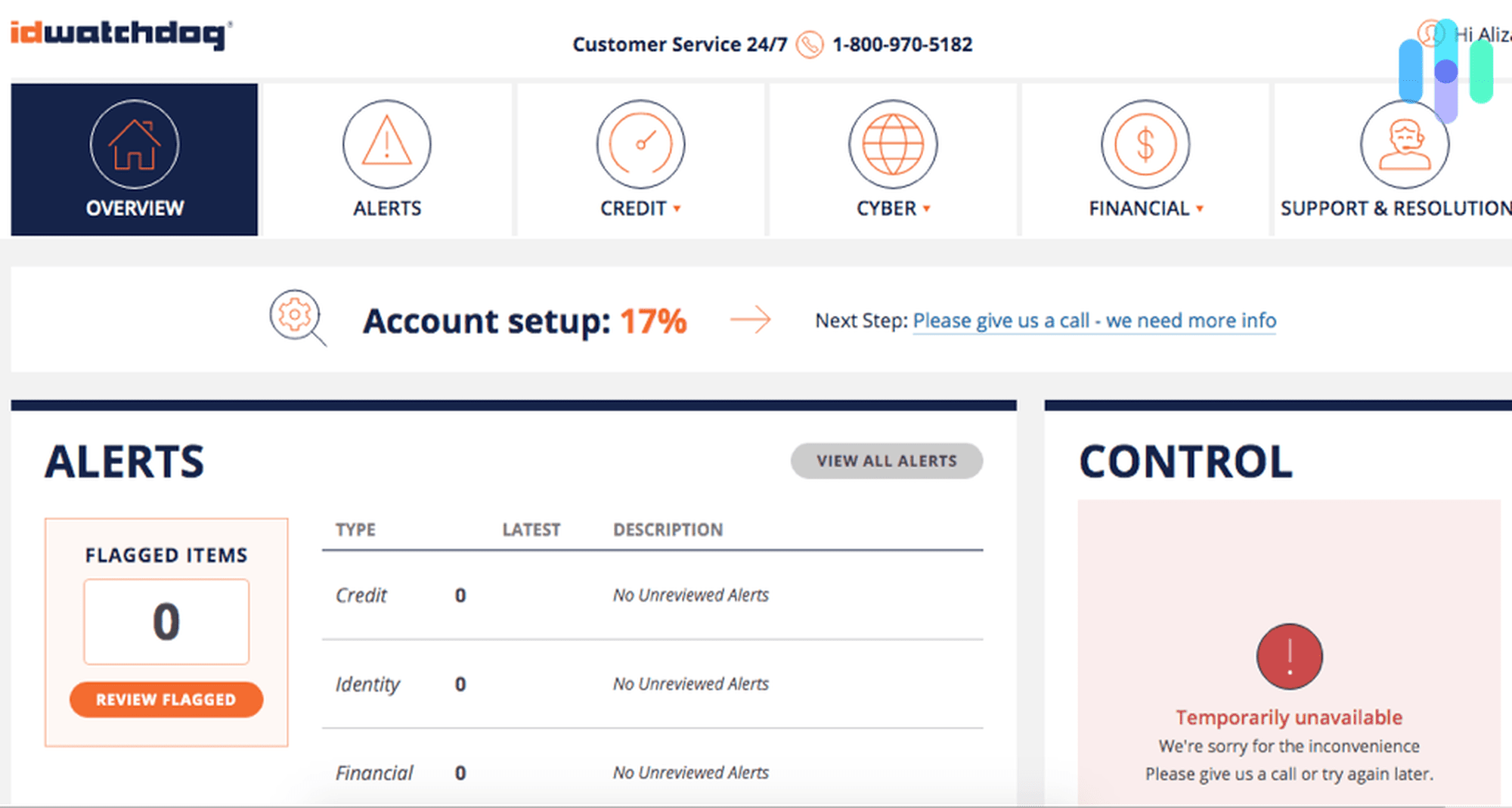

6. ID Watchdog - Best Value Dark Web Monitoring

Product Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 30-day Individual Monthly Plans $12.50 and up Family Monthly Plans $20 and up With great service starting under $14 month-to-month, ID Watchdog is another best value in identity protection with dark web monitoring. This offshoot of Equifax can provide Equifax credit score tracking, three-bureau credit alerts, and annual three-bureau credit reports. You can get alerts by text, mobile push notification, email, and/or telephone. Assistance is available in about 100 languages, and ID Watchdog gets great ratings for customer service. Support is available at any hour, 365 days/year.

Combined with ID Watchdog’s mobile app, their dark web monitoring and credit alerts can help you detect identity fraud… and if you do become a victim, ID Watchdog will see your case through resolution with a dedicated case manager. Each plan includes a $1 million insurance policy to cover stolen funds and out-of-pocket expenses related to restoring your identity and credit. Additionally the Platinum plan provides $500,000 insurance for your 401K and HSA.

Also impressive is ID Watchdog’s social media monitoring. It keeps an eye on social sites and alerts you if someone posts content that could hurt your reputation. Furthermore with family accounts, parents can get alerts and support if their children are involved in cyberbullying on Facebook, Instagram and other platforms.

As for credit monitoring, ID Watchdog Plus is limited to Equifax credit alerts. Upgrading to the Platinum plan adds triple-bureau alerts, triple-bureau annual reports, and live Equifax score tracking.

ID Watchdog Prices

The Plus plan for one adult costs $14.95 month-to-month or $13.66/month with a yearly deal. Family rates start around $25 monthly.

Premium for an individual costs $19.95 month-to-month or $18.25/month with a 12-month deal. Family rates start around $35 monthly.

A maximum of two adults and four children can share a plan.

List of ID Watchdog Platinum Features

The Platinum ID Watchdog plan combined with safe browsing can give you comprehensive identity protection. Benefits can mostly be classified as searching for stolen information, monitoring and reporting credit, reimbursing stolen funds/investments, and assisting with identity fraud resolution. ID Watchdog also sends alerts about registered sex offenders, guards mailboxes against junk mail, and more. Features include:

- Dark web monitoring

- Payday lender monitoring

- Public records and social media monitoring

- Three-bureau monitoring

- Daily Equifax credit score tracking based on Vantage data

- Annual three-bureau reports with VantageScore 3.0

- Mobile app available for alerts and responses

- Lost wallet assistance

- Credit freeze assistance

- Registered sex offender reporting

- Junk mail reduction

You can try ID Watchdog free for two weeks. You’ll get Equifax credit score tracking very quickly, and three-bureau monitoring can be active within a few days.

-

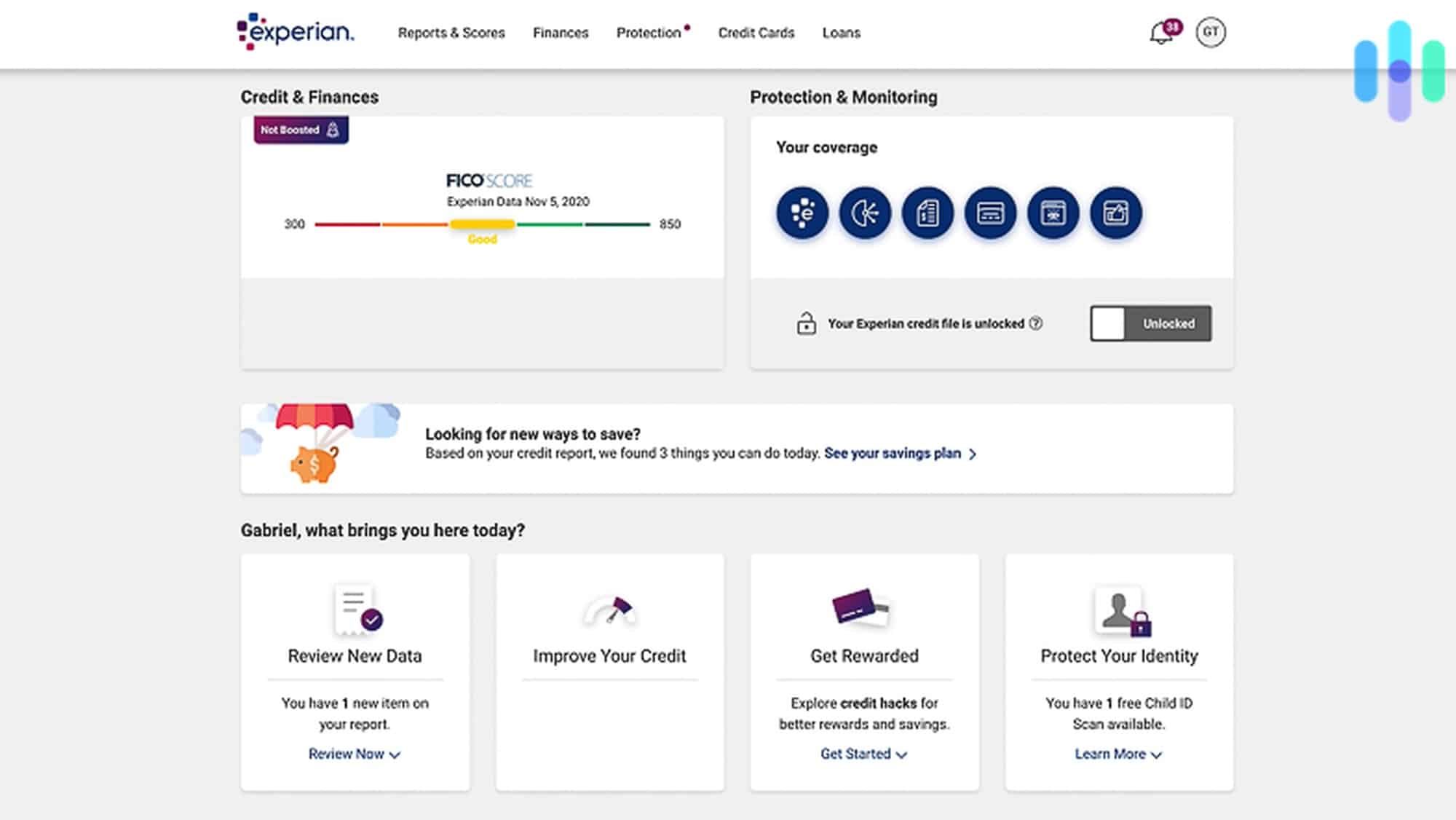

7. Experian IdentityWorks - Best Dark Web Scan

Product Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 30-day Individual Monthly Plans Starting at $24.99 per month Family Monthly Plans $34.99 and up The credit bureau Experian helps protect against fraud with Experian IdentityWorks. They offer the best ID protection with FICO reporting, as you can get daily Experian FICO scores and quarterly FICO credit scores from all three bureaus. Premium membership also makes it easy to lock/unlock your Experian report anytime. Combined with Experian’s dark web scans and other proactive services, an IdentityWorks subscription can help you prevent and minimize the mayhem wrought by identity theft.

Policies provide up to $1,000,000 in compensation for stolen funds. Additionally, IdentityWorks can reimburse you for child care and other expenses incurred as a result of spending time on identity restoration.

The cheapest option with dark web surveillance starts at just $9.99/month. Prices for Premium plans, which combine the best FICO reporting and dark web scans, are:

- $19.99 month to month for an adult

- $24.99 for one adult and up to 10 children

- $29.99 for two adults and up to 10 minors

Opting for a yearly deal will cut the rates by about 20%.

List of Experian IdentityWorks Premium Features

An Experian membership gives ID theft protection in the main categories of financial accounts monitoring and reporting, credit improvement, dark web scans and other cyber surveillance, and records checking. Their compensation package in case of ID theft is generous.

- Dark web surveillance

- P2P network checks

- Bank account and credit card alerts

- Lost wallet assistance

- Address change verification

- Payday lender monitoring

- Court records monitoring

- Social network monitoring

- Sex offender registry reports

- Daily Experian credit score

- Quarterly three-bureau reports

- $1M insurance limit

- $1,500 weekly lost wages replacement, up to five weeks

- $2,000 family care coverage

- Dedicated US-based case manager

The first 30 days of Experian IdentityWorks membership are free. Month-to-month and yearly plans are available.

Review of ID Theft Protection with Dark Web Monitoring

As explained above, dark web monitoring is included with ID protection plans priced under $10/month for an individual. These extra-affordable plans also include stolen funds insurance, expert case management and other benefits. The absolute best identity theft protection with dark web monitoring comes with slightly higher priced deals that include credit alerts and other additional features. Expect to spend about $20 month-to-month for individual coverage, or save per person with annual service and/or a family ID protection plan.

FAQs about Identity Theft Protection with Dark Web Monitoring

-

If I’ve never been on the dark web, do I need dark web monitoring?

Just because you’ve never been on the dark web doesn’t mean your personal information can’t end up there. More often than not, the person who steals your personal information isn’t actually the one who uses it. Instead, they sell it on the dark web or other black market channels for someone else to use.

-

What does dark web monitoring do?

Basically, these services monitor common dark web marketplaces for any details related to your personal information. Any time they find a piece of your information, you get an alert of the leak which lets you take action before your information gets sold to someone who might actually use it.

-

What should I do if my information gets leaked on the dark web?

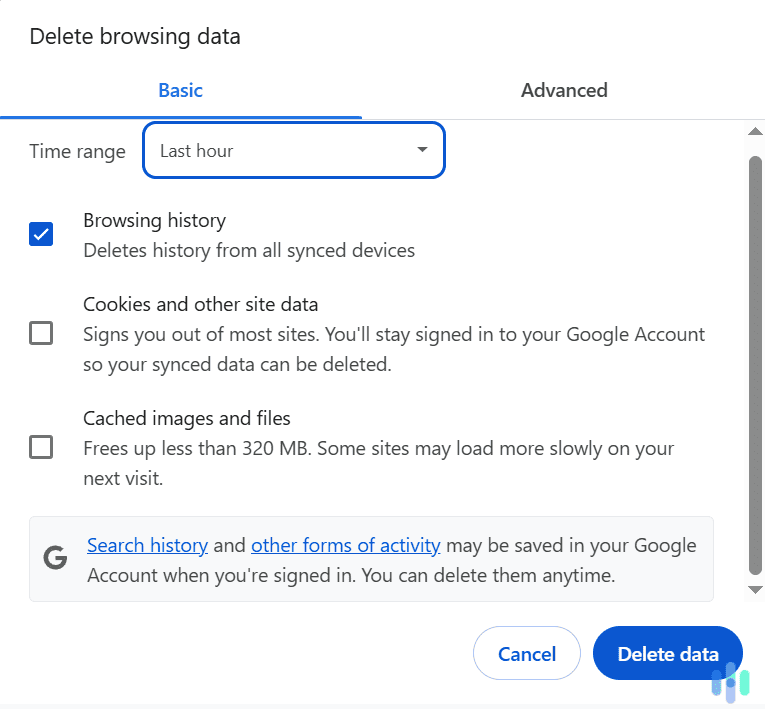

When you get an alert that your information was leaked on the dark web, immediately change all of your passwords. That should always be your first step. From there, add extra security measures to all of your accounts like 2-factor authentication.

-

Is dark web monitoring expensive?

Generally, dark web monitoring isn’t too expensive. In fact, a lot of companies include it with their standard identity theft protection plans. More advanced services might require a mid-tier or top-tier subscription to get dark web monitoring, but we find it well worth the extra cost for the peace of mind.

-

How can I keep my information safe?

Even if you take every cybersecurity measure to protect your information, everyone is vulnerable to a leak of their information. You have to trust third-parties with your logins and those third-parties can leak your data. But, adding multi-factor authentication and regularly changing your passwords reduces your risks significantly.

Disclaimer: This content is not provided or commissioned by the companies referenced in this article. Opinions expressed here are the author’s alone and have not been reviewed, approved or otherwise endorsed by the companies mentioned. We may be compensated through advertiser affiliate programs.