Best Identity Theft Protection with Credit Reporting

Our number one pick, LifeLock, provides annual credit reports, real-time alerts, and monthly credit scores.

- Offers a VantageScore each month for credit tracking

- One subscription provides credit monitoring on all your devices

- Includes bank account alerts and lost wallet protection

- Offers a VantageScore each month for credit tracking

- One subscription provides credit monitoring on all your devices

- Includes bank account alerts and lost wallet protection

- Provides annual reports from all three major credit bureaus

- Real-time credit alerts via the Identity Guard app

- Monthly credit scores from TransUnion

- Provides annual reports from all three major credit bureaus

- Real-time credit alerts via the Identity Guard app

- Monthly credit scores from TransUnion

- Available family plans monitor your spouse’s and children’s credit in addition to your own

- Issues instant fraud alerts

- Provides up to $1 million in credit fraud insurance

- Available family plans monitor your spouse’s and children’s credit in addition to your own

- Issues instant fraud alerts

- Provides up to $1 million in credit fraud insurance

All of the best identity theft protection services include credit reporting. With credit reporting as a feature, these services give you real-time activity alerts and frequent credit score updates from the major credit bureaus Equifax, Experian and TransUnion. These features can help you stop unauthorized loans, spending sprees in your name, and other identity theft crimes.

Along with credit monitoring and reporting, the best ID protection companies scan the dark web, monitor payday lenders, and take other proactive measures against identity fraud. For more details on the features you should look for in your identity theft protection service, make sure to read our guide to identity theft protection. If your identity is compromised they’ll provide up to $1,000,000 in stolen funds replacement and will cover expenses for expert restoration of your identity and credit record.

The seven companies below have the market’s best identity theft protection deals with credit reporting included. Plans for individuals and families cost around $20 to $35 per month. You can choose month-by-month and yearly subscriptions with free trials.

What Features We Looked For

| Credit monitoring | Scores, reports |

|---|---|

| Identity monitoring | Online, public records |

| Insurance coverage maximum | $500,000-$1 million |

| Child coverage | 10 minors maximum |

>> Also read: Preventing Tax Identity Theft

Types of Credit Monitoring and Reporting

Credit reporting varies from plan to plan. Here are three important differences to keep in mind as you shop:

- Besides making your credit reports available to you, the best ID theft protection companies monitor all three credit bureaus for signs of suspicious activity. They can send you alerts by phone call, text, and email right away.

- Some plans provide a single-bureau credit score (i.e., from Equifax, Experian, or TransUnion). Others provide scores from two or three bureaus. Companies this year give you FICO 8 or VantageScore 3.0 scores.

- The frequency of your credit score updates varies will vary from plan to plan. Monthly updates are most common with the best plans. Daily credit score updates are available too.

Best ID Protection with Credit Reporting

- LifeLock - Best Credit Reporting & Scores

- Identity Guard® - Best Credit Reporting Overall

- Aura - Best Credit Reporting for Families

- Surfshark Alert - Best Digital Protection

- IdentityForce - Best Credit Score Tracker

- ID Watchdog - Best Value Credit Reporting

- Experian IdentityWorks - Best Credit Reporting with FICO

Detailed List of the Best ID Protection with Credit Reporting

-

1. LifeLock - Best Credit Reporting & Scores

Product Specs

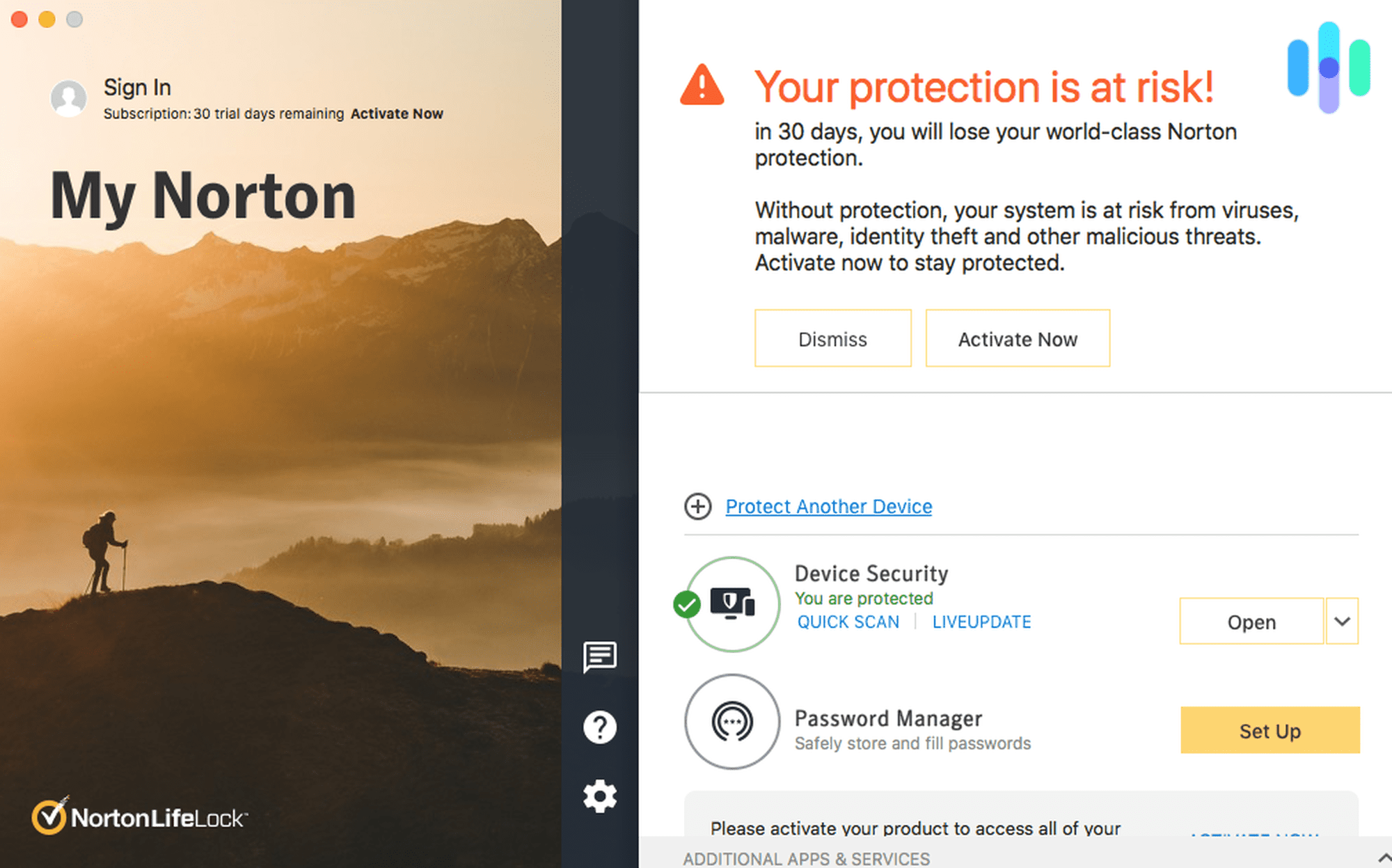

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 30-day Individual Monthly Plans $3.33 and up Family Monthly Plans $18.49 and up LifeLock has been a leading name in ID theft protection for about 15 years. LifeLock subscribers gets the benefit of Norton 360 for online protection from identity theft. Norton 360 gives you a virtual private network, and the best LifeLock plan protects all your desktop and mobile devices.

Those who choose the top-tier plan, LifeLock Ultimate Plus, additionally get some of the best credit reporting and scores in the industry. Included are:

- Monthly credit score tracking with a VantageScore 3.0 number based on Equifax data

- Annual credit reports with VantageScore 3.0 numbers that reflect Equifax, Experian and Transunion

The rate is $25.99/month for adults, and children can be added to an adult’s account for $5.99 each. The rate increases if you keep the service after 12 months. Many are convinced that it’s a smart investment. Some LifeLock Ultimate Plus benefits beyond credit monitoring are 500GB of backup for all your devices, up to $1 million in reimbursement for stolen funds, $1 million for expert assistance with identity restoration, and $1 million in personal expense compensation.

LifeLock Ultimate Plus Features

Ultimate Plus combines Norton 360 with three-bureau monitoring, bank account alerts, and many other identity protection features. Here’s a partial list of benefits:

- Constant three-bureau credit monitoring

- Annual three-bureau credit scores and reports

- 500GB device backup to cloud

- Virtual private network with anonymous browsing

- Norton antivirus software

- Dark web monitoring

- File-sharing network searches

- Banking and investment alerts

- SSN alerts

- Lost wallet protection

- Security for unlimited computers and mobile devices

- VPN (virtual private network) for unlimited devices

- Alerts about crimes tied to your name

- Alerts about convicted sex offenders in your neighborhood

- Social media monitoring for fictitious accounts

- Stolen funds reimbursement up to $1M

- Personal expense compensation up to $1M

- Coverage for lawyers and other experts up to $1M

It’s very impressive comprehensive protection for around $25/month. The antivirus protection, 500GB backup and VPN alone could be worth the investment… and then there’s the insurance policy!

LifeLock subscriptions have a 60-day money-back guarantee.

-

2. Identity Guard® - Best Credit Reporting Overall

Product Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 30-day Individual Monthly Plans $7.50 and up Family Monthly Plans $12.50 and up Identity Guard has served nearly 50 million individual and family accounts since 2001. The company maintains an A+ rating with the Better Business Bureau, and it’s our choice for best credit reporting overall considering the real-time alerts from all three credit bureaus. Three-bureau monitoring is included with the Identity Guard Premier plan, which costs $20.83/month for an individual and $29.17/month for a family, when billed annually.

With Identity Guard Premier you can receive alerts on your smartphone and take action via a highly secure mobile app. For instance, you could get instant notification that an auto dealership made a hard inquiry. If you didn’t apply for an auto loan, this would be a tipoff to identity theft! With quick action you could help prevent a criminal from riding into the sunset with a new car and your name.

Additionally with the Premier plan you’ll get annual three-bureau credit reports and monthly TransUnion reports… and if your identity is compromised, Identity Guard will replace up to $1,000,000 in stolen funds and help restore your credit record.

Other Identity Guard Features

Along with monitoring all three credit bureaus for signs of fraud, Identity Guard helps protect its subscribers with IBM Watson. A supercomputer the size of ten standard refrigerators constantly scours public and “dark web” data, processing trillions of data points per second. As an Identity Guard subscriber you’ll be alerted right away if Watson finds your credit card number, SSN or other private personal information.

To help keep your data safe as you use the web, Identity Guard Premier also provides anti-phishing and safe browsing tools.

Overall the main features of Identity Guard Premier are:

- Three-bureau credit change monitoring

- Monthly TransUnion credit score

- Annual three-bureau credit reports

- IBM Watson artificial intelligence

- Bank account monitoring

- Mobile and desktop applications

- Anti-phishing mobile app

- Safe browsing desktop extension

- Social media profile risk report

- $1 million insurance for stolen funds

- Dedicated case manager

In sum, Identity Guard is a best buy for comprehensive identity theft protection. It costs about $20/month for an individual and $30/month for families.

-

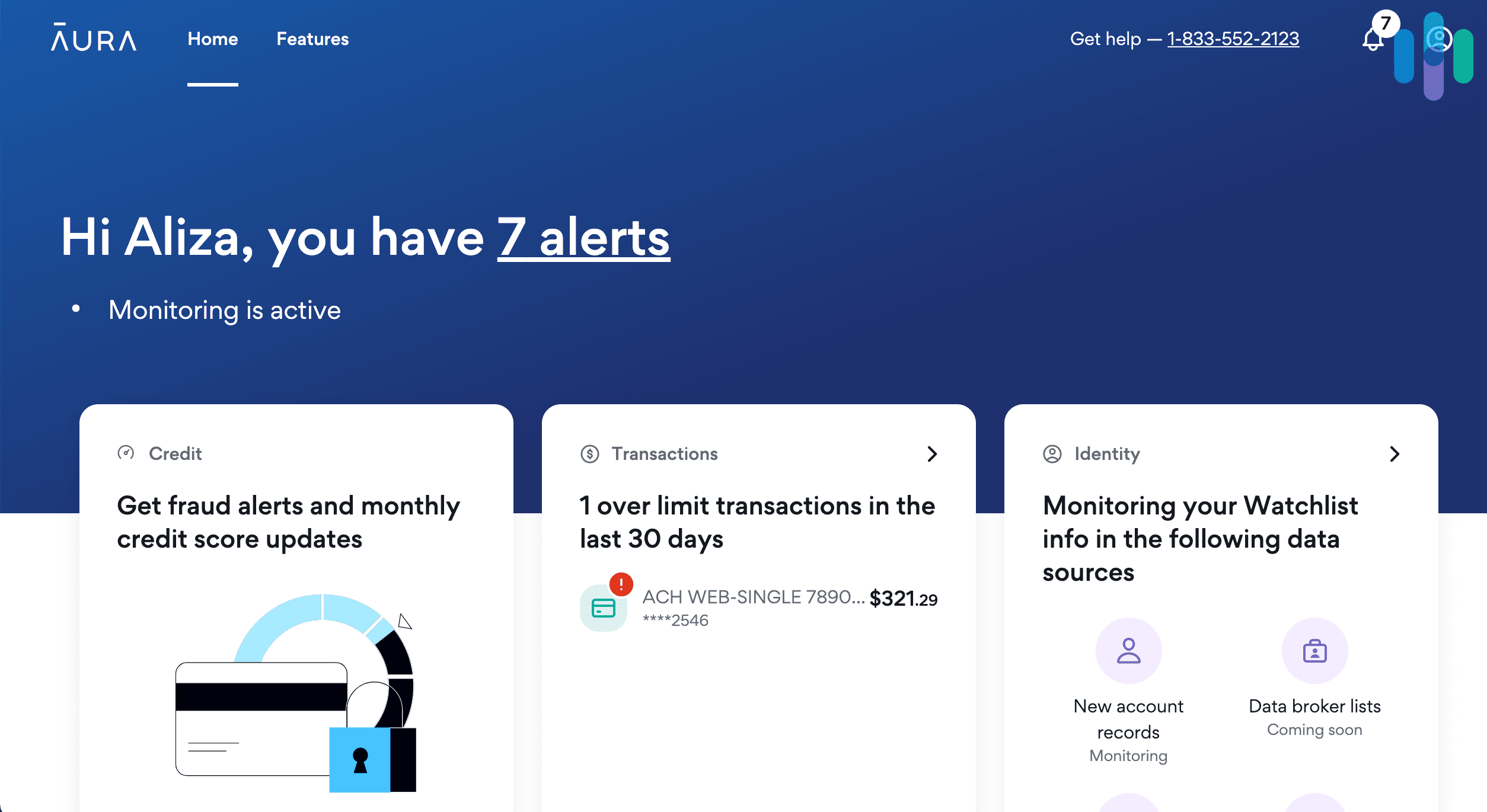

3. Aura - Best Credit Reporting for Families

Product Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 14-day Individual Monthly Plans $12 Family Monthly Plans $45 Aura is one of the most versatile identity theft protection services on the market. In fact, it’s more of a complete digital security solution. Which makes a lot of sense if you’re looking to keep yourself and your family out of the crosshairs of cybercriminals. Complete protection is the name of the game these days when fraudsters are attacking from so many different positions.

With an Aura plan you get a virtual private network (VPN), malware protection, and a password manager/vault for your personal details — in addition to triple-bureau credit and SSN monitoring for the whole family. That’s if you go with the family plan. But even if you’re just looking for top-tier identity theft protection for yourself and a spouse, you get the same protections. This isn’t usually the case with ID theft protection providers, which tend to cut some of the good stuff from their basic plans to bump you up to a more expensive tier.

The price tag for all of this digital security is strangely not as much as you’d expect. Check out our Aura pricing guide for a full breakdown. But on the yearly plan individuals and couples only pay $11-$12 per month. With a family plan ($50) you can add as many children as you want. The more kids you add, the more you save. Refreshingly, if your Aura plan doesn’t work out, you have 60 days to cancel it without paying a cent.

Here are our favorite Aura features at a glace:

- Triple-bureau credit monitoring

- Instant fraud alerts

- Round-the-clock fraud support

- Up to $1,000,000 in coverage

- Unlimited SSN monitoring for families

- VPN and antivirus software

- Password manager and vault

- Parental controls and cyberbullying protection

- Free trial with 2-month money-back guarantee

Bottom line? There isn’t much more digital security you could squeeze out of 11 bucks a month.

-

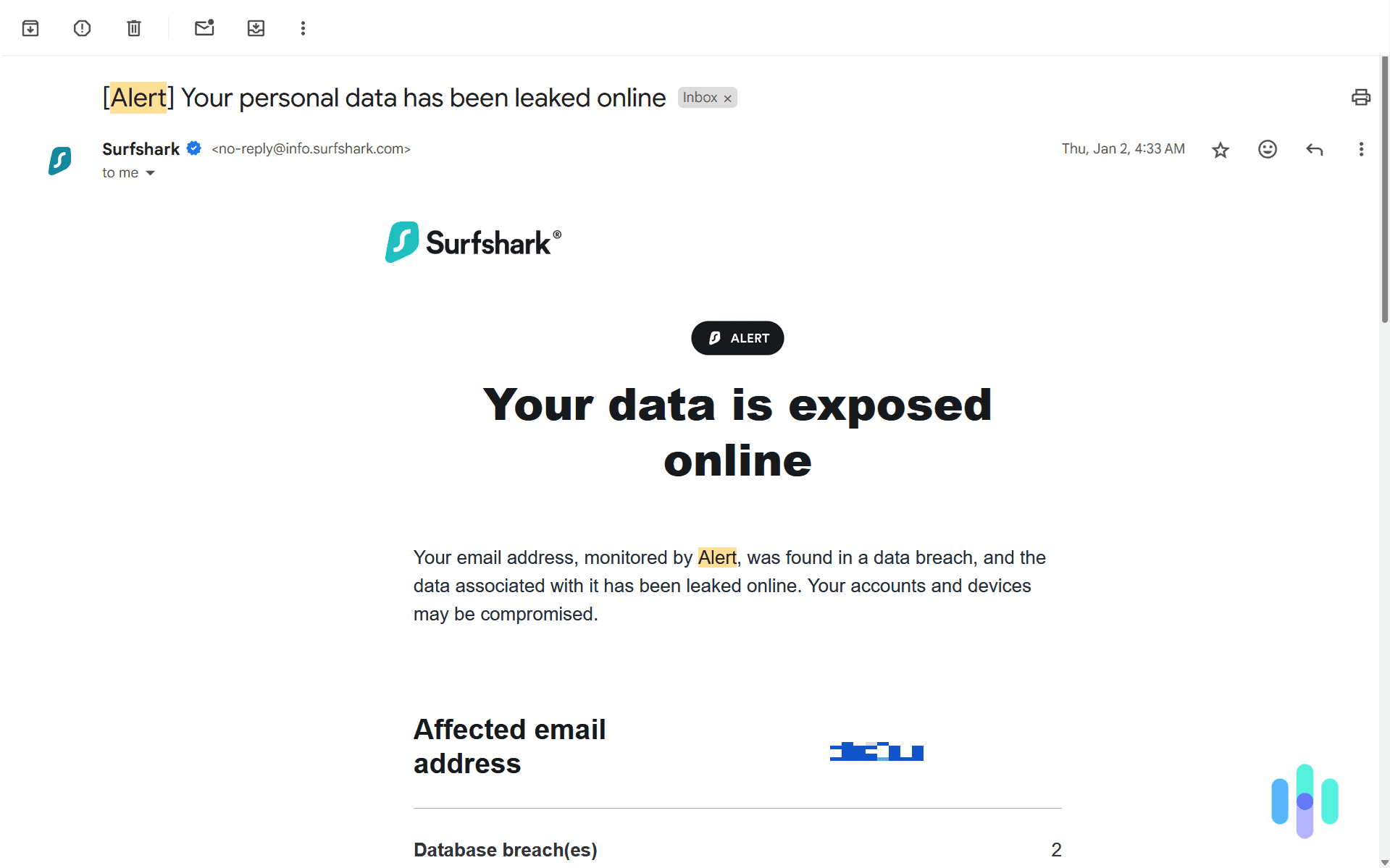

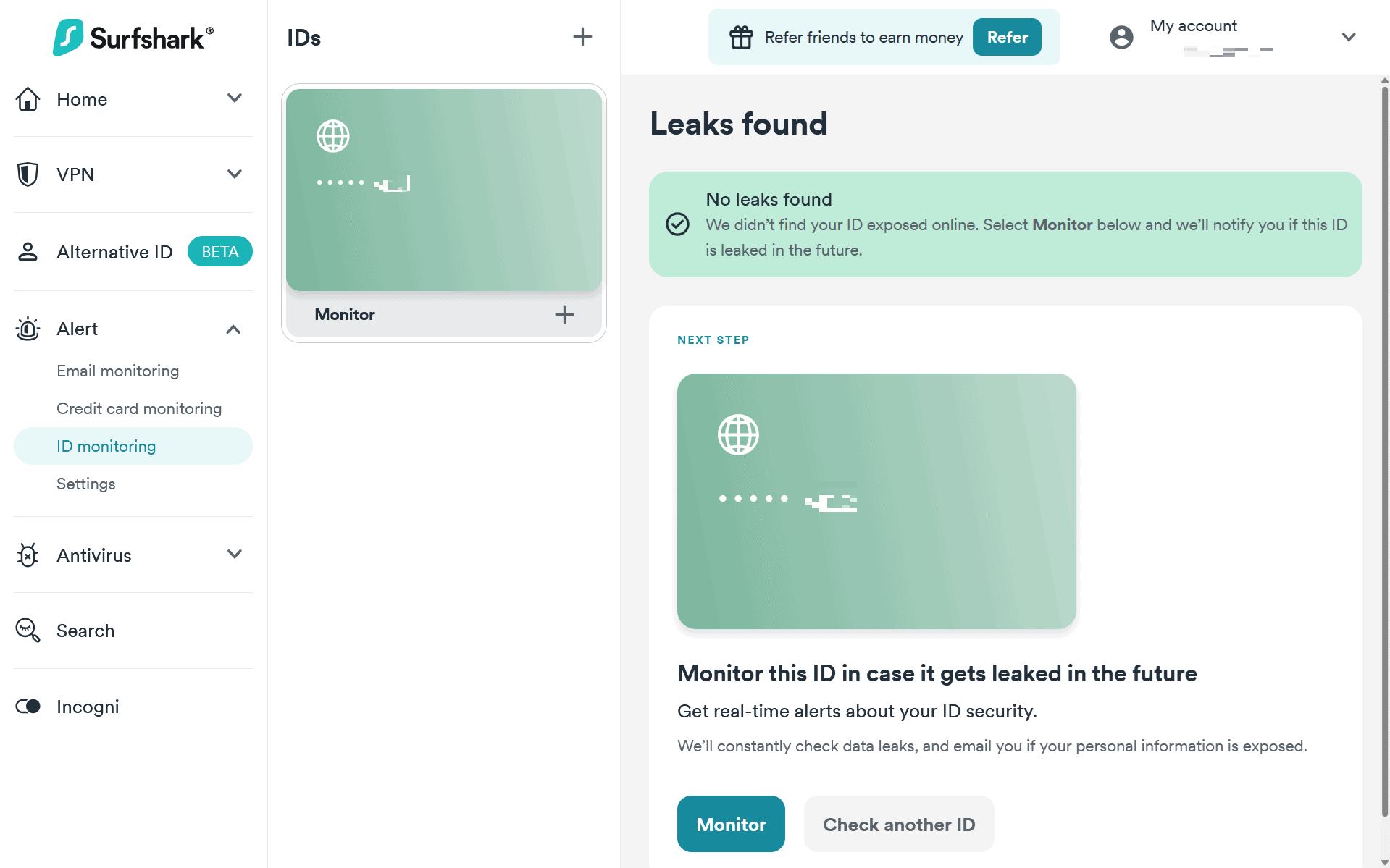

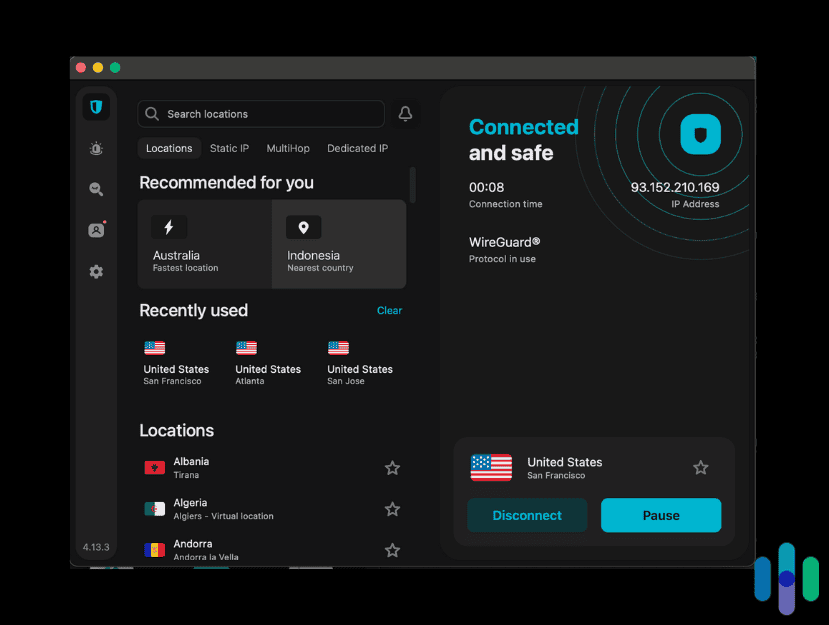

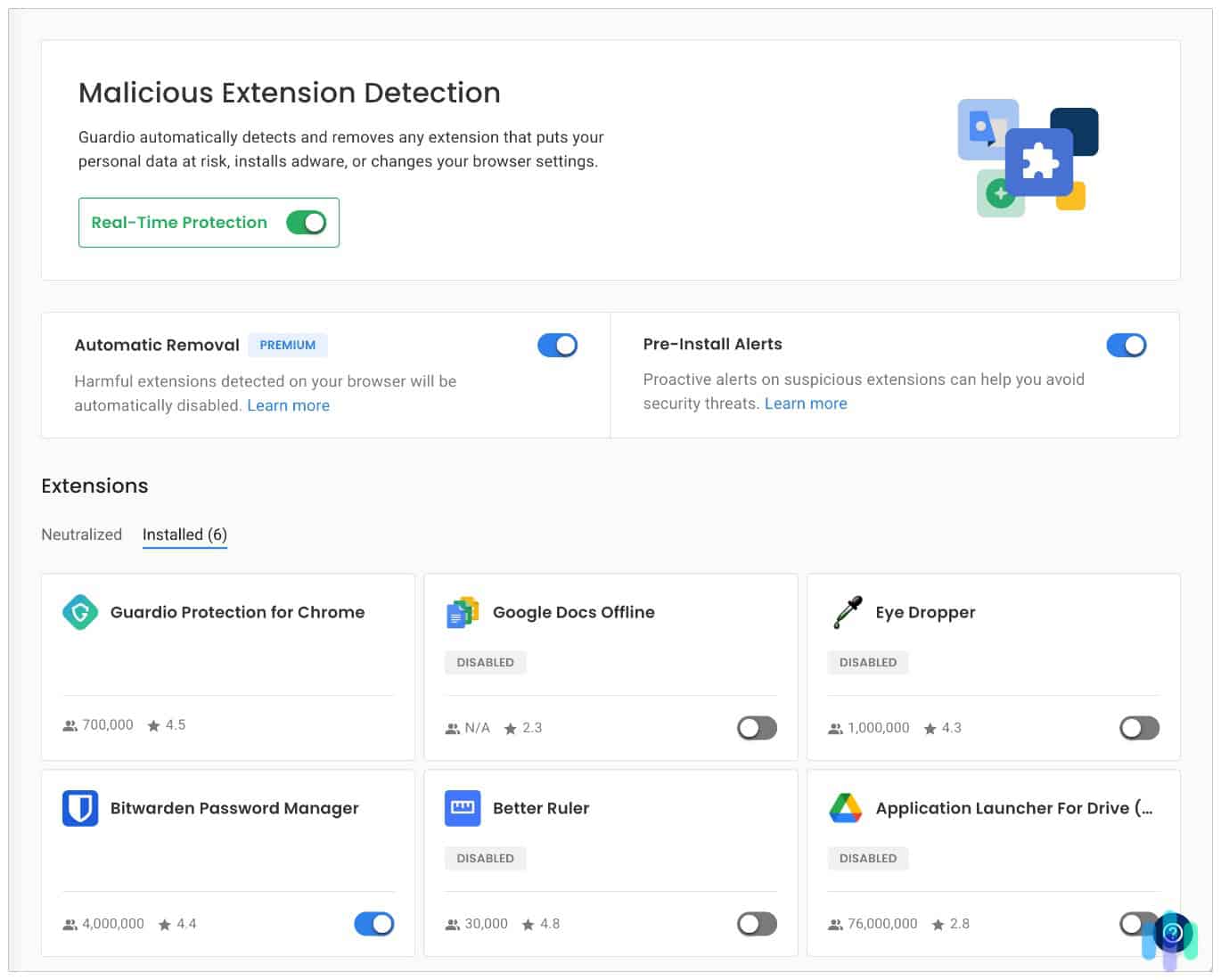

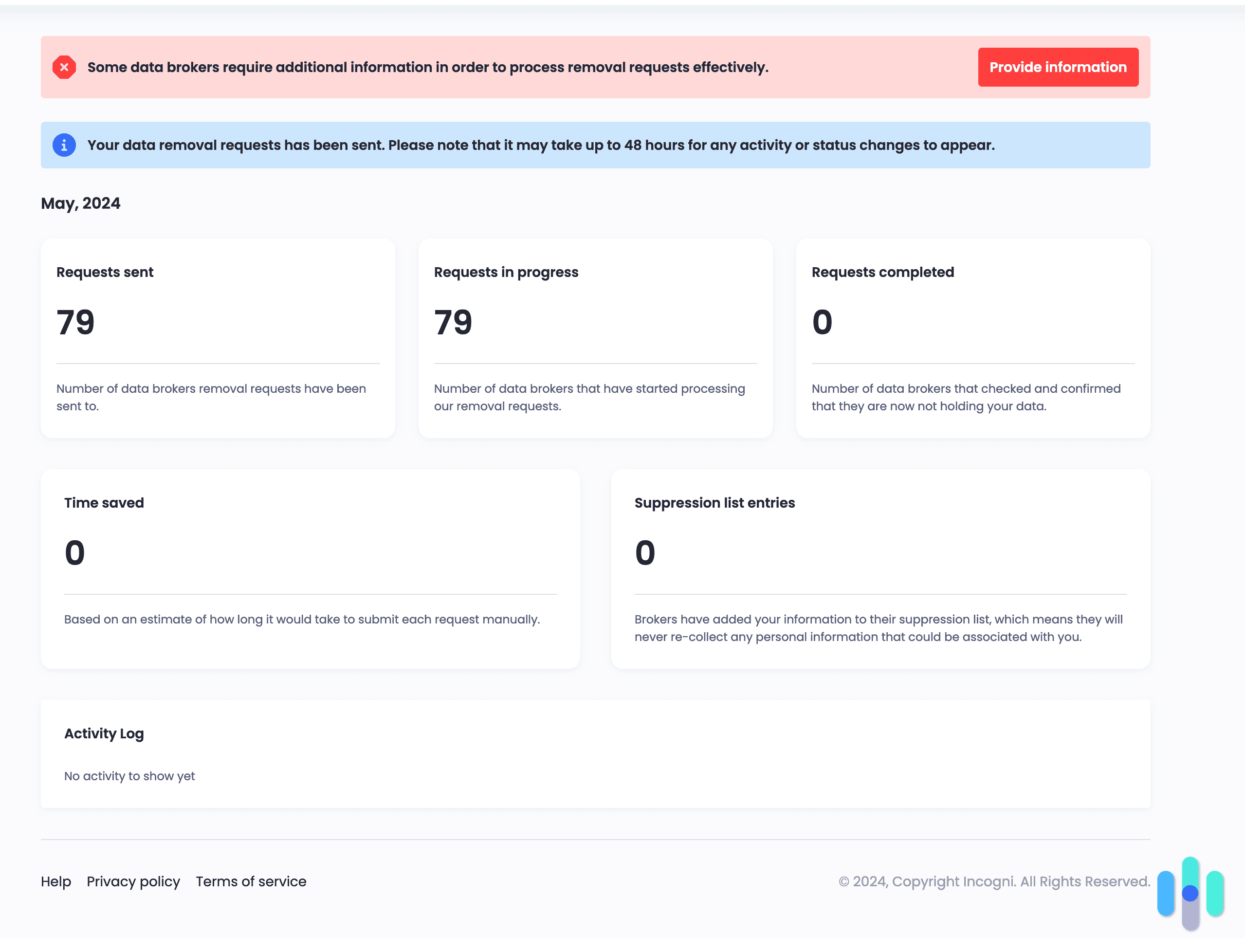

4. Surfshark Alert - Best Digital Protection

View Packages Links to Surfshark.comProduct Specs

Dark Web Monitoring Yes Credit Reporting No Insurance Coverage No Free Trial 30-day money-back guarantee Individual Monthly Plans $2.69 and up Family Monthly Plans $2.69 and up Surfshark Alert monitored our SSN for online leaks that could lead to identity theft. It might seem strange that we’re adding a service that doesn’t actually offer credit reporting to this list. But nowadays, you can request a credit report from all three credit bureaus on a weekly basis for free. Our test of Surfshark Alert found that they offer great supplementary services to those free reports.

Before someone steals your identity, usually your information gets leaked online or found on a dark web marketplace. Surfshark looks for those leaks and then notifies you with guidance on what to do next. Pair this with those free credit reports and you have top-notch identity security at a fraction of the price of a traditional identity theft protection service.

FYI: ou can add as many IDs as you want to Surfshark Alert’s monitoring. We recommend adding your SSN, passport number, and driver’s license number at a minimum. They can also monitor your credit cards and email addresses.

Speaking of Surfshark’s low prices, here’s an overview of their plans:

Surfshark Subscriptions Surfshark One Surfshark One+ Monthly plan $17.95 $20.65 Annual plan $50.85 ($3.39 per month) $91.35 ($6.09 per month) Two-year plan $72.63 ($2.69 per month) $115.83 ($4.29 per month) Other Surfshark Features

Surfshark’s VPN blocked ads and pop-ups as long as we were connected through one of their servers. Surfshark’s other tools minimize your exposure to identity theft risks. Namely, their Surfshark One plan includes a VPN and antivirus. When we tested Surfshark’s VPN, it blocked all pop-ups and ads which are commonly used for phishing scams. That’s when a fraudulent site tries to get you to input your personal information so they can steal it. Surfshark Antivirus stops malware from stealing your information through keyloggers or other malicious programs.

Then, there’s Incogni which is included in Surfshark One+. When we tested Incogni, it requested the removal of our personal information from 100 data brokers and people search sites within a week. That’s why it became our favorite data removal service.

>> Learn More: Surfshark Antivirus Review & Pricing in 2025

-

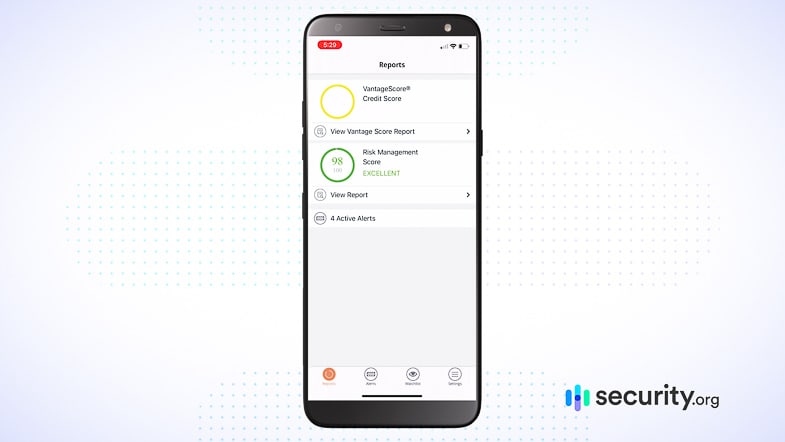

5. IdentityForce - Best Credit Score Tracker

Product Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 30-day Individual Monthly Plans $19.90 and up Family Monthly Plans $39.90 and up IdentityForce is a top recommendation when you want on-demand access to your credit scores, full credit reports, and a handy credit improvement simulator. Their UltraSecure + Credit plan ($23.95/month) gives you data from the big three bureaus anytime! In contrast many other plans have you wait for monthly or yearly updates. You’ll also get virtually real-time alerts when lenders request your credit report, so you’ll have the chance to respond proactively if an attempt at fraud is underway.

You can access your credit information anytime with the IdentityForce desktop platform or user-friendly mobile app. Both platforms protect your account with advanced login authentication options such as facial recognition.

UltraSecure + Credit starts at around $17/month and includes up to $1,000,000 in stolen funds insurance. Children’s profiles with the same financial benefits, SSN alerts, and more can be added for $2.75 or less each.

Features of Ultra Secure + Credit

IdentityForce plans are comprehensive. With the children’s accounts, for example, parents can get alerts about cyberbullying. With the adult accounts, a handy credit simulator is available anytime. It lets you explore how different financial moves would likely impact your credit score. You can see how transferring a balance might increase your score, for example, or how paying off a credit card would affect your profile.

- Three-bureau credit monitoring

- Three-bureau credit reports anytime

- $1,000,000 in stolen funds insurance

- Fully managed identity restoration

- Anti-phishing and anti-keylogging software

- Bank and credit card activity alerts

- 401K and other investment account alerts

- Lost wallet assistance

- Medical ID fraud protection

- SSN tracking

- Change of address alerts

- Sex offender alerts

- Social media fraud monitoring

In sum, IdentityForce is a top choice when you’d like to see your credit reports anytime. It can help you stay alert to criminals and also make the most of your financial opportunities. You can try IdentityForce Ultra Secure + Credit totally free for two weeks.

-

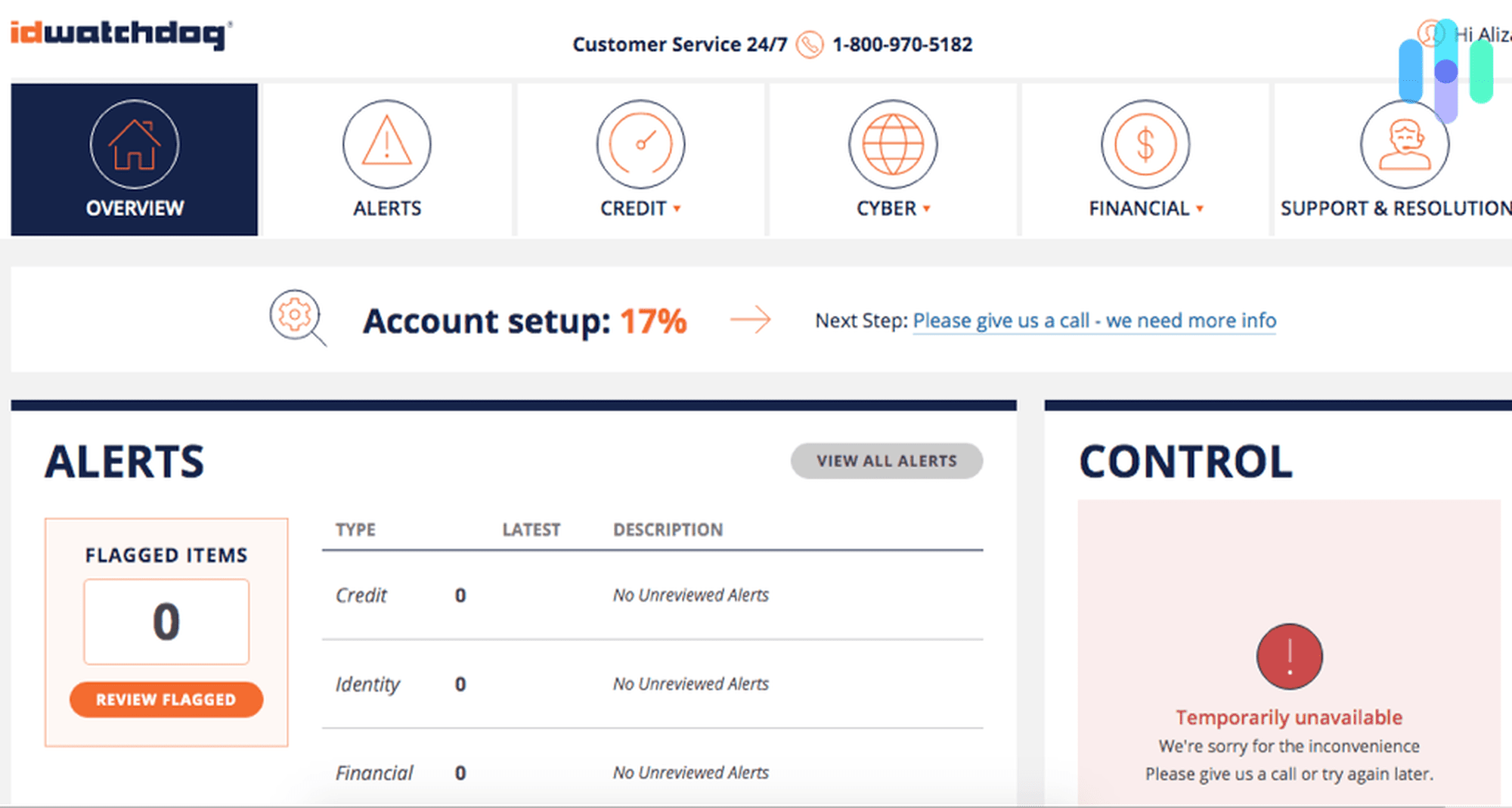

6. ID Watchdog - Best Value Credit Reporting

Product Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 30-day Individual Monthly Plans $12.50 and up Family Monthly Plans $20 and up ID Watchdog is a daughter company of the Equifax credit reporting agency. It offers the best value credit reporting for many of our readers, as ID Watchdog prices are competitive, you get daily credit score tracking as well.

Every plan includes uncapped support for resolution in case of identity theft. ID Watchdog will pay for legal counsel for as long as needed, for example, whereas other ID protection companies set a limit on attorney time or funds.

- Individual rates for ID watchdog protection are as low as $14.95 month with one-bureau credit reporting and daily Equifax score tracking.

- The best ID Watchdog plan includes reporting from Equifax, Experian and TransUnion. This Platinum plan costs $19.95 for an individual and $34.95 for a family. A family plan can include up to two adults and four minors.

Best Credit Reporting Value

ID Watchdog Platinum provides the best credit reporting value. It includes:

- Daily credit score tracking with Equifax

- Daily Equifax credit report access

- Alerts from Equifax, Experian and TransUnion

- Annual VantageScore 3.0 report

- Instant report locking with Equifax and TransUnion

- Financial accounts monitoring

The cheaper plan, ID Watchdog Plus ($14.95 for one, $25.95 for a family) is limited to sending Equifax alerts and locking your Equifax report.

Other ID Watchdog Features

Along with credit monitoring and reporting, ID Watchdog has a full suite of features to detect trouble, send alerts, and help with identity restoration. Both plans (Plus and Platinum) include these and other perks:

- Credit monitoring

- Credit reports

- Mobile app for alerts and responses

- Fraud alert assistance

- Credit freeze assistance

- Dark web monitoring

- Payday loan monitoring

- Public records monitoring

- Social identity profile risk report

- Registered sex offender reporting

- Lost wallet assistance

- Junk mail reduction

Free trial: You can try two weeks for free. Details are at the ID Watchdog website.

Final points are that ID Watchdog is known for pleasant customer service, and they can help in about 100 languages. This Equifax company has an A+ rating from the BBB in 2019.

-

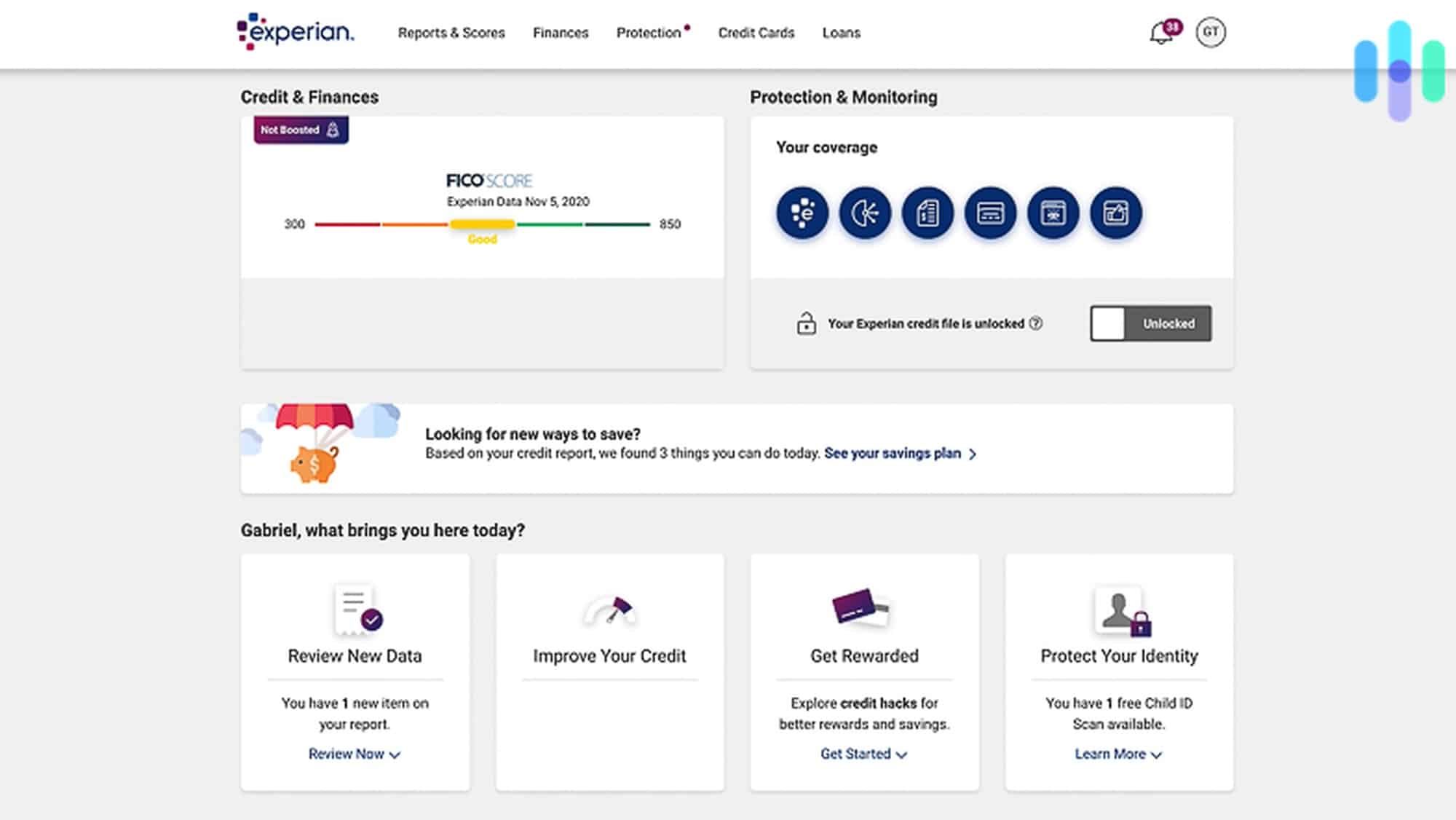

7. Experian IdentityWorks - Best Credit Reporting with FICO

Product Specs

Dark Web Monitoring Yes Credit Reporting Yes Insurance Coverage Up to $1 million Free Trial 30-day Individual Monthly Plans Starting at $24.99 per month Family Monthly Plans $34.99 and up Lenders most often use FICO scores when making loan decisions. Most people with credit histories have up to three FICO scores, one for each major credit bureau: Experian, Equifax, and TransUnion. You can get all three credit scores on a quarterly basis with an identity protection plan from Experian IdentityWorks, which is an offshoot of the Experian credit reporting agency. Even better, IdentityWorks can provide daily updates to your Experian FICO score. You can always know what a lender might see.

The best FICO credit reporting comes with an IdentityWorks Premium plan. Month-to-month this family-friendly deal costs $19.99 for one adult and up to 10 minors, or $29.99 for two adults and up to 10 minors. That’s competitive pricing regardless of whether you have kids, plus you can save another 17% by paying for a full year at once. The plan also provides compensation for caregiving expenses and wage losses incurred as a result of ID theft.

IdentityWorks Premium also includes up to $1,000,000 in ID theft insurance.

Credit Reporting with IdentityWorks

Credit reporting and monitoring with Experian IdentityWorks Premium includes around-the-clock monitoring, daily updates and quarterly updates. The main features are:

- Three-bureau monitoring to alert you about inquiries, new accounts, big balance changes, and other signs of possible ID fraud

- Positive activity alerts that can help you choose a wise time to apply for more credit

- Daily updates to your FICO Score 8 Experian credit score

- Quarterly three-bureau reports with FICO Score 8 numbers

- Quick lock/unlock for your Experian credit file

Credit locking can be invaluable, as it prevents criminals from accessing information. It also prevents lenders from making unauthorized hard inquiries that could automatically lower your credit score.

Along with the best FICO credit reporting, the Experian Premium plan also provides a credit simulator to help you make the most of your income. For instance, you might want to hold off until you attain a specific credit score before you apply for a home loan. A credit simulator can help you efficiently reach your goal.

Other IdentityWorks Benefits

IdentityWorks is loaded with features to help protect your ID and help with identity theft recovery. Here are some benefits of the Premium plan:

- Daily Experian score

- Quarterly three-bureau reports

- $1M insurance limit

- $1,500 lost wages replacement per week, up to five weeks

- $2,000 per policy period for ID theft-related needs for family care

- Dark web surveillance

- Bank account and credit card alerts

- Lost wallet assistance

- Social security number monitoring

- Address change verification

- Identity validation alerts

- Payday lender monitoring

- Court information with your name

- Sex offender registry reports

- File-sharing network monitoring

- Social network monitoring

You can try Experian IdentityWorks for 30 days without charge.

Summing It All Up

If someone steals your identity and tries to use it to take out a loan or open up a credit card, that request will show up on your credit report. That’s why some identity theft protection services include credit reporting. Oftentimes, they’ll monitor your credit reports for you as well. This lets you take a more hands-off approach while still getting the same protection as though you reviewed your credit report regularly.

When you have a good credit score, there’s a lot that someone can do with your identity if they steal it. They’ll be able to take out massive loans, open up credit cards with large balances, or even finance a new car. So, while not everyone needs identity theft protection with credit reporting, anyone at a higher risk due to having a solid credit score to begin with can get huge benefits from this added protection.

FAQs about Identity Theft Protection with Credit Reporting

-

If I have a bad credit score, do I need identity theft protection with credit reporting?

When you have a bad credit score, it can feel like you don’t need credit reporting since there isn’t a whole lot someone can do using your credit. But, they can still find high-risk loans that have huge interest rates that can cause your credit score to drop even further. So, if you can afford it, we suggest identity theft protection with credit reporting.

-

I already check my credit report regularly. Do I need identity theft protection with credit reporting?

Checking your credit report regularly costs money. And, you’re probably not an expert at reviewing your credit report to look for suspicious activity. A lot of times, you can get identity theft protection with credit reporting for just a bit more than you already pay to review your credit report on a regular basis.

-

Will identity theft protection with credit reporting improve my credit score?

Unfortunately, buying identity theft protection with credit reporting won’t have any impact on your credit score. It can help you identify suspicious activity before that activity causes your credit score to drop. So, it can protect your credit score, but it won’t improve your credit score.