We all know someone who has lived through a burglary, reported a package theft, or had their email compromised in a data breach. But someone whose identity was stolen, lock, stock, and barrel? That isn’t the kind of story you hear every day, which is exactly how cybercriminals want to keep identity theft: out of the conversation and off our radars.

Here’s what’s actually happening: The Federal Trade Commission (FTC) has received over 1.4 million fraud reports and nearly 750,000 identity theft reports in the first half of 2025 alone.1

>> Read More: A Parent’s Guide to Child Identity Theft

The good news? Identity thieves aren’t criminal masterminds. They’re opportunists using predictable tactics that you can absolutely defend against. Most victims could have avoided the mess entirely with some basic precautions that cost less than your monthly streaming subscriptions.

In this digital security guide, I’ll explain what identity theft is in everyday language and lay out the most effective measures you can take to keep the internet’s shadiest grifters far away from your sensitive data.

Did You Know: Most identity theft victims aren’t seniors getting tricked over the phone. People aged 30 to 39 actually report the highest rates of identity theft, often through social media and online shopping scams.

What Is Identity Theft?

Think of identity theft like someone making a perfect copy of your house key — except instead of your house, it’s your entire financial life. These criminals gather enough personal information to essentially become you in the digital world. They may buy your data on the dark web. They may hack into or steal one of your devices. They may even get you to give it to them through a phony email or telephone call.

Once they’ve collected the right pieces — your Social Security number, birthdate, maybe your mother’s maiden name — they spring into action. They might open new credit cards, take out loans, or even file fake tax returns to steal your refund. The scariest part? They can and do change the mailing addresses on these accounts, so you won’t even know it’s happening until the damage is done.

>> Also Check Out: How to Spot and Stop Online Phishing

By the time you discover the theft — usually when you’re denied credit or get a call from a debt collector — the thieves have moved on, leaving you with months of cleanup work and a credit score that looks like it went through a shredder.

And that, as they say, is all she wrote.

Pro Tip: Never give any personal details — such as your Social Security number, birthdate, or driver’s license number — over the phone. No legitimate entity will ever ask for those. Only criminals will.

Types of ID Fraud and Number of Reports in 2026

| Fraud Type | Number of Reports (First Half of 2025) |

|---|---|

| Imposter scams | 516,724 |

| Online shopping | 193,020 |

| Internet services | 118,071 |

| Business and job opportunities | 75,364 |

| Investment related | 66,703 |

| Telephone and mobile services | 43,646 |

| Health care | 37,768 |

| Prizes, sweepstakes, and lotteries | 34,845 |

| Travel, vacation, and timeshare plans | 27,439 |

| Advance payment for credit services | 25,464 |

| Total | 1,460,776 |

How to Prevent Identity Theft Online

Discovering that someone’s out there pretending to be you is a life-disrupting nightmare that can take years to fully resolve. It’s even worse if they’ve targeted your kids, which they like to do.

>> Learn More: Best ID Theft Protection Services for Families

But what happens when you find out, three, five, ten years down the line, that you can’t buy your dream house because your credit rating, which you’ve never actually looked at before, is a big fat 300?

Here’s what you can do to make sure you never get to that point.

FYI: Social media is the number one point of contact for victims (age 20-70) and ID thieves.2

>> We Recommend: The Top ID Theft Protection Providers

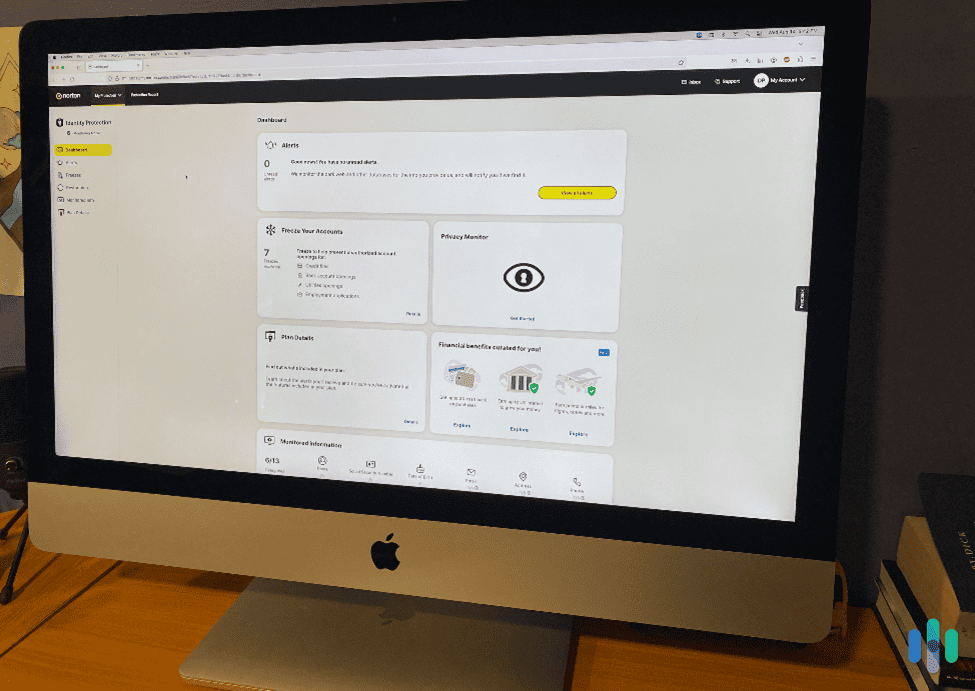

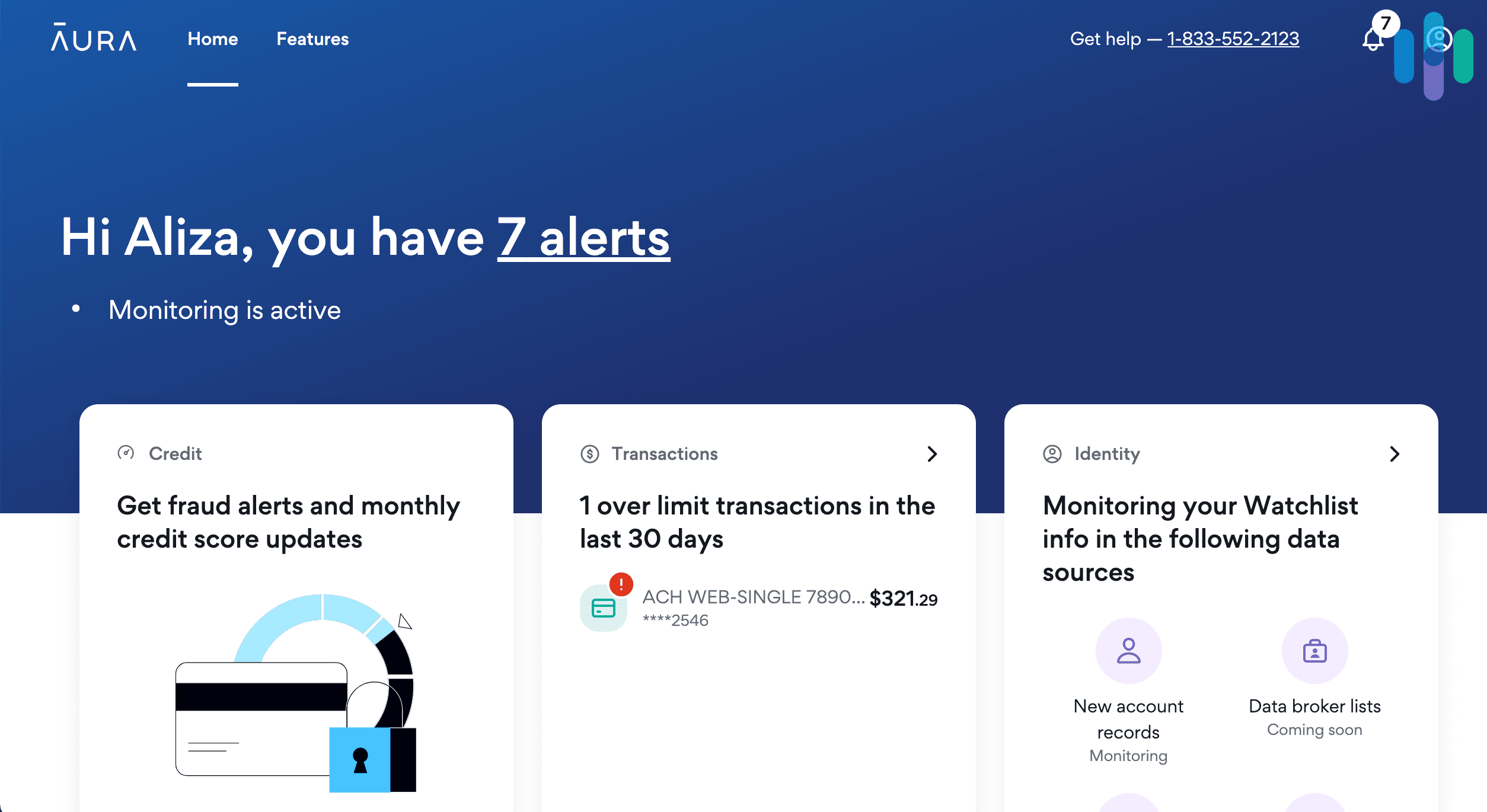

Here’s why I recommend these services to everyone, not just the paranoid. First, they consolidate all your monitoring in one dashboard. There’s no more logging into three credit bureaus, your bank, and who knows what else to check if you’re safe.

Second, if the worst happens, you get actual humans who know what they’re doing to help fix the mess. We’re talking certified restoration specialists who’ll spend hours on hold with creditors so you don’t have to, and many services offer insurance coverage up to $1 million for stolen funds and expenses.

Finally, top identity theft protection providers, such as Aura and LifeLock, bundle other useful digital-security tools — VPNs, antivirus software, and password managers — with their plans to offset some of the costs of their subscriptions and shore up access to the other main channels ID thieves use to steal your data.

>> Read More: Aura Identity Theft Protection Review

Did You Know: Easy-to-crack, reused passwords could be giving thieves easy access to your bank accounts and identity. Think yours are fraudster proof? Run them by our free password checker.

Use a VPN and Malware Protection

ID theft protection makes it nearly impossible for cybercriminals to steal your identity, but it can’t prevent a hacker from stealing your data if you don’t take any steps to keep them off your devices.

Here’s a real scenario I see all the time: You’re at your favorite coffee shop, connected to their free WiFi. You see an Instagram ad for 70% off those sneakers you’ve been eyeing. You click through, enter your credit card info, and boom — you’ve just handed your financial details to a scammer running a fake store. If you were running quality antivirus software in the background, however, you would have almost surely gotten a warning not to click the link.

>> Go Deeper: Does Antivirus Really Stop Hackers?

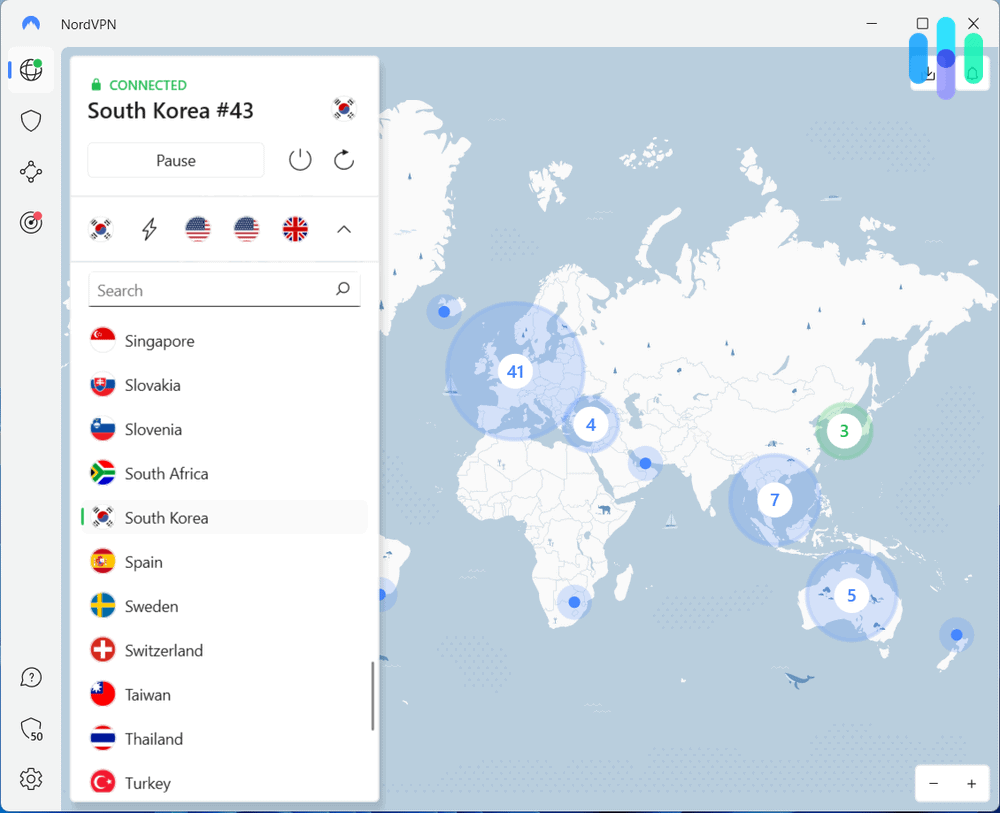

A VPN takes a different approach — it creates an encrypted tunnel for all your internet traffic. Even if you’re on sketchy public WiFi, hackers can’t see what you’re doing or intercept your passwords and credit card numbers as they travel across the internet. Think of it as sending your data in an armored car instead of on a postcard.

Pro Tip: Want to make sure no one but you can log in to your accounts? Enable two-factor authentication, or 2FA, for all your apps. With 2FA, you’ll need a unique, time-sensitive code delivered to your phone to log in. Unless a thief has your phone, in other words, he’s out of luck.

>> Also Check Out: Our Experts Rate the Top VPNs of the Year

Shop Carefully

There have been nearly 78,000 reports of online shopping fraud so far this year, and they’ve raked in upwards of $85 million for grifters.3 By the end of the holiday season, those numbers likely will have gone through the roof.

Losing money to bogus e-retailers is easy. If a shady character emerged from an alley selling $2 iPhone covers, you’d move on. Online, in a snazzy-looking storefront, those same covers may strike you as a deal and, what the heck, you need a few extra stocking stuffers. So you give them your credit card details.

The red flags are usually there if you look closely. Watch out for prices that seem too good to be true, websites with tons of spelling errors, or stores that only accept payment through gift cards or wire transfers. Legitimate businesses don’t operate like that. Stick to established retailers or verify unknown sellers through the Better Business Bureau before handing over your payment info.

FYI: Also be wary of giving your credit card info to smaller legitimate outfits that may not be thieves themselves, but don’t maintain adequate online security to prevent breaches.

Online Shopping Fraud by Age

| Age | Most common payment methods | Most common contact method | Average loss |

|---|---|---|---|

| 20 to 29 | Payment app | Social media | $500 |

| 30 to 39 | Payment app or credit or debit card | Social media | $492 |

| 40 to 49 | Credit or debit card | Social media | $482 |

| 50 to 59 | Credit or debit card | Social media | $482 |

| 60 to 69 | Credit or debit card | Social media | $500 |

| 70 to 79 | Credit card or gift card | Phone call | $800 |

| 80+ | Credit card or gift card | Phone call | $1,500 |

Keep an Eye on Your Bank Statements (and Activate Push Notifications)

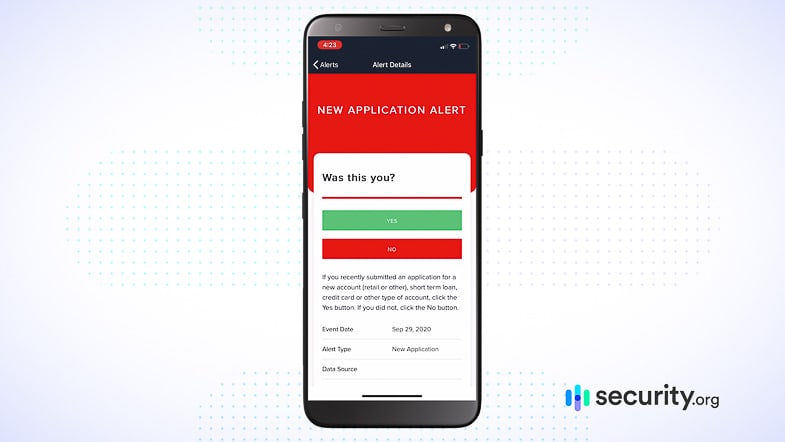

Remember when catching fraud meant waiting for your monthly paper statement? Those days are long gone. Today’s banking apps can alert you instantly — literally within seconds — whenever your card gets used. If you’re not using these features, you’re basically leaving your front door unlocked.

Your bank’s fraud department uses sophisticated AI to spot unusual patterns, but they’re not perfect. They might miss the thief who carefully charges $9.99 here and there to stay under the radar. But you’ll notice immediately when you get a notification for a Netflix subscription you didn’t sign up for or a gas purchase in a state you’ve never visited.

>> Learn More: 2026 Credit Card Fraud Report

Pro Tip: Living off the radar isn’t protection against online fraud. Case in point: Alaska, which had the most victims of imposter scams per capita in the U.S. this year.

The Takeaway

You’d be hard pressed to find a porch that’s completely immune from package theft or a home that’s 100 percent burglar-proof. That’s why we have home security systems. The same goes for identity theft. To keep safe, most of us need a little help — especially when we’re online.

The truth is, protecting your identity doesn’t require becoming a cybersecurity expert or living off the grid. It’s about layering smart defenses. We recommend getting identity theft protection to monitor the big picture, using a VPN and antivirus to secure your devices, and staying alert when shopping or sharing information online. These simple steps cost less than what most people spend on coffee each month, but they can save you from years of financial headaches.

After that, safeguarding your identity is just a matter of staying vigilant and making “reasonable suspiciousness” your default mode whenever you go online.

FAQs

-

What does an identity theft protection service do?

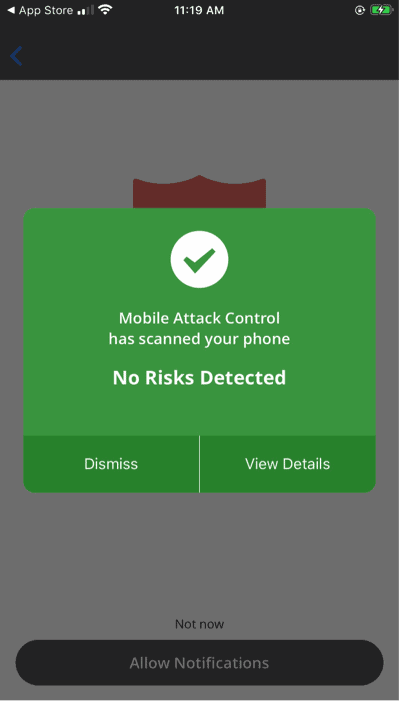

Identity theft protection providers are a combination hub and vault for your personally identifiable information. The main service they provide is notifying you the second someone has used your information to do something suspicious like apply for a driver’s license, credit card, or loan.

-

How much does ID theft protection cost?

The top services we’ve reviewed range from $8 to $35 per month, with family plans typically running $15 to $60 monthly for comprehensive coverage.

-

Do I need a VPN?

We recommend using one. ID theft protection by itself doesn’t seal off your devices from attack, but a virtual private network does. Check out our top pick, NordVPN.

-

What is phishing?

Phishing is when a grifter sends you a bad link through an email or text that leads you to a website or page set up to steal your data.

-

How can I protect older loved ones from identity theft and fraud?

The same way you protect your younger loved ones. Have the “scams and predators” talk with them. Explain how fraudsters operate and have regular check-ups so you can stay on top of suspicious activity. You can also check out these ID theft protection services for seniors.