LifeLock Identity Theft Protection in 2025 – How Much Does It Cost?

LifeLock offers one of the highest insurance coverages in the industry (up to $3 million) with subscription prices starting at $7.50 per month.

- Full-service identity theft and credit monitoring

- Device protection with Norton 360 antivirus

- Reputation for outstanding customer service

Identity theft costs Americans $43 billion a year,1 which is why identity theft protection is more than a luxury. Besides detecting identity theft, identity theft protection services cover financial losses resulting from stolen funds and legal fees for anyone recovering from having their identity stolen. When we did a deep-dive review of LifeLock, we found that it’s one of the best in that area — it offers insurance coverage of up to $3 million per individual.

This time, we’re going to look at LifeLock from a price-focused angle. Not all LifeLock users get $3 million coverage, and not all of them enjoy the same protections. So if you’re considering LifeLock for your identity theft protection needs, read this guide to learn how to get the most out of your money.

How Much Do LifeLock Subscriptions Cost?

We’ll get to the point, because unlike Aura’s simple price structure — one of LifeLock’s rivals — LifeLock offers more than a dozen options for identity protection.

Here’s what you should know:

- There are three LifeLock plans: Standard (or Select), Advantage, and Ultimate Plus.

- Each plan has subscriptions for individuals, couples, and families.

- Each plan can be bundled with a Norton 360 cybersecurity suite.

- For each option, you can choose to pay monthly or yearly. The latter is discounted.

For a high level overview, here’s how much each LifeLock plan costs:

| LifeLock Plan | LifeLock Standard and Select | LifeLock Advantage | LifeLock Ultimate Plus |

|---|---|---|---|

| Individual Plan | $7.50/mo | $14.99/mo | $19.99/mo |

| 2 Adults Plan | $12.49/mo | $23.99/mo | $32.99/mo |

| Family Plan | $18.49/mo | $29.99/mo | $38.99/mo |

| Individual Plan with Norton 360 | $8.33/mo | $16.67/mo | $25.00/mo |

| 2 Adults Plan with Norton 360 | $15.83/mo | $31.66/mo | $44.99/mo |

| Family Plan with Norton 360 | $20.01/mo | $35.84/mo | $49.17/mo |

LifeLock for Individuals

Let’s start with pricing for individuals. These subscriptions cover one adult. We recommend these to folks living by themselves, especially young adults. According to the Federal Trade Commission (FTC), Americans in the 20 to 29 age group are the third most targeted individuals for identity theft.2

Here’s an overview of LifeLock’s individual plans:

| LifeLock individual plans | Standard | Advantage | Ultimate Plus |

|---|---|---|---|

| Coverage | 1 adult | 1 adult | 1 adult |

| Monthly price | $11.99 | $22.99 | $34.99 |

| One-year price | $89.99

($7.50 monthly avg.) |

$179.88

($14.99 monthly avg.) |

$239.88

($19.99 monthly avg.) |

| Monthly price with Norton 360 | $14.99 | $24.99 | $34.99 |

| One-year price with Norton 360 | $99.48

($8.29 monthly avg.) |

$191.88

($15.99 monthly avg.) |

$299.88

($24.99 monthly avg.) |

| Stolen funds reimbursement | $25,000 | $100,000 | $1 million |

| Legal fees reimbursement | $1 million | $1 million | $1 million |

| Personal expenses reimbursement | $25,000 | $100,000 | $1 million |

| Identity monitoring | Yes | Yes | Yes |

| Credit monitoring | 1-bureau | 1-bureau | 3-bureau |

FYI: For plans bundled with Norton 360, the entry-level subscription is called LifeLock Select. It’s similar to LifeLock Standard in most aspects, but lacks Utility Account Creation Monitoring. With this feature, if someone uses your personal information to create a utility account (electric, water, gas, telecom, etc.), LifeLock Standard will notify you.

LifeLock for Couples

LifeLock also offers subscriptions for people living together, whether as partners, spouses, or roommates. But you have to pick carefully. Not all options will give you savings compared to buying two individual plans. For example, the Standard plan with monthly billing costs $23.99 per month — double the cost of the same plan for individuals.

In any case, here are the available options:

| LifeLock couple plans | Standard | Advantage | Ultimate Plus |

|---|---|---|---|

| Coverage | 2 adults | 2 adults | 2 adults |

| Monthly price | $23.99 | $45.99 | $69.99 |

| One-year price | $149.87

($12.49 monthly avg.) |

$287.88

($23.99 monthly avg.) |

$395.88

($32.99 monthly avg.) |

| Monthly price with Norton 360 | $26.99 | $47.99 | $69.99 |

| One-year price with Norton 360 | $158.88

($13.24 monthly avg.) |

$299.88

($24.99 monthly avg.) |

$419.88

($34.99 monthly avg.) |

| Stolen funds reimbursement | $25,000 per member | $100,000 per member | $1 million per member |

| Legal fees reimbursement | $1 million per member | $1 million per member | $1 million per member |

| Personal expenses reimbursement | $25,000 per member | $100,000 per member | $1 million per member |

| Identity monitoring | Yes | Yes | Yes |

| Credit monitoring | 1-bureau | 1-bureau | 3-bureau |

LifeLock Family Plans

Lastly, LifeLock offers plans for families. These plans offer coverage for two adults plus up to five children under the age of 18. Note that LifeLock is one of the best identity theft protection services for families because of its features, but it may not be the best fit for larger families or extended-family households because of its two-adult limit.

We found Aura and Identity Guard family plans better options for larger families, as they protect up to five adults and an unlimited number of children. So if your family consists of you and your spouse, a young-adult offspring, and minor-aged children, go with either Aura or Identity Guard. But if your family fits LifeLock’s plans, here are your options:

| LifeLock family plans | Standard | Advantage | Ultimate Plus |

|---|---|---|---|

| Coverage | 2 adults | 2 adults | 2 adults |

| Monthly price | $35.99 | $57.99 | $79.99 |

| One-year price | $221.87

($18.49 monthly avg.) |

$359.88

($29.99 monthly avg.) |

$467.88

($38.99 monthly avg.) |

| Monthly price with Norton 360 | $38.99 | $59.99 | $81.99 |

| One-year price with Norton 360 | $227.88

($18.99 monthly avg.) |

$371.88

($30.99 monthly avg.) |

$491.88

($81.99 monthly avg.) |

| Stolen funds reimbursement (adult) | $25,000 per adult | $100,000 per adult | $1 million per adult |

| Legal fees reimbursement (adult) | $1 million per adult | $1 million per adult | $1 million per adult |

| Personal expenses reimbursement (adult) | $25,000 per adult | $100,000 per adult | $1 million per adult |

| Stolen funds reimbursement (child) | $25,000 per child | $100,000 per child | $1 million per child |

| Legal fees reimbursement (child) | $1 million per child | $1 million per child | $1 million per child |

| Personal expenses reimbursement (child) | $25,000 per child | $100,000 per child | $1 million per child |

| Identity monitoring | Yes | Yes | Yes |

| Credit monitoring | 1-bureau | 1-bureau | 3-bureau |

Note: The reimbursements we listed throughout this guide are the maximum amounts that LifeLock covers. Actual reimbursements will be computed on a case-to-case basis and could include insurance deductibles.

What You Should Know About LifeLock’s Pricing

LifeLock is in the top three of our 2025 ranking of identity theft protection services. It has our seal of approval, tested by our team of experts. But like any company, LifeLock uses marketing tactics that can feel like “gotchas” if you didn’t know about them beforehand. We’re here to shed a light on those.

At the same time, LifeLock has deals and guarantees you won’t want to miss out on, like their money-back guarantee and free trial. Having tested LifeLock ourselves, we’re here to tell you about those as well.

Introductory vs. Renewal Pricing for Annual Plans

The promotional first-year price is one of the most surefire ways to get a discount from LifeLock, but if you didn’t know about it before signing up, you could end up feeling robbed once your plan renews. Basically, first-year subscriptions are discounted but come with auto-renewal. When your plan renews for the second year, LifeLock charges you the regular renewal price.

Let’s look at LifeLock’s renewal rates for individual plans.

| First year vs. renewal rates | First year price | Renewal price | First year price w/ Norton 360 | Renewal price w/ Norton 360 |

|---|---|---|---|---|

| Standard | $89.99 | $124.99 ($35 increase) | $99.48 | $149.99 ($50 increase) |

| Advantage | $179.88 | $239.99 ($60 increase) | $191.88 | $249.99 ($58 increase) |

| Ultimate Plus | $239.88 | $339.99 ($100 increase) | $299.88 | $349.99 ($50 increase) |

Not many identity protection services offer low introductory pricing — it’s more common among VPN and antivirus companies. The only other identity theft protection service we’ve reviewed that offers this is McAfee (see our McAfee review).

In fairness to LifeLock, the renewal rates are displayed on its website’s pricing page — in a smaller but visible font. McAfee is more vague about, only explaining how the renewal rates work in the terms and conditions.

Free Trial

LifeLock is also one of the few services that offer a free trial, but you can only try select plans. We used this option when we signed up for the Ultimate Plus individual plan. The other free trials are for the Standard individual plan and Ultimate Plus plan for couples.

The LifeLock trial is good for 30 days, which is longer than the 14 days Aura offers but the same as the free trial for the entry-level IdentityForce plans. We like that with LifeLock you can try either its entry-level (Standard) or top-tier (Ultimate Plus) subscription. You also don’t forfeit your access to the low introductory price deal by signing up for the trial. Once our 30 days ended, LifeLock billed us $239.88 for one year of Ultimate Plus.

Cancellation and Refunds

LifeLock also gave us a 60-day grace period to change our minds, starting from the day we paid for our subscription. That’s the standard for all LifeLock annual subscriptions. For monthly subscriptions, LifeLock offers a 14-day money-back guarantee.

We liked that LifeLock gives customers plenty of time to test the service to see how it fits in their lives. In fact, we believe that LifeLock has the best customer policies among our top three picks:

| Policies | Aura | LifeLock | Identity Guard |

|---|---|---|---|

| Editor’s rating | 9.6/10 | 9.2/10 | 9.5/10 |

| Money-back guarantee | 60 days for annual plans only | 60 days for annual plans; 14 days for monthly plans | 60 days for annual plans only |

| Free trial | 14 days | 30 days | No free trial |

| Low introductory prices | No | Yes | No |

Tip: To see how LifeLock fares overall against our other top picks, see our comparison guides for Aura vs. LifeLock and Identity Guard vs. LifeLock. Comparing identity theft protection services side by side is a great way to find out which service offers the most value to you, price-wise and feature-wise

LifeLock Features

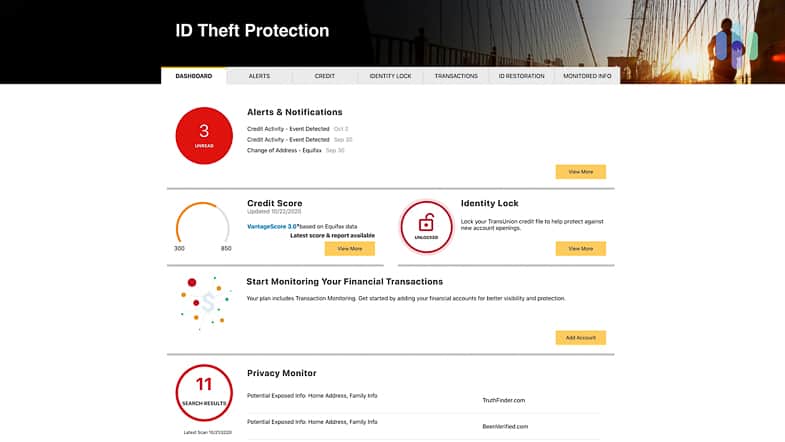

We’ve touched on the insurance coverage of each plan, which helps you if your identity gets stolen. Here, let’s talk about identity and credit monitoring features that help reduce your risk of identity theft.

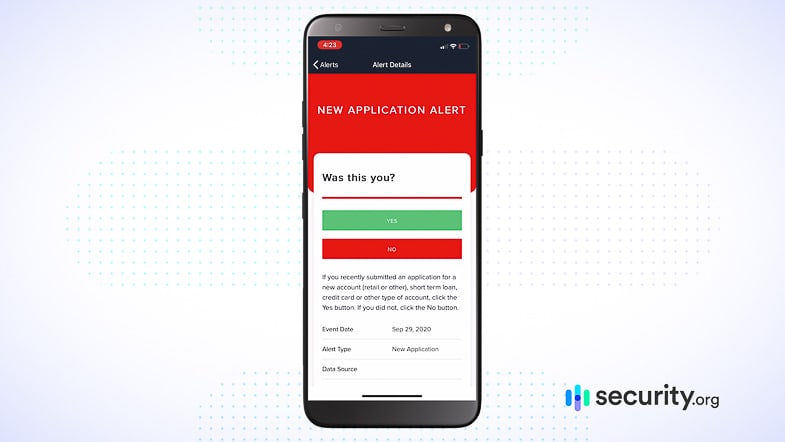

- Identity monitoring: These features aim to detect early signs of identity theft by monitoring a user’s personally identifiable information. You’ll get an alert if any of your personal details like criminal records, court records, or USPS address change requests appear on the dark web.

- Credit monitoring: These features detect identity theft by monitoring your credit file with one or all of the three credit reporting bureaus — Equifax, Experian, and TransUnion. It can also involve monitoring bank and credit card transactions, investment accounts, and other personal financial accounts.

LifeLock Identity Monitoring

Some identity monitoring features come standard with all LifeLock subscriptions. However, some niche features like synthetic identity theft monitoring and social media monitoring are reserved for the upper-tier plans.

These are the features included in all subscriptions:

- Social Security number monitoring

- Stolen wallet protection

- USPS address change verification

- Dark web monitoring

- ID verification monitoring

- Data breach notifications

- Utility account creation monitoring

Here’s what the Advantage and Ultimate Plus plans offer in addition to those:

| Identity monitoring features | Advantage | Ultimate Plus |

|---|---|---|

| Criminal identity theft monitoring | Yes | Yes |

| Synthetic identity theft monitoring | Yes | Yes |

| Phone Takeover Monitoring | Yes | Yes |

| Home title monitoring | No | Yes |

| Sex offender registry reports | No | Yes |

| Social media monitoring | No | Yes |

LifeLock Credit Monitoring

At the very least, LifeLock will monitor your Equifax credit file. That means you’ll get an alert anytime there’s a hard inquiry, new credit account, or suspicious change. That’s the only credit monitoring feature included in the Standard plan.

As for the Advantage and Ultimate Plus plans, you’ll also receive credit reports and score updates as well as monitoring of your personal finances. The more areas you allow LifeLock to monitor, the better your chances at detecting signs of identity theft.

Here’s an overview of LifeLock’s credit monitoring features under each of its three tiers:

| Credit monitoring features | Standard | Advantage | Ultimate Plus |

|---|---|---|---|

| Credit monitoring | 1-bureau | 1-bureau | 3-bureau |

| Credit scores and reports | None | 1-bureau (monthly) | 1-bureau (unlimited); 3-bureau (yearly) |

| Bank and credit card activity alerts | No | Yes | Yes |

| Buy now pay later alerts | No | Yes | Yes |

| Credit file lock | No | Yes | Yes |

| Payday loan lock | No | Yes | Yes |

| Checking & savings account opening alerts | No | No | Yes |

| Bank account takeover alerts | No | No | Yes |

| 401(k) & investment account alerts | No | No | Yes |

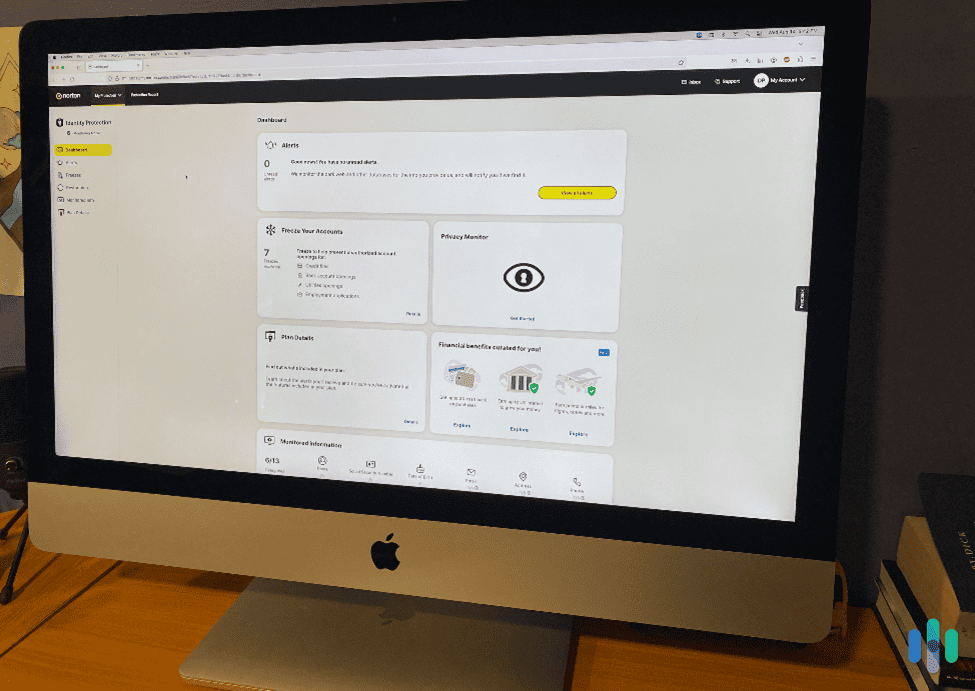

Online and Device Protections

Besides identity and credit monitoring — which detect early signs of identity theft — LifeLock can help you prevent digital identity theft if you bundle it with Norton 360. Norton’s advantage over Aura and Identity Guard is that it’s a top-tier antivirus brand. You’ll find more information in our Norton antivirus review.

It’s not all peachy, though. We found ourselves switching between the LifeLock app (or web dashboard) and Norton 360 app too often, since they’re not integrated. But at least you’ll be saving money. Antivirus software typically costs $5 per month; bundling Norton 360 (Norton’s top-tier subscription) with LifeLock adds about $2 to $3 per month.

Note that there are device limits, and all members of the plan will share those limits. For example, the LifeLock Advantage with Norton 360 has a 10-device limit for its VPN and antivirus software. If you’re on a couple’s plan, you and the other person on the plan will be able to install the Norton 360 app on a total of 10 devices; not 10 devices each.

- LifeLock Select with Norton 360: 5 devices

- LifeLock Advantage with Norton 360: 10 devices

- LifeLock Ultimate Plus with Norton 360: Unlimited devices

Pro Tip: Protecting your kids online helps prevent child identity theft. All LifeLock family plans bundled with Norton 360 include access to Norton’s parental control software, which lets parents limit and monitor their children’s screen time, track device locations, and block harmful apps and websites.

Our Recommendations: Which LifeLock Plans Are the Best?

We’ve reached the end of this LifeLock pricing guide, so now it’s time to review your options and decide which subscription is best for you. Only you can make that call, but here’s our expert advice:

Standard vs. Advantage vs. Ultimate Plus

We found that the Advantage plan is the most well-balanced option when it comes to pricing and features. It offers identity monitoring features missing from the entry-level Standard plan (like phone takeover monitoring and synthetic identity theft monitoring). The one-bureau credit monitoring bothers us. But since LifeLock is one of the best identity theft protection services with credit protection, we think it’s enough to detect credit fraud. And don’t forget about the identity theft insurance coverage of up to $1.2 million.

The Ultimate Plus plan is also great for those looking to enjoy complete protection, but at $19.99 per month if you pay for one year, it’s a tad expensive. That’s with the promotional first-year pricing and without Norton 360. In comparison, Aura’s individual plan costs $12 per month (paid yearly) for roughly the same protection. We do like the $3 million insurance coverage and the payday loan lock feature from LifeLock. Aura doesn’t offer the latter, and it offers a maximum coverage of $1 million per user. But do those features justify the $8 monthly difference? We don’t think so.

FYI: There are services that offer identity theft protection and device protections using one app. Aura and Identity Guard fit the bill, but if you’re looking for antivirus software that’s similar to Norton 360, see our McAfee antivirus review. The same app we tested there offers McAfee’s identity protection suite.

Lastly, if you want a budget-friendly identity protection service, we do recommend the Standard plan, at least over the entry-level plan from Identity Guard. LifeLock’s Standard plan offers one-bureau credit monitoring, while Identity Guard’s Value plan offers no credit protection. Considering that the two options cost the same if you pay yearly, our pick is LifeLock.

Should You Bundle Norton 360?

As for whether or not you should add Norton 360 to your LifeLock account, we say “yes” if you don’t have antivirus software. But if you already have antivirus software (and it’s a good fit for you), bundling isn’t necessary. Using LifeLock with Norton 360 isn’t any different from using it with any other antivirus software, because you’ll still be using a different app. The only reason you should bundle is if you’re looking to save, since bundling is cheaper.

Monthly or Yearly?

Lastly, let’s talk about how you’re going to pay. Normally, we recommend trying out a monthly plan first, but LifeLock gives users plenty of reasons to go straight to a one-year plan:

- Free trial: You have 30 days to try the Standard or Ultimate Plus annual subscriptions before billing starts.

- Money-back guarantee: After receiving the first bill, you have 60 days to change your mind. If you cancel within that period, you’ll get a full refund.

- Low first-year price: The introductory price is exclusive to new customers. If you buy a one-month subscription and then upgrade to an annual subscription, you will pay the regular annual price.

Recap

Choosing the best-value identity protection service isn’t just about looking at the price tag. You have to consider what kind of protection is included. Even though LifeLock is on the expensive side, we believe it’s a good pick.

We like the up to $3 million identity theft insurance coverage, which provides a sturdy safety net in case you fall victim to identity theft. No service can guarantee your protection; it’s great to know you have insurance to fall back on.

It also helps that you can bundle LifeLock with Norton 360 for protection against digital identity theft. It’s one of the best antivirus software out there.

Of course, LifeLock isn’t for everybody. For our more budget-focused picks, read our Aura review and Identity Guard review. Together with LifeLock, they round out our top-three identity theft protection picks.

FAQs

Now let’s answer some of the most common questions about LifeLock.

-

Is LifeLock the best identity theft protection service?

LifeLock is one of the best identity protection services, alongside Aura and Identity Guard. It offers comprehensive identity and credit monitoring, digital and online protections, and identity theft insurance coverage better than most options. However, it’s more expensive than both Aura and Identity Guard.

-

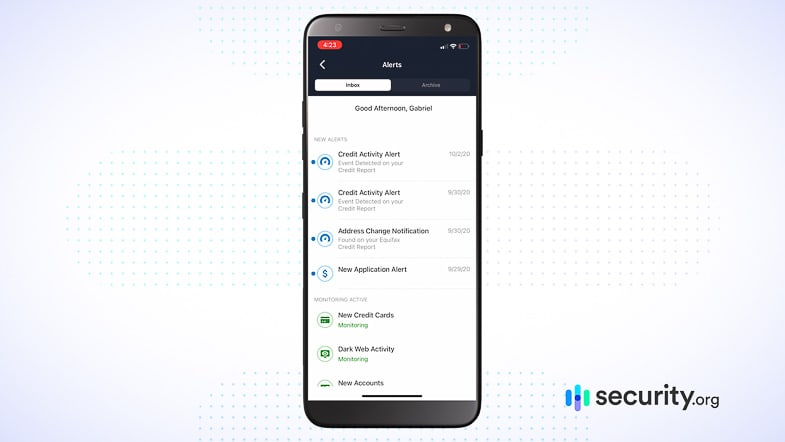

Is LifeLock easy to use?

Despite offering a comprehensive feature set, we found LifeLock easy to use. Signing up took only an hour or so, including filling in the required personal information. And once we finished setting it up, we only needed the app to update information or check alerts.

-

Is LifeLock good for families?

LifeLock is good for families because it has family plans that protect up to two adults and five minor-aged children. However, for families with more than two adults (e.g., extended family households or families with children over the age of 18), there are better options. Aura, for example, protects up to five adults with its family plans.

-

Is LifeLock affordable?

LifeLock offers affordable entry-level plans like the Standard plan and LifeLock Select with Norton 360. These plans offer one-bureau credit monitoring, basic identity protection, and identity theft insurance coverage up to $1,050,000. Prices start at $7.50 per month if you buy a one-year subscription.

-

What does LifeLock’s identity theft insurance cover?

LifeLock’s identity theft insurance covers reimbursement for stolen funds, legal fees, and personal expenses resulting from identity theft and fraud. Each plan has set limits for each type of reimbursement. With the top-tier Ultimate Plus plan, you get $1 million each for stolen funds, legal fees, and personal expenses (e.g., documentary stamps, notary fees, lost wages, etc.), totaling up to $3 million.

-

AARP. (2024). Identity Fraud Cost Americans $43 Billion in 2023 .

https://www.aarp.org/money/scams-fraud/info-2024/identity-fraud-report.html -

Statista. (2024). Number of identity theft complaints lodged with the Federal Trade Commission in the United States in 2022, by age of victims

https://www.statista.com/statistics/587677/identity-theft-complaints-victims-age-in-the-us/