Identity Guard Pricing and Subscription Costs

Learn how much it costs to protect your identity with Identity Guard

- Identity theft protection powered by AI

- Impressive $1 million in identity theft insurance

- Multiple service levels, from basic to advanced

Your identity – as in your personal information – is intangible, but if it’s stolen, the consequences are very real. Identity theft can ruin your reputation, make a mess of your credit score, or even cause a loss of income and funds. Identity theft can also be very costly and time-consuming to repair. That’s why it’s crucial to protect yourself from identity theft. For full protection you’re going to need to do more than just read a guide to identity theft protection though.

You really want a high-quality identity theft protection service. An identity protection service is an important tool to prevent identity theft — or at the very least, detect it early before it causes damage. Identity Guard is an example of an identity protection service, and you could say that it’s one of the best there is. Today, we’ll tour you around Identity Guard’s pricing and help you decide which of its plans provide the best value for your money.

How Much Does Identity Guard Cost?

Identity Guard keeps its pricing structure simple and straightforward. You won’t have to customize your protection package; you’ll simply choose from the three levels of protection available, namely: Value, Total, and Ultra.

Identity Guard uses a sliding model in terms of how comprehensive the protection you’ll get from each plan. The Value plan offers the least amount of protection, while the Ultra plan covers almost everything you’ll need to safeguard your identity. Thus, the first step is to choose how much identity protection you wish to have.

>> Read More: Identity Theft Prevention: Tips and Techniques for 2025

After that, you’ll choose whether the subscription is for only you or the entire family. Individual plans cover one adult, while family plans cover up to five adults and unlimited kids living with them. If you want more options that can cover your whole family, head on over to our list of the best family identity theft protection services.

Did You Know: While kids are covered in the family plans, Identity Guard monitors only their Social Security numbers. That means added protection is still necessary, such as teaching them the basics of digital security before giving them a smartphone.

The third step is to choose whether to pay every month or for a full year. Yearly subscriptions carry discounts — up to $6 per month for family plans and $5 per month for individual plans — as compared to the monthly plans.

However, with a monthly plan, you’ll enjoy greater flexibility as you only pay as you go. You can cancel anytime if your budget priority shifts, unlike with a yearly plan where if you cancel in the middle of your subscription, your subscription will end only when the year is up.

Here’s a complete breakdown of Identity Guard’s subscriptions, their features, and their pricing.

| Feature | Value | Total | Ultra |

|---|---|---|---|

| 401k and investment account monitoring | No | No | Yes |

| Annual credit report from 3 bureaus | No | No | Yes |

| Bank account monitoring | No | Yes | Yes |

| Credit and debit card monitoring | No | No | Yes |

| Credit monitoring from 3 bureaus | No | Yes | Yes |

| Criminal and sex offense monitoring | No | No | Yes |

| Customer support based in U.S | Yes | Yes | Yes |

| Dark web monitoring | Yes | Yes | Yes |

| Data breach notifications | Yes | Yes | Yes |

| High risk transaction monitoring | Yes | Yes | Yes |

| Home title monitoring | No | No | Yes |

| Identity theft insurance with $1 million maximum reimbursement | Yes | Yes | Yes |

| Monthly credit score from 1 bureau | No | Yes | Yes |

| Risk management report | Yes | Yes | Yes |

| Safe browsing tool | Yes | Yes | Yes |

| Social media insights report | No | No | Yes |

| USPS address change monitoring | No | No | Yes |

| White glove resolution concierge | No | No | Yes |

| Monthly plan for individuals | $8.99/month | $19.99/month | $29.99/month |

| Monthly plan for families | $14.99/month | $29.99/month | $39.99/month |

| Annual plan for individuals | $90.00/year | $200.00/year | $300.00/year |

| Annual plan for families | $150.00/year | $300.00/year | $400.00/year |

| Monthly cost of the annual individual plan | $7.50 | $16.67 | $25.00 |

| Monthly cost of the annual family plan | $12.50 | $25.00 | $33.33 |

Did You Know? The latest 2021 Census data shows there are 46,000 non-family households in the U.S.1 To help protect the people you do life with, we highly recommend talking to your roommates to save on identity protection! Make it like electricity or Wi-Fi, just another bill you’re splitting.

When we tested Identity Guard, we decided to push through with an individual plan and to pay monthly, but we had to decide which level of coverage we wanted. Here are our notes on each tier to help you out if you’re ever in the same rut we were.

The Value plan, as the name implies, provides a lot of value for its low price of $8.99 per month for individuals or $14.99 per month for families. With this plan, you get to provide identity protection for yourself for less than the cost of two fancy Brooklyn coffees per month. Not bad.

It gets even better with the family plan. Even if you ignore the fact that it provides protection to all your children living with you, $14.99 is still $3 less than the cost of two individual plans. So even if it’s just you and your spouse, you’ll get a lot more value with the Value family subscription than the individual plan. That’s $36 worth of savings in a year.

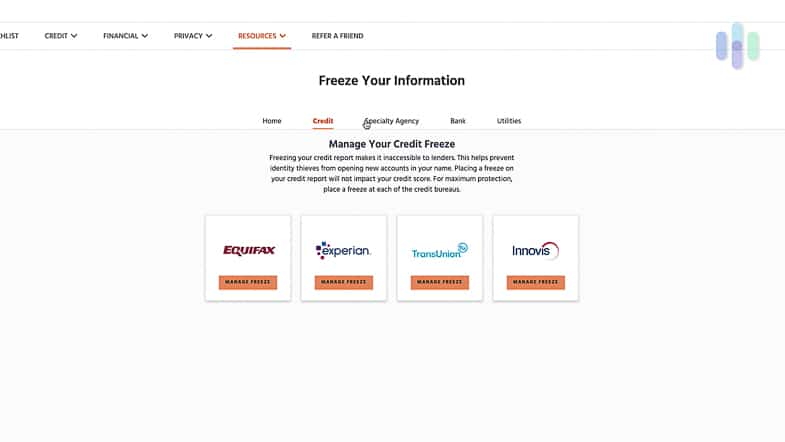

Pro Tip: Aside from getting identity protection service, freezing your can greatly reduce potential effects of identity theft. Or, you can use one of the best credit protection services to keep your credit safe without freezing it. That comes in handy if you’re planning a big purchase that requires a new line of credit like a car or a house.

The plans increase from there, but there are a lot of core services that Identity Guard offers across all three levels:

- $1 million insurance with stolen funds reimbursement: As you might know from reading our other identity monitoring reviews, $1 million is the standard insurance coverage across the industry. But ID theft plans from LifeLock, for example, don’t provide this much coverage at the most basic level, so it’s nice to see that Identity Guard does. We put LifeLock vs Identity Guard in a head-to-head comparison to find every difference between the two. Whether you’re on the most affordable Value plan or the $39.99 Ultra plan, you’ll be covered by this insurance.

- U.S-based dedicated case manager: In case of identity theft, LifeLock would provide us with a real-life person who would work with us in recovering and restoring our stolen identities. As cool as IBM Watson © is, it’s nice to know that if everything goes wrong, there will also be a real person there to walk us through freezing our credit and taking back control of our credentials.

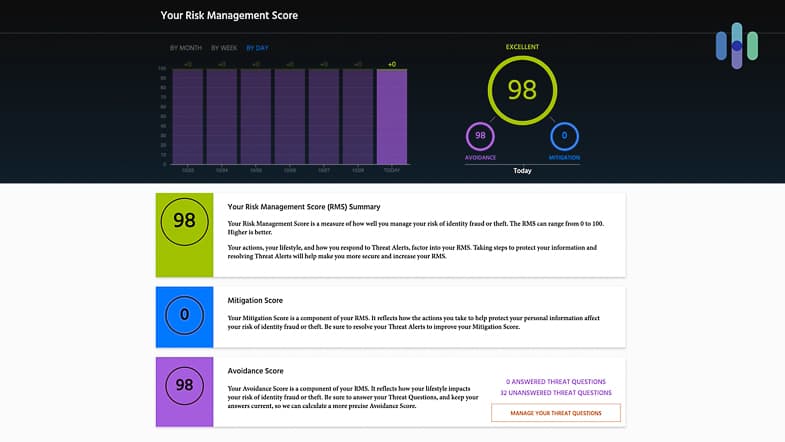

- Risk management score: This is the score that doesn’t lie. It tells us how at risk of identity fraud we might be, and how our actions and lifestyles change our score. Without naming names, let’s just say one of us has a lifestyle much more conducive to high-risk management scores than the other.

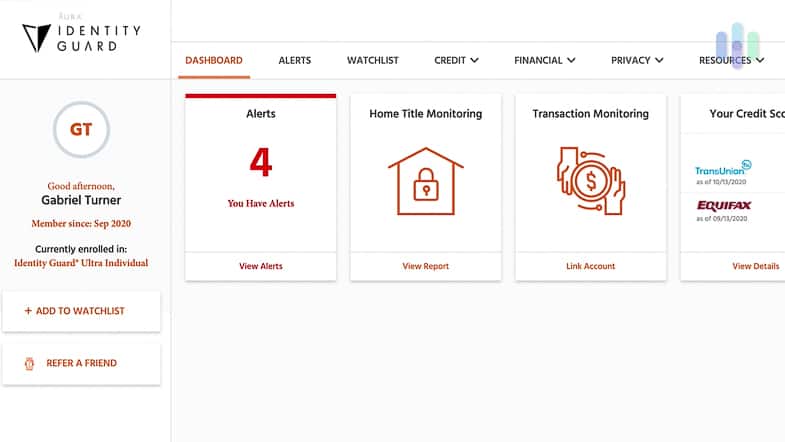

- Online identity dashboard: The more information we feed the beast, the more monitoring it can give us. The dashboard has many boxes that provide easy access to potential alerts, the Watchlist, and our credit reports and scores.

- Mobile application: We love having a mobile app companion for the services we use. You may not know this about us, but Aliza is an iPhone girl for life and Gabe swears by his Android. It’s the biggest fight we have, but somehow we get by. Luckily, the Identity Guard app was available on the Google Play Store and Apple App Store for both of us to enjoy, bug-free on either device.

- Monitoring for personal information on the dark web: We’ve never personally been on the dark web, but that doesn’t mean our information hasn’t been there; it’s a hotbed of anonymous cybercrime.While we were trying out Identity Guard, there was a data breach at one of the online platforms we use to order sushi, and our username and password were actually on the dark web, just waiting to be sold. Fortunately, Identity Guard sent us an alert and we were able to change our password on the platform in minutes. Our sushi was safe, but so were our identities.

- Monitoring high-risk transactions: If you’re a millennial like we are, think of a high-risk transaction as one your mother would make, but you never will. It’s hard to know who exactly you’re giving your credit card information to online these days, with all the middlemen payment services companies use, which is why this monitoring is key.

- Safe browsing extension: With Identity Guard, we were protected not only on our phones but also on our laptops. Identity Guard has a browser extension that helps protect our privacy online, which includes an ad and flash blocker, tracking protection, mining protection, and more.

- Password manager: Finally, Identity Guard offers a password manager, a tool where you can safely store your passwords for convenient and secure access. This is another necessary digital tool for identity protection, as our online accounts contain sensitive information like our names, email addresses, and even payment information.

App ratings

| App name and compatibility | Rating |

|---|---|

| Identity Guard, iOS | 4.1 |

| Identity Guard, Android | 2.3 |

FYI: In 2021, phishing attacks are on pace to rise 47 percent compared to 2020, and most phishing takes place in the United States.2 You always think you’re too smart to be susceptible…until you aren’t. Apps and tools like Identity Guard’s browser extension will protect you even if you’re good at recognizing phishing attempts.

It is comforting to know that all those features and protections are available even with the most basic of Identity Guard’s plans. That said, one feature is clearly missing: Credit monitoring.

Credit monitoring involves looking at your credit status from the Big Three credit bureaus, namely, Experian, Equifax, and TransUnion. It can also include getting credit reports and credit score updates.

Did You Know: According to the Bureau of Justice Statistics, 7% of people in the United States experienced identity theft that involved the perpetrator using their bank account or credit card. A lot of times, these cases of identity theft can be identified early if you’re using one of the best identity theft protection services with fraud detection.

Identity Guard’s credit monitoring features are exclusive to the Total and Ultra plan. The former includes daily credit monitoring and monthly credit score updates from one bureau, while the latter includes credit score updates from all three bureaus plus a yearly credit report.

We could say, then, that your decision on whether to choose the Ultra plan or go with a lower tier plan hinges on how much you value credit monitoring. Identity Guard’s credit monitoring monitors all three major credit bureaus — Experian, Equifax, and TransUnion. As previously mentioned, the Ultra plan includes credit scores and reports, the Total plan includes monthly score updates but no reports, and the Value plan includes none of those features.

Credit monitoring is obviously critical if you want to protect yourself from identity theft, but it’s also crucial to choose a plan that offers just the right protection. This is where we’ll leave you to decide: Do you need the Ultra plan’s comprehensive credit reporting and score updates, or can you live with the Total plan’s more basic credit monitoring?

As for ourselves, we chose to go with the Total plan. We rent our apartments and don’t plan on buying a home anytime soon, so we’re not keeping super close watch of our credit. As long as we know that our credit is safe, that’s good enough for us.

But you should know some of the monitoring we missed out on that’s available with Ultra: social media insights, bank accounts, credit and debit cards, 401(k), address changes, and more. To learn more, read our full review of Identity Guard.

Can We Do A Free Trial of Identity Guard First?

Much to our dismay, Identity Guard doesn’t do free trials. If you want to try it, you have to pay for it. That being said, you can always use the monthly plans to test out a service. The Value plan starts at just $9 per month. You can sign up just to get a feel of how the service works and see how the app looks.

Another thing is, there are deals here and there on Identity Guard. Once, we saw a 20-percent off deal for the first month. You can use deals like those to offset the cost of trying out the service. It’s not a free trial, but it’s not nothing.

Other theft protection services do offer free trials, like IdentityForce and IDShield, but you might find they don’t offer the same level of service as Identity Guard.

Our Favorite Features

Once we got over the fact that we’d be paying from the get-go, we logged into Identity Guard and began to explore what all the fuss was all about. It turned out we liked Identity Guard enough to name it one of the best ID theft protection services overall. Its top features?

- IBM Watson © artificial intelligence: Available through all the plans, IBM Watson © is a feature that gathers insights about potential identity theft threats, which Identity Guard claims gives them the quickest response time for inquiries made with the three credit bureaus. Next to identity theft protection, early detection and damage control is the next most important feature of these services.

- Low prices: Identity Guard has some of the lowest prices around, with the Value plan pricing at $7.50 per month for an individual and only $12.50 per month for a family. Even at the highest tier, the Ultra plan, Identity Guard family plan pricing only goes up to $39.99 a month.

- Three credit bureaus: Even though credit reports are only available through the Total and Ultra plans, these offerings cover all of the basics we need to keep up to date on our credit. Simple and to the point.

Identity Guard’s Cancellation Policy

You know that feeling when something is supposed to be easy and simple, but it never is, so then the one time something is actually easy and simple, it feels like a miracle? Identity Guard’s cancellation policy makes it simple to stop its service and makes up for the fact that there are no Identity Guard free trials.

We could cancel online literally just by logging into our account and going to the settings page. However, if we had been feeling up to a little human interaction (a rarity for us, personally), we could call the Customer Care Center at 1-855-443-7748.

We signed up for a month-to-month subscription because we like to live on the edge and are testing out the latest identity theft protection on the block constantly, but if we’d signed up for an annual subscription, we also could have canceled within 30 days of purchase and gotten our money back.

Find out if Identity Guard can protect your home like other services

We tested Identity Guard and compared it side-by-side with other brands to give you the full picture.

Recap

Overall, we’re fans of Identity Guard’s comprehensive features and affordable pricing, especially on the lower-tier Value and Total plans. Also, we really appreciated how easy it was to reach a human through a specific case manager or customer service. While it still annoys us that it doesn’t have a free trial, this certainly isn’t a dealbreaker, and we think Identity Guard is worth it overall.

FAQs

Here’s how it works: you have questions, and we have the answers. Below are some of the most frequently asked questions that we get regarding Identity Guard:

-

Which is better, LifeLock or Identity Guard?

We think Identity Guard is slightly better than Lifelock. They both ranked highly for us, but we gave Identity Guard a 9.5 out of 10 in our review, and LifeLock a 9.3 out of 10. What did that .2 difference come down to?

For us, it was privacy. LifeLock has run into some issues with the Federal Trade Commission (FTC) regarding its lack of protection surrounding customer data, while Identity Guard’s history is relatively tame with no history of run-ins with the federal government.

-

What is Identity Guard with Watson?

Identity Guard provides a service called IBM Watson © Artificial Intelligence. IBM created a computing system called Watson that can scour the internet for users’ credentials. Identity Guard uses this tool to gather insights about potential identity theft threats, which it claims gives it the shortest response time for inquiries made with the three credit bureaus.

-

Is Identity Guard a legitimate company?

Yes, Identity Guard is a legitimate company founded in 2001 with about 500 employees. Aura, another identity protection company, owns Identity Guard and has been registered with the Better Business Bureau since 1996 with an A+ rating.

-

Where is Identity Guard located?

Identity Guard is located in Herndon, Virginia. But, obviously, the service is available online wherever and whenever you are located in the United States. For us, Identity Guard worked just as well in Brooklyn as it would in Virginia.

-

How much is Identity Guard per month?

The cost of Identity Guard depends on what plan you sign up for. If you’re signing up just for yourself, the plans range from $7.50 to $25 a month. If you’re signing up for a family, meaning anyone and everyone in your household, those plans cost between $12.50 and $40 per month. Of course, there are savings to be had if you sign up for an annual plan.

Plan type Value Total Ultra Individual $8.99/month $19.99/month $29.99/month Family $14.99/month $29.99/month $39.99/month

-

US Census. (2021). America’s Families and Living Arrangements: 2021.

census.gov/data/tables/2021/demo/families/cps-2021.html -

Phish Labs. (2021). Q1 2021 Threat Trends & Intelligence Report.

phishlabs.com/blog/q1-2021-threat-trends-intelligence-report-2/